Residential Furnace Market

Global Residential Furnace Market Size, Share & Trends Analysis Report by Product (Gas Furnace, Electric Furnace, Oil Furnace, Wood Furnace, and Hybrid Furnace) By Application (Single Family and Multi-Family) and Forecast, 2019-2025 Update Available - Forecast 2025-2031

The global residential furnace market is estimated to grow at a CAGR of nearly 6.8% during the forecast period. Increasing demand for indoor heating solutions and a significant rise in residential construction activities across the globe. As per the US Census Bureau, in the US, in February 2020, building permits for privately?owned residential units were 1,464,000, which is 13.8% more than the rate of 1,287,000 February 2019. The demand for residential construction is also increasing in emerging countries, including India and China owing to the rapid urbanization and significant population base in these countries. The growing residential construction is encouraging the adoption of heating and cooling equipment to reduce the level of energy consumption.

As per the Energy Information Administration (EIA), in the US, space heating and water heating account for approximately two-thirds of energy use in the homes. This, in turn, leading the adoption of residential furnaces which is one of the crucial energy-efficient equipment for space and water heating. With the growing consumers’ choices for equipment that reduce environmental impact and offer significant long-term savings for energy cost, the builders are focusing on marketing their homes with highly efficient equipment. Due to consumer pressure, in the US, the federal Energy Star program is offering incentives to promote the use of more efficient equipment. As a result, there is an emerging adoption of residential furnaces for energy-saving and reduce carbon footprint.

Market Segmentation

The global residential furnace market is segmented based on product and application. Based on the product, the market is classified into the gas furnace, electric furnace, oil furnace, wood furnace, and hybrid furnace. As per the Government of Canada, forced-air furnace certified by ENERGY STAR, fueled by oil uses 9% less energy and fueled by gas uses 6% less energy, on average, as compared to a standard model. Homeowners significantly rely on natural gas as it is a safe, clean, affordable, and energy-efficient choice. It costs less as compared to electricity, from 50%-70% lower, which can greatly reduce water and heating costs. Based on the application, the market is classified into single-family and multi-family.

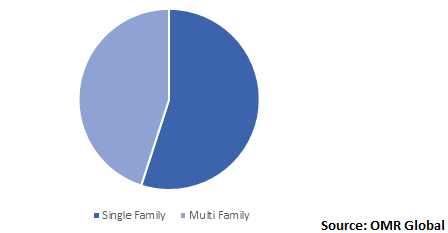

Residential furnace finds its significant application in single-family homes

Single-family homes are being significantly adopting furnaces as central heating is common in single-family homes. Two furnaces are being significantly used in a single home that offers an equal quantity of heat without adding wear and tear on the heating system. A gas furnace is a significantly used space and water heating equipment in single-family homes. In single-family homes, the contractor and homeowner are accountable to opt for space and water heating equipment. For the new construction of single homes, the builder is accountable for the selection of space and water heating equipment. Rising awareness regarding energy-efficient solutions among consumers and builders are primarily contributing to the demand for residential furnaces in single homes.

Global Residential Furnace Market Share by Application, 2018 (%)

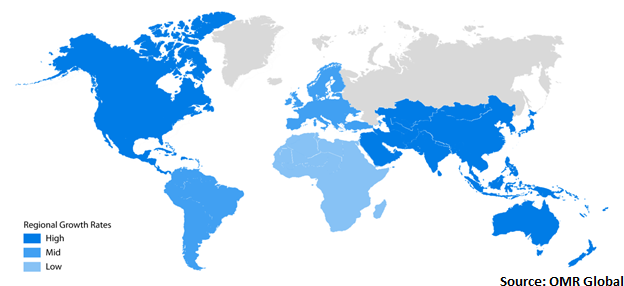

Regional Outlook

Geographically, the market is segmented based on four major regions, including North America, Europe, Asia-Pacific, and Rest of the World (RoW). North America is anticipated to hold a potential share in the market owing to the increasing demand for energy-efficient solutions coupled with the government initiatives to offer subsidies for Energy Star certified products. Increasing adoption of space heating and cooling equipment in the region is primarily driving the demand energy-efficient furnace in the homes.

Asia-Pacific is estimated to witness potential growth during the forecast period owing to the increasing adoption of heating, ventilation, and air conditioning (HVAC) equipment coupled with rising urbanization and awareness regarding energy-efficient solutions in the region. A significant rise in the residential construction industry is driving the demand for gas, oil, and electric furnaces in the region.

Global Residential Furnace Market Growth, by Region 2019-2025

Market Players Outlook

The major players operating in the market include Daikin Industries Ltd., Carrier Global Corp., Ingersoll Rand, Inc., Whirlpool Corp., and Johnson Controls, Inc. The market players are constantly focusing on gaining major market share by adopting mergers & acquisitions, geographical expansion, product launch, and partnerships and collaborations. For instance, in February 2017, Ingersoll-Rand plc plans to acquire the business of Thermocold Costruzioni S.r.l, a manufacturer and distributor of HVAC systems and solutions for commercial, residential, and industrial buildings in Europe. With this acquisition, Ingersoll-Rand plc aims to strengthen its portfolios and take the benefit of the market opportunity in Europe. In addition, it will widen the distribution of Thermocold technologies across the globe where demand is significantly rising. Due to the support from Ingersoll Rand and Trane, Thermocold will be able to better provide service to new and current customers.

The Report Covers

- Market value data analysis of 2018 and forecast to 2025.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global residential furnace market. Based on the availability of data, information related to products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

2.3. Rules & Regulations

3. Competitive Landscape

3.1. Key Strategy Analysis

3.2. Key Company Analysis

3.2.1. Daikin Industries Ltd.

3.2.1.1. Overview

3.2.1.2. Financial Analysis

3.2.1.3. SWOT Analysis

3.2.1.4. Recent Developments

3.2.2. Carrier Global Corp.

3.2.2.1. Overview

3.2.2.2. Financial Analysis

3.2.2.3. SWOT Analysis

3.2.2.4. Recent Developments

3.2.3. Ingersoll Rand, Inc.

3.2.3.1. Overview

3.2.3.2. Financial Analysis

3.2.3.3. SWOT Analysis

3.2.3.4. Recent Developments

3.2.4. Whirlpool Corp.

3.2.4.1. Overview

3.2.4.2. Financial Analysis

3.2.4.3. SWOT Analysis

3.2.4.4. Recent Developments

3.2.5. Johnson Controls, Inc.

3.2.5.1. Overview

3.2.5.2. Financial Analysis

3.2.5.3. SWOT Analysis

3.2.5.4. Recent Developments

4. Market Determinants

4.1 Motivators

4.2 Restraints

4.3 Opportunities

5. Market Segmentation

5.1. Global Residential Furnace Market by Product

5.1.1. Gas Furnace

5.1.2. Electric Furnace

5.1.3. Oil Furnace

5.1.4. Wood Furnace

5.1.5. Hybrid Furnace

5.2. Global Residential Furnace Market by Application

5.2.1. Single Family

5.2.2. Multi Family

6. Regional Analysis

6.1. North America

6.1.1. United States

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. Boyertown Furnace

7.2. Bryant Heating & Cooling Systems

7.3. Carrier Global Corp.

7.4. Daikin Industries, Ltd.

7.5. Dettson Industries Inc.

7.6. Fujitsu General Ltd.

7.7. Ingersoll Rand, Inc.

7.8. International Comfort Products LLC (ICP)

7.9. Johnson Controls, Inc.

7.10. Lennox International Inc.

7.11. Mr Furnace

7.12. MRCOOL LLC

7.13. Nortek Global HVAC LLC

7.14. R.E. Michel Co., Inc.

7.15. Rheem Manufacturing Co.

7.16. WaterFurnace Renewable Energy, Inc.

7.17. Whirlpool Corp.

1. GLOBAL RESIDENTIAL GAS FURNACE MARKET RESEARCH AND ANALYSIS BY COMPONENT, 2018-2025 ($ MILLION)

2. GLOBAL RESIDENTIAL ELECTRIC FURNACE MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

3. GLOBAL RESIDENTIAL OIL FURNACE MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

4. GLOBAL RESIDENTIAL FURNACE MARKET RESEARCH AND ANALYSIS BY END-USER, 2018-2025 ($ MILLION)

5. GLOBAL RESIDENTIAL WOOD FURNACE MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

6. GLOBAL RESIDENTIAL FURNACE MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2018-2025 ($ MILLION)

7. GLOBAL RESIDENTIAL FURNACE IN SINGLE FAMILY MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

8. GLOBAL RESIDENTIAL FURNACE IN MULTI FAMILY MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

9. GLOBAL RESIDENTIAL FURNACE MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2018-2025 ($ MILLION)

10. NORTH AMERICAN RESIDENTIAL FURNACE MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

11. NORTH AMERICAN RESIDENTIAL FURNACE MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2018-2025 ($ MILLION)

12. NORTH AMERICAN RESIDENTIAL FURNACE MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2018-2025 ($ MILLION)

13. EUROPEAN RESIDENTIAL FURNACE MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

14. EUROPEAN RESIDENTIAL FURNACE MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2018-2025 ($ MILLION)

15. EUROPEAN RESIDENTIAL FURNACE MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2018-2025 ($ MILLION)

16. ASIA-PACIFIC RESIDENTIAL FURNACE MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

17. ASIA-PACIFIC RESIDENTIAL FURNACE MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2018-2025 ($ MILLION)

18. ASIA-PACIFIC RESIDENTIAL FURNACE MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2018-2025 ($ MILLION)

19. REST OF THE WORLD RESIDENTIAL FURNACE MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2018-2025 ($ MILLION)

20. REST OF THE WORLD RESIDENTIAL FURNACE MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2018-2025 ($ MILLION)

1. GLOBAL RESIDENTIAL FURNACE MARKET SHARE BY PRODUCT, 2018 VS 2025 (%)

2. GLOBAL RESIDENTIAL FURNACE MARKET SHARE BY APPLICATION, 2018 VS 2025 (%)

3. GLOBAL RESIDENTIAL FURNACE MARKET SHARE BY GEOGRAPHY, 2018 VS 2025 (%)

4. US RESIDENTIAL FURNACE MARKET SIZE, 2018-2025 ($ MILLION)

5. CANADA RESIDENTIAL FURNACE MARKET SIZE, 2018-2025 ($ MILLION)

6. UK RESIDENTIAL FURNACE MARKET SIZE, 2018-2025 ($ MILLION)

7. FRANCE RESIDENTIAL FURNACE MARKET SIZE, 2018-2025 ($ MILLION)

8. GERMANY RESIDENTIAL FURNACE MARKET SIZE, 2018-2025 ($ MILLION)

9. ITALY RESIDENTIAL FURNACE MARKET SIZE, 2018-2025 ($ MILLION)

10. SPAIN RESIDENTIAL FURNACE MARKET SIZE, 2018-2025 ($ MILLION)

11. ROE RESIDENTIAL FURNACE MARKET SIZE, 2018-2025 ($ MILLION)

12. INDIA RESIDENTIAL FURNACE MARKET SIZE, 2018-2025 ($ MILLION)

13. CHINA RESIDENTIAL FURNACE MARKET SIZE, 2018-2025 ($ MILLION)

14. JAPAN RESIDENTIAL FURNACE MARKET SIZE, 2018-2025 ($ MILLION)

15. REST OF ASIA-PACIFIC RESIDENTIAL FURNACE MARKET SIZE, 2018-2025 ($ MILLION)

16. REST OF THE WORLD RESIDENTIAL FURNACE MARKET SIZE, 2018-2025 ($ MILLION)