Railway Management System Market

Railway Management System Market Size, Share & Trends Analysis Report by Offering (Solutions (Rail Operations Management, Rail Traffic Management, Asset Management, Intelligent In-Train Solutions). and Services (Consulting Services, System Integration and Deployment Services And Support and Maintenance Services). and by Deployment Type (Cloud and On-premise). Forecast Period (2024-2031).

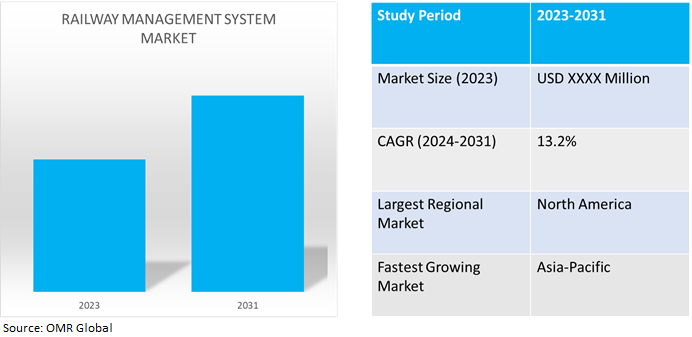

Railway management system market is anticipated to grow at a significant CAGR of 13.2% during the forecast period (2024-2031). The market growth is attributed to the increasing dependability of society on railroads, increased infrastructure development, safety and security, growing use of IoT and automation, and rising global passenger traffic, globally. Furthermore, the global market is being positively impacted by the growing expenditures made by governments globally to modernize the infrastructure of already-existing railways through the integration of intelligent sensors, big data analytics, the Internet of Things (IoT), and others.

Market Dynamics

Growing Demand for Efficient Rail Operation

Effective asset scheduling, monitoring, and maintenance are necessary for a smooth rail operation. Scheduled maintenance causes downtime, which lowers asset productivity. Owing to the low success rate of manual maintenance, this downtime is further prolonged. Rail authorities place a strong emphasis on condition-based and predictive maintenance solutions to increase efficiency and decrease time consumption. By assisting with timely asset scheduling and monitoring, these solutions reduce downtime. In addition, a major growth-inducing aspect is the growing requirement for profitability enhancement, operational cost reduction, passenger safety, and railway management system optimization to drive the growth of the market.

Predictive and Condition-Based Maintenance

By utilizing real-time data, predictive and condition-based maintenance lessens the need for manual maintenance. LoT technology has enabled the extensive use of GPS sensors, detectors, and Radio Frequency Identification (RFID) in rail assets and infrastructures. Thus, a variety of variables, such as state, location, temperature, heat, and pressure, can be collected, transferred, and analyzed. This enhances the rail asset's maintenance cycle. Rail asset usage can be optimized with the help of data from rail assets. It also makes scheduled asset maintenance, resource intensities, and resource pricing possible.

Market Segmentation

Our in-depth analysis of the global railway management system market includes the following segments offering (solution and services) and deployment mode.

- Based on the offering, the market is segmented into solutions (rail operations management, rail traffic management, asset management, intelligent in-train solutions) and services (consulting services, system integration and deployment services, and support and maintenance services).

- Based on the deployment type, the market is segmented into cloud and on-premise.

Rail Operations Management is Projected to Hold the Largest Segment

The solution segment is expected to hold the largest share of the market. The primary factors supporting the growth include the growing adoption of rail operations management systems in real-time, the rail operations management system provides solutions to improve everyday operations. By centrally supervising and managing many factors, including rail infrastructure, traffic flow, freight and passenger handling, revenue and ticketing, workforce, and rail automation, it ensures minimal disruptions in operations. Real-time rail movement monitoring helps prevent undesirable mishaps and accidents, its main advantage. The key market players offering solutions for rail operations management include ALSTOM SA, Hitachi, Ltd., Huawei Technologies Co., Ltd., IBM Corp., Wabtec Corp., and others. For instance, in October 2023, India’s first semi-high-speed regional train by Alstom – NaMo Bharat was inaugurated, setting a new standard in advanced signaling technology. The project also marks the global premiere of several new signaling technologies that set new benchmarks in the rail space globally.

Cloud Segment to Hold a Considerable Market Share

The cloud segment is expected to hold a considerable share of the market. Real-time monitoring offers the most recent information on rail operations, which is a great addition to cloud computing. Proactive decision-making has grown increasingly vital in the fast-paced rail business, and this competence is essential for it. Operators may oversee equipment health, track train locations, and track conditions using real-time monitoring. A continuous flow of data to the cloud is ensured by the integration of sensors and IoT devices across rail infrastructure. This data includes a variety of factors, such as vibration, speed, and humidity in addition to temperature. Through real-time data analysis, operators can spot anomalies, possible malfunctions, or even dangerous situations.

Regional Outlook

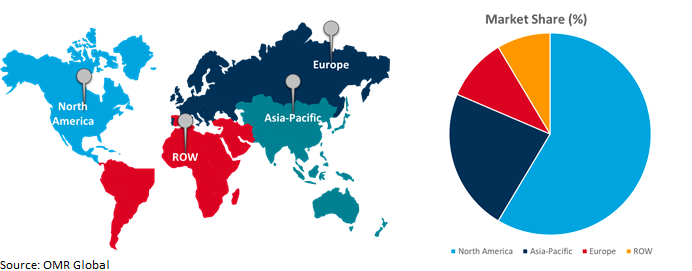

Railway management system market is further segmented based on geography including North America (the US, and Canada), Europe (UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia-Pacific), and the Rest of the World (the Middle East & Africa, and Latin America).

Growing Advancement in Railway Management Systems in Asia-Pacific

- The regional growth is attributed to the growing adoption of advanced railway management systems modernization solutions, generational change to assure safety, improve productivity, take advantage of advanced innovation, and the adoption of new technologies. For instance, in April 2021, National High-Speed Rail Corp Ltd. (NHSRCL) signed a memorandum of understanding (MoU) with Japan Railway Technical Service (JARTS) for training & certification and advisory services for the construction of Track works. The slab track system used for Shinkansen- a high-speed rail in Japan, is highly specialized and requires the use of special machines.

- To improve connectivity and promote economic development, countries in the region are making significant investments in updating and enlarging their rail networks, with a focus on high-speed rail systems. With the increasing use of automation and predictive analytics to enhance operational effectiveness and passenger experience, technology adoption is growing. According to the State Council Information Office of China (SCIO), in June 2022, The railway network has improved substantially in scale and quality over the past decade. Investment in railway fixed assets exceeded 7.0 trillion yuan ($1.1) trillion, contributing to a mileage increase of 52,000 kilometers. China had 150,000 kilometers of railways in operation by the end of 2021, including 40,000 kilometers of high-speed railways.

Global Railway Management System Market Growth by Region 2024-2031

North America Holds Major Market Share

Among all the regions, North America holds a significant share owing to numerous prominent railway management system companies and providers such as Honeywell International Inc., IBM Corp., and Wabtec Corp. in the region. The growth is mainly attributed to the increasing advancements in freight operations, such as rail planning and traffic, operation control, station communication, maintenance schedules, and others provide growth in the railway management system market in the region. The increasing use of innovative digital communication and catastrophe management technologies helps to satisfy customers while guaranteeing the highest level of security. Additionally, supportive government investment for improved operation and maintenance drives the growth of the market. For instance, in December 2023, the US government announced $8.2 billion in new funding for 10 major passenger rail projects across the country, including the first world-class high-speed rail projects. The project includes advanced future projects to significantly improve travel times by increasing operating speeds and reducing delays.

Market Players Outlook

*Note: Major Players Sorted in No Particular Order.

The major companies serving railway management system market include ALSTOM SA, Hitachi, Ltd., Huawei Technologies Co., Ltd., Siemens AG, and THALES Group, among others. The market players are increasingly focusing on business expansion and product development by applying strategies such as collaborations, mergers, and acquisitions to stay competitive in the market. For instance, in February 2024, Alstom and PKP PLK collaborated and signed a maintenance agreement for railway traffic control systems and devices. The contract aims to offer post-warranty maintenance for railway traffic control devices and computer systems produced by Alstom.

Recent Development

- In August 2021, Xinshuo Railway Co., Ltd., a subsidiary of China Energy, introduced a centralized traffic control (CTC) system. The railway CTC system aims to enhance the transport and production integrated management capacity and efficiency through centralized management of communications, signals, power supply units, traffic control, and others.

The Report Covers

- Market value data analysis of 2023 and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in railway management system market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. ALSTOM SA

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. Hitachi, Ltd.

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. Huawei Technologies Co., Ltd.

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Siemens AG

3.5.1. Overview

3.5.2. Financial Analysis

3.5.3. SWOT Analysis

3.5.4. Recent Developments

3.6. THALES group

3.6.1. Overview

3.6.2. Financial Analysis

3.6.3. SWOT Analysis

3.6.4. Recent Developments

3.7. Key Strategy Analysis

4. Market Segmentation

4.1. Global Railway Management System Market by Offering

4.1.1. Solution

4.1.1.1. Rail Operations Management

4.1.1.2. Rail Traffic Management

4.1.1.2.1. Signaling Solution

4.1.1.2.2. Real-Time Train Planning And Route Scheduling/Optimizing

4.1.1.2.3. Centralized Traffic Control

4.1.1.2.4. Positive Train Control

4.1.1.2.5. Rail Communications-Based Train Control (CBTC)

4.1.1.3. Asset Management

4.1.1.3.1. Enterprise Asset Management

4.1.1.3.2. Field Service Management

4.1.1.3.3. Asset Performance Management

4.1.1.4. Intelligent In-Train Solutions

4.1.2. Services

4.1.2.1. Consulting Services

4.1.2.2. System Integration And Deployment Services

4.1.2.3. Support And Maintenance Services

4.2. Global Railway Management System Market by Deployment Mode

4.2.1. Cloud

4.2.2. On-Premise

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

5.4.1. Latin America

5.4.2. Middle East & Africa

6. Company Profiles

6.1. ABB Ltd.

6.2. Advantech Co., Ltd.

6.3. Belden Inc.

6.4. CAF, Construcciones y Auxiliar de Ferrocarriles, S.A.

6.5. CGI Inc.

6.6. Cisco Systems, Inc.

6.7. General Electric Company

6.8. Honeywell International Inc.

6.9. IBM Corp.

6.10. Indra Sistemas S.A.

6.11. L&T Technology Services Ltd.

6.12. Mitsubishi Electric Group

6.13. Moxa Inc.

6.14. Nokia Corp.

6.15. Railnova SA

6.16. Selectron Systems AG

6.17. Toshiba Infrastructure Systems & Solutions Corp.

6.18. Trimble Inc.

6.19. Vector Informatik GmbH

6.20. Wabtec Corp.

1. GLOBAL RAILWAY MANAGEMENT SYSTEM MARKET RESEARCH AND ANALYSIS BY OFFERING,2023-2031 ($ MILLION)

2. GLOBAL RAILWAY MANAGEMENT SYSTEMSOLUTIONMARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

3. GLOBAL RAILWAY OPERATIONS MANAGEMENT SYSTEMMARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

4. GLOBAL RAILWAY TRAFFIC MANAGEMENT SYSTEMMARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

5. GLOBAL RAILWAY ASSET MANAGEMENT SYSTEMMARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

6. GLOBAL RAILWAY INTELLIGENT IN-TRAIN SOLUTIONSMANAGEMENT SYSTEMMARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

7. GLOBAL RAILWAY MANAGEMENT SYSTEMSERVICESMARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

8. GLOBAL RAILWAY MANAGEMENT CONSULTING SERVICESSYSTEMMARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

9. GLOBAL RAILWAY MANAGEMENT SYSTEM INTEGRATION AND DEPLOYMENT SERVICESMARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

10. GLOBAL RAILWAY MANAGEMENT SUPPORT AND MAINTENANCE SERVICESSYSTEM MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

11. GLOBAL RAILWAY MANAGEMENT SYSTEM MARKET RESEARCH AND ANALYSIS BY DEPLOYMENT MODE, 2023-2031 ($ MILLION)

12. GLOBAL RAILWAY CLOUD MANAGEMENT SYSTEM MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

13. GLOBAL RAILWAY ON-PREMISE MANAGEMENT SYSTEM MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

14. GLOBAL RAILWAY MANAGEMENT SYSTEM MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

15. NORTH AMERICAN RAILWAY MANAGEMENT SYSTEM MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

16. NORTH AMERICAN RAILWAY MANAGEMENT SYSTEM MARKET RESEARCH AND ANALYSIS BY OFFERING,2023-2031 ($ MILLION)

17. NORTH AMERICAN RAILWAY MANAGEMENT SYSTEM MARKET RESEARCH AND ANALYSIS BY DEPLOYMENT MODE, 2023-2031 ($ MILLION)

18. EUROPEAN RAILWAY MANAGEMENT SYSTEM MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

19. EUROPEAN RAILWAY MANAGEMENT SYSTEM MARKET RESEARCH AND ANALYSIS BY OFFERING, 2023-2031 ($ MILLION)

20. EUROPEAN RAILWAY MANAGEMENT SYSTEM MARKET RESEARCH AND ANALYSIS BY DEPLOYMENT MODE, 2023-2031 ($ MILLION)

21. ASIA- PACIFIC RAILWAY MANAGEMENT SYSTEM MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

22. ASIA- PACIFIC RAILWAY MANAGEMENT SYSTEM MARKET RESEARCH AND ANALYSIS BY OFFERING, 2023-2031 ($ MILLION)

23. ASIA- PACIFIC RAILWAY MANAGEMENT SYSTEM MARKET RESEARCH AND ANALYSIS BY DEPLOYMENT MODE, 2023-2031 ($ MILLION)

24. REST OF THE WORLD RAILWAY MANAGEMENT SYSTEM MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

25. REST OF THE WORLD RAILWAY MANAGEMENT SYSTEM MARKET RESEARCH AND ANALYSIS BY OFFERING, 2023-2031 ($ MILLION)

26. REST OF THE WORLD RAILWAY MANAGEMENT SYSTEM MARKET RESEARCH AND ANALYSIS BY DEPLOYMENT MODE, 2023-2031 ($ MILLION)

1. GLOBAL RAILWAY MANAGEMENT SYSTEM MARKET RESEARCH AND ANALYSIS BY OFFERING, 2023 VS 2031 (%)

2. GLOBAL RAILWAY MANAGEMENT SYSTEMSOLUTIONMARKET RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

3. GLOBAL RAILWAY OPERATIONS MANAGEMENT SYSTEMMARKET RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

4. GLOBAL RAILWAY TRAFFIC MANAGEMENT SYSTEMMARKET RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

5. GLOBAL RAILWAY ASSET MANAGEMENT SYSTEMMARKET RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

6. GLOBAL RAILWAY INTELLIGENT IN-TRAIN SOLUTIONSMANAGEMENT MARKET RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

7. GLOBAL RAILWAY MANAGEMENT SYSTEMSERVICESMARKET RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

8. GLOBAL RAILWAY MANAGEMENT CONSULTING SERVICESSYSTEMMARKET RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

9. GLOBAL RAILWAY MANAGEMENT SYSTEM INTEGRATION AND DEPLOYMENT SERVICESMARKET RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

10. GLOBAL RAILWAY MANAGEMENT SUPPORT AND MAINTENANCE SERVICESSYSTEM MARKET RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

11. GLOBAL RAILWAY MANAGEMENT SYSTEM MARKET RESEARCH AND ANALYSIS BY DEPLOYMENT MODE, 2023 VS 2031 (%)

12. GLOBAL RAILWAY CLOUD MANAGEMENT SYSTEMMARKET RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

13. GLOBAL RAILWAY ON-PREMISE MANAGEMENT SYSTEMMARKET RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

14. GLOBAL RAILWAY MANAGEMENT SYSTEM MARKET RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

15. US RAILWAY MANAGEMENT SYSTEM MARKET SIZE, 2023-2031 ($ MILLION)

16. CANADA RAILWAY MANAGEMENT SYSTEM MARKET SIZE, 2023-2031 ($ MILLION)

17. UK RAILWAY MANAGEMENT SYSTEM MARKET SIZE, 2023-2031 ($ MILLION)

18. FRANCE RAILWAY MANAGEMENT SYSTEM MARKET SIZE, 2023-2031 ($ MILLION)

19. GERMANY RAILWAY MANAGEMENT SYSTEM MARKET SIZE, 2023-2031 ($ MILLION)

20. ITALY RAILWAY MANAGEMENT SYSTEM MARKET SIZE, 2023-2031 ($ MILLION)

21. SPAIN RAILWAY MANAGEMENT SYSTEM MARKET SIZE, 2023-2031 ($ MILLION)

22. REST OF EUROPE RAILWAY MANAGEMENT SYSTEM MARKET SIZE, 2023-2031 ($ MILLION)

23. INDIA RAILWAY MANAGEMENT SYSTEM MARKET SIZE, 2023-2031 ($ MILLION)

24. CHINA RAILWAY MANAGEMENT SYSTEM MARKET SIZE, 2023-2031 ($ MILLION)

25. JAPAN RAILWAY MANAGEMENT SYSTEM MARKET SIZE, 2023-2031 ($ MILLION)

26. SOUTH KOREA RAILWAY MANAGEMENT SYSTEM MARKET SIZE, 2023-2031 ($ MILLION)

27. REST OF ASIA-PACIFIC RAILWAY MANAGEMENT SYSTEM MARKET SIZE, 2023-2031 ($ MILLION)

28. REST OF THE WORLD RAILWAY MANAGEMENT SYSTEM MARKET SIZE, 2023-2031 ($ MILLION)