Ready to Drink Tea Market

Global Ready to Drink Tea Market Size, Share & Trends Analysis Report by Type (Green Tea, Black Tea, and Others), by Nature (Organic and Conventional), by Flavor (Fruit Flavor, Lemon Flavor, Spice Flavor, Herbal Flavor, and Other Flavors), and by Packaging (Bottles, Cans, and Carton Packaging), Forecast 2021-2027 Update Available - Forecast 2025-2035

The global ready to drink tea market is anticipated to grow at a significant CAGR of 4.9% during the forecast period. Increasing introduction of new flavours and innovations at ingredient levels in RTD tea are found to be very appealing to consumers who crave for a variety of drinks. Companies launching new flavoured teas such as peach, watermelon, citrus, cranberry, lemon, and lime to attract more customers is providing remunerative opportunities for the expansion of global ready to drink tea market. For instance, in June 2020, Teavana, a Starbucks company announced the launch of new RTD wellness craft Iced Teas in three vibrant flavours. The company introduced six new flavoured teas: defense orange cinnamon white tea, balance watermelon basil oolong tea, refresh blueberry mint herbal tea, mandarin mimosa herbal tea and lemon ginger bliss herbal tea. The new teas are made with the finest teas and botanicals, plus ingredients like ginger, turmeric, and peppermint

Impact of COVID-19 Pandemic on Global Ready to Drink Tea Market

The COVID-19 pandemic had a considerable impact on the growth global ready to drink tea market. The pandemic had created awareness of diet and health among consumers which accelerated the inclination towards healthier and high quality RTD teas with nutritious and herbal ingredients. RTD flavored teas with health benefits and clean labels became a primary purchase motivation for consumers. RTD tea brands with products containing ingredients such as ginger, turmeric, cinnamon, honey, lime was high in demand during the pandemic.

Segmental Outlook

The global ready to drink tea market is segmented based on the type, nature, flavor, and packaging. Based on the type, the market is segmented into green tea, black tea, and others such as herbal tea. Based on the nature, the market is sub-segmented into the organic and conventional. Based on the flavor the market is segmented into fruit flavor, lemon flavor, spice flavor, herbal flavor and other flavors. The other flavors include chocolate flavors. Based on the packaging the market is sub-segmented into bottles, cans, carton packaging and others. The above-mentioned segments can be customized as per the requirements.

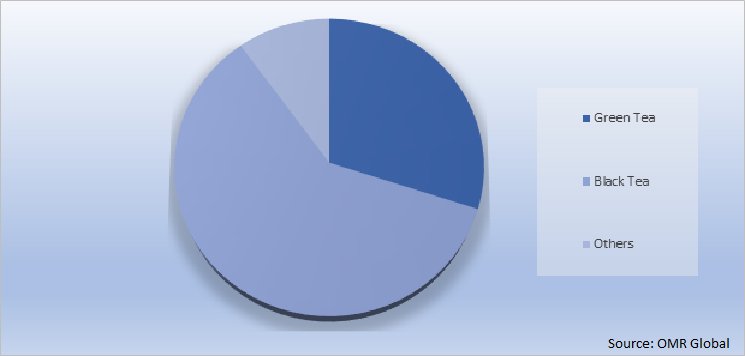

Global Ready to Drink Tea Market Share by Type, 2020 (%)

The Black Tea Segment is Anticipated to Hold a Prominent Share in the Global Ready to Drink Tea Market

Based on type, the black tea segment is anticipated to hold maximum share owing to numerous health benefits of black tea consumption. Black tea contains powerful antioxidants and other compounds which help to provide protection against several chronic conditions. Black tea is non-sweetened, contains no sodium and, is less-calorie drink which drives its demand towards among health-conscious people. Due to people growing concerns and health benefits of black tea, Black tea is the most consumed tea in the US. According to Tea Association of the U.S.A Inc. people who regularly consume three or more cups of black tea per day have a reduced risk of heart disease and stroke.

Regional Outlooks

The global ready to drink tea market is further segmented based on geography including North America (the US, and Canada), Europe (Italy, Spain, Germany, France, and Others), Asia-Pacific (India, China, Japan, South Korea, and Others), and the Rest of the World (the Middle East &Africa, and Latin America). The market can be analyzed for particular region or country level as per the requirement.

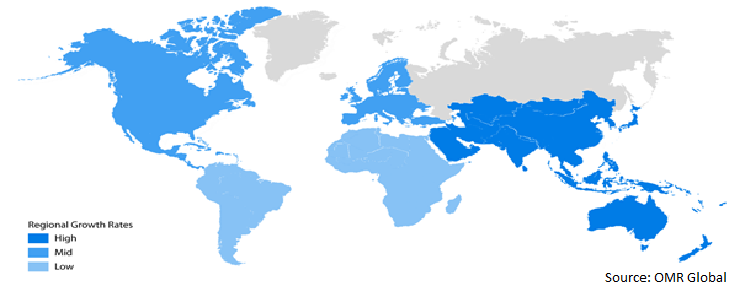

Global Ready to Drink Tea Market Growth, by Region 2021-2027

The Asia-Pacific Region Holds the Considerable Share in the Global Ready to Drink Tea Market

The North America is projected to hold a prominent share in the market due to growing demand for low-sugar and RTD tea over carbonated soft drinks. The growing health-conscious people in US are heavily driving the market of RTD tea in that region. Approximately 75 - 80% of tea consumed in America is iced which is one of the main reasons RTD tea is growing rapidly in the country. For instance, in September 2021, the co-founder of Arizona Iced Tea, John Ferolito is lining up the debut of an iced tea brand in the US. Saint James Tea RTD green tea launched in US with three flavors – Pineapple & Mango, Passionfruit & Peach and Blueberry & Raspberry. All four come packaged in 50cl Tetra Paks and are organic.

Market Players Outlook

The major companies serving the global ready to drink tea market include Archer Daniels Midland Co., Snapple Beverage Corp., Suntory Holdings Ltd., Tata Consumer Products Ltd., The Coca-Cola Co., and others. The market players are considerably contributing to the market growth by the adoption of various strategies including mergers & acquisitions, collaborations, funding, and new product launches, to stay competitive in the market. For instance, in August 2018, Coca-Cola Singapore has launched a new line of low- or no-sugar ready-to-drink (RTD) teas called Authentic Tea House. The Authentic Tea House range complements and has been rebranded from the existing Heaven and Earth RTD tea drink portfolio

The Report Covers

- Market value data analysis of 2020 and forecast to 2027.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global ready to drink tea market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

• Impact of COVID-19 on the Global Ready to Drink Tea Market

• Recovery Scenario of Global Ready to Drink Tea Market

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. BY Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Archer Daniels Midland Co.

3.1.1. Overview

3.1.2. Financial Analysis

3.1.3. SWOT Analysis

3.1.4. Recent Developments

3.2. Snapple Beverage Corp.

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. Suntory Holdings Ltd.

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. Tata Consumer Products Ltd.

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. The Coca-Cola Co.

3.5.1. Overview

3.5.2. Financial Analysis

3.5.3. SWOT Analysis

3.5.4. Recent Developments

3.6. Key Strategy Analysis

3.7. Impact of Covid-19 on Key Players

4. Market Segmentation

4.1. Global Ready to Drink Tea Market by Type

4.1.1. Green Tea

4.1.2. Black Tea

4.1.3. Others (Herbal Tea)

4.2. Global Ready to Drink Tea Market by Nature

4.2.1. Organic

4.2.2. Conventional

4.3. Global Ready to Drink Tea Market by Flavor

4.3.1. Fruit Flavor

4.3.2. Lemon Flavor

4.3.3. Spice Flavor

4.3.4. Herbal Flavor

4.3.5. Other Flavors (Chocolate)

4.4. Global Ready to Drink Tea Market by Packaging

4.4.1. Bottles

4.4.2. Cans

4.4.3. Carton Packaging

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

6. Company Profiles

6.1. AriZona Beverages USA, LLC

6.2. Beam Suntory, Inc.

6.3. Coca-Cola HBC.

6.4. Danone S.A.

6.5. Davidson's Organics

6.6. Ekaterra

6.7. Elev8 Hemp, LLC.

6.8. ITO EN (North America) Inc.

6.9. Jade Monk

6.10. Kirin Holdings Company, Ltd.

6.11. Mighty Drinks Ltd.

6.12. Numi Organic Tea

6.13. PepsiCo, Inc.

6.14. Red Diamond, Inc.

6.15. SAINTJAMESICEDTEA

6.16. Starbucks Corp.

6.17. Steaz

6.18. Talking Rain Beverage Co.

6.19. The Republic of Tea

6.20. Nestlé

6.21. Zevia

1. GLOBAL READY TO DRINK TEA MARKET RESEARCH AND ANALYSIS BY TYPE, 2020-2027 ($ MILLION)

2. GLOBAL READY TO DRINK BLACK TEA MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

3. GLOBAL READY TO DRINK GREEN TEA MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

4. GLOBAL READY TO DRINK OTHERS MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

5. GLOBAL READY TO DRINK TEA MARKET RESEARCH AND ANALYSIS BY NATURE, 2020-2027 ($ MILLION)

6. GLOBAL ORGANIC READY TO DRINK TEA MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

7. GLOBAL CONVENTIONAL READY TO DRINK TEA MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

8. GLOBAL READY TO DRINK TEA MARKET RESEARCH AND ANALYSIS BY FLAVOR, 2020-2027 ($ MILLION)

9. GLOBAL FRUIT FLAVORED READY TO DRINK TEA MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

10. GLOBAL LEMON FLAVORED READY TO DRINK TEA MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

11. GLOBAL SPICE FLAVORED READY TO DRINK TEA MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

12. GLOBAL HERBAL FLAVORED READY TO DRINK TEA MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

13. GLOBAL OTHER FLAVORED READY TO DRINK TEA MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

14. GLOBAL READY TO DRINK TEA MARKET RESEARCH AND ANALYSIS BY PACKAGING, 2020-2027 ($ MILLION)

15. GLOBAL READY TO DRINK TEA IN BOTTLES PACKAGING MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

16. GLOBAL READY TO DRINK TEA IN CANS PACKAGING MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

17. GLOBAL READY TO DRINK TEA IN CARTON PACKAGING MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

18. GLOBAL READY TO DRINK TEA MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2020-2027 ($ MILLION)

19. NORTH AMERICAN READY TO DRINK TEA MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027 ($ MILLION)

20. NORTH AMERICAN READY TO DRINK TEA MARKET RESEARCH AND ANALYSIS BY TYPE, 2020-2027 ($ MILLION)

21. NORTH AMERICAN READY TO DRINK TEA MARKET RESEARCH AND ANALYSIS BY NATURE, 2020-2027 ($ MILLION)

22. NORTH AMERICAN READY TO DRINK TEA MARKET RESEARCH AND ANALYSIS BY FLAVOR, 2020-2027 ($ MILLION)

23. NORTH AMERICAN READY TO DRINK TEA MARKET RESEARCH AND ANALYSIS BY PACKAGING, 2020-2027 ($ MILLION)

24. EUROPEAN READY TO DRINK TEA MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027 ($ MILLION)

25. EUROPEAN READY TO DRINK TEA MARKET RESEARCH AND ANALYSIS BY TYPE, 2020-2027 ($ MILLION)

26. EUROPEAN READY TO DRINK TEA MARKET RESEARCH AND ANALYSIS BY NATURE, 2020-2027 ($ MILLION)

27. EUROPEAN READY TO DRINK TEA MARKET RESEARCH AND ANALYSIS BY FLAVOR, 2020-2027 ($ MILLION)

28. EUROPEAN READY TO DRINK TEA MARKET RESEARCH AND ANALYSIS BY PACKAGING, 2020-2027 ($ MILLION)

29. ASIA-PACIFIC READY TO DRINK TEA MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027 ($ MILLION)

30. ASIA-PACIFIC READY TO DRINK TEA MARKET RESEARCH AND ANALYSIS BY TYPE, 2020-2027 ($ MILLION)

31. ASIA-PACIFIC READY TO DRINK TEA MARKET RESEARCH AND ANALYSIS BY NATUIRE, 2020-2027 ($ MILLION)

32. ASIA-PACIFIC READY TO DRINK TEA MARKET RESEARCH AND ANALYSIS BY FLAVOUR, 2020-2027 ($ MILLION)

33. ASIA-PACIFIC READY TO DRINK TEA MARKET RESEARCH AND ANALYSIS BY PACKAGING, 2020-2027 ($ MILLION)

34. REST OF THE WORLD READY TO DRINK TEA MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027 ($ MILLION)

35. REST OF THE WORLD READY TO DRINK TEA MARKET RESEARCH AND ANALYSIS BY TYPE, 2020-2027 ($ MILLION)

36. REST OF THE WORLD READY TO DRINK TEA MARKET RESEARCH AND ANALYSIS BY NATURE, 2020-2027 ($ MILLION)

37. REST OF THE WORLD READY TO DRINK TEA MARKET RESEARCH AND ANALYSIS BY FLAVOR, 2020-2027 ($ MILLION)

38. REST OF THE WORLD READY TO DRINK TEA MARKET RESEARCH AND ANALYSIS BY PACKAGING, 2020-2027 ($ MILLION)

1. IMPACT OF COVID-19 ON GLOBAL READY TO DRINK TEA MARKET, 2020-2027 ($ MILLION)

2. IMPACT OF COVID-19 ON GLOBAL READY TO DRINK TEA MARKET BY SEGMENT, 2020-2027 ($ MILLION)

3. RECOVERY OF GLOBAL READY TO DRINK TEA MARKET, 2021-2027 (%)

4. GLOBAL READY TO DRINK TEA MARKET SHARE BY TYPE, 2020 VS 2027 (%)

5. GLOBAL READY TO DRINK BLACK TEA MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

6. GLOBAL READY TO DRINK GREEN TEA MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

7. GLOBAL READY TO DRINK OTHERS MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

8. GLOBAL READY TO DRINK TEA MARKET SHARE BY NATURE, 2020 VS 2027 (%)

9. GLOBAL ORGANIC READY TO DRINK TEA MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

10. GLOBAL CONVENTIONAL READY TO DRINK TEA MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

11. GLOBAL READY TO DRINK TEA MARKET SHARE BY FLAVOR, 2020 VS 2027 (%)

12. GLOBAL FRUIT FLAVORED READY TO DRINK TEA MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

13. GLOBAL LEMON FLAVORED READY TO DRINK TEA MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

14. GLOBAL SPICE FLAVORED READY TO DRINK TEA MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

15. GLOBAL HERBAL FLAVORED READY TO DRINK TEAMARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

16. GLOBAL OTHER FLAVORED READY TO DRINK TEA MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

17. GLOBAL READY TO DRINK TEA MARKET SHARE BY PACKAGING, 2020 VS 2027 (%)

18. GLOBAL READY TO DRINK TEA IN BOTTLES PACKAGING MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

19. GLOBAL READY TO DRINK TEA IN CANS PACKAGING MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

20. GLOBAL READY TO DRINK TEA IN CARTON PACKAGING MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

21. GLOBAL READY TO DRINK TEA MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

22. US READY TO DRINK TEA MARKET SIZE, 2020-2027 ($ MILLION)

23. CANADA READY TO DRINK TEA MARKET SIZE, 2020-2027 ($ MILLION)

24. UK READY TO DRINK TEA MARKET SIZE, 2020-2027 ($ MILLION)

25. FRANCE READY TO DRINK TEA MARKET SIZE, 2020-2027 ($ MILLION)

26. GERMANY READY TO DRINK TEA MARKET SIZE, 2020-2027 ($ MILLION)

27. ITALY READY TO DRINK TEA MARKET SIZE, 2020-2027 ($ MILLION)

28. SPAIN READY TO DRINK TEA MARKET SIZE, 2020-2027 ($ MILLION)

29. REST OF EUROPE READY TO DRINK TEA MARKET SIZE, 2020-2027 ($ MILLION)

30. INDIA READY TO DRINK TEA MARKET SIZE, 2020-2027 ($ MILLION)

31. CHINA READY TO DRINK TEA MARKET SIZE, 2020-2027 ($ MILLION)

32. JAPAN READY TO DRINK TEA MARKET SIZE, 2020-2027 ($ MILLION)

33. SOUTH KOREA READY TO DRINK TEA MARKET SIZE, 2020-2027 ($ MILLION)

34. REST OF ASIA-PACIFIC READY TO DRINK TEA MARKET SIZE, 2020-2027 ($ MILLION)

35. REST OF THE WORLD READY TO DRINK TEA MARKET SIZE, 2020-2027 ($ MILLION)