Radiation Detection, Monitoring and Safety Market

Radiation Detection, Monitoring and Safety Market Size, Share & Trends Analysis Report by Radiation Detection and Monitoring Products Type (Area Process Monitors, Environment Radiation Monitors, Surface Contamination Monitors, Personal Dosimeters, and Radioactive Material Monitors), by Radiation Safety Products Type (Full-Body Protection Products, Face Protection Products, Hand Safety Products and Other), and by Application (Healthcare, Homeland Security & Defense, Nuclear Power Plants and Industrial) Forecast Period (2024-2031)

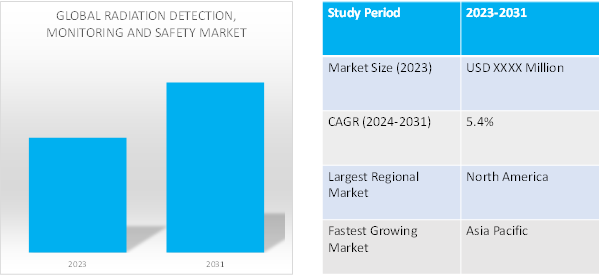

Radiation detection, monitoring and safety market is anticipated to grow at a CAGR of 5.4% during the forecast period (2024-2031) owing to the rising prevalence of cancer, growing use of nuclear medicine and radiation therapy for the diagnosis, increasing radiation safety awarness, and increasing use of radiation monitoring in different industries. They are essential in a variety of fields and situations where radiation exposure is a possibility, including nuclear power plants, healthcare institutions, industrial locations, research labs, and homeland security.

Market Dynamics

Rising Adoption Of Nuclear Medicine And Radiation Therapy

The market is witnessing rapid growth due to growing use of nuclear medicine and radiation therapy for the diagnosis and high prevalence of cancers. Nuclear medicine uses radiation to provide information about the functioning of a person's specific organs, or to treat disease. Radiotherapy can be used to treat some medical conditions, especially cancer, using radiation to weaken or destroy particular targeted cells. According to the World Nuclear Association, the demand for radioisotopes rising by around 5% each year and around 40 million nuclear medicine procedures are performed annually. About 1 in 50 individuals in developed nations (which account for 25% of the global population) use diagnostic nuclear medicine annually and the frequency of radioisotope therapy accounts for approximately a one-tenth of this cases. In the US there are over 20 million nuclear medicine procedures per year, and in Europe about 10 million, with 2 million of these being therapeutic.

Rising Focus On Nuclear Power In Developing Nations

Major players operating in the radiation detection monitoring safety market are expected to drive the market growth in developing economies such as India, South Korea, Brazil, Turkey, Russia, and South Africa. According to the World Nuclear Association till May 2023, around 440 nuclear reactors were operating in 33 countries with a capacity of 390GWe, while a further 60 power reactors are being constructed in 15 countries including China, India and Russia. The Indian government is committed to growing its nuclear power capacity as part of its massive infrastructure development programme. The operation phase of a nuclear power plant is generally the longest phase of its life cycle. India currently has 22 reactors in operation, with an installed capacity of 6780 MWe. Pressurised Heavy Water Reactors (PHWRs) make up eighteen of these reactors, while Light Water Reactors (LWRs) make up four. Further, India focuses on nuclear power to meet its future electric demands. For instance, according to the World Nuclear Association, India aims to supply 25% of electricity from nuclear power by 2050.

Market Segmentation

Our in-depth analysis of the global radiation detection, monitoring and safety market includes the following segments by type, product, and technology:

- Based on radiation detection and monitoring products type, the market is sub-segmented into area process monitors, environment radiation monitors, surface contamination monitors, personal dosimeters, and radioactive material monitors.

- Based radiation safety products type on product, the market is bifurcated into full-body protection products, face protection products, hand safety products and other.

- Based on application, the market is augmented into healthcare, homeland security & defense, nuclear power plants and industrial.

Healthcare is Projected to Emerge as the Largest Segment

Based on the application, the global radiation detection, monitoring and safety market is sub-segmented healthcare, homeland security & defense, nuclear power plants and industrial. Among these, the healthcare sub-segment is expected to hold the largest share of the market owing to the increasing adoption of dosimeters and detectors in radiology, emergency care, dentistry, nuclear medicine, and other applications.

The detection and measurement of ionizing radiation are the basis for the majority of diagnostic imaging. Radiological imaging, such as mammography and computer tomography, is of key importance, as it uses x-rays for diagnosis, planning and guiding treatments. Ionising radiation therapy is the most common form of medical application of ionising radiation, with over 500 million operations performed in the Europe each year. Radioactive substances are mostly used in nuclear medicine to diagnose cardiac and other conditions in addition to cancer. For the purpose of treating cancer, radiotherapy employs charged particles, high-energy x-rays, or radioactive sources. It is a vital component of contemporary cancer care, with 1.5 million procedures performed in Europe each year. Through the global initiative on radiation safety in health care settings, WHO is mobilizing the health sector towards safe and effective use of radiation in medicine. By integrating radiation protection into the concepts of good medical practice and health care service quality.

Personal Dosimeters Sub-Segment To Hold A Considerable Market Share

This growth is attributed to the wide-ranging applications of the dosimeters in nuclear power plants, radiation dose measurements in medical and industrial processes. Furthermore, this segment is anticipated to register high growth due to the technical developments such as optically stimulated luminescence (OSL), which improves the precision of measuring low amounts of radioactivity. It is anticipated that the extension of the firms present product range and the resulting general rise in product adoption would accelerate the growth of the product category. Personal dosimeters are crucial for measuring the radiation exposure levels of workers who operate in places where radiation exposure is a concern. This is especially important in industries such as radiography, nuclear power, and medical imaging where workers are exposed to ionising radiation.

Regional Outlook

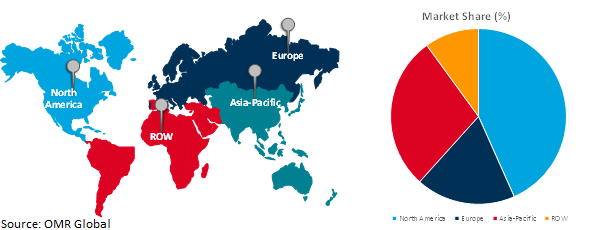

The global radiation detection, monitoring and safety market is further segmented based on geography including North America (the US, and Canada), Europe (UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia), and the Rest of the World (the Middle East & Africa, and Latin America).

Asia Pacific area to expand at the quickest rate

Asia Pacific area to expand at the quickest rate owing to the rising prevalence of cancer, growing use of nuclear medicine and radiation therapy for the diagnosis, expanding diagnostic imaging facilities and increasing radiation safety awareness. In India, The Radiation Medicine Centre (RMC) of Bhabha Atomic Research Centre (BARC) in Mumbai, has become the nucleus for the growth of nuclear medicine in the country and carries out a large number of patient investigations every year. Similarly Tata Memorial Centre (TMC), provides comprehensive treatment for cancer and allied diseases and is one of the best radiation oncology centres in the country. Every year nearly 40,000 new patients visit the clinics from all over India and neighbouring countries. Nearly 60% of these cancer patients receive primary care at the Hospital. Every year, about 6300 major surgeries and 6000 patients receiving chemotherapy and radiation therapy are handled by multidisciplinary programmes that provide well-established medical care.

Global Radiation detection, monitoring and safety Market Growth by Region 2024-2031

North America Holds Major Market Share

Among all the regions, North America holds a significant share owing to the favorable government initiatives, a higher number of active nuclear power plants, increasing prevalence of cancer, and growing awareness of radiation safety, in this region. In 2022 more than 18 million Americans with a history of invasive cancer were alive. According to American cancer Society, in the US, an estimated 41 out of 100 men and 39 out of 100 women will develop cancer during their lifetime. Moreover, the major vendors (Thermo Fischer Scientific, Mirion Technologies, Ludlum Measurement, Ametek, Ultra Electronics, and Landauer) of this market are based in the US is expected to boost market growth during the forecast period.

The US Nuclear Regulatory Commission (NRC) is committed to shielding the general public and industrial workers from radiation risks associated with the many applications of radioactive materials in industry, academia, medicine, and science. The NRC conducts comprehensive technical reviews of radiation protection plans for all new reactor licence applications in addition to Radiation Monitoring at Operating Nuclear Power Plants. The NRC's Health Physics staff examines public radiation safety, radioactive waste management, and occupational radiation protection. Furthermore, the NRC inspects radiation protection devices and design elements when new nuclear facilities are being built to make sure they adhere to the agency's set safety standards. Till 2023, total 93 nuclear reactors were operating at 54 nuclear power plants in 28 states of US. The nuclear energy industry has supplied about 20% of total annual US electricity.

Market Players Outlook

*Note: Major Players Sorted in No Particular Order.

The major companies serving the global radiation detection, monitoring and safety market include Mirion Technologies, Inc., Thermo Fisher Scientific, Fortive, IBA Worldwide, AmRay, Fuji Electric Co., Ltd., Honeywell International Inc., International Medcom, Inc., ECOTEST, Rapiscan Systems, Inc., AMETEK, Arktis Radiation Detectors Ltd, Burlington Medical., John Caunt Scientific ltd., LANDAUER, Ludlum Measurements, Inc., S.E. International, Inc among others. The market players are increasingly focusing on business expansion and product development by applying strategies such as collaborations, mergers, and acquisitions to stay competitive in the market. For instance In March 2021, Ametek launched the new rugged RADEAGLET-R, the latest generation of scintillation hand-held radioisotope identification devices (RIIDs). The RADEAGLET-R is a highly portable and extremely rugged device designed for the military, first responders, customs agents, and intelligence organizations. 'The Ruggedized RADEAGLET represents a new standard for lightweight handheld RIIDs.

The Report Covers

- Market value data analysis of 2023 and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global radiation detection, monitoring and safety market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. Mirion Technologies, Inc.

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. Thermo Fisher Scientific

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. Fortive

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. IBA Worldwide

3.5.1. Overview

3.5.2. Financial Analysis

3.5.3. SWOT Analysis

3.5.4. Recent Developments

3.6. Key Strategy Analysis

4. Market Segmentation

4.1. Global Radiation Detection and Monitoring Products Market by Type

4.1.1. Area Process Monitors

4.1.2. Environment Radiation Monitors

4.1.3. Surface Contamination Monitors

4.1.4. Personal Dosimeters

4.1.5. Radioactive Material Monitors

4.2. Global Radiation Safety Products Market by Type

4.2.1. Full-Body Protection Products

4.2.2. Face Protection Products

4.2.3. Hand Safety Products

4.2.4. Other

4.3. Global Radiation Detection, Monitoring And Safety Market by Application

4.3.1. Healthcare

4.3.2. Homeland Security & Defense

4.3.3. Nuclear Power Plants

4.3.4. Industrial

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

6. Company Profiles

6.1. AMETEK

6.2. AmRay

6.3. Arktis Radiation Detectors Ltd.

6.4. ATOMTEX

6.5. BERTIN TECHNOLOGIES

6.6. Burlington Medical.

6.7. ECOTEST

6.8. Fuji Electric Co., Ltd.

6.9. Honeywell International Inc.

6.10. International Medcom, Inc.

6.11. John Caunt Scientific ltd.

6.12. LANDAUER

6.13. Ludlum Measurements, Inc.

6.14. Rapiscan Systems, Inc.

6.15. RaySafe

6.16. S.E. International, Inc

6.17. Sun Nuclear Corporation

1. GLOBAL RADIATION DETECTION AND MONITORING PRODUCTS MARKET RESEARCH AND ANALYSIS BY TYPE, 2023-2031 ($ MILLION)

2. GLOBAL AREA PROCESS RADIATION DETECTION, MONITORING AND SAFETY MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

3. GLOBAL ENVIRONMENT RADIATION DETECTION, MONITORING, AND SAFETY MARKET RESEARCH, AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

4. GLOBAL SURFACE CONTAMINATION RADIATION DETECTION, MONITORING, AND SAFETY MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

5. GLOBAL PERSONAL DOSIMETERS RADIATION DETECTION, MONITORING AND SAFETY MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

6. GLOBAL RADIOACTIVE MATERIAL RADIATION DETECTION, MONITORING, AND SAFETY MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

7. GLOBAL RADIATION SAFETY PRODUCTS MARKET RESEARCH AND ANALYSIS BY PRODUCTS TYPE, 2023-2031 ($ MILLION)

8. GLOBAL FULL-BODY PROTECTION RADIATION DETECTION, MONITORING, AND SAFETY PRODUCT MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

9. GLOBAL FACE PROTECTION RADIATION DETECTION, MONITORING, AND SAFETY PRODUCT MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

10. GLOBAL HAND SAFETY RADIATION DETECTION, MONITORING AND SAFETY PRODUCT MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

11. GLOBAL OTHER RADIATION DETECTION, MONITORING AND SAFETY PRODUCTS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

12. GLOBAL RADIATION DETECTION, MONITORING, AND SAFETY MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

13. GLOBAL RADIATION DETECTION, MONITORING AND SAFETY FOR HEALTHCARE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

14. GLOBAL RADIATION DETECTION, MONITORING AND SAFETY HOMELAND SECURITY & DEFENSE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

15. GLOBAL RADIATION DETECTION, MONITORING, AND SAFETY FOR NUCLEAR POWER PLANTS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

16. GLOBAL RADIATION DETECTION, MONITORING AND SAFETY FOR INDUSTRIAL MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

17. GLOBAL RADIATION DETECTION, MONITORING, AND SAFETY MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

18. NORTH AMERICAN RADIATION DETECTION, MONITORING, AND SAFETY MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

19. NORTH AMERICAN RADIATION DETECTION AND MONITORING PRODUCTS MARKET RESEARCH AND ANALYSIS BY TYPE, 2023-2031 ($ MILLION)

20. NORTH AMERICAN RADIATION SAFETY PRODUCTS MARKET RESEARCH AND ANALYSIS BY TYPE, 2023-2031 ($ MILLION)

21. NORTH AMERICAN RADIATION DETECTION, MONITORING, AND SAFETY MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

22. EUROPEAN RADIATION DETECTION, MONITORING, AND SAFETY MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

23. EUROPEAN RADIATION DETECTION AND MONITORING PRODUCTS MARKET RESEARCH AND ANALYSIS BY TYPE, 2023-2031 ($ MILLION)

24. EUROPEAN RADIATION SAFETY PRODUCTS MARKET RESEARCH AND ANALYSIS BY TYPE, 2023-2031 ($ MILLION)

25. EUROPEAN RADIATION DETECTION, MONITORING, AND SAFETY MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

26. ASIA-PACIFIC RADIATION DETECTION, MONITORING AND SAFETY MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

27. ASIA-PACIFIC RADIATION DETECTION AND MONITORING PRODUCTS MARKET RESEARCH AND ANALYSIS BY TYPE, 2023-2031 ($ MILLION)

28. ASIA-PACIFIC RADIATION SAFETY PRODUCTS MARKET RESEARCH AND ANALYSIS BY TYPE, 2023-2031 ($ MILLION)

29. ASIA-PACIFIC RADIATION DETECTION, MONITORING AND SAFETY MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

30. REST OF THE WORLD RADIATION DETECTION, MONITORING AND SAFETY MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

31. REST OF THE WORLD RADIATION DETECTION AND MONITORING PRODUCTS MARKET RESEARCH AND ANALYSIS BY TYPE, 2023-2031 ($ MILLION)

32. REST OF THE WORLD RADIATION SAFETY PRODUCTS MARKET RESEARCH AND ANALYSIS BY TYPE, 2023-2031 ($ MILLION)

33. REST OF THE WORLD RADIATION DETECTION, MONITORING AND SAFETY MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

1. GLOBAL RADIATION DETECTION AND MONITORING PRODUCTS MARKET SHARE BY TYPE, 2023 VS 2031 (%)

2. GLOBAL AREA PROCESS RADIATION DETECTION, MONITORING AND SAFETY MARKET SHARE BY REGION, 2023 VS 2031 (%)

3. GLOBAL ENVIRONMENT RADIATION DETECTION, MONITORING AND SAFETY MARKET SHARE BY REGION, 2023 VS 2031 (%)

4. GLOBAL SURFACE CONTAMINATION RADIATION DETECTION, MONITORING, AND SAFETY MARKET SHARE BY REGION, 2023 VS 2031 (%)

5. GLOBAL PERSONAL DOSIMETERS RADIATION DETECTION, MONITORING AND SAFETY MARKET SHARE BY PRODUCT, 2023 VS 2031 (%)

6. GLOBAL RADIATION DETECTION, MONITORING, AND SAFETY FOR ENERGY DRIVEN MARKET SHARE BY REGION, 2023 VS 2031 (%)

7. GLOBAL RADIOACTIVE MATERIAL RADIATION DETECTION, MONITORING, AND SAFETY FOR MATERIAL DRIVEN MARKET SHARE BY REGION, 2023 VS 2031 (%)

8. GLOBAL RADIATION SAFETY PRODUCTS MARKET SHARE BY TYPE, 2023 VS 2031 (%)

9. GLOBAL FULL-BODY PROTECTION PRODUCT RADIATION DETECTION, MONITORING, AND SAFETY MARKET SHARE BY REGION, 2023 VS 2031 (%)

10. GLOBAL FACE PROTECTION PRODUCTS RADIATION DETECTION, MONITORING, AND SAFETY MARKET SHARE BY REGION, 2023 VS 2031 (%)

11. GLOBAL HAND SAFETY PRODUCTS RADIATION DETECTION, MONITORING, AND SAFETY MARKET SHARE BY REGION, 2023 VS 2031 (%)

12. GLOBAL OTHER SAFETY PRODUCTS RADIATION DETECTION, MONITORING, AND SAFETY MARKET SHARE BY REGION, 2023 VS 2031 (%)

13. GLOBAL RADIATION DETECTION, MONITORING, AND SAFETY MARKET SHARE BY REGION, 2023 VS 2031 (%)

14. US RADIATION DETECTION, MONITORING AND SAFETY MARKET SIZE, 2023-2031 ($ MILLION)

15. CANADA RADIATION DETECTION, MONITORING AND SAFETY MARKET SIZE, 2023-2031 ($ MILLION)

16. UK RADIATION DETECTION, MONITORING AND SAFETY MARKET SIZE, 2023-2031 ($ MILLION)

17. FRANCE RADIATION DETECTION, MONITORING AND SAFETY MARKET SIZE, 2023-2031 ($ MILLION)

18. GERMANY RADIATION DETECTION, MONITORING AND SAFETY MARKET SIZE, 2023-2031 ($ MILLION)

19. ITALY RADIATION DETECTION, MONITORING AND SAFETY MARKET SIZE, 2023-2031 ($ MILLION)

20. SPAIN RADIATION DETECTION, MONITORING AND SAFETY MARKET SIZE, 2023-2031 ($ MILLION)

21. REST OF EUROPE RADIATION DETECTION, MONITORING AND SAFETY MARKET SIZE, 2023-2031 ($ MILLION)

22. INDIA RADIATION DETECTION, MONITORING AND SAFETY MARKET SIZE, 2023-2031 ($ MILLION)

23. CHINA RADIATION DETECTION, MONITORING AND SAFETY MARKET SIZE, 2023-2031 ($ MILLION)

24. JAPAN RADIATION DETECTION, MONITORING AND SAFETY MARKET SIZE, 2023-2031 ($ MILLION)

25. SOUTH KOREA RADIATION DETECTION, MONITORING AND SAFETY MARKET SIZE, 2023-2031 ($ MILLION)

26. REST OF ASIA-PACIFIC RADIATION DETECTION, MONITORING AND SAFETY MARKET SIZE, 2023-2031 ($ MILLION)

27. LATIN AMERICA RADIATION DETECTION, MONITORING AND SAFETY MARKET SIZE, 2023-2031 ($ MILLION)

28. THE MIDDLE EAST AND AFRICA RADIATION DETECTION, MONITORING AND SAFETY MARKET SIZE, 2023-2031 ($ MILLION)