Ready to Drink Beverages Market

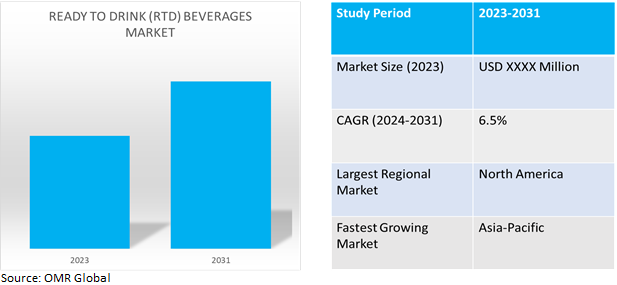

Ready to Drink Beverages Market Size, Share & Trends Analysis Report by Product type (Tea, Coffee, Soft Drinks, Energy Drinks, Dairy based beverages, Flavored and fortified Water and other Beverages), and by Distribution Channel (Online Marketplace, Supermarkets and Retail Stores) Forecast Period (2024-2031)

Ready-to-drink beverage market is anticipated to grow at a CAGR of 6.5% during the forecast period (2024-2031). Ready-to-drink beverages are packaged drinks sold in a ready state that can be consumed immediately post-purchase. It includes a variety of beverages, such as tea, coffee, soft drinks, energy drinks, and others. The market has gained traction in recent decades owing to changing consumption habits, rising urbanization, and increasing adoption of ready drinks beverages across demographics. Furthermore, the market has remained relevant through its constant innovation with products and marketing, such as the development of novel drinks (energy drinks and locally -flavored drinks).

Market Dynamics

Increasing Urbanization and Disposable Income

The growth in the ready to drink beverages market is driven by the rising adoption of packaged beverages globally. Major reason for adoption is increasing urbanization, changing drinking habits and spending patterns. For instance, as per World Bank, over 50% of the population lives in urban areas today and by 2045, the world's urban population will increase by 1.5 times to 6 billion. Rising urban population with increase in global per capita is contributing to the rise, for instance, Also, consumption of RTD beverages is comparatively more inclined to urban areas. For instance, as per IBEF India 40% of business for packaged foods and beverages firms operating in this market is skewed towards large metros, with the rest coming from the rest of the country.

Simultaneously, increases in disposable income and spending are also acting positively for the RTD market with more contributions from away from home spending. For instance, as per the U.S department of agriculture in 2022, the share of disposable personal income spent on total food had the sharpest annual increase (12.7 %), driven by an increase in the share of income spent on food away from home. Whereas, in 2022, food spending by U.S. consumers, businesses, and government entities totaled $2.39 trillion, after a sharp decline in 2020 in which the food market was disrupted by the Coronavirus (COVID-19) pandemic and the recession. U.S. food spending in 2020 totaled $1.81 trillion.

Growing Obesity and introduction of Tax may impede growth

On the contrary, there are constant warnings from organizations such as WHO about rising obesity rates and related diseases. Obesity rates are increasing globally, and packaged foods are attributed as one of major contributors. For instance, as per National Health Institute (NIH) In the United States, consumption of sugar-sweetened beverages, particularly soft drinks, has been associated with rising obesity and diabetes. Wherein, several countries have introduced tax on such beverages to impede consumption and counter rising health concerns. For instance, India in 2017 introduced bill to impose higher tax (28% GST and 12% cess) on aerated drinks and Mexico was the first country in 2014 to impose such as tax causing 10% decline in consumption.

Healthy and Local Alternatives Creating Opportunity for Companies

To counter rising health concerns and provide consumers with alternatives companies are launching drinks with low-sugar content and ingredients like probiotics, adaptogens and natural sweeteners. Whereas, local as well as hybrid beverage experiences are gaining traction. RTD drinks that combine different types offer consumers exciting and unique flavors. Example wine-based margaritas. For instance, Coca-Cola India has extended homegrown Limca into the hydrating sports drinks category with Limca Sportz. The new variant contains electrolytes that claim to rehydrate a consumer. The move is in line with Coca-Cola’s global strategy to beef up its portfolio of healthier drinks. Similarly, Pepsi launched hybrid drink in 2020 Pepsi Café, a drink that blends cola with coffee and comes in original and vanilla flavors with caffeine nearly doubled. Overall, the RTD market looks positive with growing demand and an increase in supply infrastructure. Government regulation and health concerns remains as a negative, however market is growing with good adoption rates in developing and underdeveloped countries and ample opportunities to innovate product offerings for each segment and geographic leaving scope for positive trend line in future.

Segment Outlook

Our in-depth analysis of the global ready to drink beverages market includes the following segments by product type, and distribution channel.

- Based on product type, the market is sub-segmented into tea, coffee, soft drinks, energy drinks, flavored and fortified water, dairy based beverages and others.

- Based on distribution channel, the market is sub-segmented into online marketplaces, supermarkets and retail stores.

Soft drink is the Largest Sub-Segment

Based on product type, the market has a diverse sub-segments such as tea, coffee, soft drinks, energy drinks, flavored and fortified water, dairy based beverages and others. Among all the offerings soft drink is the biggest market with demand from consumers and good supply chain. For instance, as of 2020, around 62% of adults in the USA reported consuming sugary drinks on any given day and the market is forecasted to reach a value of $449.32 billion by 2025.

Retail Stores Sub-segment to Hold a Considerable Market Share

Retail stores are by far the front runner in RTD beverages supply and distribution with wide reach and availability. It holds such a good market in distribution as it is one of the oldest form of distribution used by beverage companies. For instance, Coca-Cola alone has 225 bottling partners across 900 bottling plants, serving an estimated 30 million retail outlets in total. Retail stores are still one of the prime way for companies to serve customers in developing countries, thus holding substantial market share.

Regional Outlook

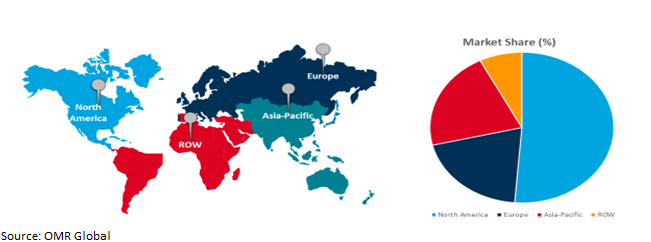

The global ready to drink beverages market is further segmented based on geography including North America (the US, and Canada), Europe (UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia), and the Rest of the World (the Middle East & Africa, and Latin America).

North America Holds Highest Share in Global Ready to Drink Beverages Market

North America holds the highest share of the global ready to drink beverages market share. the key factor contributing to the growth of the market presence of major ready to drink beverages manufacturers such as Coca-Cola, PepsiCo and Keurig dr. pepper., a well-established supply chain and growing consumption of energy drinks in young population. For instance, according to national center for complimentary and integrative health, next to multivitamins, energy drinks are the most popular dietary supplement consumed by American teens and young adults. Also, men between the ages of 18 and 34 years consume the most energy drinks, and almost one-third of teens between 12 and 17 years drink them regular. Further, as per American society for pediatrics, between 30-50% of adolescents and young adults consume energy drinks.

Global Ready to Drink Beverages Market Growth by Region 2024-2031

Asia-Pacific is the Fastest Growing in Ready to Drink Beverages Market

- Low- cost offering of RTD beverages with wide availability and good marketing in Asian markets is driving growth for the Ready to Drink Beverages market

- Major players such as Coca-Cola and Pepsi Are Investing more in Asia Pacific for setting up manufacturing facilities and strengthening supply Chain.

Market Players Outlook

*Note: Major Players Sorted in No Particular Order.

The major companies serving the global ready to drink beverages market includes Coca-Cola, Pepsi, Keurig Dr. Pepper, Nestle and Red bull among others. With growing demand, market players are focusing on capitalizing on growth by adopting strategies such as collaboration, partnerships, and market expansion among others. For instance, In September 2023, Coca-Cola and Molson Coors expanded their fast-growing partnership with the launch of a ready-to-drink cocktail. The third drink to be introduced by the beverage makers since they first joined in 2020, will debut in more than 20 markets across the U.S. in 2023.

The Report Covers

- Market value data analysis of 2023 and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global ready to drink beverages market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tool

1.2. Market Breakdown

1.3. By Segments

1.4. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.3. Key Findings

2.4. Recommendations

2.5. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. Coca Cola Bebidas de Colombia, S.A.

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. Keurig Dr Pepper

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. Nestlé S.A.

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5.PepsiCo,Inc.

3.5.1. Overview

3.5.2. Financial Analysis

3.5.3. SWOT Analysis

3.5.4. Recent Developments

3.6.Red Bull GmbH

3.6.1. Overview

3.6.2. Financial Analysis

3.6.3. SWOT Analysis

3.6.4. Recent Developments

3.7. Key Strategy Analysis

4. Market Segmentation

4.1. Global Ready to Drink Beverages Market by Product Type

4.1.1. Tea

4.1.2. Coffee

4.1.3. Soft Drinks

4.1.4. Energy Drinks

4.1.5. Dairy-based beverages

4.1.6. Flavored & Fortified Water

4.1.7. Other Beverages

4.2. Global Ready to Drink Beverages Market by Distribution Channel

4.2.1. Online Marketplace

4.2.2. Supermarkets

4.2.3. Retail Stores

5. Regional Analysis

5.1. North America

5.1.1. United States

5.2.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.5.5, Rest of Asia-Pacific

5.5.6. Rest of the World

Latin America

The Middle East & Africa

6. Company Profiles

6.1.Achian Foods Pvt. Ltd.

6.2.Al Rabie Saudi Foods Co. Ltd.

6.3.Asahi Group Holdings Pty Ltd.

6.4. Danone S.A.

6.5.Kirin Holdings Co., Ltd.

6.6.Monster Beverage Corp.

6.7.National Beverage Corp.

6.8.Parle Ago Pvt. Ltd.

6.9.Power Horse Energy Drinks GmbH

6.10.Primo Water Corp.

6.11.Refresco Group N.V.

6.13.Starbucks Corp.

6.14.Unilever Plc.

1. GLOBAL READY TO DRINK BEVERAGES MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2023-2031 ($ MILLION)

2. GLOBAL READY TO DRINK TEAMARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

3. GLOBAL READY TO DRINK COFFEE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

4. GLOBAL READY TO DRINK SOFT DRINKS MARKETRESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

5. GLOBAL READY TO DRINK ENERGY DRINKSMARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

6. GLOBAL READY TO DRINK DAIRY-BASED BEVERAGES MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

7. GLOBAL READY TO DRINK FLAVORED & FORTIFIED WATER MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

8. GLOBAL READY TO DRINK OTHER BEVERAGES MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

9. GLOBAL READY TO DRINK BEVERAGES MARKET RESEARCH AND ANALYSIS BY DISTRIBUTION CHANNEL, 2023-2031 ($ MILLION)

10. GLOBAL READY TO DRINK BEVERAGES VIAONLINE MARKETPLACES MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

11. GLOBAL READY TO DRINK BEVERAGES VIA SUPERMARKETS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

12. GLOBAL READY TO DRINK BEVERAGES VIA RETAIL STORES MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

13. GLOBAL READY TO DRINK BEVERAGES MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

14. NORTH AMERICAN READY TO DRINK BEVERAGES MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

15. NORTH AMERICAN READY TO DRINK BEVERAGES MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2023-2031 ($ MILLION)

16. NORTH AMERICAN READY TO DRINK BEVERAGES MARKET RESEARCH AND ANALYSIS BY DISTRIBUTION CHANNEL, 2023-2031 ($ MILLION)

17. EUROPEAN READY TO DRINK BEVERAGES MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

18. EUROPEAN READY TO DRINK BEVERAGES MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2023-2031 ($ MILLION)

19. EUROPEAN READY TO DRINK BEVERAGES MARKET RESEARCH AND ANALYSIS BY DISTRIBUTION CHANNEL, 2023-2031 ($ MILLION)

20. ASIA-PACIFIC READY TO DRINK BEVERAGES MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

21. ASIA-PACIFIC READY TO DRINK BEVERAGES MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2023-2031 ($ MILLION)

22. ASIA-PACIFIC READY TO DRINK BEVERAGES MARKET RESEARCH AND ANALYSIS BY DISTRIBUTION CHANNEL, 2023-2031 ($ MILLION)

23. REST OF THE WORLD READY TO DRINK BEVERAGES MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

24. REST OF THE WORLD READY TO DRINK BEVERAGES MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2023-2031 ($ MILLION)

25. REST OF THE WORLD READY TO DRINK BEVERAGES MARKET RESEARCH AND ANALYSIS BY DISTRIBUTION CHANNEL, 2023-2031 ($ MILLION)

1. GLOBAL READY TO DRINK BEVERAGES MARKET SHARE BY PRODUCT TYPE, 2023 VS 2031 (%)

2. GLOBAL READY TO DRINK TEA MARKET SHARE BY REGION, 2023 VS 2031 (%)

3. GLOBAL READY TO DRINK COFFEE MARKET SHARE BY REGION, 2023 VS 2031 (%)

4. GLOBAL SOFT DRINKS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

5. GLOBAL ENERGY DRINKS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

6. GLOBAL DAIRY-BASED BEVERAGESS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

7. GLOBAL FLAVORED & FORTIFIED WATER MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

8. GLOBAL OTHER BEVERAGES MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

9. GLOBAL READY TO DRINK BEVERAGES MARKET SHARE BY DISTRIBUTION CHANNEL, 2023 VS 2031 (%)

10. GLOBAL READY TO DRINK BEVERAGES VIAONLINE MARKETPLACES MARKET SHARE BY REGION, 2023 VS 2031 (%)

11. GLOBAL READY TO DRINK BEVERAGES VIA SUPERMARKETS MARKET SHARE BY REGION, 2023 VS 2031 (%)

12. GLOBAL READY TO DRINK BEVERAGES VIA RETAIL STORESMARKET SHARE BY REGION, 2023 VS 2031 (%)

13. GLOBAL READY TO DRINK BEVERAGES MARKET SHARE BY REGION, 2023 VS 2031 (%)

14. US READY TO DRINK BEVERAGES MARKET SIZE, 2023-2031 ($ MILLION)

15. CANADA READY TO DRINK BEVERAGES MARKET SIZE, 2023-2031 ($ MILLION)

16. UK READY TO DRINK BEVERAGES MARKET SIZE, 2023-2031 ($ MILLION)

17. FRANCE READY TO DRINK BEVERAGES MARKET SIZE, 2023-2031 ($ MILLION)

18. GERMANY READY TO DRINK BEVERAGES MARKET SIZE, 2023-2031 ($ MILLION)

19. ITALY READY TO DRINK BEVERAGES MARKET SIZE, 2023-2031 ($ MILLION)

20. SPAIN READY TO DRINK BEVERAGES MARKET SIZE, 2023-2031 ($ MILLION)

21. REST OF EUROPE READY TO DRINK BEVERAGES MARKET SIZE, 2023-2031 ($ MILLION)

22. INDIA READY TO DRINK BEVERAGES MARKET SIZE, 2023-2031 ($ MILLION)

23. CHINA READY TO DRINK BEVERAGES MARKET SIZE, 2023-2031 ($ MILLION)

24. JAPAN READY TO DRINK BEVERAGES MARKET SIZE, 2023-2031 ($ MILLION)

25. SOUTH KOREA READY TO DRINK BEVERAGES MARKET SIZE, 2023-2031 ($ MILLION)

26. REST OF ASIA-PACIFIC READY TO DRINK BEVERAGES MARKET SIZE, 2023-2031 ($ MILLION)

27. LATIN AMERICA READY TO DRINK BEVERAGES MARKET SIZE, 2023-2031 ($ MILLION)

28. THE MIDDLE EAST AND AFRICA READY TO DRINK BEVERAGES MARKET SIZE, 2023-2031 ($ MILLION)