R-125 Refrigerant Market

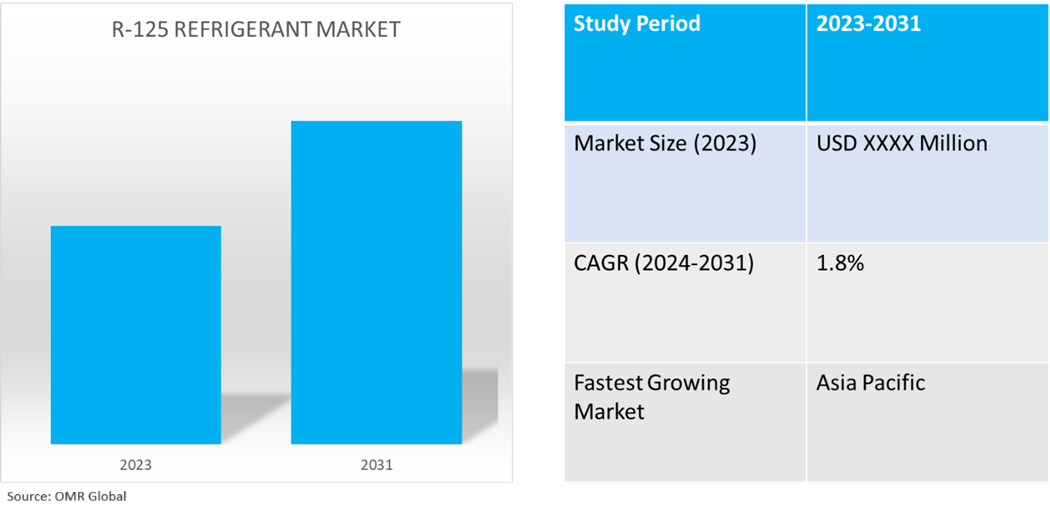

R-125 Refrigerant Market Size, Share & Trends Analysis Report by Type (Purity 99.5%, and Purity 99.8%), and by End-User (Extinguishants, Air Conditioners, and Industrial Refrigeration) Forecast Period (2024-2031)

R-125 refrigerant market is anticipated to grow at a CAGR of 1.8% during the forecast period (2024-2031). The R-125 refrigerant, also known as pentafluoroethane, is a key component in many refrigerant blends, with a lower environmental impact compared to older refrigerants. The market is growing owing to factors such as increasing demand for HVAC systems, regulatory requirements supporting environmentally friendly refrigerants, the development of new refrigerant blends that include R-125, and the shift to low-global warming potential (GWP) refrigerants.

Market Dynamics

Increasing Demand for HVAC Systems

Globally, the demand for HVAC systems is on the rise, attributed to factors such as rising temperature levels, growth of urban population, and increasing disposable income, among others. Further, the demand is primarily propelled from regions exposed to tropical and subtropical climates, such as India, Brazil, Australia, China, Mexico, and the US, among others. These regions are experiencing increased demand for HVAC systems, which is expected to benefit the refrigerant market. For instance, according to the International Trade Administration, India's HVAC sector is experiencing rapid growth owing to urbanization, rising disposable income, and changing climate. Government initiatives such as 'Make in India' and a commitment to becoming carbon neutral by 2070 are driving this growth. The market is projected to reach $30.0 billion by 2030, growing at a compound annual growth rate (CAGR) of 15.8%.

Rising Adoption of Low- Global Warming Potential (GWP) Refrigerants

Simultaneously, the market for R-125 refrigerants is facing a threat owing to the increasing adoption of low-GWP refrigerants. There is a significant trend towards using refrigerants with lower global warming potential (GWP) as part of global initiatives to combat climate change. This trend is reinforced by regulations, making it challenging for R-125 refrigerants to sustain their growth, especially in developed regions. For instance, the US HVAC industry is transitioning to new refrigerants as required by the American Innovation and Manufacturing Act of 2020. The US Environmental Protection Agency has set transition dates for new equipment required to use new refrigerants, commonly referred to as A2Ls. Residential and light commercial air conditioners and heat pumps manufactured after January 2025 must use the new refrigerant with a grace period until January 2026, for installation.

Segmental Outlook

- Based on type, the market is segmented into purity 99.5% and purity 99.8%.

- Based on industry, the market is segmented into Extinguishants, Air Conditioners, and Industrial Refrigeration.

R-125 Dominated the Type Segment

R-125 is the preferred refrigerant type over HCFC-123 and HCFC-124 in the refrigerant market owing to its lower impact on ozone depletion and greater stability, which supports compliance with global environmental regulations. Further, the segmental growth is fueled by strict emissions targets and the gradual elimination of substances harmful to the ozone layer, making R-125 a sustainable option for upcoming refrigeration needs.

Air Conditioner Remained the Biggest Industry

Air conditioners are the dominant industry among extinguishants and industrial refrigeration, driven by increasing global demand for cooling solutions, rising temperature levels owing to climate change, technological advancements in air conditioners, and expanding urbanization requiring indoor climate control.

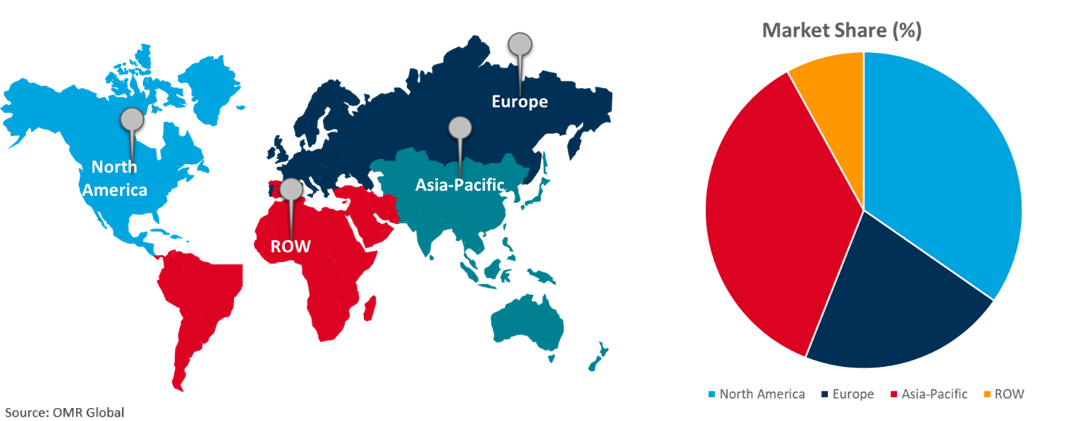

Regional Outlook

The global R-125 refrigerant market is further segmented based on geography including North America (the US, and Canada), Europe (the UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia-Pacific), and the Rest of the World (the Middle East & Africa, and Latin America).

Global R-125 Refrigerant Market Growth by Region 2024-2031

Asia-Pacific is Anticipated to Exhibit Significant Growth in the Global R-125 Refrigerant Market

Asia-Pacific is anticipated to exhibit significant growth in the global market, attributed to the increasing demand for HVAC systems advocated by rising temperatures and income levels and supportive regulations for the use of R-125 refrigerants. Further, the growing demand for refrigerators in industrial and commercial settings and the regional shift towards low-GWP refrigerants are expected to influence the market in the region. For instance, according to the International Energy Agency (IEA), the Southeast Asian region is expected to experience a significant increase in air conditioner sales due to rising temperatures and incomes. The total number of air conditioner units is projected to soar from 40 million units in 2017 to 300 million units in 2040, with around half of them being in Indonesia.

Market Players Outlook

*Note: Major Players Sorted in No Particular Order*.

The major companies serving the global R-125 refrigerant market include Honeywell International, Inc., Mexichem S.A.B. de C.V. (Orbia), and The Chemours Company LLC, among others. The market players are focusing on capitalizing on growth by adopting strategies such as collaboration, partnerships, and market expansion among others. For instance, in June 2021, the U.S. Department of Commerce announced a preliminary countervailing duty ruling on R125 pentafluoroethane imported from China. Preliminary countervailing duty rates were 3.23% for Zhejiang Quzhou Juxin Fluorine Chemical Co., Ltd. and 2.31% for Zhejiang Sanmei Chemical Ind. Co., Ltd. For Arkema Daikin Advanced Fluorochemicals (Changsu) Co., Ltd., Daikin Fluorochemicals (China) Co., Ltd., Hongkong Richmax Ltd., and Weitron International Refrigeration Equipment (Kunshan) Co., Ltd., the rate is 291.26%, while the rate for other Chinese producers and exporters is 3.12%. The final countervailing duty adjudication was made on October 25, 2021.

The Report Covers

- Market value data analysis of 2023 and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global R-125 refrigerant market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Industry Trends

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. Honeywell International, Inc.

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. Mexichem S.A.B. de C.V. (Orbia)

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. The Chemours Company LLC

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Key Strategy Analysis

4. Market Segmentation

4.1. Global R-125 Refrigerant Market by Type

4.1.1. PURITY 99.5%

4.1.2. PURITY 99.8%

4.2. Global R-125 Refrigerant Market by Industry

4.2.1. Extinguishant

4.2.2. Air Conditioners

4.2.3. Industrial Refrigeration

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

5.4.1. Latin America

5.4.2. Middle East and Africa

6. Company Profiles

6.1. AFS Cooling (AFS Energy)

6.2. A-Gas International Ltd.

6.3. Arkema Group

6.4. Beijing Starget Chemicals Co., Ltd.

6.5. Changzhou Kangmei Chemical Industry Co., Ltd.

6.6. Chongqing Haixisi Chemical Ltd.

6.7. Dongyue Group

6.8. Hangzhou Fine Fluorotech Co., Ltd

6.9. LUXI GROUP

6.10. SINTECO S.R.L

6.11. SRF Ltd.

6.12. Star Grace Mining Co., Ltd.

6.13. Xiamen Juda Chemical & Equipment Co., Ltd.

6.14. Zhejiang Yonghe Refrigerant Co., Ltd.

1. Global R-125 Refrigerant Market Research and Analysis by Type, 2023-2031 ($ Million)

2. Global R-125 Refrigerant Purity 99.5% Refrigerant Market Research and Analysis by Region, 2023-2031 ($ Million)

3. Global R-125 Refrigerant Purity 99.8% Refrigerant Market Research and Analysis by Region, 2023-2031 ($ Million)

4. Global R-125 Refrigerant Market Research and Analysis by Industry, 2023-2031 ($ Million)

5. Global R-125 Refrigerant in Extinguishant Market Research and Analysis by Region, 2023-2031 ($ Million)

6. Global R-125 Refrigerant in Air Conditioners Market Research and Analysis by Region, 2023-2031 ($ Million)

7. Global R-125 Refrigerant in Industrial Refrigeration Market Research and Analysis by Region, 2023-2031 ($ Million)

8. Global R-125 Refrigerant Market Research and Analysis by Region, 2023-2031 ($ Million)

9. North American R-125 Refrigerant Market Research and Analysis by Country, 2023-2031 ($ Million)

10. North American R-125 Refrigerant Market Research and Analysis by Type, 2023-2031 ($ Million)

11. North American R-125 Refrigerant Market Research and Analysis by Industry, 2023-2031 ($ Million)

12. European R-125 Refrigerant Market Research and Analysis by Country, 2023-2031 ($ Million)

13. European R-125 Refrigerant Market Research and Analysis by Type, 2023-2031 ($ Million)

14. European R-125 Refrigerant Market Research and Analysis by Industry, 2023-2031 ($ Million)

15. Asia-Pacific R-125 Refrigerant Market Research and Analysis by Country, 2023-2031 ($ Million)

16. Asia-Pacific R-125 Refrigerant Market Research and Analysis by Type, 2023-2031 ($ Million)

17. Asia-Pacific R-125 Refrigerant Market Research and Analysis by Industry, 2023-2031 ($ Million)

18. Rest of The World R-125 Refrigerant Market Research and Analysis by Region, 2023-2031 ($ Million)

19. Rest of The World R-125 Refrigerant Market Research and Analysis by Type, 2023-2031 ($ Million)

20. Rest of The World R-125 Refrigerant Market Research and Analysis by Industry, 2023-2031 ($ Million)

1. Global R-125 Refrigerant Market Share by Type, 2023 Vs 2031 (%)

2. Global R-125 Refrigerant Purity 99.5% Refrigerant Market Share by Region, 2023 Vs 2031 (%)

3. Global R-125 Refrigerant Purity 99.8% Refrigerant Market Share by Region, 2023 Vs 2031 (%)

4. Global R-125 Refrigerant Market Share by Industry, 2023 Vs 2031 (%)

5. Global R-125 Refrigerant in Extinguishant Market Share by Region, 2023 Vs 2031 (%)

6. Global R-125 Refrigerant in Air Conditioners Market Share by Region, 2023 Vs 2031 (%)

7. Global R-125 Refrigerant in Industrial Refrigeration Market Share by Region, 2023 Vs 2031 (%)

8. Global R-125 Refrigerant Market Share by Region, 2023 Vs 2031 (%)

9. US R-125 Refrigerant Market Size, 2023-2031 ($ Million)

10. Canada R-125 Refrigerant Market Size, 2023-2031 ($ Million)

11. UK R-125 Refrigerant Market Size, 2023-2031 ($ Million)

12. France R-125 Refrigerant Market Size, 2023-2031 ($ Million)

13. Germany R-125 Refrigerant Market Size, 2023-2031 ($ Million)

14. Italy R-125 Refrigerant Market Size, 2023-2031 ($ Million)

15. Spain R-125 Refrigerant Market Size, 2023-2031 ($ Million)

16. Rest of Europe R-125 Refrigerant Market Size, 2023-2031 ($ Million)

17. India R-125 Refrigerant Market Size, 2023-2031 ($ Million)

18. China R-125 Refrigerant Market Size, 2023-2031 ($ Million)

19. Japan R-125 Refrigerant Market Size, 2023-2031 ($ Million)

20. South Korea R-125 Refrigerant Market Size, 2023-2031 ($ Million)

21. Rest of Asia-Pacific R-125 Refrigerant Market Size, 2023-2031 ($ Million)

22. Latin America R-125 Refrigerant Market Size, 2023-2031 ($ Million)

23. Middle East And Africa R-125 Refrigerant Market Size, 2023-2031 ($ Million)