Remote Patient Monitoring Systems Market

Remote Patient Monitoring Market Size, Share & Trends Analysis Report by Device Type (Heart Monitors, Respiratory Rate Monitors, Breath Monitors, Hematology Monitors, Multi-parameter Monitors, and Others), by Application (Sleep Disorder, Cancer Treatment, Diabetes Treatment, Cardiovascular Diseases, Weight Management and Fitness Monitoring, and Others) and by End-User (Home Care Settings, Hospitals/Clinics, and Others) Forecast Period (2024-2031)

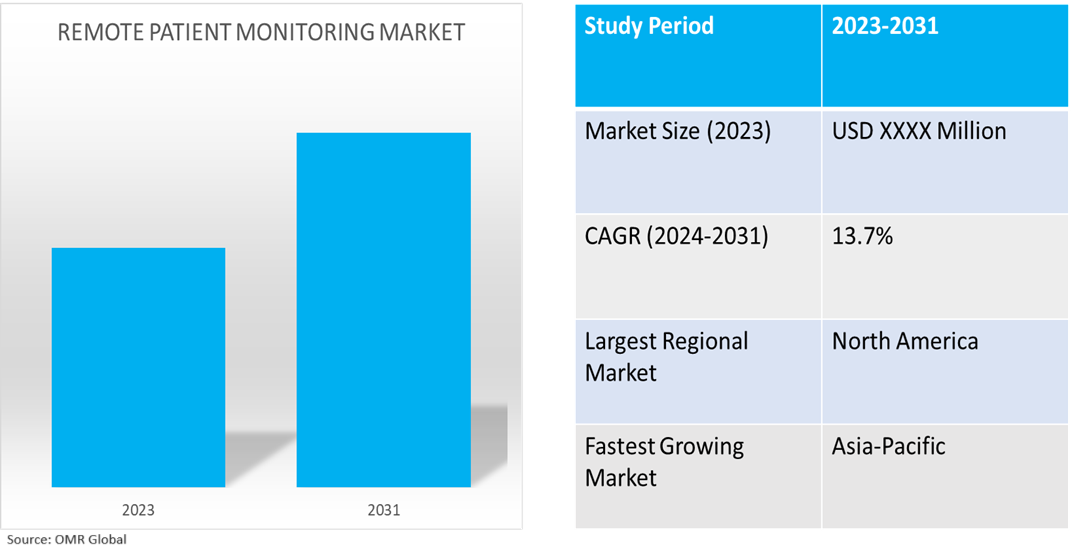

Remote patient monitoring market is anticipated to grow at a CAGR of 13.7% during the forecast period (2024-2031). The rising need for continuous health monitoring in case of chronic disorders has le d to the development of remote patient management (RPM) technologies. Technological advancements, including telecommunications, mobile devices, and wearables, have improved healthcare efficiency and patient outcomes. The COVID-19 pandemic has accelerated RPM adoption, supporting aging populations, reducing costs, and enhancing quality of life.

Market Dynamics

Increasing Prevalence of Chronic Diseases

The increasing prevalence of chronic diseases globally necessitates scalable and cost-effective solutions like RPM for managing and monitoring large patient populations. According to the World Health Organization, in September 2023, noncommunicable diseases (NCDs) are responsible for a significant number of fatalities worldwide, with 41 million mortalities occurring annually, accounting for 74.0% of all global mortalities. The leading causes of NCD deaths are cardiovascular diseases (17.9 million), followed by cancers (9.3 million), chronic respiratory diseases (4.1 million), and diabetes (2.0 million, including kidney disease mortalities caused by diabetes). Factors such as tobacco use, physical inactivity, alcohol misuse, unhealthy diets, and air pollution contribute to the increased risk of mortality from NCDs. It is essential to prioritize the detection, screening, treatment, and palliative care for NCDs to effectively address this global health challenge which in turn drives demand for the RPM market.

Increasing Demand for Home Healthcare Solutions

The demand for home healthcare solutions is on the rise as patients and healthcare providers seek convenient, scalable solutions for continuous health monitoring outside traditional clinical settings. For instance, in January 2024, Blue Spark Technologies launched a unique multi-sensor remote patient monitoring platform, VitalTraq, featuring Remote Photoplethysmography (rPPG) for measuring vital signs. The platform includes iOS and Android applications, a HIPAA-compliant cloud service, and a web-based dashboard, being tested by leading healthcare and pharmaceutical companies.

Market Segmentation

- Based on device type, the market is segmented into heart monitors, respiratory rate monitors, breath monitors, hematology monitors, multi-parameter monitors, and others (fetal monitors, and neurological monitors).

- Based on application, the market is segmented into sleep disorders, cancer treatment, diabetes treatment, cardiovascular diseases, weight management and fitness monitoring, and others (mental health monitoring, and post-acute care monitoring).

- Based on the end-user, the market is segmented into home care settings, hospitals/clinics, and others (government and public health organizations, and ambulatory care centers).

Cardiovascular Diseases (CVDs) Hold a Considerable Market Share Based on Application

The increased awareness of cardiovascular risk factors and regular monitoring by the general population has made a significant contribution to this market segment. This empowers individuals to maintain the process with their health and potentially decreases the death rates associated with CVD. According to the World Heart Federation, in 2023, CVDs can be accountable for 20.5 million mortalities globally, which is one-third of all mortalities. The primary cause of premature mortality is ischemic heart disease. There has been inconsistent progress in reducing death rates, with differences based on socioeconomic level, sex, and race.

Regional Outlook

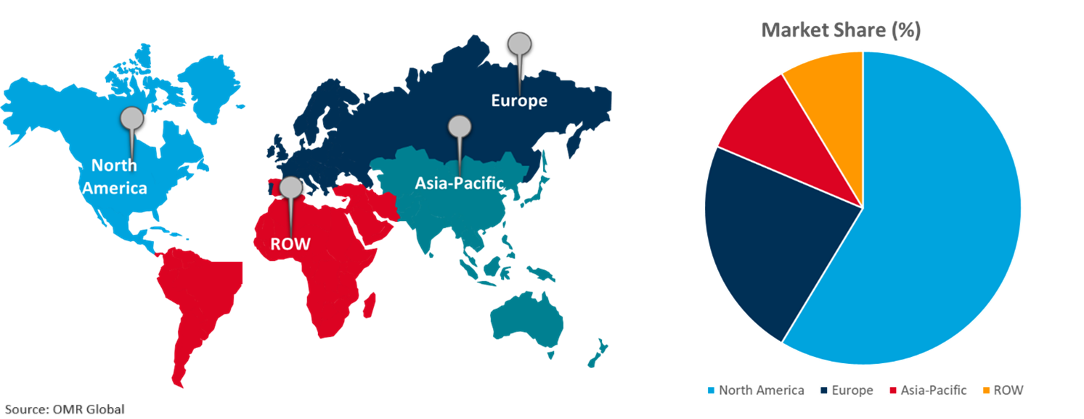

The remote patient monitoring market is further segmented based on geography including North America (the US, and Canada), Europe (UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia-Pacific), and the Rest of the World (the Middle East & Africa, and Latin America).

Regulatory Support In Asia-Pacific Region

Governments and healthcare organizations are implementing policies and reimbursement frameworks to promote the adoption of RPM technologies, ensuring data privacy, security, and compliance. For instance, in October 2023, Dozee introduced its 'Dozee Pro Ex', its ‘Made in India' a next-generation ambulatory connected system. It features wireless wearable sensors for continuous monitoring of vital parameters and an AI-powered early warning system.

Remote Patient Monitoring Market Growth by Region 2024-2031

North America Holds Major Market Share

Regulatory support and telehealth adoption drive market expansion in oncology care settings, improving access to specialized cancer care and overcoming geographical barriers. According to the American Cancer Society, in 2023, the US is projected to see over 1.9 million new cases of cancer, excluding basal cell and squamous cell skin cancers as well as carcinoma in situ. Additionally, an estimated 609,820 mortalities from cancer is expected, rendering it the US's second prevalent cause of mortality.

Market Players Outlook

*Note: Major Players Sorted in No Particular Order.

The major companies serving the remote patient monitoring market include Abbott Laboratories, Boston Scientific Cardiac Diagnostics Inc., GE Healthcare Technologies Inc., Baxter International, Inc., and Medtronic Plc among others. The market players are focusing on capitalizing on growth by adopting strategies such as collaboration, partnerships, and market expansion among others. For instance, in April 2024, OMRON Healthcare acquired Luscii Healthtech, a rapidly growing digital health and remote consultation platform company. Since 2018, the two companies have collaborated on digital health development. Luscii offers a customizable platform for home care, catering to over 150 diseases such as, including those affecting chronic hypertensive, cardiovascular, and respiratory patients.

Further, in May 2023, Ucardia acquired Phas3, a cardiac conditioning software developer, resulting in a market-leading solution for cardiac rehabilitation, conditioning, and remote patient monitoring for cardiovascular disease patients, including cardiologist practice.

The Report Covers

- Market value data analysis of 2023 and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global remote patient monitoring market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Industry Trends

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. Abbott Laboratories

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. Boston Scientific Cardiac Diagnostics Inc.

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. GE Healthcare Technologies Inc.

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Key Strategy Analysis

4. Market Segmentation

4.1. Global Remote Patient Monitoring Market by Device Type

4.1.1. Heart Monitors

4.1.2. Respiratory Rate Monitors

4.1.3. Breath Monitors

4.1.4. Hematology Monitors

4.1.5. Multi-parameter Monitors

4.1.6. Other (Fetal Monitors, and Neurological Monitors)

4.2. Global Remote Patient Monitoring Market by Application

4.2.1. Sleep Disorder

4.2.2. Cancer Treatment

4.2.3. Diabetes Treatment

4.2.4. Cardiovascular Diseases

4.2.5. Weight Management and Fitness Monitoring

4.2.6. Other (Mental Health Monitoring, and Post-Acute Care Monitoring)

4.3. Global Remote Patient Monitoring Market by End-User

4.3.1. Home Care Settings

4.3.2. Hospitals/Clinics

4.3.3. Others (Government and Public Health Organizations, and Ambulatory Care Centers)

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

5.4.1. Latin America

5.4.2. Middle East and Africa

6. Company Profiles

6.1. A&D Co,.Ltd

6.2. ACME Consulting

6.3. Baxter International, Inc.

6.4. Biobeat

6.5. Cardiomo Care Inc.

6.6. Cerner Corp.

6.7. ConnectAmerica.com, LLC

6.8. Dexcom, Inc.

6.9. Docobo Ltd

6.10. DrKumo Inc.

6.11. Honeywell International Inc.

6.12. Masimo Corp.

6.13. Medtronic Plc

6.14. Neteera Technologies Ltd.

6.15. NIHON KOHDEN CORp.

6.16. OMRON Healthcare, Inc.

6.17. Qualcomm Inc.

6.18. Resideo Technologies, Inc.

6.19. SCHILLER AG

6.20. Smart Meter LLC

6.21. Teladoc Health, Inc.

6.22. Vitls Inc.

6.23. VivaLNK, Inc.

1. Global Remote Patient Monitoring Market Research And Analysis By Device Type, 2023-2031 ($ Million)

2. Global Remote Patient Heart Monitoring Market Research And Analysis By Region, 2023-2031 ($ Million)

3. Global Remote Patient Respiratory Rate Monitoring Market Research And Analysis By Region, 2023-2031 ($ Million)

4. Global Remote Patient Breath Monitoring Market Research And Analysis By Region, 2023-2031 ($ Million)

5. Global Remote Patient Hematology Monitoring Market Research And Analysis By Region, 2023-2031 ($ Million)

6. Global Remote Patient Multi-parameter Monitoring Market Research And Analysis By Region, 2023-2031 ($ Million)

7. Global Remote Patient Other Device Type Monitoring Market Research And Analysis By Region, 2023-2031 ($ Million)

8. Global Remote Patient Monitoring Market Research And Analysis By Application, 2023-2031 ($ Million)

9. Global Remote Patient Monitoring In Sleep Disorder Market Research And Analysis By Region, 2023-2031 ($ Million)

10. Global Remote Patient Monitoring In Cancer Treatment Market Research And Analysis By Region, 2023-2031 ($ Million)

11. Global Remote Patient Monitoring In Diabetes Treatment Market Research And Analysis By Region, 2023-2031 ($ Million)

12. Global Remote Patient Monitoring In Cardiovascular Diseases Market Research And Analysis By Region, 2023-2031 ($ Million)

13. Global Remote Patient Monitoring In Weight Management and Fitness Monitoring Market Research And Analysis By Region, 2023-2031 ($ Million)

14. Global Remote Patient Monitoring In Other Application Market Research And Analysis By Region, 2023-2031 ($ Million)

15. Global Remote Patient Monitoring Market Research And Analysis By End-User, 2023-2031 ($ Million)

16. Global Remote Patient Monitoring For Home Care Settings Market Research And Analysis By Region, 2023-2031 ($ Million)

17. Global Remote Patient Monitoring For Hospitals/Clinics Market Research And Analysis By Region, 2023-2031 ($ Million)

18. Global Remote Patient Monitoring For Other End-User Market Research And Analysis By Region, 2023-2031 ($ Million)

19. Global Remote Patient Monitoring Market Research And Analysis By Region, 2023-2031 ($ Million)

20. North American Remote Patient Monitoring Market Research And Analysis By Country, 2023-2031 ($ Million)

21. North American Remote Patient Monitoring Market Research And Analysis By Device Type, 2023-2031 ($ Million)

22. North American Remote Patient Monitoring Market Research And Analysis By Application, 2023-2031 ($ Million)

23. North American Remote Patient Monitoring Market Research And Analysis By End-User, 2023-2031 ($ Million)

24. European Remote Patient Monitoring Market Research And Analysis By Country, 2023-2031 ($ Million)

25. European Remote Patient Monitoring Market Research And Analysis By Device Type, 2023-2031 ($ Million)

26. European Remote Patient Monitoring Market Research And Analysis By Application, 2023-2031 ($ Million)

27. European Remote Patient Monitoring Market Research And Analysis By End-User, 2023-2031 ($ Million)

28. Asia-Pacific Remote Patient Monitoring Market Research And Analysis By Country, 2023-2031 ($ Million)

29. Asia-Pacific Remote Patient Monitoring Market Research And Analysis By Device Type, 2023-2031 ($ Million)

30. Asia-Pacific Remote Patient Monitoring Market Research And Analysis By Application, 2023-2031 ($ Million)

31. Asia-Pacific Remote Patient Monitoring Market Research And Analysis By End-User, 2023-2031 ($ Million)

32. Rest Of The World Remote Patient Monitoring Market Research And Analysis By Region, 2023-2031 ($ Million)

33. Rest Of The World Remote Patient Monitoring Market Research And Analysis By Device Type, 2023-2031 ($ Million)

34. Rest Of The World Remote Patient Monitoring Market Research And Analysis By Application, 2023-2031 ($ Million)

35. Rest Of The World Remote Patient Monitoring Market Research And Analysis By End-User, 2023-2031 ($ Million)