Radiation-Hardened Electronics Market

Radiation-Hardened Electronics Market Size, Share & Trends Analysis Report by Component (Discrete, Integrated Circuit, Microcontrollers, and Microprocessors, Memory, and Sensors) and by End-User (Aerospace and Defense, Medical, Research, and Scientific Institutions, and Others (Energy and Telecommunications)) Forecast Period (2024-2031)

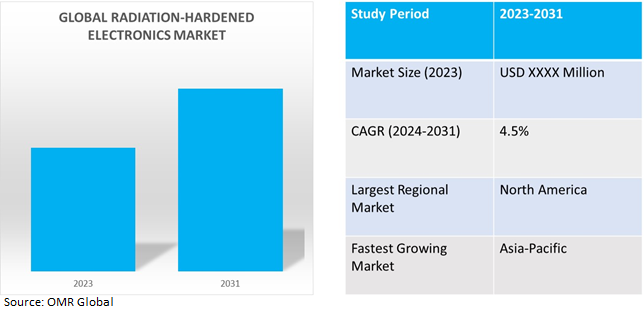

Radiation-hardened electronics market is anticipated to grow at a CAGR of 4.5% during the forecast period (2024-2031). Radiation-hardened electronics, also called rad-hard electronics, are electronic components (circuits, transistors, resistors, diodes, capacitors, etc.), single-board computer CPUs, and sensors that are designed and produced to be less susceptible to damage from exposure to radiation and extreme temperatures (-55°C to 125°C).

Market Dynamics

Increased space exploration mission and satellite deployments

Increasing space exploration missions and satellite deployments are fueling the market growth due to the harsh environment in space. High-reliability, radiation-resistant electronic components are needed for these missions to guarantee the durability and proper operation of vital systems. Radiation-hardened electronics are in greater demand as space exploration increases, offering manufacturers great opportunities to meet the specific needs of the aerospace sector. For instance, in April 2024, EPC Space introduced the EPC7009L16SH, a Radiation-Hardened Gallium Nitride (GaN) gate driver IC, utilizing EPC's eGaN IC technology. This compact device offers high efficiency, compact size, and uncomplicated design for power management. It combines an input logic interface, Under voltage Lockout (UVLO) protection, a 10V-to-5.25V linear regulator, and a driver circuit. It ensures a 1,000 kRad total ionizing dose. The EPC7009L16SH belongs to a recently introduced series of radiation-hardened integrated circuits (ICs) designed for space applications.

Market Segmentation

Our in-depth analysis of the global radiation-hardened electronics market includes the following segments by component and end-user:

- Based on components, the market is sub-segmented into discrete, integrated circuits, microcontrollers and microprocessors, memory, and sensors.

- Based on end-users, the market is segmented into aerospace and defense, medical, research and scientific institutions, and others.

Aerospace and Defense is Projected to Emerge as the Largest Segment

The aerospace and defense sub-segment is expected to hold the largest share of the market. The primary factor supporting the segment's growth includes substantial investments made by governments globally. The aerospace and defense sectors face radiation-rich environments, posing a risk of electronic system disruption or damage, leading to strong demand for radiation-hardened electronic solutions for resilient and reliable systems.

Microcontrollers and Microprocessors Sub-segment to Hold a Considerable Market Share

The need for radiation-hardened microprocessors and microcontrollers is growing as space exploration progresses and more missions are launched to farther-off places. These parts support the expansion of spacecraft systems in the radiation-hardened electronics industry by guaranteeing their dependability and robustness in orbit. As radiation-hardened microprocessors and microcontrollers are resistant to radiation-induced malfunctions, they are essential in nuclear plants and space applications. Standard electronics are prone to malfunctioning in these kinds of conditions. Radiation-hardened components, on the other hand, guarantee dependable operation while improving performance and safety. This important function in protecting delicate systems increases the need for these microprocessors and microcontrollers, which propels the market's growth.

Regional Outlook

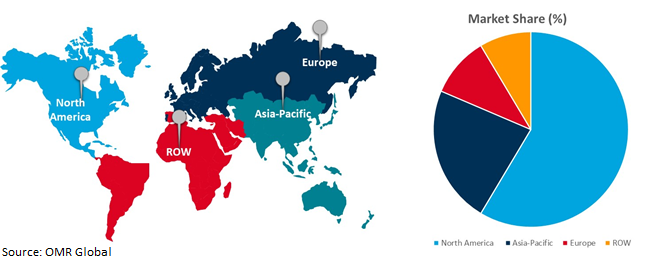

The global radiation-hardened electronics market is further segmented based on geography including North America (the US, and Canada), Europe (UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia), and the Rest of the World (the Middle East & Africa, and Latin America).

Asia-Pacific countries to invest in radiation-hardened electronics market

- China's rising space exploration program and satellite deployments are fueling the market growth.

- India’s growing defense and aerospace industries as well as increased spending on vital infrastructure.

Global Radiation-Hardened Electronics Market Growth by Region 2024-2031

North America Holds Major Market Share

North America holds a significant share owing to the focus on space and nuclear programs, in addition to the government investments in space electronics radiation hardened for space missions supplement the further growth of the market revenue. The rise in market revenue is also being supported by the expansion of radiation-tolerant material production and the mounting environmental concerns related to the massive amounts of radioactive discharge from nuclear weapon testing. Important organizations like BAE Systems plc. is involved to guarantee that production is enhanced and that several novel goods are created. The primary goal of BAE Systems is to construct dependable, radiation-resistant equipment for use in national security, commercial, and civil space initiatives. The company has been concentrating on producing and utilizing advanced radiation-hardened ASICs, which are mostly utilized in the critical domains of space and the military.

The U.S. Department of Defense is enhancing domestic production of radiation-hardened microelectronic components through legislative efforts and the modernization of satellites and nuclear plants to promote self-reliance. For instance, in December 2021, the US government issued an authorization to utilize Defense Production Act (DPA) Title III to strengthen and expand the domestic industrial base for radiation-hardened and strategic radiation-hardened microelectronics.

Market Players Outlook

*Note: Major Players Sorted in No Particular Order.

The major companies serving the global radiation-hardened electronics market include Advanced Micro Devices, Inc., BAE Systems plc, Honeywell International Inc., Renesas Electronics Corporation, and Microchip Technology Inc., among others. The market players are increasingly focusing on business expansion and product development by applying strategies such as collaborations, mergers, and acquisitions to stay competitive in the market. For instance, in October 2023, Teledyne e2v collaborated with Microchip Technology to develop a space computing reference design, featuring Microchip's Radiation-Tolerant Gigabit Ethernet PHYs. The innovative design focuses on high-speed data routing in space applications, presented at the European Data Handling & Data Processing Conference (EDHPC) 2023.

The Report Covers

- Market value data analysis of 2023 and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global radiation-hardened electronics market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. Advanced Micro Devices, Inc.

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. BAE Systems plc

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. Honeywell International Inc.

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Key Strategy Analysis

4. Market Segmentation

4.1. Global Radiation-Hardened Electronics Market by Component

4.1.1. Discrete

4.1.2. Integrated Circuit

4.1.3. Microcontrollers and Microprocessors

4.1.4. Memory

4.1.5. Sensors

4.2. Global Radiation-Hardened Electronics Market by End-User

4.2.1. Aerospace and Defense

4.2.2. Medical

4.2.3. Research and Scientific Institutions

4.2.4. Others (Energy and Telecommunications)

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

5.4.1. Latin America

5.4.2. Middle East and Africa

6. Company Profiles

6.1. Cobham Advanced Electronic Solutions (CAES)

6.2. Data Device Corporation

6.3. Everspin Technologies Inc.

6.4. Frontgrade Technologies

6.5. Infineon Technologies AG

6.6. Magics Technologies NV

6.7. Microchip Technology Inc.

6.8. Power Device Corp.

6.9. Renesas Electronics Corp.

6.10. Solid State Devices Inc.

6.11. Teledyne Technologies, Inc.

6.12. Texas Instruments, Inc.

6.13. TM Technologies, Inc.

6.14. Triad Semiconductor

6.15. VORAGO Technologies

1. GLOBAL RADIATION-HARDENED ELECTRONICS MARKET RESEARCH AND ANALYSIS BY COMPONENT, 2023-2031 ($ MILLION)

2. GLOBAL DISCRETE RADIATION-HARDENED ELECTRONICS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

3. GLOBAL INTEGRATED CIRCUIT RADIATION-HARDENED ELECTRONICS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

4. GLOBAL MICROCONTROLLERS AND MICROPROCESSORS RADIATION-HARDENED ELECTRONICS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

5. GLOBAL MEMORY RADIATION-HARDENED ELECTRONICS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

6. GLOBAL SENSORS RADIATION-HARDENED ELECTRONICS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

7. GLOBAL RADIATION-HARDENED ELECTRONICS MARKET RESEARCH AND ANALYSIS BY END-USER, 2023-2031 ($ MILLION)

8. GLOBAL RADIATION-HARDENED ELECTRONICS FOR AEROSPACE AND DEFENSE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

9. GLOBAL RADIATION-HARDENED ELECTRONICS FOR MEDICAL MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

10. GLOBAL RADIATION-HARDENED ELECTRONICS FOR RESEARCH AND SCIENTIFIC INSTITUTIONS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

11. GLOBAL RADIATION-HARDENED ELECTRONICS FOR OTHERS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

12. GLOBAL RADIATION-HARDENED ELECTRONICS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

13. NORTH AMERICAN RADIATION-HARDENED ELECTRONICS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

14. NORTH AMERICAN RADIATION-HARDENED ELECTRONICS MARKET RESEARCH AND ANALYSIS BY COMPONENT, 2023-2031 ($ MILLION)

15. NORTH AMERICAN RADIATION-HARDENED ELECTRONICS MARKET RESEARCH AND ANALYSIS BY END-USER, 2023-2031 ($ MILLION)

16. EUROPEAN RADIATION-HARDENED ELECTRONICS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

17. EUROPEAN RADIATION-HARDENED ELECTRONICS MARKET RESEARCH AND ANALYSIS BY COMPONENT, 2023-2031 ($ MILLION)

18. EUROPEAN RADIATION-HARDENED ELECTRONICS MARKET RESEARCH AND ANALYSIS BY END-USER, 2023-2031 ($ MILLION)

19. ASIA-PACIFIC RADIATION-HARDENED ELECTRONICS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

20. ASIA-PACIFIC RADIATION-HARDENED ELECTRONICS MARKET RESEARCH AND ANALYSIS BY COMPONENT, 2023-2031 ($ MILLION)

21. ASIA-PACIFIC RADIATION-HARDENED ELECTRONICS MARKET RESEARCH AND ANALYSIS BY END-USER, 2023-2031 ($ MILLION)

22. REST OF THE WORLD RADIATION-HARDENED ELECTRONICS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

23. REST OF THE WORLD RADIATION-HARDENED ELECTRONICS MARKET RESEARCH AND ANALYSIS BY COMPONENT, 2023-2031 ($ MILLION)

24. REST OF THE WORLD RADIATION-HARDENED ELECTRONICS MARKET RESEARCH AND ANALYSIS BY END-USER, 2023-2031 ($ MILLION)

1. GLOBAL RADIATION-HARDENED ELECTRONICS MARKET SHARE BY COMPONENT, 2023 VS 2031 (%)

2. GLOBAL DISCRETE RADIATION-HARDENED ELECTRONICS MARKET SHARE BY REGION, 2023 VS 2031 (%)

3. GLOBAL INTEGRATED CIRCUIT RADIATION-HARDENED ELECTRONICS MARKET SHARE BY REGION, 2023 VS 2031 (%)

4. GLOBAL MICROCONTROLLERS AND MICROPROCESSORS RADIATION-HARDENED ELECTRONICS MARKET SHARE BY REGION, 2023 VS 2031 (%)

5. GLOBAL MEMORY RADIATION-HARDENED ELECTRONICS MARKET SHARE BY REGION, 2023 VS 2031 (%)

6. GLOBAL SENSORS RADIATION-HARDENED ELECTRONICS MARKET SHARE BY REGION, 2023 VS 2031 (%)

7. GLOBAL RADIATION-HARDENED ELECTRONICS MARKET SHARE BY END-USER, 2023 VS 2031 (%)

8. GLOBAL RADIATION-HARDENED ELECTRONICS FOR AEROSPACE AND DEFENSE MARKET SHARE BY REGION, 2023 VS 2031 (%)

9. GLOBAL RADIATION-HARDENED ELECTRONICS FOR MEDICAL MARKET SHARE BY REGION, 2023 VS 2031 (%)

10. GLOBAL RADIATION-HARDENED ELECTRONICS FOR RESEARCH AND SCIENTIFIC INSTITUTIONS MARKET SHARE BY REGION, 2023 VS 2031 (%)

11. GLOBAL RADIATION-HARDENED ELECTRONICS FOR OTHERS MARKET SHARE BY REGION, 2023 VS 2031 (%)

12. GLOBAL RADIATION-HARDENED ELECTRONICS MARKET SHARE BY REGION, 2023 VS 2031 (%)

13. US RADIATION-HARDENED ELECTRONICS MARKET SIZE, 2023-2031 ($ MILLION)

14. CANADA RADIATION-HARDENED ELECTRONICS MARKET SIZE, 2023-2031 ($ MILLION)

15. UK RADIATION-HARDENED ELECTRONICS MARKET SIZE, 2023-2031 ($ MILLION)

16. FRANCE RADIATION-HARDENED ELECTRONICS MARKET SIZE, 2023-2031 ($ MILLION)

17. GERMANY RADIATION-HARDENED ELECTRONICS MARKET SIZE, 2023-2031 ($ MILLION)

18. ITALY RADIATION-HARDENED ELECTRONICS MARKET SIZE, 2023-2031 ($ MILLION)

19. SPAIN RADIATION-HARDENED ELECTRONICS MARKET SIZE, 2023-2031 ($ MILLION)

20. REST OF EUROPE RADIATION-HARDENED ELECTRONICS MARKET SIZE, 2023-2031 ($ MILLION)

21. INDIA RADIATION-HARDENED ELECTRONICS MARKET SIZE, 2023-2031 ($ MILLION)

22. CHINA RADIATION-HARDENED ELECTRONICS MARKET SIZE, 2023-2031 ($ MILLION)

23. JAPAN RADIATION-HARDENED ELECTRONICS MARKET SIZE, 2023-2031 ($ MILLION)

24. SOUTH KOREA RADIATION-HARDENED ELECTRONICS MARKET SIZE, 2023-2031 ($ MILLION)

25. REST OF ASIA-PACIFIC RADIATION-HARDENED ELECTRONICS MARKET SIZE, 2023-2031 ($ MILLION)

26. LATIN AMERICA RADIATION-HARDENED ELECTRONICS MARKET SIZE, 2023-2031 ($ MILLION)

27. MIDDLE EAST AND AFRICA RADIATION-HARDENED ELECTRONICS MARKET SIZE, 2023-2031 ($ MILLION)