Refractories Market

Refractories Market Size, Share & Trends Analysis Report by Alkalinity (Acidic & Neutral, Basic). by Form (Shaped and Unshaped), by Chemical Composition (Alumina, Silica, Magnesia, and Fireclay) and by End-Use (Iron and Steel, Cement & Lime, Glass & Ceramics, Non-ferrous Metals, and Others) Forecast Period (2024-2031)

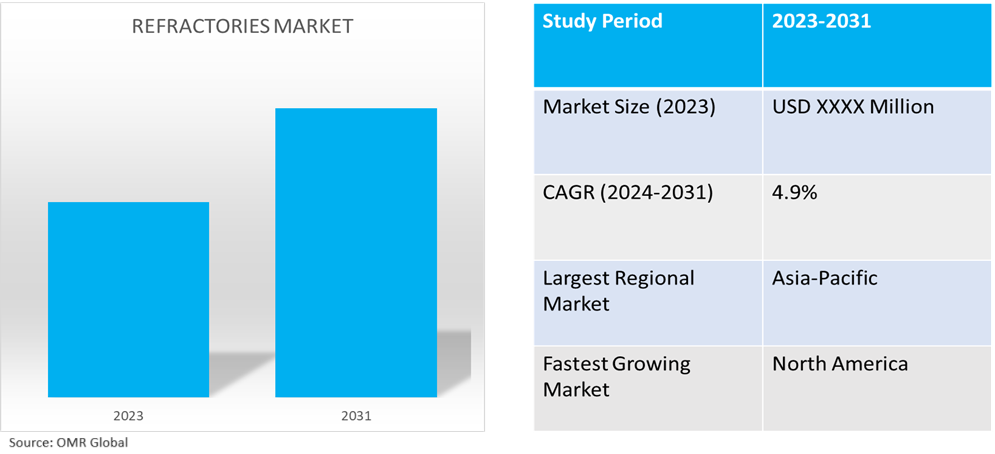

Refractories market is anticipated to grow at a CAGR of 4.9% during the forecast period (2024-2031). The increasing prevalence of non-metallic minerals and materials and increasing demand for refractories from steel and iron industries are driving market growth. The growing demand for metal and non-metal castings in the manufacturing of heavy machinery is expected to boost market growth. The rising concerns regarding environmental degradation are restraining the market growth. The surge in demand for automobiles is expected to act as an opportunity for market growth in the forecast period.

Market Dynamics

Increasing Application in the Power Generation Sector

The refractories have flourishing demand for applications in the power generation sector such as in boilers, inside lining, and others. Power generation experiences major growth due to the high demand for electricity worldwide, robust growth of renewable energy, and others for a sustainable future. According to the Energy Information Administration (EIA), the electricity generation in 2020 by geothermal accounted for 15.9 billion kilowatt hours, compared to 16.2 billion kilowatt hours in 2020. Furthermore, as per the Central Electricity Authority (CEA), the power requirement in India is estimated to reach 817.0 GW by 2030. Thus, with the flourishing power generation sector, the demand for refractory materials such as zirconium silicate, aluminum oxides, sillimanite, and others for various applications in the power sector is growing, thereby offering major growth opportunities in the market.

Increase in the Number of Construction Activities to Boost Market Growth

An increase in the number of construction activities can drive the refractories market. Refractories are materials that can withstand high temperatures and are used in a wide range of applications, including construction, manufacturing, and energy production. In the construction industry, refractories are commonly used in the construction of high-temperature furnaces, boilers, and kilns. As the demand for construction materials and infrastructure increases, so does the demand for refractories. For example, in the manufacturing of cement, which is a key building material, refractories are used in the kiln to withstand the high temperatures required for the production process.

Market Segmentation

Our in-depth analysis of the global refractories market includes the following segments by alkalinity, form, chemical composition, and end use:

- Based on alkalinity, the market is segmented into acidic & neutral, and basic.

- Based on form, the market is segmented into shaped and unshaped.

- Based on chemical composition, the market is segmented into alumina, silica, magnesia, and fireclay.

- Based on end-use, the market is segmented into iron and steel, cement & lime, glass & ceramics, non-ferrous metals, and others.

Iron and Steel is Projected to Emerge as the Largest Segment

The iron and steel segment is expected to hold the largest share of the market. The iron and steel sector's relentless pursuit of efficiency and cost-effectiveness is providing impetus to market growth. Refractories play a vital role in maintaining the integrity of high-temperature equipment including blast furnaces, converters, and ladles. As the iron and steel industry continuously seeks to optimize production processes and reduce energy consumption, the need for advanced refractories becomes paramount. These materials enable higher productivity, prolonged equipment lifespan, and reduced downtime, translating into substantial cost savings. Apart from this, refractories that can withstand extreme temperatures and chemical interactions are essential for ensuring product quality and safety in this critical sector, underpinning the persistent demand for refractories in iron and steel production.

Shaped Segment to Hold a Considerable Market Share

Utilization of shaped refractory materials for providing exposure to high temperatures in various end-use sectors such as cement manufacturing, iron & steel, glass manufacturing, and others is the major key market trend in the global market. The increase in population has led to the growth of the building & construction sector, which has led cement manufacturers to produce high-quality cement where shaped refractory materials are widely used in furnaces, kilns, incinerators, and reactors exposed at high temperatures. For instance, according to a report published by the National Investment Promotion and Facilitation Agency, the construction output in India is expected to grow by 7.1% year-on-year by 2025. This is expected to boost the growth of shaped refractory materials in the building & construction sector.

Regional Outlook

The global refractories market is further segmented based on geography including North America (the US, and Canada), Europe (UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia-Pacific), and the Rest of the World (the Middle East & Africa, and Latin America).

North America to Grow at the Fastest CAGR

North America, Refractories market, is expected to grow at the fastest during the forecast period. The growth of the refractories market in North America is attributed to the increasing demand for refractories in the iron and steel industry. The region has a significant presence of iron and steel manufacturers, which are driving the demand for refractories. Additionally, the increasing construction activities and infrastructure development in the region are also contributing to the growth of the refractories market. Furthermore, the increasing use of non-ferrous metals, such as aluminum and copper, is also driving the demand for refractories in the region. The automotive industry in North America is also expanding, which is further contributing to the growth of the refractories market. Moreover, the US refractories market held the largest market share, and the Canadian refractories market was the fastest-growing market in the North American region.

Global Refractories Market Growth by Region 2024-2031

Asia-Pacific Holds Major Market Share

Asia-Pacific holds a significant share owing to the region's dominance can be attributed to its thriving steel, cement, and glass industries, which are among the primary consumers of refractory products. Rapid industrialization and urbanization in countries like China and India have driven substantial demand for steel and cement, boosting the need for refractories in their production processes. Additionally, Asia Pacific's vast manufacturing base and robust infrastructure development contribute significantly to refractory consumption. The region benefits from a competitive advantage in terms of cost-effective production and a skilled labor force, making it an attractive hub for refractory manufacturing. China is the largest producer of steel in the world. As per the World Steel Association report, China produced around 80.1 Mt (million tons) in February 2023, which is up by 5.6% compared to February 2022. This massive demand for steel in the country projects market opportunities for refractories.

Market Players Outlook

*Note: Major Players Sorted in No Particular Order.

The major companies serving the global refractories market include Krosaki Harima Corp., Morgan Advanced Materials plc, RHI Magnesita GmbH, and Shinagawa Refractories Co., Ltd. among others. The market players are increasingly focusing on business expansion and product development by applying strategies such as collaborations, mergers, and acquisitions to stay competitive in the market. For instance, in January 2023, RHI Magnesita GmbH announced the completion of its acquisition of Dalmia Bharat Refractories Limited's (DBRL) Indian refractory business is expected to add almost 300,000 tons of capacity annually to the existing production footprint in India, enhancing the company's business in the studied market.

The Report Covers

- Market value data analysis of 2023 and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global refractories market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. Krosaki Harima Corp.

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. Morgan Advanced Materials Plc.

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. RHI Magnesita GmbH

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Shinagawa Refractories Co., Ltd.

3.5.1. Overview

3.5.2. Financial Analysis

3.5.3. SWOT Analysis

3.5.4. Recent Developments

3.6. Key Strategy Analysis

4. Market Segmentation

4.1. Global Refractories Market by Alkalinity

4.1.1. Acidic & Neutral

4.1.2. Basic

4.2. Global Refractories Market by Form

4.2.1. Shaped

4.2.2. Unshaped

4.3. Global Refractories Market by Chemical Composition

4.3.1. Alumina

4.3.2. Silica

4.3.3. Magnesia

4.3.4. Fireclay

4.4. Global Refractories Market by End-Use

4.4.1. Iron and Steel

4.4.2. Cement & Lime

4.4.3. Glass & Ceramics

4.4.4. Non-Ferrous Metals

4.4.5. Others (Power Generation)

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

5.4.1. Latin America

5.4.2. Middle East & Africa

6. Company Profiles

6.1. AGC Inc.

6.2. ALLIED MINERAL PRODUCTS

6.3. Almatis

6.4. ALTEO

6.5. AluChem Inc.

6.6. Calderys

6.7. CerCo Corporation

6.8. Chosun Refractories Co., Ltd.

6.9. CoorsTek, Inc.

6.10. Corning Incorporated

6.11. HarbisonWalker International Inc.

6.12. IFGL Refractories Ltd.

6.13. Imerys

6.14. INTOCAST AG

6.15. Lanexis Enterprises (P) Ltd.

6.16. Magnezit Group

6.17. Minerals Technologies Inc.

6.18. Puyang Refractories Group Co., Ltd.

6.19. Saint-Gobain

6.20. TYK Corporation

1. GLOBAL REFRACTORIES MARKET RESEARCH AND ANALYSIS BY ALKALINITY, 2023-2031 ($ MILLION)

2. GLOBAL ACIDIC & NEUTRAL REFRACTORIES MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

3. GLOBAL BASIC REFRACTORIES MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

4. GLOBAL REFRACTORIES MARKET RESEARCH AND ANALYSIS BY FORM, 2023-2031 ($ MILLION)

5. GLOBAL SHAPED REFRACTORIES MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

6. GLOBAL UNSHAPED REFRACTORIES MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

7. GLOBAL REFRACTORIES MARKET RESEARCH AND ANALYSIS BY CHEMICAL COMPOSITION, 2023-2031 ($ MILLION)

8. GLOBAL ALUMINA-BASED REFRACTORIES MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

9. GLOBAL SILICA-BASED REFRACTORIES MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

10. GLOBAL MAGNESIA-BASED REFRACTORIES MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

11. GLOBAL FIRECLAY-BASED REFRACTORIES MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

12. GLOBAL REFRACTORIES MARKET RESEARCH AND ANALYSIS BY END-USE, 2023-2031 ($ MILLION)

13. GLOBAL REFRACTORIES IN IRON AND STEEL MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

14. GLOBAL REFRACTORIES IN CEMENT & LIME MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

15. GLOBAL REFRACTORIES IN GLASS & CERAMICS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

16. GLOBAL REFRACTORIES IN NON-FERROUS METALS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

17. GLOBAL REFRACTORIES IN OTHERS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

18. GLOBAL REFRACTORIES MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

19. NORTH AMERICAN REFRACTORIES MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

20. NORTH AMERICAN REFRACTORIES MARKET RESEARCH AND ANALYSIS BY ALKALINITY, 2023-2031 ($ MILLION)

21. NORTH AMERICAN REFRACTORIES MARKET RESEARCH AND ANALYSIS BY FORM, 2023-2031 ($ MILLION)

22. NORTH AMERICAN REFRACTORIES MARKET RESEARCH AND ANALYSIS BY CHEMICAL COMPOSITION, 2023-2031 ($ MILLION)

23. NORTH AMERICAN REFRACTORIES MARKET RESEARCH AND ANALYSIS BY END-USE, 2023-2031 ($ MILLION)

24. EUROPEAN REFRACTORIES MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

25. EUROPEAN REFRACTORIES MARKET RESEARCH AND ANALYSIS BY ALKALINITY, 2023-2031 ($ MILLION)

26. EUROPEAN REFRACTORIES MARKET RESEARCH AND ANALYSIS BY FORM, 2023-2031 ($ MILLION)

27. EUROPEAN REFRACTORIES MARKET RESEARCH AND ANALYSIS BY CHEMICAL COMPOSITION, 2023-2031 ($ MILLION)

28. EUROPEAN REFRACTORIES MARKET RESEARCH AND ANALYSIS BY END-USE, 2023-2031 ($ MILLION)

29. ASIA-PACIFIC REFRACTORIES MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

30. ASIA-PACIFIC REFRACTORIES MARKET RESEARCH AND ANALYSIS BY ALKALINITY, 2023-2031 ($ MILLION)

31. ASIA-PACIFIC REFRACTORIES MARKET RESEARCH AND ANALYSIS BY FORM, 2023-2031 ($ MILLION)

32. ASIA-PACIFIC REFRACTORIES MARKET RESEARCH AND ANALYSIS BY CHEMICAL COMPOSITION, 2023-2031 ($ MILLION)

33. ASIA-PACIFIC REFRACTORIES MARKET RESEARCH AND ANALYSIS BY END-USE, 2023-2031 ($ MILLION)

34. REST OF THE WORLD REFRACTORIES MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

35. REST OF THE WORLD REFRACTORIES MARKET RESEARCH AND ANALYSIS BY ALKALINITY, 2023-2031 ($ MILLION)

36. REST OF THE WORLD REFRACTORIES MARKET RESEARCH AND ANALYSIS BY FORM, 2023-2031 ($ MILLION)

37. REST OF THE WORLD REFRACTORIES MARKET RESEARCH AND ANALYSIS BY CHEMICAL COMPOSITION, 2023-2031 ($ MILLION)

38. REST OF THE WORLD REFRACTORIES MARKET RESEARCH AND ANALYSIS BY END-USE, 2023-2031 ($ MILLION)

1. GLOBAL REFRACTORIES MARKET SHARE BY ALKALINITY, 2023 VS 2031 (%)

2. GLOBAL ACIDIC & NEUTRAL REFRACTORIES MARKET SHARE BY REGION, 2023 VS 2031 (%)

3. GLOBAL BASIC REFRACTORIES MARKET SHARE BY REGION, 2023 VS 2031 (%)

4. GLOBAL REFRACTORIES MARKET SHARE BY FORM, 2023 VS 2031 (%)

5. GLOBAL SHAPED REFRACTORIES MARKET SHARE BY REGION, 2023 VS 2031 (%)

6. GLOBAL UNSHAPED REFRACTORIES MARKET SHARE BY REGION, 2023 VS 2031 (%)

7. GLOBAL REFRACTORIES MARKET SHARE BY CHEMICAL COMPOSITION, 2023 VS 2031 (%)

8. GLOBAL ALUMINA-BASED REFRACTORIES MARKET SHARE BY REGION, 2023 VS 2031 (%)

9. GLOBAL SILICA-BASED REFRACTORIES MARKET SHARE BY REGION, 2023 VS 2031 (%)

10. GLOBAL MAGNESIA-BASED REFRACTORIES MARKET SHARE BY REGION, 2023 VS 2031 (%)

11. GLOBAL FIRECLAY-BASED REFRACTORIES MARKET SHARE BY REGION, 2023 VS 2031 (%)

12. GLOBAL REFRACTORIES MARKET SHARE BY END-USE, 2023 VS 2031 (%)

13. GLOBAL REFRACTORIES IN IRON AND STEEL MARKET SHARE BY REGION, 2023 VS 2031 (%)

14. GLOBAL REFRACTORIES IN CEMENT & LIME MARKET SHARE BY REGION, 2023 VS 2031 (%)

15. GLOBAL REFRACTORIES IN GLASS & CERAMICS MARKET SHARE BY REGION, 2023 VS 2031 (%)

16. GLOBAL REFRACTORIES IN NON-FERROUS METALS MARKET SHARE BY REGION, 2023 VS 2031 (%)

17. GLOBAL REFRACTORIES IN OTHER METALS MARKET SHARE BY REGION, 2023 VS 2031 (%)

18. GLOBAL REFRACTORIES MARKET SHARE BY REGION, 2023 VS 2031 (%)

19. US REFRACTORIES MARKET SIZE, 2023-2031 ($ MILLION)

20. CANADA REFRACTORIES MARKET SIZE, 2023-2031 ($ MILLION)

21. UK REFRACTORIES MARKET SIZE, 2023-2031 ($ MILLION)

22. FRANCE REFRACTORIES MARKET SIZE, 2023-2031 ($ MILLION)

23. GERMANY REFRACTORIES MARKET SIZE, 2023-2031 ($ MILLION)

24. ITALY REFRACTORIES MARKET SIZE, 2023-2031 ($ MILLION)

25. SPAIN REFRACTORIES MARKET SIZE, 2023-2031 ($ MILLION)

26. REST OF EUROPE REFRACTORIES MARKET SIZE, 2023-2031 ($ MILLION)

27. INDIA REFRACTORIES MARKET SIZE, 2023-2031 ($ MILLION)

28. CHINA REFRACTORIES MARKET SIZE, 2023-2031 ($ MILLION)

29. JAPAN REFRACTORIES MARKET SIZE, 2023-2031 ($ MILLION)

30. SOUTH KOREA REFRACTORIES MARKET SIZE, 2023-2031 ($ MILLION)

31. REST OF ASIA-PACIFIC REFRACTORIES MARKET SIZE, 2023-2031 ($ MILLION)

32. LATIN AMERICA REFRACTORIES MARKET SIZE, 2023-2031 ($ MILLION)

33. MIDDLE EAST AND AFRICA REFRACTORIES MARKET SIZE, 2023-2031 ($ MILLION)