Residential Smoke Detectors Market

Global Residential Smoke Detectors Market Size, Share & Trends Analysis Report by Type (Photoelectric Smoke Detectors, Ionization Smoke Detectors, Dual Sensor Smoke Detectors, and Optical Sensor Smoke Detectors), By Power Source (Battery Powered, and Hardwiring) Forecast, 2021-2027 Update Available - Forecast 2025-2035

The global residential smoke detectors market is anticipated to grow significantly at a CAGR of 5.0% during the forecast period. A smoke detector is a gadget having a sensor that detects smoke and alerts the user to a fire. Smoke can be detected using two methods: optical and physical. Photoelectric detectors use an optical mechanism, while ionization detectors employ a physical process. Both strategies are used by some detectors. According to the National Fire Protection Association of the US (NFPA) in 2019, there were around 5 deaths per 1000 houses in homes with functional smoke alarms, compared to 12 deaths in homes without smoke alarms. The usage of smoke detectors has considerably reduced the number of people who have died as a result of a fire.

Furthermore, the market for residential smoke detectors is boosted by rapid urbanization around the globe. According to the United Nations (UN), over 3.4 billion people (55% of the population) lived in urban areas in 2018, with this number expected to rise to around 5.9 billion people (68%) by 2050. Cohesive government regulations, efforts, and projects in favor of smoke detectors, rising acceptance of smart home and smart home security, and technological advancements are all contributing to the market's growth. Aside from these factors, the growing IoT industry would have a substantial impact on market growth over the projection period. However, the high initial installation cost is one of the primary factors that is expected to stifle market expansion.

Impact of COVID-19 Pandemic on Global Residential Smoke Detectors Market

The global residential smoke detectors market is hit by the outbreak of COVID-19 in December 2019. China was the epicenter of the pandemic, from where the pandemic spread throughout the globe. As a result, existing safety equipment manufacturing plants were forced to close their operations, while new projects across China were put on hold. Several offices and manufacturing sites have been permanently closed. Apart from it, the outbreak has adversely affected all the manufacturing and industrial sectors, and also it has disrupted the business functions of a wide range of industries across the globe. The nationwide lockdowns imposed to prevent the spread of COVID-19 have had a negative impact on the construction sector, which is the smoke detectors industry's largest revenue generator. The market will witness “V” shape recovery in near future owing to the restart of activities in major economies.

Segmental Outlook

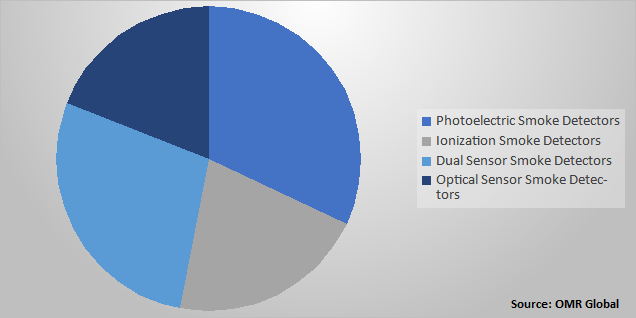

The global residential smoke detectors market can be bifurcated based on type, and power source. Based on the type, the market is segmented into photoelectric smoke detectors, ionization smoke detectors, dual sensor smoke detectors, and optical sensor smoke detectors. Ionization technology is developed to detect fires with rapid burning capabilities, whereas photoelectric technology is specialized in detecting fires that emit huge smoke particles. Based on the power source, the market is classified into battery-powered, and hardwiring.

Global Residential Smoke Detectors Market Share by Type, 2020 (%)

Photoelectric Smoke Detectors Segment holds the significant share in the Global Residential Smoke Detectors Market

Among the type for the global residential smoke detectors market, the photoelectric smoke detectors segment held the highest share in 2020 and is also anticipated to grow during the forecast period. Smoldering flames, which can only be detected by these photoelectric or dual sensors, are the leading cause of fire deaths, hence the market for both smoke detectors is rising. Additionally, the major players' focus on launches of dual sensors systems is fueling the growth. For instance, in September 2019, the Smart Home Twinguard, Bosch's newest smart fire safety system, was launched by the German industrial behemoth. The dual sensor system can be connected to smoke alarms and includes a burglary alarm siren as well as an air quality sensor. The device, which can be coupled with the Bosch Smart Home System, will activate all cameras in the house in the event of a fire.

Regional Outlooks

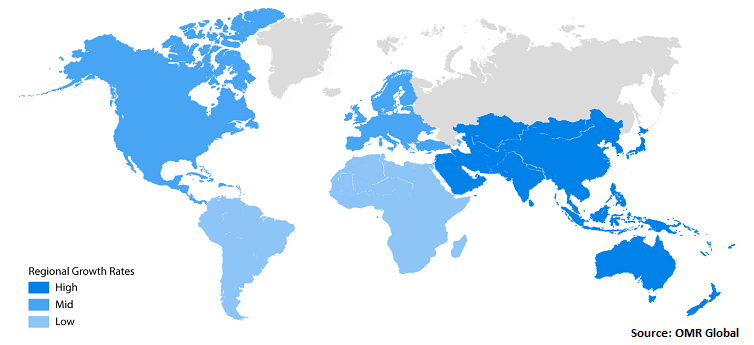

The global residential smoke detectors market is further segmented based on geography including North America (the US, and Canada), Europe (Italy, Spain, Germany, France, and Others), Asia-Pacific (India, China, Japan, and Others), and the Rest of the World (the Middle East and Africa, and Latin America). North America has been predicted to dominate the global residential smoke detectors market, followed by Europe. The growth is mainly attributed due to supportive government regulations for mandatory installation of smoke detectors in buildings.

Global Residential Smoke Detectors Market Growth, by Region 2021-2027

Asia-Pacific is projected to have a considerable share in the Global Residential Smoke Detectors Market

Asia-Pacific is anticipated to exhibit the fastest growth in the global residential smoke detectors market. In the region, countries such as China and India are the most promising economies in terms of growth. This is due to the increased urbanization in the region. For instance, according to the World Bank, in 2019 there were around 34% of the population in India lived in an urban area, and in China, it was around 60%.

Market Players Outlook

The key players of the global residential smoke detectors market include Apollo Fire Detectors Ltd., Johnsons Controls Inc., Siemens AG, Honeywell International Inc., Robert Bosch GmbH, Gentex Corp., and Universal Security Instruments, Inc., among others. The market players are considerably contributing to the market growth by the adoption of various strategies including mergers & acquisitions, collaborations, funding, and new product launches, to stay competitive in the market. For instance, in August 2019, Honeywell International Inc. has launched VESDA-E VES aspirating smoke detectors. VESDA-E VES aspirating smoke detectors are part of the VESDA-E series of advanced smoke detection technology. They allow users to separate protected areas into four discrete sectors to help assure early detection and notification of a potential threat. The detectors also contribute to lower total cost of ownership by lowering installation, commissioning, and operational costs.

The Report Covers

- Market value data analysis of 2020 and forecast to 2027.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global residential smoke detectors market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

• Impact of COVID-19 on the Global Residential Smoke DetectorsIndustry

• Recovery Scenario of Global Residential Smoke DetectorsIndustry

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. BY Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.1.1. Overview

3.1.2. Financial Analysis

3.1.3. SWOT Analysis

3.2. Key Strategy Analysis

3.3. Impact of COVID-19 on Key Players

4. Market Determinants

4.1. Motivators

4.2. Restraints

4.3. Opportunities

5. Market Segmentation

5.1. Global Residential Smoke Detectors Market by Type

5.1.1. Photoelectric Smoke Detectors

5.1.2. Ionization Smoke Detectors

5.1.3. Dual Sensor Smoke Detectors

5.1.4. Optical Sensor Smoke Detectors

5.2. Global Residential Smoke Detectors Market by Powered Source

5.2.1. Battery Powered

5.2.2. Hardwiring

6. Regional Analysis

6.1. North America

6.1.1. United States

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. South Korea

6.3.5. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. Apollo Fire Detectors Ltd.

7.2. Ceasefire Industries Pvt. Ltd.

7.3. Detector Electronics Corp.

7.4. Emerson Electric Co.

7.5. Everspring Industry Co., Ltd.

7.6. General Motors Co.

7.7. Gentex Corp.

7.8. Hochiki America Corp.

7.9. Honeywell International Inc.

7.10. Indiegogo, Inc.

7.11. Johnson Controls, Inc.

7.12. Lansinoh Laboratories, Inc.

7.13. Microm Group

7.14. Nest Labs Inc.(Google Nest)

7.15. Protec Fire & Security Group Ltd

7.16. Robert Bosch GmbH

7.17. Schneider Electric SE

7.18. SECOM Co., Ltd.

7.19. Siemens AG

7.20. Universal Security Instruments, Inc.

1. GLOBAL RESIDENTIAL SMOKE DETECTORS MARKET RESEARCH AND ANALYSIS, 2020-2027 ($ MILLION)

2. GLOBAL RESIDENTIAL SMOKE DETECTORS MARKET RESEARCH AND ANALYSIS BY TYPE, 2020-2027 ($ MILLION)

3. GLOBAL PHOTOELECTRIC SMOKE DETECTORS MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

4. GLOBAL IONIZATION SMOKE DETECTORS MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

5. GLOBAL DUAL SENSOR SMOKE DETECTORS MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

6. GLOBAL OPTICAL SENSOR SMOKE DETECTORS MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

7. GLOBAL RESIDENTIAL SMOKE DETECTORS MARKET RESEARCH AND ANALYSIS BY POWERED SOURCE, 2020-2027 ($ MILLION)

8. GLOBAL BATTERY-POWERED RESIDENTIAL SMOKE DETECTORS MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

9. GLOBAL HARDWIRING RESIDENTIAL SMOKE DETECTORS MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

10. GLOBAL RESIDENTIAL SMOKE DETECTORS MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2020-2027 ($ MILLION)

11. NORTH AMERICAN RESIDENTIAL SMOKE DETECTORS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027 ($ MILLION)

12. NORTH AMERICAN RESIDENTIAL SMOKE DETECTORS MARKET RESEARCH AND ANALYSIS BY TYPE, 2020-2027 ($ MILLION)

13. NORTH AMERICAN RESIDENTIAL SMOKE DETECTORS MARKET RESEARCH AND ANALYSIS BY POWERED SOURCE, 2020-2027 ($ MILLION)

14. EUROPEAN RESIDENTIAL SMOKE DETECTORS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027 ($ MILLION)

15. EUROPEAN RESIDENTIAL SMOKE DETECTORS MARKET RESEARCH AND ANALYSIS BY TYPE, 2020-2027 ($ MILLION)

16. EUROPEAN RESIDENTIAL SMOKE DETECTORS MARKET RESEARCH AND ANALYSIS BY POWERED SOURCE, 2020-2027 ($ MILLION)

17. ASIA-PACIFIC RESIDENTIAL SMOKE DETECTORS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027 ($ MILLION)

18. ASIA-PACIFIC RESIDENTIAL SMOKE DETECTORS MARKET RESEARCH AND ANALYSIS BY TYPE, 2020-2027 ($ MILLION)

19. ASIA-PACIFIC RESIDENTIAL SMOKE DETECTORS MARKET RESEARCH AND ANALYSIS BY POWERED SOURCE, 2020-2027 ($ MILLION)

20. REST OF THE WORLD RESIDENTIAL SMOKE DETECTORS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027 ($ MILLION)

21. REST OF THE WORLD RESIDENTIAL SMOKE DETECTORS MARKET RESEARCH AND ANALYSIS BY TYPE, 2020-2027 ($ MILLION)

22. REST OF THE WORLD RESIDENTIAL SMOKE DETECTORS MARKET RESEARCH AND ANALYSIS BY POWERED SOURCE, 2020-2027 ($ MILLION)

1. IMPACT OF COVID-19 ON GLOBAL RESIDENTIAL SMOKE DETECTORS MARKET, 2020-2027 ($ MILLION)

2. IMPACT OF COVID-19 ON GLOBAL RESIDENTIAL SMOKE DETECTORS MARKET BY SEGMENT, 2020-2027 ($ MILLION)

3. RECOVERY OF GLOBAL RESIDENTIAL SMOKE DETECTORS MARKET, 2021-2027 (%)

4. GLOBAL RESIDENTIAL SMOKE DETECTORS MARKET SHARE BY TYPE, 2020 VS 2027 (%)

5. GLOBAL RESIDENTIAL SMOKE DETECTORS MARKET SHARE BY POWERED SOURCE, 2020 VS 2027 (%)

6. GLOBAL RESIDENTIAL SMOKE DETECTORS MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

7. GLOBAL PHOTOELECTRIC SMOKE DETECTORS MARKET SHARE BY REGION, 2020 VS 2027(%)

8. GLOBAL IONIZATION SMOKE DETECTORS MARKET SHARE BY REGION, 2020 VS 2027 (%)

9. GLOBAL DUAL SENSOR SMOKE DETECTORS MARKET SHARE BY REGION, 2020 VS 2027 (%)

10. GLOBAL OPTICAL SENSOR SMOKE DETECTORS MARKET SHARE BY REGION, 2020 VS 2027 (%)

11. GLOBAL BATTERY-POWERED RESIDENTIAL SMOKE DETECTORS MARKET SHARE BY REGION, 2020 VS 2027 (%)

12. GLOBAL HARDWIRING RESIDENTIAL SMOKE DETECTORS MARKET SHARE BY REGION, 2020 VS 2027 (%)

13. US RESIDENTIAL SMOKE DETECTORS MARKET SIZE, 2020-2027 ($ MILLION)

14. CANADA RESIDENTIAL SMOKE DETECTORS MARKET SIZE, 2020-2027 ($ MILLION)

15. UK RESIDENTIAL SMOKE DETECTORS MARKET SIZE, 2020-2027 ($ MILLION)

16. FRANCE RESIDENTIAL SMOKE DETECTORS MARKET SIZE, 2020-2027 ($ MILLION)

17. GERMANY RESIDENTIAL SMOKE DETECTORS MARKET SIZE, 2020-2027 ($ MILLION)

18. ITALY RESIDENTIAL SMOKE DETECTORS MARKET SIZE, 2020-2027 ($ MILLION)

19. SPAIN RESIDENTIAL SMOKE DETECTORS MARKET SIZE, 2020-2027 ($ MILLION)

20. REST OF EUROPE RESIDENTIAL SMOKE DETECTORS MARKET SIZE, 2020-2027 ($ MILLION)

21. INDIA RESIDENTIAL SMOKE DETECTORS MARKET SIZE, 2020-2027 ($ MILLION)

22. CHINA RESIDENTIAL SMOKE DETECTORS MARKET SIZE, 2020-2027 ($ MILLION)

23. JAPAN RESIDENTIAL SMOKE DETECTORS MARKET SIZE, 2020-2027 ($ MILLION)

24. SOUTH KOREA RESIDENTIAL SMOKE DETECTORS MARKET SIZE, 2020-2027 ($ MILLION)

25. REST OF THE ASIA-PACIFIC RESIDENTIAL SMOKE DETECTORS MARKET SIZE, 2020-2027 ($ MILLION)

26. REST OF THE WORLD RESIDENTIAL SMOKE DETECTORS MARKET SIZE, 2020-2027 ($ MILLION)