Regulatory Technology Market

Global Regulatory Technology Market Size, Share & Trends Analysis Report by Solution (Risk Management, Transaction Reporting & Monitoring, Customer Identification and AML/KYC, Regulatory Intelligence), By Deployment Model (On-Premises, Cloud) Forecast Period 2021-2027 Update Available - Forecast 2025-2035

The global regulatory technology (RegTech) market is anticipated to grow at a significant CAGR of 19.5% during the forecast period (2021-2027). RegTech is the management of regulatory processes within the financial industry through technology. The rising demand for risk management, regulatory intelligence solutions, and transaction and monitoring solution among others is a key factor contributing towards the growth of the global regulatory technology market. Apart from this, the additional costs of managing compliance procedures and increasing demand for regulating business processes are some other factors that are propelling the global market growth. As per World Bank, a robust regulatory framework can boost GDP growth by more than 2.0% on an annual basis.

In April 2021, the federal government of Australia has committed $10 million in grant funding for regtech companies creating innovative solutions to a set of key challenges. Under the latest round of the Business Research and Innovation Initiative (BRII), Australian startups and SMEs can submit proposals for solutions addressing one of four issues. Successful applicants will be eligible for grants of up to $100,000 to develop their ideas and test feasibility over three months. There is a total of $2 million in grant funding available for the development and feasibility study phase, and a total of $8 million available for the proof-of-concept stage. Presence of such initiatives across the globe, significant penetration of advanced technologies, and growing funding for RegTech startups across the globe are some of the key factors to accelerate the growth of the global regulatory technology market.

Segmental Outlook

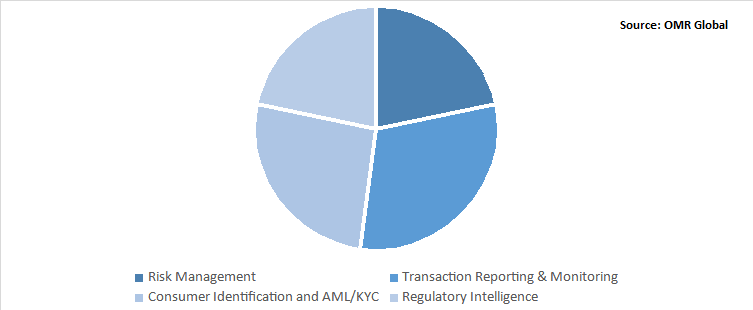

The global regulatory technology market is segmented based on solution and deployment model. Based on solution, the market is segmented into risk management, transaction reporting & monitoring, customer identification and AML/KYC, regulatory intelligence. Based on deployment model, the regulatory technology market is segmented into on-premises and cloud. Based on deployment, on-premises held major market share in 2020. However, cloud based solution are anticipated to exhibit considerable growth during the forecast period. The growing awareness regarding the benefits of cloud based solutions is a key factor driving the growth of this market segment.

Global Regulatory technology Market Share by Solution, 2020 (%)

Risk Management held Considerable Share in 2020, Based on Solution

Based on solution, risk management is anticipated to hold major market share during the forecast period. The high requirement for the risk and compliance management by the industries operating across the region along with the high investment of several investors in investment of these solutions is a key factor which is anticipated to drive the growth of this market segment.

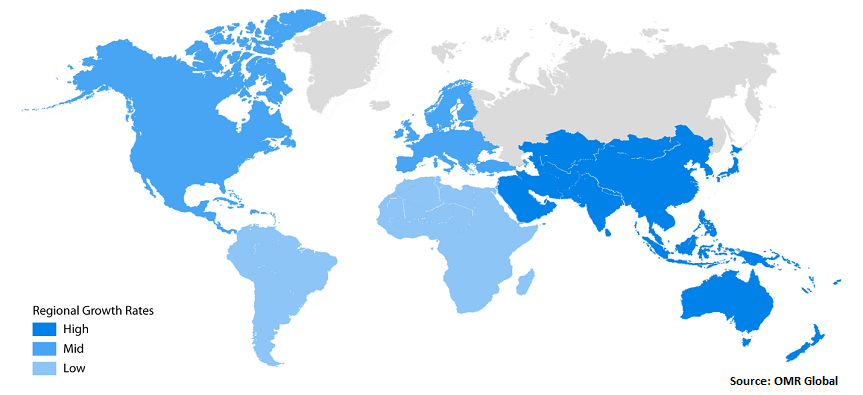

Regional Outlooks

The global regulatory technology market is further segmented based on geography including North America, Europe, Asia-Pacific, and the Rest of the World. North America held a significant share in the global market in 2020. In North America, the US contributes over 75.0% share in the North American regulatory technology market in 2020. The US is having the first mover advantage of the regulatory technology. The early adoption of regulatory technology by the country’s financial institutions to reduce their compliance cost by taking leverage of advanced technologies such as AI, ML, blockchain, big data, and cloud computing is a key factor contributing towards the high share of the North American regulatory technology market. Rising need for regulatory compliance, high penetration of advanced technologies such AI, ML, NL, and cloud computing across the region, and implementation of these solutions in fintech industries is another key factor driving the growth of the regional market.

Global Regulatory Technology Market Growth, by Region 2021-2027

Asia-Pacific is Projected to Have Considerable Share in the Global Regulatory technology Market

Asia-Pacific is anticipated to hold a considerable market share in the global regulatory technology market. In May 2019, the regtech committees of the fintech associations of Hong Kong, Singapore and Japan have jointly launched the ‘APAC RegTech Network’, an initiative to enhance cross-border collaboration on regtech education and implementation across the Asia Pacific region. The Singapore Fintech Association (SFA) has also sign an MoU with the Australia’s RegTech Association to better engage with the regtech ecosystem in the region. Presence of such initiatives across the region, significant penetration of advanced technologies, and growing funding for RegTech startups across the region are some of the key factors to accelerate the growth of the regional market.

Market Players Outlook

The key players that are contributing significantly to the growth of the global regulatory technology market include ACTICO GmbH, Ascent Technologies, Inc., Ayasdi AI LLC, Compendor GmbH, Deloitte AG, Elliptic Enterprises Ltd., Fenergo, and IBM Corp. among others are the key players operating in the global regulatory Technology market. These players are adopting different growth strategies such as investment in technological advancement, mergers & acquisition, partnership, and collaboration among others to expand their footprints in the global marketplace. As this market is in its initial phase of development hence, many startups are raising funding for the development of this technology. For instance, in January 2021, Vcomply, B2B Software-as-a-company has raised $6 million in Series A funding round from Accel and Counterpart Ventures.

The Report Covers

- Market value data analysis of 2020 and forecast to 2027.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global regulatory technology market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. BY Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.1.1. Overview

3.1.2. Financial Analysis

3.1.3. SWOT Analysis

3.1.4. Recent Developments

3.2. Key Strategy Analysis

4. Market Determinants

4.1. Motivators

4.2. Restraints

4.3. Opportunities

5. Market Segmentation

5.1. Global Regulatory technology Market, By Solution

5.1.1. Risk Management

5.1.2. Transaction Reporting & Monitoring

5.1.3. Customer Identification and AML/KYC

5.1.4. Regulatory Intelligence

5.2. Global Regulatory technology Market, By Deployment Model

5.2.1. On-Premises

5.2.2. Cloud

6. Regional Analysis

6.1. North America

6.1.1. United States

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. South Korea

6.3.5. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. ACTICO GmbH

7.2. Ascent Technologies, Inc.

7.3. Ayasdi AI LLC

7.4. Broadridge Financial Solutions, Inc.

7.5. Compendor GmbH

7.6. Deloitte AG

7.7. Elliptic Enterprises Ltd.

7.8. Fenergo

7.9. IBM Corp.

7.10. Infrasoft Technologies Ltd.

7.11. Jumio

7.12. London Stock Exchange Group plc

7.13. MetricStream Inc.

7.14. NICE Ltd.

7.15. PricewaterhouseCoopers LLP

7.16. Reed Business Information Ltd. (Accuity)

7.17. Rimes Technologies Corp.

7.18. SAI Global Pty Ltd.

7.19. Trulioo

7.20. Wolters Kluwer N.V.?

1. GLOBAL REGULATORY TECHNOLOGY MARKET RESEARCH AND ANALYSIS BY SOLUTION,2020-2027 ($ MILLION)

2. GLOBAL RISK MANAGEMENT TECHNOLOGY MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

3. GLOBAL TRANSACTION REPORTING & MONITORING TECHNOLOGY MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

4. GLOBAL CUSTOMER IDENTIFICATION AND AML/KYC TECHNOLOGY MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

5. GLOBAL REGULATORY INTELLIGENCE TECHNOLOGY MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

6. GLOBAL REGULATORY TECHNOLOGY MARKET RESEARCH AND ANALYSIS BY DEPLOYMENT MODEL, 2020-2027 ($ MILLION)

7. GLOBAL ON-PREMISES REGULATORY TECHNOLOGY SOLUTIONS MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

8. GLOBAL CLOUD REGULATORY TECHNOLOGY SOLUTIONS MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

9. NORTH AMERICAN REGULATORY TECHNOLOGY MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027 ($ MILLION)

10. NORTH AMERICAN REGULATORY TECHNOLOGY MARKET RESEARCH AND ANALYSIS BY SOLUTION,2020-2027 ($ MILLION)

11. NORTH AMERICAN REGULATORY TECHNOLOGY MARKET RESEARCH AND ANALYSIS BY DEPLOYMENT MODEL,2020-2027 ($ MILLION)

12. EUROPEAN REGULATORY TECHNOLOGY MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027 ($ MILLION)

13. EUROPEAN REGULATORY TECHNOLOGY MARKET RESEARCH AND ANALYSIS BY SOLUTION,2020-2027 ($ MILLION)

14. EUROPEAN REGULATORY TECHNOLOGY MARKET RESEARCH AND ANALYSIS BY DEPLOYMENT MODEL, 2020-2027 ($ MILLION)

15. ASIA-PACIFIC REGULATORY TECHNOLOGY MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027 ($ MILLION)

16. ASIA-PACIFIC REGULATORY TECHNOLOGY MARKET RESEARCH AND ANALYSIS BY SOLUTION,2020-2027 ($ MILLION)

17. ASIA-PACIFIC REGULATORY TECHNOLOGY MARKET RESEARCH AND ANALYSIS BY DEPLOYMENT MODEL, 2020-2027 ($ MILLION)

18. REST OF THE WORLD REGULATORY TECHNOLOGY MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027 ($ MILLION)

19. REST OF THE WORLD REGULATORY TECHNOLOGY MARKET RESEARCH AND ANALYSIS BY SOLUTION, 2020-2027 ($ MILLION)

20. REST OF THE WORLD REGULATORY TECHNOLOGY MARKET RESEARCH AND ANALYSIS BY DEPLOYMENT MODEL, 2020-2027 ($ MILLION)

1. GLOBAL REGULATORY TECHNOLOGY MARKET SHARE BY SOLUTION, 2020 VS 2027 (%)

2. GLOBAL REGULATORY TECHNOLOGY MARKET SHARE BY DEPLOYMENT MODEL, 2020 VS 2027 (%)

3. GLOBAL REGULATORY TECHNOLOGY MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

4. GLOBAL RISK MANAGEMENT TECHNOLOGY MARKET SHARE BY REGION, 2020 VS 2027 (%)

5. GLOBAL TRANSACTION REPORTING & MONITORING TECHNOLOGY MARKET SHARE BY REGION, 2020 VS 2027 (%)

6. GLOBAL CUSTOMER IDENTIFICATION AND AML/KYC TECHNOLOGY MARKET SHARE BY REGION, 2020 VS 2027 (%)

7. GLOBAL REGULATORY INTELLIGENCE TECHNOLOGY MARKET SHARE BY REGION, 2020 VS 2027 (%)

8. GLOBAL ON-PREMISES REGULATORY TECHNOLOGY SOLUTION MARKET SHARE BY REGION, 2020 VS 2027 (%)

9. GLOBAL CLOUD REGULATORY TECHNOLOGY SOLUTION MARKET SHARE BY REGION, 2020 VS 2027 (%)

10. US REGULATORY TECHNOLOGY MARKET SIZE, 2020-2027($ MILLION)

11. CANADA REGULATORY TECHNOLOGY MARKET SIZE, 2020-2027($ MILLION)

12. UK REGULATORY TECHNOLOGY MARKET SIZE, 2020-2027 ($ MILLION)

13. FRANCE REGULATORY TECHNOLOGY MARKET SIZE, 2020-2027 ($ MILLION)

14. GERMANY REGULATORY TECHNOLOGY MARKET SIZE, 2020-2027 ($ MILLION)

15. ITALY REGULATORY TECHNOLOGY MARKET SIZE, 2020-2027 ($ MILLION)

16. SPAIN REGULATORY TECHNOLOGY MARKET SIZE, 2020-2027 ($ MILLION)

17. REST OF EUROPE REGULATORY TECHNOLOGY MARKET SIZE, 2020-2027 ($ MILLION)

18. INDIA REGULATORY TECHNOLOGY MARKET SIZE, 2020-2027 ($ MILLION)

19. CHINA REGULATORY TECHNOLOGY MARKET SIZE, 2020-2027 ($ MILLION)

20. JAPAN REGULATORY TECHNOLOGY MARKET SIZE, 2020-2027 ($ MILLION)

21. SOUTH KOREA REGULATORY TECHNOLOGY MARKET SIZE, 2020-2027 ($ MILLION)

22. REST OF ASIA-PACIFIC REGULATORY TECHNOLOGY MARKET SIZE, 2020-2027 ($ MILLION)

23. REST OF THE WORLD REGULATORY TECHNOLOGY MARKET SIZE, 2020-2027 ($ MILLION)