Refurbished Medical Devices Market

Global Refurbished Medical Devices Market Size, Share & Trends Analysis Report by Type (Operating Room Equipment and Surgical Devices, Diagnostic/Imaging, Patient Monitors, Defibrillators, and Other Devices), By Application (Cardiology, Neurology, Endoscopy, and Other Applications), By End-User (Hospitals, and Private Clinics) Forecast, 2021-2027 Update Available - Forecast 2025-2035

The global refurbished medical devices market is anticipated to grow considerably at a CAGR of 12.3% during the forecast period. The market is being driven by an increase in the adoption of low-cost refurbished equipment, increased demand in emerging nations due to budget constraints, increasing privatization of the healthcare sector, and an increase in sales due to online marketing. With the advancement of technology, there has been a growing trend of "affordable buying," which is the driving factor behind the growth of the refurbished device market. For instance, a consumer seeking a CT scanner under 4-slice nowadays will choose a refurbished machine over a brand-new system. The refurbished medical devices allow healthcare facilities, including small and medium-sized ones, to purchase critical items at affordable costs without sacrificing quality.

Moreover, the demand for refurbished medical devices is substantially higher in low- and middle-income nations, with poor health infrastructure and limited access to healthcare resources being two of the main factors, are driving the growth of the market. Besides, quality concerns such as safety and efficacy, as well as strict regulatory rules regarding the use of refurbished equipment, are restraining the market growth. The focus on high-quality compliance of refurbished equipment is a competitive advantage is creating an opportunity for market growth during the forecast period.

Impact of COVID-19 Pandemic on Global Refurbished Medical Devices Market

The global refurbished medical devices market is negatively impacted by the COVID-19 pandemic in December 2019. The major players such as Philips Healthcare, GE Healthcare, Soma technology, and Block Imaging International, among others, in the market for refurbished medical devices, are coming in front to take precaution measures to cope up with the CIOVID-19 pandemic. Extensive research is being conducted on the COVID-19 pandemic, which will provide current strategies and alternative strategies for reducing the impact of COVID-19 on revenue from the used and refurbished medical device market. For refurbished medical devices, Philips Healthcare is working as the diamond system. The healthcare industry, on the other hand, is still dealing with a significant supply chain disruption that has had a severe impact on refurbished medical devices. The market will witness “V” shape recovery in near future owing to the restart of key industries in major economies.

Segmental Outlook

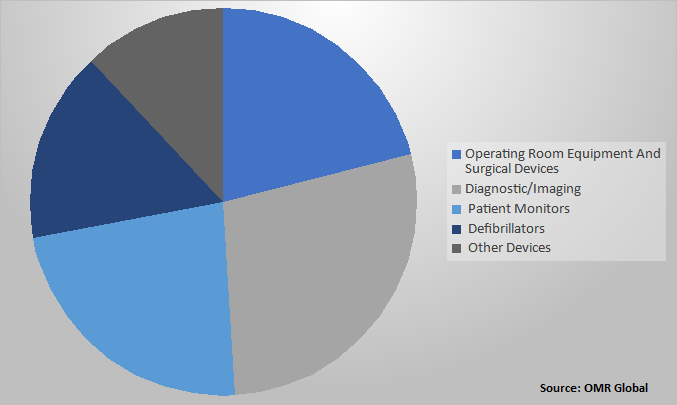

The global refurbished devices market is segmented into type, application, and end-user. Based on the type, the market is segmented into operating room equipment and surgical devices, patient monitors, defibrillators, diagnostic/imaging, and other devices. Among these, the operating room equipment and surgical devices segment is classified into anesthesia machines, operating tables, operating lights, surgical light sources, surgical microscopes, medical gas equipment, and others. The diagnostic/imaging devices bifurcated into MRI, CT scanners, ultrasound systems, and others. The patient monitor devices are classified into ECG, fetal monitors, pulse oximeters, and others. Apart from it, based on the application, the market is segmented into cardiology, neurology, endoscopy, and other applications. The end-user segment is bifurcated into hospitals and private clinics.

Global Refurbished Medical Devices Market Share by Type, 2020 (%)

Diagnostic/Imaging Segment holds the significant share in the Global Refurbished Medical Devices Market

Among the type for the global refurbished medical devices market, the diagnostic/imaging segment held the highest share in 2020 and is also anticipated to grow significantly during the forecast period. The technique of creating a visual depiction of the interior of the body for medical intervention is known as medical imaging. The rising demand for diagnostic imaging procedures, the high cost of new medical imaging equipment, the expanding application of diagnostic imaging procedures, regulatory approvals for using refurbished medical equipment, low purchasing power in emerging economies, and major players' adoption of established & government validated refurbishment processes are all factors that are driving the growth of the segment in the market during the forecast period.

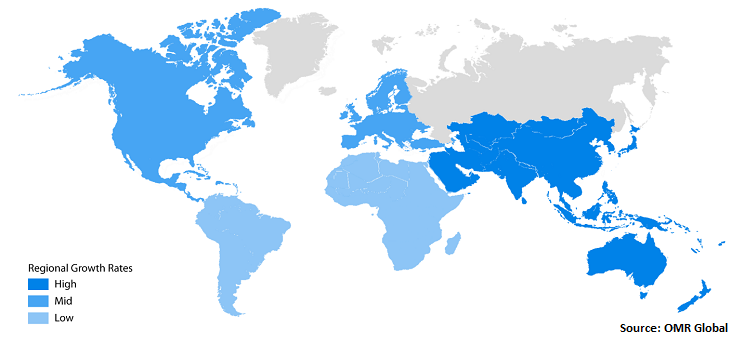

Regional Outlook

The global refurbished medical devices market is further segmented based on geography including North America (the US, and Canada), Europe (Italy, Spain, Germany, France, and Others), Asia-Pacific (India, China, Japan, and Others), and the Rest of the World (the Middle East and Africa, and Latin America). North America has been predicted to dominate the global refurbished medical devices market, followed by Europe. The growth is mainly attributed due to the increased adoption of low-cost refurbished equipment, and the presence of leading manufacturers in the region.

Global Refurbished Medical Devices Market Growth, by Region 2021-2027

Asia-Pacific is projected to have a considerable growth in the Global Refurbished Medical Devices market

Asia-Pacific is anticipated to exhibit the sigificant growth in the global refurbished medical devices market. In the region, China and India are showing rapid progress. This is due to budget constraints of private hospitals within the countries, the increasing number of the private hospital in the region, and a rise in sales due to online marketing. Furthermore, regulatory policy reform is likely to assist market growth. For instance, the Malaysian Medical Device Authority (MDA), established recommendations in February 2020 about the requirement of paperwork submission for refurbished medical equipment. As a result, COVID-19 is projected to have a favorable impact in this region.

Market Players Outlook

The key players of the global refurbished medical devices market include General electric Co., Koninklijke Philips N.V., Siemens AG, Stryker Corp., DRE Medical Inc., AGITO Medical A/S, and Soma Technology Inc., among others. The market players are considerably contributing to the market growth by the adoption of various strategies including mergers & acquisitions, collaborations, funding, and new product launches, to stay competitive in the market. For instance, in February 2020, Probo Medical, a refurbished medical device supplier based in the US, announced the acquisition of Elite Medical Technologies, LLC and Future Medical Equipment Ltd. The former is a well-known reseller of pre-owned digital medical devices, while the latter specializes in equipment de-installation and sales of second-hand equipment.

The Report Covers

- Market value data analysis of 2020 and forecast to 2027.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global refurbished medical devices market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

• Impact of COVID-19 on the Global Refurbished Medical DevicesIndustry

• Recovery Scenario of Global Refurbished Medical DevicesIndustry

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. BY Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.1.1. Overview

3.1.2. Financial Analysis

3.1.3. SWOT Analysis

3.2. Key Strategy Analysis

3.3. Impact of COVID-19 on Key Players

4. Market Determinants

4.1. Motivators

4.2. Restraints

4.3. Opportunities

5. Market Segmentation

5.1. Global Refurbished Medical Devices Market by Type

5.1.1. Operating Room Equipment And Surgical Devices

5.1.1.1. Anesthesia Machines

5.1.1.2. Operating Tables

5.1.1.3. Operating Lights

5.1.1.4. Surgical Light Sources

5.1.1.5. Surgical Microscopes

5.1.1.6. Medical Gas Equipment

5.1.1.7. Others

5.1.2. Diagnostic/Imaging

5.1.2.1. MRI

5.1.2.2. CT Scanners

5.1.2.3. Ultrasound Systems

5.1.2.4. Other (X-Ray Machines, PET/CT, C-Arm, Mammography)

5.1.3. Patient Monitors

5.1.3.1. ECG

5.1.3.2. Fetal Monitors

5.1.3.3. Pulse Oximeters

5.1.3.4. Others

5.1.4. Defibrillators

5.1.5. Other Devices

5.2. Global Refurbished Medical Devices Market By Application

5.2.1. Cardiology

5.2.2. Neurology

5.2.3. Endoscopy

5.2.4. Other Applications

5.3. Global Refurbished Medical Devices Market By End-User

5.3.1. Hospitals

5.3.2. Private Clinics

6. Regional Analysis

6.1. North America

6.1.1. United States

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. South Korea

6.3.5. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. 3KRF (MarkPeri International)

7.2. Advanced Microderm, Inc.

7.3. AGITO Medical A/S

7.4. Biomex Instruments (P) Ltd.

7.5. Block Imaging International Inc.

7.6. DRE Medical Inc.

7.7. Everx Pvt Ltd.

7.8. First Source, Inc.

7.9. General Electric Co.

7.10. Integrity Medical Systems Inc.

7.11. Koninklijke Philips N.V.

7.12. Master Medical Equipment LLC

7.13. Radiology Oncology Systems Inc.

7.14. Siemens AG

7.15. Soma Technology Inc.

7.16. Stryker Corp.

7.17. Toshiba International Corp.

7.18. US Med-Equip, Inc.

7.19. Zigma Meditech India Pvt. Ltd.

1. GLOBAL REFURBISHED MEDICAL DEVICES MARKET RESEARCH AND ANALYSIS, 2020-2027 ($ MILLION)

2. GLOBAL REFURBISHED MEDICAL DEVICES MARKET RESEARCH AND ANALYSIS BY TYPE, 2020-2027 ($ MILLION)

3. GLOBAL OPERATING ROOM EQUIPMENT AND SURGICAL DEVICES MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

4. GLOBAL OPERATING ROOM EQUIPMENT AND SURGICAL DEVICES MARKET RESEARCH AND ANALYSIS BY TYPE, 2020-2027 ($ MILLION)

5. GLOBAL REFURBISHED DIAGNOSTIC/IMAGING MEDICAL DEVICES MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

6. GLOBAL REFURBISHED DIAGNOSTIC/IMAGING MEDICAL DEVICES MARKET RESEARCH AND ANALYSIS BY TYPE, 2020-2027 ($ MILLION)

7. GLOBAL REFURBISHED PATIENT MONITORS MEDICAL DEVICES MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

8. GLOBAL REFURBISHED PATIENT MONITORS MEDICAL DEVICES MARKET RESEARCH AND ANALYSIS BY TYPE, 2020-2027 ($ MILLION)

9. GLOBAL REFURBISHED DEFIBRILLATORS MEDICAL DEVICES MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

10. GLOBAL OTHER REFURBISHED MEDICAL DEVICES MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

11. GLOBAL REFURBISHED MEDICAL DEVICES MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2020-2027 ($ MILLION)

12. GLOBAL REFURBISHED MEDICAL DEVICES IN CARDIOLOGY MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

13. GLOBAL REFURBISHED MEDICAL DEVICES IN NEUROLOGY MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

14. GLOBAL REFURBISHED MEDICAL DEVICES IN ENDOSCOPY MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

15. GLOBAL REFURBISHED MEDICAL DEVICES IN OTHERS APPLICATION MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

16. GLOBAL REFURBISHED MEDICAL DEVICES MARKET RESEARCH AND ANALYSIS BY END-USER, 2020-2027 ($ MILLION)

17. GLOBAL REFURBISHED MEDICAL DEVICES IN HOSPITALS MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

18. GLOBAL REFURBISHED MEDICAL DEVICES IN PRIVATE CLINICS MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

19. GLOBAL REFURBISHED MEDICAL DEVICES MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2020-2027 ($ MILLION)

20. NORTH AMERICAN REFURBISHED MEDICAL DEVICES MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027 ($ MILLION)

21. NORTH AMERICAN REFURBISHED MEDICAL DEVICES MARKET RESEARCH AND ANALYSIS BY TYPE, 2020-2027 ($ MILLION)

22. NORTH AMERICAN REFURBISHED MEDICAL DEVICES MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2020-2027 ($ MILLION)

23. NORTH AMERICAN REFURBISHED MEDICAL DEVICES MARKET RESEARCH AND ANALYSIS BY END-USER, 2020-2027 ($ MILLION)

24. EUROPEAN REFURBISHED MEDICAL DEVICES MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027 ($ MILLION)

25. EUROPEAN REFURBISHED MEDICAL DEVICES MARKET RESEARCH AND ANALYSIS BY TYPE, 2020-2027 ($ MILLION)

26. EUROPEAN REFURBISHED MEDICAL DEVICES MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2020-2027 ($ MILLION)

27. EUROPEAN REFURBISHED MEDICAL DEVICES MARKET RESEARCH AND ANALYSIS BY END-USER, 2020-2027 ($ MILLION)

28. ASIA-PACIFIC REFURBISHED MEDICAL DEVICES MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027 ($ MILLION)

29. ASIA-PACIFIC REFURBISHED MEDICAL DEVICES MARKET RESEARCH AND ANALYSIS BY TYPE, 2020-2027 ($ MILLION)

30. ASIA-PACIFIC REFURBISHED MEDICAL DEVICES MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2020-2027 ($ MILLION)

31. ASIA-PACIFIC REFURBISHED MEDICAL DEVICES MARKET RESEARCH AND ANALYSIS BY END-USER, 2020-2027 ($ MILLION)

32. REST OF THE WORLD REFURBISHED MEDICAL DEVICES MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027 ($ MILLION)

33. REST OF THE WORLD REFURBISHED MEDICAL DEVICES MARKET RESEARCH AND ANALYSIS BY TYPE, 2020-2027 ($ MILLION)

34. REST OF THE WORLD REFURBISHED MEDICAL DEVICES MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2020-2027 ($ MILLION)

35. REST OF THE WORLD REFURBISHED MEDICAL DEVICES MARKET RESEARCH AND ANALYSIS BY END-USER, 2020-2027 ($ MILLION)

1. IMPACT OF COVID-19 ON GLOBAL REFURBISHED MEDICAL DEVICES MARKET, 2020-2027 ($ MILLION)

2. IMPACT OF COVID-19 ON GLOBAL REFURBISHED MEDICAL DEVICES MARKET BY SEGMENT, 2020-2027 ($ MILLION)

3. RECOVERY OF GLOBAL REFURBISHED MEDICAL DEVICES MARKET, 2021-2027 (%)

4. GLOBAL REFURBISHED MEDICAL DEVICES MARKET SHARE BY TYPE, 2020 VS 2027 (%)

5. GLOBAL REFURBISHED MEDICAL DEVICES MARKET SHARE BY APPLICATION, 2020 VS 2027 (%)

6. GLOBAL REFURBISHED MEDICAL DEVICES MARKET SHARE BY END-USER, 2020 VS 2027 (%)

7. GLOBAL REFURBISHED MEDICAL DEVICES MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

8. GLOBAL OPERATING ROOM EQUIPMENT AND SURGICAL DEVICES MARKET SHARE BY REGION, 2020 VS 2027(%)

9. GLOBAL REFURBISHED DIAGNOSTIC/IMAGING MEDICAL DEVICES MARKET SHARE BY REGION, 2020 VS 2027 (%)

10. GLOBAL REFURBISHED PATIENT MONITORS MEDICAL DEVICES MARKET SHARE BY REGION, 2020 VS 2027 (%)

11. GLOBAL REFURBISHED DEFIBRILLATORS MEDICAL DEVICES MARKET SHARE BY REGION, 2020 VS 2027 (%)

12. GLOBAL OTHER REFURBISHED MEDICAL DEVICES MARKET SHARE BY REGION, 2020 VS 2027 (%)

13. GLOBAL REFURBISHED MEDICAL DEVICES IN CARDIOLOGY MARKET SHARE BY REGION, 2020 VS 2027 (%)

14. GLOBAL REFURBISHED MEDICAL DEVICES IN NEUROLOGY MARKET SHARE BY REGION, 2020 VS 2027 (%)

15. GLOBAL REFURBISHED MEDICAL DEVICES IN ENDOSCOPY MARKET SHARE BY REGION, 2020 VS 2027 (%)

16. GLOBAL REFURBISHED MEDICAL DEVICES IN OTHERS APPLICATION MARKET SHARE BY REGION, 2020 VS 2027 (%)

17. GLOBAL REFURBISHED MEDICAL DEVICES IN HOSPITALS MARKET SHARE BY REGION, 2020 VS 2027 (%)

18. GLOBAL REFURBISHED MEDICAL DEVICES IN PRIVATE CLINICS MARKET SHARE BY REGION, 2020 VS 2027 (%)

19. US REFURBISHED MEDICAL DEVICES MARKET SIZE, 2020-2027 ($ MILLION)

20. CANADA REFURBISHED MEDICAL DEVICES MARKET SIZE, 2020-2027 ($ MILLION)

21. UK REFURBISHED MEDICAL DEVICES MARKET SIZE, 2020-2027 ($ MILLION)

22. FRANCE REFURBISHED MEDICAL DEVICES MARKET SIZE, 2020-2027 ($ MILLION)

23. GERMANY REFURBISHED MEDICAL DEVICES MARKET SIZE, 2020-2027 ($ MILLION)

24. ITALY REFURBISHED MEDICAL DEVICES MARKET SIZE, 2020-2027 ($ MILLION)

25. SPAIN REFURBISHED MEDICAL DEVICES MARKET SIZE, 2020-2027 ($ MILLION)

26. REST OF EUROPE REFURBISHED MEDICAL DEVICES MARKET SIZE, 2020-2027 ($ MILLION)

27. INDIA REFURBISHED MEDICAL DEVICES MARKET SIZE, 2020-2027 ($ MILLION)

28. CHINA REFURBISHED MEDICAL DEVICES MARKET SIZE, 2020-2027 ($ MILLION)

29. JAPAN REFURBISHED MEDICAL DEVICES MARKET SIZE, 2020-2027 ($ MILLION)

30. SOUTH KOREA REFURBISHED MEDICAL DEVICES MARKET SIZE, 2020-2027 ($ MILLION)

31. REST OF THE ASIA-PACIFIC REFURBISHED MEDICAL DEVICES MARKET SIZE, 2020-2027 ($ MILLION)

32. REST OF THE WORLD REFURBISHED MEDICAL DEVICES MARKET SIZE, 2020-2027 ($ MILLION)