Relays Market

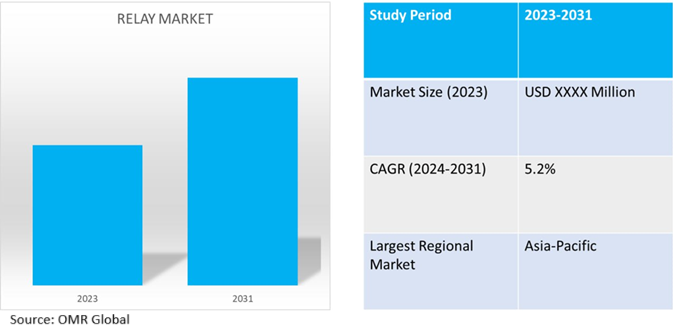

Relays Market Size, Share & Trends Analysis Report by Type (Electromechanical Relays (EMR), Solid State Relays (SSR), Thermal Relays, Latching Relays, Automotive Relays and Others), by Voltage Range (Low Voltage Relays, Medium Voltage Relays and High Voltage Relays), and by End-User Industry (Automotive and Transportation, Energy and Power, Electronics and Semiconductors, Aerospace and Defense and Others) Forecast Period (2024-2031)

Relays market is anticipated to grow at a significant CAGR of 5.2% during the forecast period (2024-2031). The market growth is attributed to pivotal factors such as increasing demand for automation in industrial processes, growth in renewable energy projects and grid modernization, expansion of smart home and IoT applications, and surge in power infrastructure development. According to the Global Smart Energy Federation (GSEF), the global smart grid market was at $100.3 billion in 2022 and is growing to approx $185.6 billion by 2032.

Market Dynamics

Increasing Demand for Automation and Industry 4.0

The relays market is primarily driven by the advancements in automation and the emergence of Industry 4.0. As industries increasingly adopt automated processes, the demand for reliable switching solutions has surged. Relays play a critical role in managing electrical circuits, ensuring efficient control over machinery and systems. Industry 4.0 emphasizes connectivity and smart technologies, further enhancing the need for advanced relay systems that support real-time data processing and communication. As manufacturing processes evolve, the need for more sophisticated and reliable control mechanisms continues to expand. This trend positions the relay market for robust growth, fueled by ongoing investments in automation technologies and smart manufacturing solutions.

Increasing Development of Smart Relays, that Offer Enhanced Connectivity

The development of smart relays is significantly driving growth in the relay market by enhancing connectivity and functionality. These advanced devices integrate communication protocols, enabling seamless interaction with other smart devices and systems. The ability to monitor and control electrical systems remotely improves efficiency and reliability, appealing to various industries, including manufacturing and energy management. Moreover, smart relays support data collection and analysis, facilitating predictive maintenance and reducing operational costs. As the demand for automation and IoT solutions increases, the adoption of smart relays becomes more prevalent. Their compatibility with cloud technologies further enhances their utility, providing real-time insights and remote access capabilities.

Market Segmentation

- Based on the type, the market is segmented into electromechanical relays (EMR), solid state relays (SSR), thermal relays, latching relays, automotive relays, and others (magnetic relays, hybrid relays, reed relays, and time delay relays).

- Based on the voltage range, the market is segmented into low voltage relays, medium voltage relays, and high voltage relays.

- Based on the end-user industry, the market is segmented into automotive and transportation, energy and power, electronics and semiconductors, aerospace and defense, and others (healthcare, chemical processing).

Thermal Relays Segment is Projected to Hold the Largest Market Share

The primary factors supporting the growth include the rising demand for thermal relays in motor protection and other automated systems, the expansion of power generation and distribution infrastructure is boosting the demand for relays, including thermal relays that are crucial for protecting electrical circuits in power systems. Thermal overload protection for motors is integrated into relays to prevent overheating and safeguard the motor by interrupting the circuit when excessive current is detected. For instance, in May 2023, ABB Ltd. introduced new functionality for the all-in-one protection and control relay REX610, REX610 is the latest addition to ABB’s Relion® product family. The Thermal overload protection for motors (49M) prevents the motor from overheating, which might cause premature insulation failure of the windings or even destroy the motor.

Energy and Power to Hold a Considerable Market Share

The factors supporting segment growth include increasing global energy consumption, driven by population growth and industrial expansion, and the demand for efficient power distribution systems grows, boosting demand for relays used in power transmission and distribution. The shift towards smart grids, that require advanced control and monitoring systems, increases the demand for relays. These devices play a critical role in managing power flow, detecting faults, and protecting electrical equipment. Relays in energy and power systems provide reliable switching and protection for electrical circuits, ensuring efficient and safe operation across various applications. For instance, Xiamen Hongfa Electroacoustic Co., Ltd. offers Hongfa power relays (general purpose relays) that are widely used in household appliances, smart homes, power control, industrial control, and other fields. Hongfa has a complete product line of power relays, covering 5-40A products, with a wide range of specifications. In the traditional power supply field, they are mainly used in UPS, ATS, inverter, switching power supply, and others.

Regional Outlook

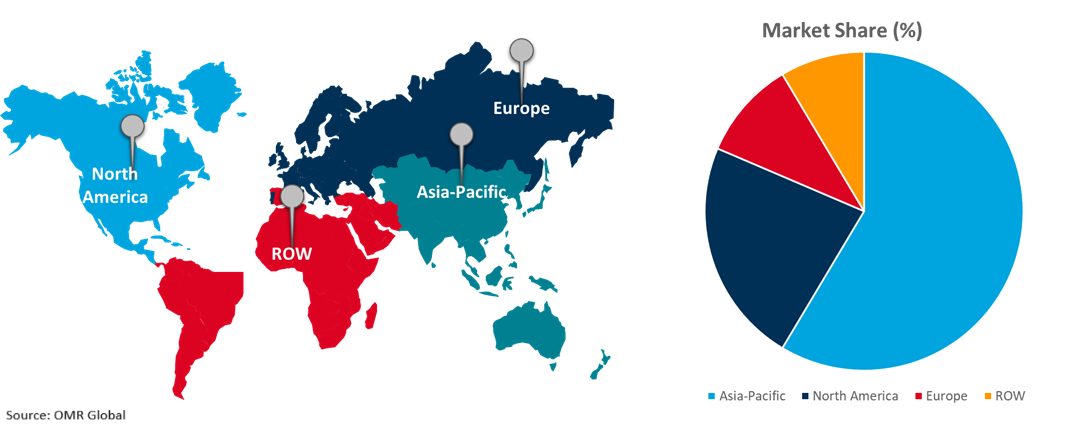

The global relays market is further segmented based on geography including North America (the US, and Canada), Europe (the UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia-Pacific), and the Rest of the World (the Middle East & Africa, and Latin America).

Growing Demand for Relays in North America

The regional growth is attributed to an increase in automation across industries such as manufacturing, automotive, and energy is driving demand for relays to control various electrical processes and machinery. The development of smart grids and the integration of renewable energy sources require advanced relay technologies for grid protection, monitoring, and control, further fueling market growth. According to the US Energy Information Administration, in 2022, US electric utilities had about 119 million advanced (smart) metering infrastructure (AMI) installations, equal to about 72.0 of total electric meter installations. Residential customers accounted for about 88.0% of total AMI installations, and about 73.0% of total residential electric meters were AMI meters.

Global Relays Market Growth by Region 2024-2031

Asia-Pacific Holds Major Market Share

Asia-Pacific holds a significant share owing to the presence of relays offering companies such as Fujitsu Ltd., Mitsubishi Electric, Omron Corp., Song Chuan Precision Co., Ltd. and Toshiba Corp., and others. The market growth is attributed to the rapid industrial growth, particularly in countries such as China, India, and South Korea, is increasing demand for relays in industrial automation, manufacturing, and process control to drive the growth of the market. According to the Organisation for Research on China and Asia (ORCA), in January 2024, China has been the largest market for industrial robots since 2013 and accounted for 52.0% of all new installations in 2022. The robot density rate (number of industrial robots per 10,000 workers) in China, a metric for automation, has grown from 97 robots per 10,000 workers in 2017 to 392 in 2023. Market players in contribute to accelerating the spread of renewable energy toward the realization of a carbon-neutral society, such as distributed power. For instance, in February 2023, OMRON Corp. introduced the G9KA-E high-capacity power relay. The G9KA-E has improved heat dissipation performance by devising a terminal shape and bottom height. The spread of renewable energy toward the realization of a carbon-neutral society, such as distributed power conditioners and EV fast chargers, stationary power storage systems (ESS), and uninterruptible power supplies (UPS).

Market Players Outlook

*Note: Major Players Sorted in No Particular Order.

The major companies serving the relays market include ABB Ltd., Omron Corp., Schneider Electric, Siemens AG, and TE Connectivity among others. The market players are increasingly focusing on business expansion and product development by applying strategies such as collaborations, mergers and acquisitions to stay competitive in the market.

Recent Development

- In June 2024, ZETTLER introduced the AZSR170 – A high-performance 70A power relay for solar and EV charging applications with optional monitoring contact. The AZSR170 offers an impressive switching performance of up to 50,000 switching cycles and a variety of features, including optional monitoring contact according to EN60947-4-1 and a large contact gap of 3.42 mm.

The Report Covers

- Market value data analysis of 2023 and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global relays market. Based on the availability of data, information related to new products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Market Trends

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. ABB Ltd.

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. Omron Corp.

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. Schneider Electric

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Siemens AG

3.5.1. Overview

3.5.2. Financial Analysis

3.5.3. SWOT Analysis

3.5.4. Recent Developments

3.6. TE Connectivity

3.6.1. Overview

3.6.2. Financial Analysis

3.6.3. SWOT Analysis

3.6.4. Recent Developments

3.7. Key Strategy Analysis

4. Market Segmentation

4.1. Global Relays Market by Type

4.1.1. Electromechanical Relays (EMR)

4.1.2. Solid State Relays (SSR)

4.1.3. Thermal Relays

4.1.4. Latching Relays

4.1.5. Automotive Relays

4.1.6. Others (Magnetic Relays, Hybrid Relays, Reed Relays, Time Delay Relays)

4.2. Global Relays Market by Voltage Range

4.2.1. Low Voltage Relays

4.2.2. Medium Voltage Relays

4.2.3. High Voltage Relays

4.3. Global Relays Market by End-User Industry

4.3.1. Automotive and Transportation

4.3.2. Energy and Power

4.3.3. Electronics and Semiconductors

4.3.4. Aerospace and Defense

4.3.5. Others (Healthcare, Chemical Processing)

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

5.4.1. Latin America

5.4.2. Middle East and Africa

6. Company Profiles

6.1. A.M.R.A. SpA

6.2. Carlo Gavazzi Holding AG

6.3. Crouzet

6.4. Danfoss A/S

6.5. Eaton Corp.

6.6. Finder S.p.A.

6.7. Fujitsu Ltd.

6.8. HONGFA Technology Co., Ltd.

6.9. Littelfuse, Inc.

6.10. Microchip Technology Inc.

6.11. Mitsubishi Electric Corp.

6.12. Panasonic Corp.

6.13. Phoenix Contact

6.14. Rockwell Automation Inc.

6.15. Sensata Technologies, Inc.

6.16. Song Chuan Precision Co., Ltd.

6.17. Toshiba Corp.

6.18. Weidmüller Interface GmbH & Co. KG

6.19. Xiamen Hongfa Electroacoustic Co.,Ltd.

6.20. ZETTLER electronics GmbH

1. Global Relays Market Research And Analysis By Type, 2023-2031 ($ Million)

2. Global Electromechanical Relays (EMR) Market Research And Analysis By Region, 2023-2031 ($ Million)

3. Global Solid State Relays (SSR) Market Research And Analysis By Region, 2023-2031 ($ Million)

4. Global Thermal Relays Market Research And Analysis By Region, 2023-2031 ($ Million)

5. Global Latching Relays Market Research And Analysis By Region, 2023-2031 ($ Million)

6. Global Automotive Relays Market Research And Analysis By Region, 2023-2031 ($ Million)

7. Global Other Relays Type Market Research And Analysis By Region, 2023-2031 ($ Million)

8. Global Relays Market Research And Analysis By Voltage Range, 2023-2031 ($ Million)

9. Global Low Voltage Relays Market Research And Analysis By Region, 2023-2031 ($ Million)

10. Global Medium Voltage Relays Market Research And Analysis By Region, 2023-2031 ($ Million)

11. Global High Voltage Relays Market Research And Analysis By Region, 2023-2031 ($ Million)

12. Global Relays Market Research And Analysis By End-User Industry, 2023-2031 ($ Million)

13. Global Relays For Automotive and Transportation Market Research And Analysis By Region, 2023-2031 ($ Million)

14. Global Relays For Energy and Power Market Research And Analysis By Region, 2023-2031 ($ Million)

15. Global Relays For Electronics and Semiconductors Market Research And Analysis By Region, 2023-2031 ($ Million)

16. Global Relays For Aerospace and Defense Market Research And Analysis By Region, 2023-2031 ($ Million)

17. Global Relays For Other End-User Industry Market Research And Analysis By Region, 2023-2031 ($ Million)

18. Global Relays Market Research And Analysis By Region, 2023-2031 ($ Million)

19. North American Relays Market Research And Analysis By Country, 2023-2031 ($ Million)

20. North American Relays Market Research And Analysis By Type, 2023-2031 ($ Million)

21. North American Relays Market Research And Analysis By Voltage Range, 2023-2031 ($ Million)

22. North American Relays Market Research And Analysis By End-User Industry, 2023-2031 ($ Million)

23. European Relays Market Research And Analysis By Country, 2023-2031 ($ Million)

24. European Relays Market Research And Analysis By Type, 2023-2031 ($ Million)

25. European Relays Market Research And Analysis By Voltage Range, 2023-2031 ($ Million)

26. European Relays Market Research And Analysis By End-User Industry, 2023-2031 ($ Million)

27. Asia-Pacific Relays Market Research And Analysis By Country, 2023-2031 ($ Million)

28. Asia-Pacific Relays Market Research And Analysis By Type, 2023-2031 ($ Million)

29. Asia-Pacific Relays Market Research And Analysis By Voltage Range, 2023-2031 ($ Million)

30. Asia-Pacific Relays Market Research And Analysis By End-User Industry, 2023-2031 ($ Million)

31. Rest Of The World Relays Market Research And Analysis By Region, 2023-2031 ($ Million)

32. Rest Of The World Relays Market Research And Analysis By Type, 2023-2031 ($ Million)

33. Rest Of The World Relays Market Research And Analysis By Voltage Range, 2023-2031 ($ Million)

34. Rest Of The World Relays Market Research And Analysis By End-User Industry, 2023-2031 ($ Million)

1. Global Relays Market Research And Analysis By Type, 2023 Vs 2031 (%)

2. Global Electromechanical Relays (EMR) Market Share By Region, 2023 Vs 2031 (%)

3. Global Solid State Relays (SSR) Market Share By Region, 2023 Vs 2031 (%)

4. Global Thermal Relays Market Share By Region, 2023 Vs 2031 (%)

5. Global Latching Relays Market Share By Region, 2023 Vs 2031 (%)

6. Global Automotive Relays Market Share By Region, 2023 Vs 2031 (%)

7. Global Other Relays Type Market Share By Region, 2023 Vs 2031 (%)

8. Global Relays Market Research And Analysis By Voltage Range, 2023 Vs 2031 (%)

9. Global Low Voltage Relays Market Share By Region, 2023 Vs 2031 (%)

10. Global Medium Voltage Relays Market Share By Region, 2023 Vs 2031 (%)

11. Global High Voltage Relays Market Share By Region, 2023 Vs 2031 (%)

12. Global Relays Market Research And Analysis By End-User Industry, 2023 Vs 2031 (%)

13. Global Relays For Automotive and Transportation Market Share By Region, 2023 Vs 2031 (%)

14. Global Relays For Energy and Power Market Share By Region, 2023 Vs 2031 (%)

15. Global Relays For Electronics and Semiconductors Market Share By Region, 2023 Vs 2031 (%)

16. Global Relays For Aerospace and Defense Market Share By Region, 2023 Vs 2031 (%)

17. Global Relays For Others End-User Industry Market Share By Region, 2023 Vs 2031 (%)

18. Global Relays Market Share By Region, 2023 Vs 2031 (%)

19. US Relays Market Size, 2023-2031 ($ Million)

20. Canada Relays Market Size, 2023-2031 ($ Million)

21. UK Relays Market Size, 2023-2031 ($ Million)

22. France Relays Market Size, 2023-2031 ($ Million)

23. Germany Relays Market Size, 2023-2031 ($ Million)

24. Italy Relays Market Size, 2023-2031 ($ Million)

25. Spain Relays Market Size, 2023-2031 ($ Million)

26. Rest Of Europe Relays Market Size, 2023-2031 ($ Million)

27. India Relays Market Size, 2023-2031 ($ Million)

28. China Relays Market Size, 2023-2031 ($ Million)

29. Japan Relays Market Size, 2023-2031 ($ Million)

30. South Korea Relays Market Size, 2023-2031 ($ Million)

31. Rest Of Asia-Pacific Relays Market Size, 2023-2031 ($ Million)

32. Latin America Relays Market Size, 2023-2031 ($ Million)

33. Middle East And Africa Relays Market Size, 2023-2031 ($ Million)