Restless Legs Syndrome Market

Global Restless Legs Syndrome Market Size, Share & Trends Analysis Report by Type (Primary Restless Legs Syndrome, Secondary Restless Legs Syndrome), by Treatment (Medication, Therapy, Devices), by End-User (Hospitals, Homecare, Others) Forecast Period 2020-2026 Update Available - Forecast 2025-2035

The global restless legs syndrome market is projected to grow at a CAGR of 6.2% during the forecast period. The increase in the prevalence of restless legs syndrome (RLS) is a key factor responsible for the growth of the market. RLS is a disorder that is associated with the part of the nervous system that causes patients an urge to move the legs restlessly. According to the estimation of the National Institute of Neurological Disorders and Stroke (NIH), around 7-10 % of the US population has RLS. Moreover, the rising geriatric population further boosts the growth of the global market. As per the UN (United Nations), by 2050 around 1 in 6 (16%) citizens will be over the age of 65 years, globally, which was 1 in 11 (9%) in 2019. Old age, obesity, and snoring conditions lead to an increase in the rate of various types of sleep disorders which will create significant demand for diagnosis and treatment for obstructive sleep-wake disorders shortly.

However, the high cost of drugs and therapy used for the treatment of restless leg syndrome coupled with low healthcare budget in some developing countries may hinder the growth of the market. For instance, the annual cost of Rotigotine (Neupro), a drug to treat used to treat restless legs syndrome and periodic limb movement disorder can cost up to $5,300 per year in the US. Huge R&D expenditure by market players for the development of the novel intervention is anticipated to create a considerable opportunity for market growth.

Segmental Outlook

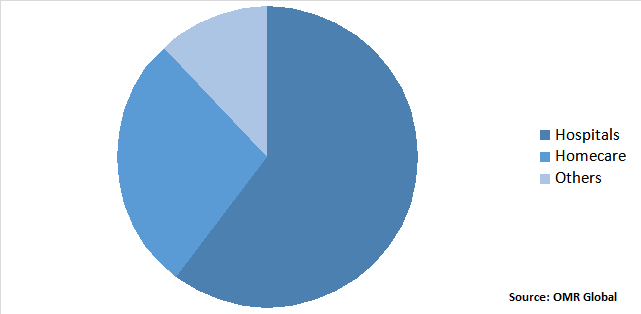

The global restless legs syndrome market is segmented based on treatment and end-users. Based on treatment, the market is segmented into medication, therapy, devices. Based on end-user, the market is segmented into hospitals, home care, and others. Hospital is forecast to be the considerable segment in the end-user market owing to the higher lifecycle, better efficiency of the medical equipment in the hospitals.

Homecare to have a significant market share

Based on end-user, the market has been segmented into hospitals, home care, and other end users. homecare is forecast to be a considerable segment in the end-user market. Medical devices in-home need a higher lifecycle, better efficiency. The device requirements are portable, lightweight, and easy to use. Also, the home care segment is forecast to be the fastest-growing segment due to the rising trend of point of care devices.

Global Restless Legs Syndrome Market Share by Product, 2019 (%)

Regional Outlook

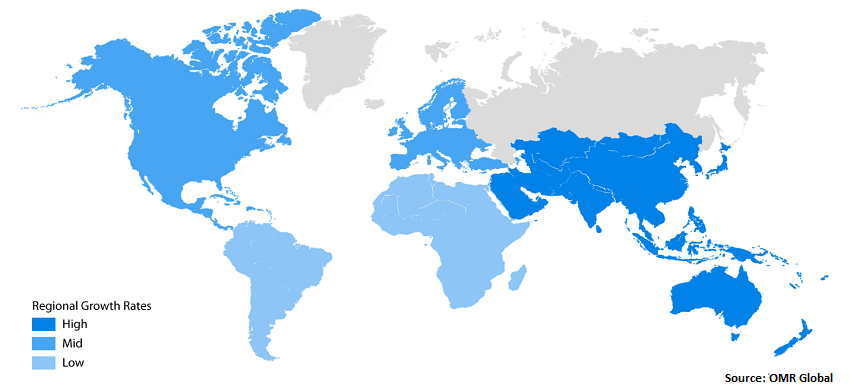

The global restless legs syndrome market is further segmented based on geography including North America, Europe, Asia-Pacific, and the Rest of the World. North America is anticipated to have a considerable market share in the market owing to the high awareness among people related to the available drugs, and devices, insurance coverage of diseases, new product approval, and rising geriatric population in the region. In addition, the presence of major market players in the US including ResMed Inc., Neurocrine Biosciences, Inc., and RespireRx Pharmaceuticals Inc.; among others further supports the growth of the market in the region. The US is the major contributor to the market, across the globe. The market of North America is further sub-segmented into the US and Canada. Europe is followed by North America, and the Asia-Pacific is expected to be the fastest-growing market during the forecasted period.

Global Restless Legs Syndrome Market Growth, by Region 2020-2026

Asia-Pacific will augment with the fastest rate in restless legs syndrome market

Emerging economies in Asia-Pacific that are contributing to the market growth include China, Japan, India, and Australia. China is the largest contributor to the Asia-Pacific restless leg syndrome treatment market. The market in the region is largely driven by increasing workplace stress and the prevalence of various mental health disorders such as anxiety, depression, and others; which substantially raises the risk of sleep disorders such as restless leg syndrome. According to the IHME (Institute for Health Metrics and Evaluation), in India, the population with depression ranges mostly between 2% and 5% across Asia-Pacific in 2017.

Market Players Outlook

Pfizer, Inc., GlaxoSmithKline plc, Boehringer Ingelheim GmbH, Teva Pharmaceutical Industries Ltd., Mylan N.V., Glenmark Pharmaceuticals Ltd., and so on are the key players operating in the global restless legs syndrome market. The new product launch and product development are the core focus of these major market players. Moreover, the key players of the restless leg syndrome market are actively adopting organic or inorganic market activities to increase their market share. . The rise in patent expiration is reducing the company’s revenue in the market. For instance, Stilnox/ Ambien/ Myslee, a Non-benzodiazepine hypnotics drug of Sanofi SA registered a downfall of 10.8% in 2018 as compared to 2017. Similar trends were observed for GSK PLC, Merck, AstraZeneca PLC. Merck has stopped the manufacturing of Sinemet, an anti-parkinsonian and restless legs syndrome drug.

The Report Covers

- Market value data analysis of 2019 and forecast to 2026.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global restless legs syndrome market.

- Based on the availability of data, information related to pipeline products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

2.3. Rules & Regulations

3. Competitive Landscape

3.1. Company Share Analysis

3.2. Key Strategy Analysis

3.3. Key Company Analysis

3.3.1. GlaxoSmithKline plc

3.3.1.1. Overview

3.3.1.2. Financial Analysis

3.3.1.3. SWOT Analysis

3.3.1.4. Recent Developments

3.3.2. Pfizer, Inc.

3.3.2.1. Overview

3.3.2.2. Financial Analysis

3.3.2.3. SWOT Analysis

3.3.2.4. Recent Developments

3.3.3. Boehringer Ingelheim GmbH

3.3.3.1. Overview

3.3.3.2. Financial Analysis

3.3.3.3. SWOT Analysis

3.3.3.4. Recent Developments

3.3.4. Teva Pharmaceutical Industries, Ltd.

3.3.4.1. Overview

3.3.4.2. Financial Analysis

3.3.4.3. SWOT Analysis

3.3.4.4. Recent Developments

3.3.5. UCB SA

3.3.5.1. Overview

3.3.5.2. Financial Analysis

3.3.5.3. SWOT Analysis

3.3.5.4. Recent Developments

4. Market Determinants

4.1 Motivators

4.2 Restraints

4.3 Opportunities

5. Market Segmentation

5.1. Global Restless Leg Syndrome Market by Treatment

5.1.1. Medication

5.1.2. Therapy

5.1.3. Devices

5.2. Global Restless Legs Syndrome Market by End-User

5.2.1. Hospitals

5.2.2. Homecare

5.2.3. Others

6. Regional Analysis

6.1. North America

6.1.1. US

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. Akorn, Inc.

7.2. Arbor Pharmaceuticals, LLC

7.3. Boehringer Ingelheim GmbH

7.4. GlaxoSmithKline plc

7.5. Glenmark Pharmaceuticals Ltd.

7.6. Jazz Pharmaceuticals plc

7.7. Kyowa Hakko Kirin Co. Ltd.

7.8. LGM Pharma

7.9. Mallinckrodt Pharmaceuticals

7.10. Merck Co, Inc.

7.11. Mylan N.V.

7.12. Pfizer, Inc.

7.13. Serina Therapeutics, Inc.

7.14. Teva Pharmaceutical Industries, Ltd.

7.15. UCB S.A.

1. GLOBAL RESTLESS LEGS SYNDROME MARKET RESEARCH AND ANALYSIS BY TREATMENT, 2019-2026 ($ MILLION)

2. GLOBAL RESTLESS LEGS SYNDROME MEDICATION MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

3. GLOBAL RESTLESS LEGS SYNDROME THERAPY MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

4. GLOBAL RESTLESS LEGS SYNDROME DEVICES MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

5. GLOBAL RESTLESS LEGS SYNDROME MARKET RESEARCH AND ANALYSIS BY END-USER, 2019-2026 ($ MILLION)

6. GLOBAL HOSPITALS FOR RESTLESS LEGS SYNDROME MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

7. GLOBAL HOMECARES FOR RESTLESS LEGS SYNDROME MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

8. GLOBAL OTHERS MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

9. GLOBAL RESTLESS LEGS SYNDROME MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2019-2026 ($ MILLION)

10. NORTH AMERICAN RESTLESS LEGS SYNDROME MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

11. NORTH AMERICAN RESTLESS LEGS SYNDROME MARKET RESEARCH AND ANALYSIS BY TREATMENT, 2019-2026 ($ MILLION)

12. NORTH AMERICAN RESTLESS LEGS SYNDROME MARKET RESEARCH AND ANALYSIS BY END-USER, 2019-2026 ($ MILLION)

13. EUROPEAN RESTLESS LEGS SYNDROME MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

14. EUROPEAN RESTLESS LEGS SYNDROME MARKET RESEARCH AND ANALYSIS BY TREATMENT, 2019-2026 ($ MILLION)

15. EUROPEAN RESTLESS LEGS SYNDROME MARKET RESEARCH AND ANALYSIS BY END-USER, 2019-2026 ($ MILLION)

16. ASIA-PACIFIC RESTLESS LEGS SYNDROME MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

17. ASIA-PACIFIC RESTLESS LEGS SYNDROME MARKET RESEARCH AND ANALYSIS BY TREATMENT, 2019-2026 ($ MILLION)

18. ASIA-PACIFIC RESTLESS LEGS SYNDROME MARKET RESEARCH AND ANALYSIS BY END-USER, 2019-2026 ($ MILLION)

19. REST OF THE WORLD RESTLESS LEGS SYNDROME MARKET RESEARCH AND ANALYSIS BY TREATMENT, 2019-2026 ($ MILLION)

20. REST OF THE WORLD RESTLESS LEGS SYNDROME MARKET RESEARCH AND ANALYSIS BY END-USER, 2019-2026 ($ MILLION)

1. GLOBAL RESTLESS LEGS SYNDROME MARKET SHARE BY TREATMENT, 2019 VS 2026 (%)

2. GLOBAL RESTLESS LEGS SYNDROME MARKET SHARE BY END-USER, 2019 VS 2026 (%)

3. GLOBAL RESTLESS LEGS SYNDROME MARKET SHARE BY GEOGRAPHY, 2019 VS 2026 (%)

4. THE US RESTLESS LEG SYNDROME MARKET SIZE, 2019-2026 ($ MILLION)

5. CANADA RESTLESS LEG SYNDROME MARKET SIZE, 2019-2026 ($ MILLION)

6. UK RESTLESS LEG SYNDROME MARKET SIZE, 2019-2026 ($ MILLION)

7. FRANCE RESTLESS LEG SYNDROME MARKET SIZE, 2019-2026 ($ MILLION)

8. GERMANY RESTLESS LEG SYNDROME MARKET SIZE, 2019-2026 ($ MILLION)

9. ITALY RESTLESS LEG SYNDROME MARKET SIZE, 2019-2026 ($ MILLION)

10. SPAIN RESTLESS LEG SYNDROME MARKET SIZE, 2019-2026 ($ MILLION)

11. ROE RESTLESS LEG SYNDROME MARKET SIZE, 2019-2026 ($ MILLION)

12. INDIA RESTLESS LEG SYNDROME MARKET SIZE, 2019-2026 ($ MILLION)

13. CHINA RESTLESS LEG SYNDROME MARKET SIZE, 2019-2026 ($ MILLION)

14. JAPAN RESTLESS LEG SYNDROME MARKET SIZE, 2019-2026 ($ MILLION)

15. REST OF ASIA-PACIFIC RESTLESS LEG SYNDROME MARKET SIZE, 2019-2026 ($ MILLION)

16. REST OF THE WORLD RESTLESS LEG SYNDROME MARKET SIZE, 2019-2026 ($ MILLION)