Residential Energy Management Market

Residential Energy Management Market Size, Share & Trends Analysis Report by Component (Hardware, and Software), by Communication Technology (Wired, and Wireless), and by Application (Smart Appliances, Smart Meters, Smart Thermostats, In-House Displays (IHD), and Others) Forecast Period (2022-2028) Update Available - Forecast 2025-2031

Residential energy management market is anticipated to grow at a considerable CAGR of 13.1% during the forecast period. Rising government initiative regarding green and sustainable energy usage for residential buildings is driving the residential energy management market. Governments globally are encouraging digitization to transform their national energy systems to boost efficiency and economic growth. Governments across various are aiming their vision toward sustainable, secure, and affordable energy systems to reinforce the significance of energy management. Realizing its importance, the Government of India is focusing on improving energy efficiency across residential building establishments. For instance, several new Initiatives in Building Energy Efficiency (BEE) were launched in July 2021, by the Bureau of Energy Efficiency, Union Minister to ensure continuous efforts to enhance energy efficiency in the economy. The initiatives are intended to help enhance the energy-efficiency levels in residential buildings across the country. Moreover, upcoming smart city projects including smart residential buildings in developing economies provide opportunities for the residential energy management market.

Segmental Outlook

The global residential energy management market is segmented based on the component, communication technology, and application. Based on the component, the market is segmented into hardware, and software. Based on the communication technology the market is categorized into wired, and wireless. Further, based on the application, the market is segmented into smart appliances, smart meters, smart thermostats, in-house displays (IHD), and others. Among the application segment, the smart meters sub-segment is expected to cater prominent market share over the forecast period owing to the increasing adoption of smart meters and smart grids over traditional meters in a residential applications. A smart energy meter is an electronic device that measures the most accurate information of consumed energy by a residence or any electrically-powered device and thus reduces the chance of error in the existing billing system to minimal. There has been a constant shift from demand for traditional meters to demand for smart metering solutions, due to their advantageous features including real-time monitoring of energy consumption for monitoring and billing purposes. Additionally, other advantages including energy management, optimized utility bills, improved reliability, reduced cost, fraud detection, and others, are enhancing the adoption of smart meters. Thus, technologically advanced smart energy meters are anticipated to promote the progress of the market. To ensure optimal energy efficiency and to fulfill the rising demand for energy management, companies are launching advanced level of smart metering solutions. For instance, in 2022, ABB India launched a series of electrical measuring and power monitoring meters for the digital panel meter market. These smart solutions allow users to make better choices to monitor their power consumption and accurately monitor the energy assets for residential, industrial, and commercial building segments.

Regional Outlooks

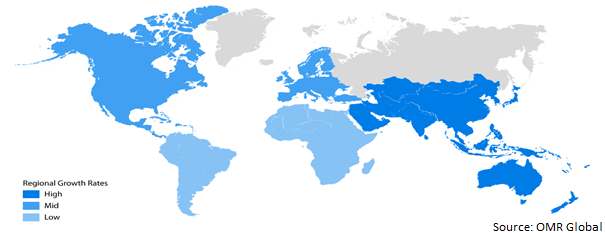

The global residential energy management market is further segmented based on geography including North America (the US, and Canada), Europe (Italy, Spain, Germany, France, and Others), Asia-Pacific (India, China, Japan, South Korea, and Others), and the Rest of the World (the Middle East &Africa, and Latin America). The market can be analyzed for a particular region or country level as per the requirement. Among these, North America is expected to cater prominent growth over the forecast period. However, Europe is projected to experience considerable growth in the residential energy management market.

Global Residential Energy Management Market Growth, by Region 2022-2028

The North American Region Is Expected to Hold Prominent Share in the Global Residential Energy Management Market

The North American region is expected to hold a prominent share in the global residential energy management market owing to the high awareness regarding energy conservation amongst the people, along with government initiatives for energy saving. For instance, The U.S. Department of Energy's State Energy Program (SEP) provides funding and technical assistance to states, territories, and the District of Columbia to enhance energy security, advance state-led energy initiatives, and increase energy affordability. As the demand for reliable power in the home continues to rise, key players in this region are adopting various strategies such as partnerships, collaborations, and new product launches. For instance, in 2020, Schneider Electric announced a technological and commercial partnership with SolarEdge Technologies Inc. for North America to accelerate the residential solar market and offer homeowners with unified energy management for smart homes.

Market Players Outlook

The major companies serving the global Residential Energy Management market includes Honeywell International Inc., LG Electronics, Panasonic Industry Co., Ltd., Samsung Electronics, Schneider Electric Industries SAS, and others. The market players are considerably contributing to the market growth by the adoption of various strategies including mergers and acquisitions, partnerships, collaborations, funding, and new product launches, to stay competitive in the market. For instance, in December 2021, Kohler Co. announced a new division within its Residential and Power Products business — the Home Energy Management Systems (HEMS). The HEMS team is focused on providing products and services to support energy resiliency.

The Report Covers

- Market value data analysis of 2021 and forecast to 2028.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global residential energy management market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segmentation

1.2.2. BY Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendation

2.2.3. Conclusion

3. Competitive Landscape

3.1. Honeywell International Inc.

3.1.1. Overview

3.1.2. Financial Analysis

3.1.3. SWOT Analysis

3.1.4. Recent Development

3.2. LG Electronics

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Development

3.3. Panasonic Industry Co., Ltd.

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Development

3.4. Samsung Electronics

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Development

3.5. Schneider Electric Industries SAS

3.5.1. Overview

3.5.2. Financial Analysis

3.5.3. SWOT Analysis

3.5.4. Recent Development

3.6. Key Strategy Analysis

4. Market Segmentation

4.1. Global Residential Energy Management Market by Component

4.1.1. Hardware

4.1.2. Software

4.2. Global Residential Energy Management Market by Communication Technology

4.2.1. Wired

4.2.2. Wireless

4.3. Global Residential Energy Management Market by Application

4.3.1. Smart Appliances

4.3.2. Smart Meters

4.3.3. Smart Thermostats

4.3.4. In-House Displays (IHD)

4.3.5. Others

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

6. Company Profiles

6.1. ABB Ltd

6.2. Aclara Technologies LLC. (Hubbell Inc.)

6.3. Amphenol group

6.4. Aztech Associates Inc.

6.5. Comcast Corp.

6.6. Eaton Corporation plc

6.7. ecobee inc.

6.8. Energate, Inc.

6.9. E.ON

6.10. General Electric Company

6.11. HPL Electric and Power Ltd

6.12. Itron, Inc.

6.13. Landis+Gyr AG

6.14. Lloyd Security Inc.

6.15. NXP Semiconductors N.V.

6.16. Oracle Corp.

6.17. Robert Bosch GmbH

6.18. Siemens AG

6.19. ZEN Within Inc.

1. GLOBAL RESIDENTIAL ENERGY MANAGEMENT MARKET RESEARCH AND ANALYSIS BY COMPONENT, 2021-2028 ($ MILLION)

2. GLOBAL RESIDENTIAL ENERGY MANAGEMENT HARDWARE MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

3. GLOBAL RESIDENTIAL ENERGY MANAGEMENT SOFTWARE MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

4. GLOBAL RESIDENTIAL ENERGY MANAGEMENT MARKET RESEARCH AND ANALYSIS BY COMMUNICATION TECHNOLOGY, 2021-2028 ($ MILLION)

5. GLOBAL RESIDENTIAL ENERGY MANAGEMENT by WIRED TECHNOLOGY MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

6. GLOBAL RESIDENTIAL ENERGY MANAGEMENT BY WIRELESS TECHNOLOGY MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

7. GLOBAL RESIDENTIAL ENERGY MANAGEMENT MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2021-2028 ($ MILLION)

8. GLOBAL SMART APPLIANCES FOR RESIDENTIAL ENERGY MANAGEMENT MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

9. GLOBAL SMART METERS FOR RESIDENTIAL ENERGY MANAGEMENT MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

10. GLOBAL SMART THERMOSTATS FOR RESIDENTIAL ENERGY MANAGEMENT MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

11. GLOBAL IN-HOUSE DISPLAYS (IHD) FOR RESIDENTIAL ENERGY MANAGEMENT MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

12. GLOBAL OTHER APPLICATIONS FOR RESIDENTIAL ENERGY MANAGEMENT MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

13. GLOBAL RESIDENTIAL ENERGY MANAGEMENT MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

14. NORTH AMERICAN RESIDENTIAL ENERGY MANAGEMENT MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

15. NORTH AMERICAN RESIDENTIAL ENERGY MANAGEMENT MARKET RESEARCH AND ANALYSIS BY COMPONENT, 2021-2028 ($ MILLION)

16. NORTH AMERICAN RESIDENTIAL ENERGY MANAGEMENT MARKET RESEARCH AND ANALYSIS BY COMMUNICATION TECHNOLOGY, 2021-2028 ($ MILLION)

17. NORTH AMERICAN RESIDENTIAL ENERGY MANAGEMENT MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2021-2028 ($ MILLION)

18. EUROPEAN RESIDENTIAL ENERGY MANAGEMENT MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

19. EUROPEAN RESIDENTIAL ENERGY MANAGEMENT MARKET RESEARCH AND ANALYSIS BY COMPONENT, 2021-2028 ($ MILLION)

20. EUROPEAN RESIDENTIAL ENERGY MANAGEMENT MARKET RESEARCH AND ANALYSIS BY COMMUNICATION TECHNOLOGY, 2021-2028 ($ MILLION)

21. EUROPEAN RESIDENTIAL ENERGY MANAGEMENT MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2021-2028 ($ MILLION)

22. ASIA-PACIFIC RESIDENTIAL ENERGY MANAGEMENT MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

23. ASIA-PACIFIC RESIDENTIAL ENERGY MANAGEMENT MARKET RESEARCH AND ANALYSIS BY COMPONENT, 2021-2028 ($ MILLION)

24. ASIA-PACIFIC RESIDENTIAL ENERGY MANAGEMENT MARKET RESEARCH AND ANALYSIS BY COMMUNICATION TECHNOLOGY, 2021-2028 ($ MILLION)

25. ASIA-PACIFIC RESIDENTIAL ENERGY MANAGEMENT MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2021-2028 ($ MILLION)

26. REST OF THE WORLD RESIDENTIAL ENERGY MANAGEMENT MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

27. REST OF THE WORLD RESIDENTIAL ENERGY MANAGEMENT MARKET RESEARCH AND ANALYSIS BY COMPONENT, 2021-2028 ($ MILLION)

28. REST OF THE WORLD RESIDENTIAL ENERGY MANAGEMENT MARKET RESEARCH AND ANALYSIS BY COMMUNICATION TECHNOLOGY, 2021-2028 ($ MILLION)

29. REST OF THE WORLD RESIDENTIAL ENERGY MANAGEMENT MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2021-2028 ($ MILLION)

1. GLOBAL RESIDENTIAL ENERGY MANAGEMENT MARKET SHARE BY COMPONENT, 2021 VS 2028 (%)

2. GLOBAL RESIDENTIAL ENERGY MANAGEMENT HARDWARE MARKET SHARE BY REGION, 2021 VS 2028 (%)

3. GLOBAL RESIDENTIAL ENERGY MANAGEMENT SOFTWARE MARKET SHARE BY REGION, 2021 VS 2028 (%)

4. GLOBAL RESIDENTIAL ENERGY MANAGEMENT MARKET SHARE BY COMMUNICATION TECHNOLOGY, 2021 VS 2028 (%)

5. GLOBAL RESIDENTIAL ENERGY MANAGEMENT BY WIRED TECHNOLOGY MARKET SHARE BY REGION, 2021 VS 2028 (%)

6. GLOBAL RESIDENTIAL ENERGY MANAGEMENT BY WIRELESS TECHNOLOGY MARKET SHARE BY REGION, 2021 VS 2028 (%)

7. GLOBAL RESIDENTIAL ENERGY MANAGEMENT MARKET SHARE BY APPLICATION, 2021 VS 2028 (%)

8. GLOBAL SMART APPLIANCES FOR RESIDENTIAL ENERGY MANAGEMENT MARKET SHARE BY REGION, 2021 VS 2028 (%)

9. GLOBAL SMART METERS FOR RESIDENTIAL ENERGY MANAGEMENT MARKET SHARE BY REGION, 2021 VS 2028 (%)

10. GLOBAL SMART THERMOSTATS FOR RESIDENTIAL ENERGY MANAGEMENT MARKET SHARE BY REGION, 2021 VS 2028 (%)

11. GLOBAL IN-HOUSE DISPLAYS (IHD) FOR RESIDENTIAL ENERGY MANAGEMENT MARKET SHARE BY REGION, 2021 VS 2028 (%)

12. GLOBAL OTHER APPLICATIONS FOR RESIDENTIAL ENERGY MANAGEMENT MARKET SHARE BY REGION, 2021 VS 2028 (%)

13. GLOBAL RESIDENTIAL ENERGY MANAGEMENT MARKET SHARE BY REGION, 2021 VS 2028 (%)

14. US RESIDENTIAL ENERGY MANAGEMENT MARKET SIZE, 2021-2028 ($ MILLION)

15. CANADA RESIDENTIAL ENERGY MANAGEMENT MARKET SIZE, 2021-2028 ($ MILLION)

16. UK RESIDENTIAL ENERGY MANAGEMENT MARKET SIZE, 2021-2028 ($ MILLION)

17. FRANCE RESIDENTIAL ENERGY MANAGEMENT MARKET SIZE, 2021-2028 ($ MILLION)

18. GERMANY RESIDENTIAL ENERGY MANAGEMENT MARKET SIZE, 2021-2028 ($ MILLION)

19. ITALY RESIDENTIAL ENERGY MANAGEMENT MARKET SIZE, 2021-2028 ($ MILLION)

20. SPAIN RESIDENTIAL ENERGY MANAGEMENT MARKET SIZE, 2021-2028 ($ MILLION)

21. REST OF EUROPE RESIDENTIAL ENERGY MANAGEMENT MARKET SIZE, 2021-2028 ($ MILLION)

22. INDIA RESIDENTIAL ENERGY MANAGEMENT MARKET SIZE, 2021-2028 ($ MILLION)

23. CHINA RESIDENTIAL ENERGY MANAGEMENT MARKET SIZE, 2021-2028 ($ MILLION)

24. JAPAN RESIDENTIAL ENERGY MANAGEMENT MARKET SIZE, 2021-2028 ($ MILLION)

25. SOUTH KOREA RESIDENTIAL ENERGY MANAGEMENT MARKET SIZE, 2021-2028 ($ MILLION)

26. REST OF ASIA-PACIFIC RESIDENTIAL ENERGY MANAGEMENT MARKET SIZE, 2021-2028 ($ MILLION)

27. REST OF THE WORLD RESIDENTIAL ENERGY MANAGEMENT MARKET SIZE, 2021-2028 ($ MILLION)