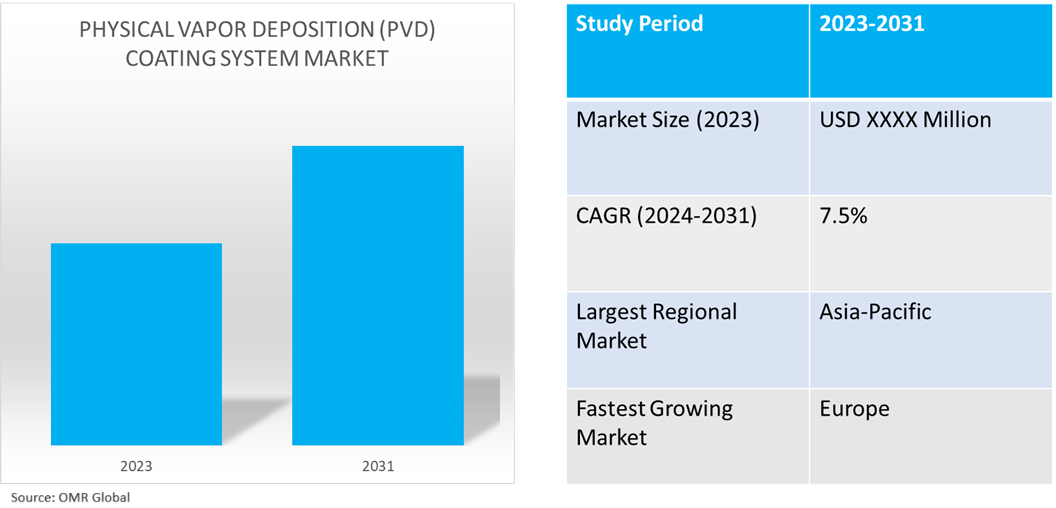

Physical Vapor Deposition (PVD) Coating System Market

Physical Vapor Deposition (PVD) Coating System Market Size, Share & Trends Analysis Report by Substrates (Nylon, Plastics, Glass, Ceramics, and Metals), by Materials (Titanium, Zirconium, Aluminum, Stainless Steel, and Copper), and by Application (Electronics and Panel Display, Optics and Glass, Automotive, Tools and Hardware, and Other) Forecast Period (2024-2031)

Physical vapor deposition (PVD) coating system market is anticipated to grow at a significant CAGR of 7.5% during the forecast period (2024-2031). The market growth is attributed to the increasing demand for green energy solutions, such as solar photovoltaic cells, which is expected to increase the demand for physical vapor deposition (PVD) coating. Further, increasing penetration of microelectronics across numerous industries drives industry growth. PVD-based coatings as alternatives to hard chromium for a range of industrial uses in automobile parts, including actuators, pumps, and bearings. According to the International Information and Engineering Technology Association, in October 2023, presently, Ti6Al4V alloy found extensive utilization in industries such as automotive, aerospace, chemical, marine, and biomedical, contributing to nearly 50.0% of global titanium production

Market Dynamics

Increasing Adoption of Eco-friendly Coating Process

Consumers and manufacturers are moving toward eco-friendly products and methods as the significance of setting sustainable goals grows. For instance, Kloeckner Metals has implemented PVD processes on their recently acquired equipment, providing an excellent means of mitigating the environmental impact of the business. To satisfy sustainable aims, several additional industries have begun to use PVD instead of other non-eco-friendly alternatives. As a result, during the projected period, these initiatives are anticipated to be favorable for the growth of the global physical vapor deposition market.

Market Segmentation

- Based on the substrates, the market is segmented into nylon, plastics, glass, ceramics, and metals.

- Based on the materials, the market is segmented into titanium, zirconium, aluminum, stainless steel, and copper.

- Based on the application, the market is segmented into electronics and panel displays, optics and glass, automotive, tools and hardware, and others.

Stainless Steel is Projected to Hold the Largest Segment

The primary factors supporting the growth include for the stainless steel and target to adhere, a high voltage circuit is required. This enables the target to be bombarded by argon ions, releasing target metal atoms that are then deposited as a coating on the stainless-steel substrate. The coating effectively prevents the insert rake surface from experiencing crater wear. The most recent titanium-rich nano-multilayer structure is incorporated into the grade's top layer, which increases the grade's hardness for better wear resistance owing to its high-density crystal orientation. For instance, in April 2021, Tungaloy introduced an AH6225 PVD grade insert for machining ISO-M stainless steels. AH6225 significantly expands the application coverage from continuous to interrupted cuts in a broad range of speeds, while maintaining outstanding tool life and reliability in stainless steel turning. For AH62225, a thick PVD coating rich in titanium and possessing exceptional thermal stability has been created.

Electronics and Panel Display Segment to Hold a Considerable Market Share

Physical vapor deposition technology demand is predicted to rise sharply in response to rising electronics and panel display investments globally. PVD and other accurate and high-quality thin-film deposition methods have grown increasingly important as semiconductor devices continue to progress in terms of performance and complexity.

Regional Outlook

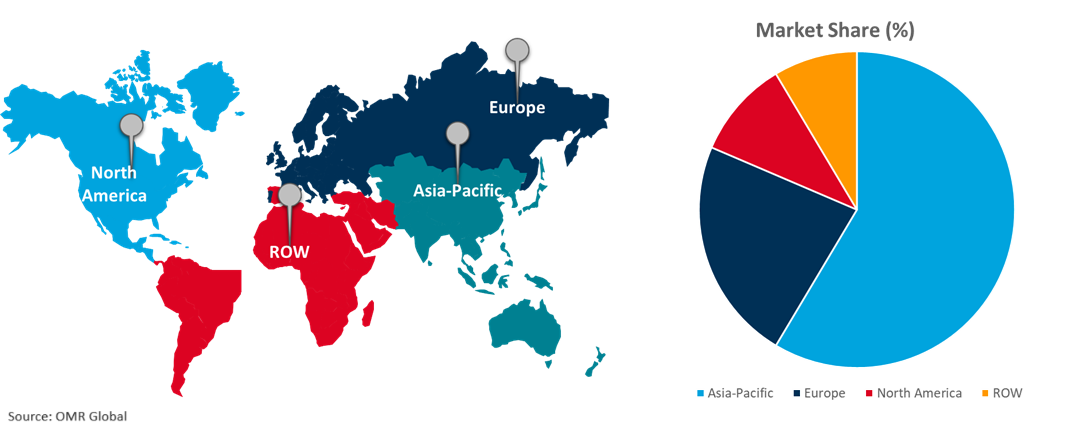

The global PVD coating system market is further segmented based on geography including North America (the US, and Canada), Europe (the UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia-Pacific), and the Rest of the World (the Middle East & Africa, and Latin America).

Growing Demand for PVD Coating Systems in Europe

- The regional growth is attributed to increasing focus on innovative technologies including quantum computing, autonomous vehicles, 5G and 6G connectivity, and artificial intelligence. The result has increased PVD demand in the microelectronics industry significantly. PVD offers improvements in functionality, durability, and the possibility of device downsizing, making it essential to produce microelectronics.

Global PVD Coating System Market Growth by Region 2024-2031

Asia-Pacific Holds Major Market Share

Asia-Pacific holds a significant share owing to several regional companies in the PVD coating system market, including Adeka Corp., IHI Ionbond AG, Mitsubishi Corp., and others. The market growth is attributed to well-established semiconductor and electronics industries, as the demand for PVD in the production of sophisticated semiconductor devices and microelectronic components grows. Furthermore, there is a growing need for PVD in the manufacturing of robust and efficient solar panels owing to the rapid expansion of solar energy projects and the emphasis on renewable energy sources. PVD coating usage is also fueled by the expansion of the automobile industry and the focus on improving the longevity and performance of automotive components.

According to the American Coatings Association, 2024 report, the APAC region consists of 50+ countries, the combined coatings production of which represents 53.0% of the volume and 47.0% of the value, of the global coatings industry. China, with roughly 60.0% of the entire coatings volume of APAC, is the most important coatings producer and user in the region, with India (18.0% of regional volume) a distant second, followed by a precipitous drop-off. Australia, despite its position as the fifth largest producer after South Korea, is nonetheless extremely small, representing less than 0.5% of all volume and 2.0% of the value.

Market Players Outlook

*Note: Major Players Sorted in No Particular Order.

The major companies serving the PVD coating system market include Applied Materials, Inc., IHI Ionbond AG, Mitsubishi Corp., Oerlikon Group, and Voestalpine Group among others. The market players are increasingly focusing on business expansion and product development by applying strategies such as collaborations, mergers, and acquisitions to stay competitive in the market.

Recent Development

- In September 2023, the Luxembourg Institute of Science and Technology (LIST) introduced a PVD pilot line in its Hautcharage premises, marking a significant milestone in the advancement of coating technology. With almost two decades of dedicated research and development in PVD, LIST is poised to transform the industry landscape in Luxembourg and the Greater Region by addressing challenges related to scalability and innovation.

- In July 2023, Oerlikon Balzers, a global technology brand for high-quality surface solutions, set a new industry standard with BALIQ TISINOS PRO. Developed specifically for these materials, this PVD coating reduces the load on the tool and significantly improves wear resistance when hard machining steels with a hardness of up to 70 HRC.

The Report Covers

- Market value data analysis of 2023 and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the PVD coating system market. Based on the availability of data, information related to new products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Industry Trends

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. Applied Materials, Inc.

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. IHI Ionbond AG

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. Oerlikon Group

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. voestalpine Group

3.5.1. Overview

3.5.2. Financial Analysis

3.5.3. SWOT Analysis

3.5.4. Recent Developments

3.6. Key Strategy Analysis

4. Market Segmentation

4.1. Global PVD Coating System Market by Substrates

4.1.1. Nylon

4.1.2. Plastics

4.1.3. Glass

4.1.4. Ceramics

4.1.5. Metals

4.2. Global PVD Coating System Market by Material

4.2.1. Titanium

4.2.2. Zirconium

4.2.3. Aluminum

4.2.4. Stainless Steel

4.2.5. Copper

4.3. Global PVD Coating System Market by Application

4.3.1. Electronics and Panel Display

4.3.2. Optics and Glass

4.3.3. Automotive

4.3.4. Tools and Hardware

4.3.5. Other

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

5.4.1. Latin America

5.4.2. Middle East and Africa

6. Company Profiles

6.1. Aurora Scientific Corp.

6.2. Bühler AG

6.3. HEF Group

6.4. Impact Coatings AB

6.5. KOLZER SRL

6.6. Kurt Lesker Co

6.7. Lafer S.P.A.

6.8. Mitsubishi Corp.

6.9. Morgan Advanced Materials Plc

6.10. Platit AG

6.11. Red Spot Paint & Varnish Company Inc.

6.12. Richter Precision Inc.

6.13. Semicore Equipment, Inc.

6.14. Silfex Inc. (Lam Research Corp.)

6.15. Singulus Technologies AG

6.16. Sputtek Advanced Metallurgical Coatings

6.17. ULVAC Technologies, Inc.

6.18. Veeco Instruments Inc.

1. Global PVD Coating System Market Research And Analysis By Technology, 2023-2031 ($ Million)

2. Global Nylon PVD Coating System Market Research And Analysis By Region, 2023-2031 ($ Million)

3. Global Plastics PVD Coating System Market Research And Analysis By Region, 2023-2031 ($ Million)

4. Global Glass PVD Coating System Market Research And Analysis By Region, 2023-2031 ($ Million)

5. Global Ceramics PVD Coating System Market Research And Analysis By Region, 2023-2031 ($ Million)

6. Global Metal PVD Coating System Market Research And Analysis By Region, 2023-2031 ($ Million)

7. Global PVD Coating System Market Research And Analysis By Materials, 2023-2031 ($ Million)

8. Global Titanium Based PVD Coating System Market Research And Analysis By Region, 2023-2031 ($ Million)

9. Global Zirconium Based PVD Coating System Market Research And Analysis By Region, 2023-2031 ($ Million)

10. Global Aluminum Based PVD Coating System Market Research And Analysis By Region, 2023-2031 ($ Million)

11. Global Stainless Steel Based PVD Coating System Market Research And Analysis By Region, 2023-2031 ($ Million)

12. Global Copper Based PVD Coating System Market Research And Analysis By Region, 2023-2031 ($ Million)

13. Global PVD Coating System Market Research And Analysis By Application, 2023-2031 ($ Million)

14. Global PVD Coating System For Electronics and Panel Display Market Research And Analysis By Region, 2023-2031 ($ Million)

15. Global PVD Coating System For Optics and Glass Market Research And Analysis By Region, 2023-2031 ($ Million)

16. Global PVD Coating System For Automotive Market Research And Analysis By Region, 2023-2031 ($ Million)

17. Global PVD Coating System For Tools and Hardware Market Research And Analysis By Region, 2023-2031 ($ Million)

18. Global Other PVD Coating System Application Market Research And Analysis By Region, 2023-2031 ($ Million)

19. Global PVD Coating System Market Research And Analysis By Region, 2023-2031 ($ Million)

20. North American PVD Coating System Market Research And Analysis By Country, 2023-2031 ($ Million)

21. North American PVD Coating System Market Research And Analysis By Substrates, 2023-2031 ($ Million)

22. North American PVD Coating System Market Research And Analysis By Material, 2023-2031 ($ Million)

23. North American PVD Coating System Market Research And Analysis By Application, 2023-2031 ($ Million)

24. European PVD Coating System Market Research And Analysis By Country, 2023-2031 ($ Million)

25. European PVD Coating System Market Research And Analysis By Substrates, 2023-2031 ($ Million)

26. European PVD Coating System Market Research And Analysis By Material, 2023-2031 ($ Million)

27. European PVD Coating System Market Research And Analysis By Application, 2023-2031 ($ Million)

28. Asia-Pacific PVD Coating System Market Research And Analysis By Country, 2023-2031 ($ Million)

29. Asia-Pacific PVD Coating System Market Research And Analysis By Substrates, 2023-2031 ($ Million)

30. Asia-Pacific PVD Coating System Market Research And Analysis By Material, 2023-2031 ($ Million)

31. Asia-Pacific PVD Coating System Market Research And Analysis By Application, 2023-2031 ($ Million)

32. Rest Of The World PVD Coating System Market Research And Analysis By Region, 2023-2031 ($ Million)

33. Rest Of The World PVD Coating System Market Research And Analysis By Substrates, 2023-2031 ($ Million)

34. Rest Of The World PVD Coating System Market Research And Analysis By Material, 2023-2031 ($ Million)

35. Rest Of The World PVD Coating System Market Research And Analysis By Application, 2023-2031 ($ Million)

1. Global PVD Coating System Market Research And Analysis By Technology, 2023 Vs 2031 (%)

2. Global Nylon PVD Coating System Market Share By Region, 2023 Vs 2031 (%)

3. Global Plastics PVD Coating System Market Share By Region, 2023 Vs 2031 (%)

4. Global Glass PVD Coating System Market Share By Region, 2023 Vs 2031 (%)

5. Global Ceramics PVD Coating System Market Share By Region, 2023 Vs 2031 (%)

6. Global Metals PVD Coating System Market Share By Region, 2023 Vs 2031 (%)

7. Global PVD Coating System Market Share By Materials, 2023 Vs 2031 (%)

8. Global Titanium Based PVD Coating System Market Share By Region, 2023 Vs 2031 (%)

9. Global Zirconium Based PVD Coating System Market Share By Region, 2023 Vs 2031 (%)

10. Global Aluminum Based PVD Coating System Market Share By Region, 2023 Vs 2031 (%)

11. Global Stainless Steel Based PVD Coating System Market Share By Region, 2023 Vs 2031 (%)

12. Global Copper Based PVD Coating System Market Share By Region, 2023 Vs 2031 (%)

13. Global PVD Coating System Market Share By Application, 2023 Vs 2031 (%)

14. Global PVD Coating System For Electronics and Panel Display Market Share By Region, 2023 Vs 2031 (%)

15. Global PVD Coating System For Optics and Glass Market Share By Region, 2023 Vs 2031 (%)

16. Global PVD Coating System For Automotive Market Share By Region, 2023 Vs 2031 (%)

17. Global PVD Coating System For Tools and Hardware Market Share By Region, 2023 Vs 2031 (%)

18. Global Other PVD Coating System Application Market Share By Region, 2023 Vs 2031 (%)

19. Global PVD Coating System Market Share By Region, 2023 Vs 2031 (%)

20. US PVD Coating System Market Size, 2023-2031 ($ Million)

21. Canada PVD Coating System Market Size, 2023-2031 ($ Million)

22. UK PVD Coating System Market Size, 2023-2031 ($ Million)

23. France PVD Coating System Market Size, 2023-2031 ($ Million)

24. Germany PVD Coating System Market Size, 2023-2031 ($ Million)

25. Italy PVD Coating System Market Size, 2023-2031 ($ Million)

26. Spain PVD Coating System Market Size, 2023-2031 ($ Million)

27. Rest Of Europe PVD Coating System Market Size, 2023-2031 ($ Million)

28. India PVD Coating System Market Size, 2023-2031 ($ Million)

29. China PVD Coating System Market Size, 2023-2031 ($ Million)

30. Japan PVD Coating System Market Size, 2023-2031 ($ Million)

31. South Korea PVD Coating System Market Size, 2023-2031 ($ Million)

32. Rest Of Asia-Pacific PVD Coating System Market Size, 2023-2031 ($ Million)

33. Rest Of The World PVD Coating System Market Size, 2023-2031 ($ Million)

34. Latin America PVD Coating System Market Size, 2023-2031 ($ Million)

35. Middle East And Africa PVD Coating System Market Size, 2023-2031 ($ Million)