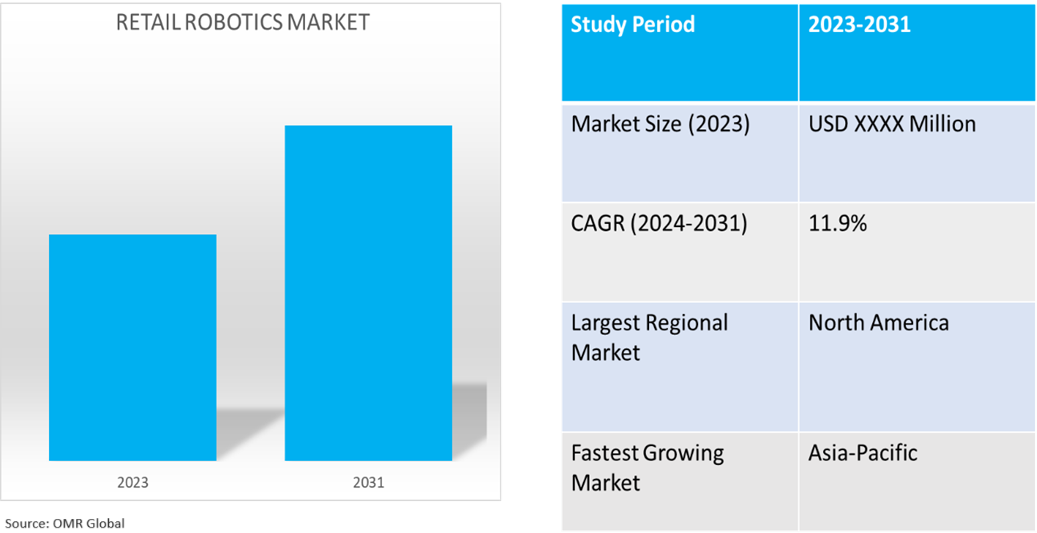

Retail Robotics Market

Retail Robotics Market Size, Share & Trends Analysis Report by Type (Mobile Robotics, Autonomous Robotics, and Semi-Autonomous Robotics), by Deployment (Independent Deployment, and Third-Party Deployment), and by Application (Inventory Management, Delivery Management, and In-Store Services) Forecast Period (2024-2031)

Retail robotics market is anticipated to grow at a significant CAGR of 11.9% during the forecast period (2024-2031). Retailers are increasingly adopting robotics to streamline operations, lower costs, and improve customer experiences. By handling repetitive tasks, reducing labor expenses, and providing sophisticated data analytics, robots enhance inventory management and integrate online and offline operations. Additionally, they help address labor shortages and contribute to energy efficiency and sustainability, making them essential for maintaining competitiveness.

Market Dynamics

Demand for Personalized AI Robot Interactions

The increasing need for engaging and personalized robot interactions, mainly composed of AI-driven services, is driving the market's growth. For instance, in April 2024, Pudu Robotics introduced the BellaBot Pro, a next-generation smart service robot that uses AI for personalized interactions. It features an advertising screen, advanced PUDU VSLAM+ technology, and safety features such as tray atmosphere light, obstacle avoidance, and ground projection lights. The robot reduces setup time by 75.0%.

Enhanced Customer Experience

Robotic solutions improve customer experience by ensuring accurate inventory levels and optimizing store layouts, an essential aspect in the competitive retail environment driving market growth. For instance, in July 2024, Simbe launched two new product capabilities. The first is Simbe Mobile, a configurable mobile application that offers prioritized inventory and pricing tasks, near real-time data analytics, and planogram compliance. The second is the Simbe Virtual Tour, allowing retailers to view their stores from anywhere, providing remote insights for optimizing store layouts and making strategic decisions. The platform includes the world's first autonomous item-scanning robot.

Market Segmentation

- Based on the type, the market is segmented into mobile robotics, autonomous robotics, and semi-autonomous robotics.

- Based on the deployment, the market is segmented into independent deployment and third-party deployment.

- Based on the application, the market is segmented into inventory management, delivery management, and in-store services.

The Autonomous Robotics Segment is projected to Hold the Largest Market Share

The increasing demand for automation in retail is driven by the need to improve efficiency, accuracy, and speed, with autonomous robots emerging as a key solution. For instance, in January 2024, 1MRobotics unveiled an autonomous store with a nano fulfillment system, set to revolutionize retail. The S2 will be mounted on the International Space Station (ISS) to perform on-orbit services, including maintenance, inspection, and life-extension operations for satellites. The company aims to achieve Technology Readiness Level 7 and establish ISAM capabilities, with plans to provide on-orbit satellite servicing in both GEO (Geostationary Equatorial Orbit) and LEO (Low Earth Orbit).

- In January 2023, Ottonomy launched the Ottobot YETI autonomous delivery robot, demonstrating its ability to operate both indoors and outdoors. The company's robot-as-a-service business model has accelerated the adoption of autonomous delivery solutions, proving its effectiveness, scalability, and longevity. Ottonomy is currently pursuing use cases such as curbside delivery, bringing grocery orders from deep inside stores to customers' waiting vehicles.

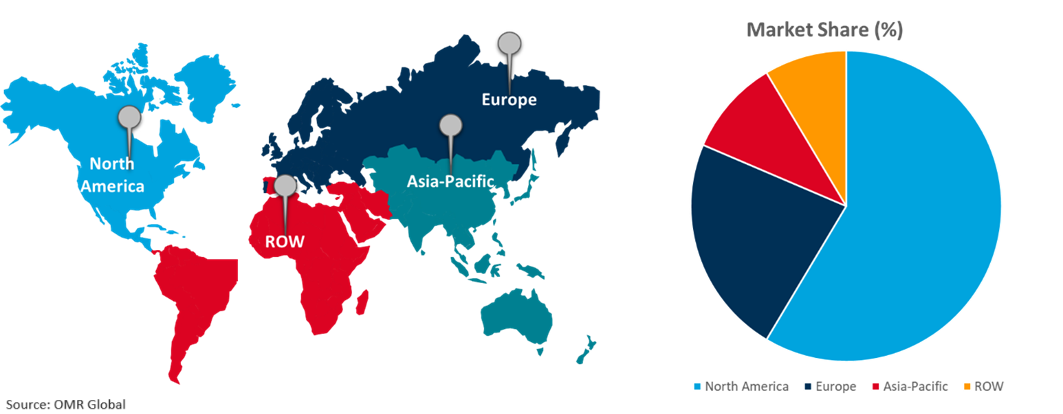

Regional Outlook

The global retail robotics market is further segmented based on geography including North America (the US, and Canada), Europe (the UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia-Pacific), and the Rest of the World (the Middle East & Africa, and Latin America).

Robotics Innovation and Initiatives In the Asia-Pacific Region

The Indian government and organizations are demonstrating their commitment to fostering innovation in robotics and unmanned systems, particularly in the retail sector, which is seen as key to market growth. For instance, in May 2024, India Accelerator (IA) launched RUMS (Robotics, Unmanned & Space), a new vertical aimed at fostering innovation and growth in the robotics and unmanned industry, focusing on strategic support for unmanned aerial systems.

- In February 2023, Svaya Robotics launched India's first collaborative robot, which debuted at the IMTEX event, boasting precision, perceptivity, versatility, and safety in its full-stack collaborative robotics platform.

Global Retail Robotics Market Growth by Region 2024-2031

North America Holds Major Market Share

The US market is a leader in adopting advanced technologies, including the 5G network, which ensures stable communication between robots and control systems, facilitating smooth operations in high-demand retail environments. For instance, in March 2024, LG Business Solutions US launched the LG CLOi CarryBot family of autonomous mobile robots at the MODEX 2024 trade show in Atlanta. These robots can navigate complex floor plans, deliver payloads in customizable configurations, and perform loading and unloading tasks. The LG P5G network, developed by LG Electronics, supported reliable, stable performance and streamlined product movement.

- In March 2023, Unbox Robotics introduced UnboxSort in the US market, aiming to revolutionize intralogistics through efficient package sorting and order consolidation. The company plans to expand internationally, supporting global e-commerce, retail, and logistics companies with its innovative plug-and-play automation solutions.

Market Players Outlook

*Note: Major Players Sorted in No Particular Order.

The major companies serving the retail robotics market include ABB Ltd, Amazon.com, Inc., KUKA AG, Bossa Nova, SoftBank Robotics Group and among others. The market players are increasingly focusing on business expansion and product development by applying strategies such as collaborations, mergers and acquisitions to stay competitive in the market.

Recent Developments

- In January 2024, Brain Corp partnered with Dane Technologies to launch new robotic retail solutions, including the BrainOS InventoryAI Suite and the Dane AIR, a purpose-built inventory scanning robot. The Dane AIR automates inventory tracking, reducing losses from out-of-stock and pricing discrepancies, which cost retailers over 6.0% of their total sales. The next-generation BrainOS Robotics Platform features advanced sensors, BrainOS Shelf Vision, BrainOS RFID, and intelligent rerouting for efficient scanning. It additionally offers autonomous operation, cloud-based smart route generation, and wireless connectivity.

- In April 2024, Sodexo partnered with Automated Retail Technologies to launch hot food robotic kiosks in the US. The Just Baked Smart Bistro kiosks deployed across Sodexo's facilities, aim to redefine hot food robotic technology. The kiosks will produce various delectable items with a click of a button.

The Report Covers

- Market value data analysis of 2023 and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global retail robotics market. Based on the availability of data, information related to new products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Industry Trends

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. ABB, Ltd.

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. Amazon.com, Inc.

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. KUKA AG

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Key Strategy Analysis

4. Market Segmentation

4.1. Global Retail Robotics Market by Type

4.1.1. Mobile Robotics

4.1.2. Autonomous Robotics

4.1.3. Semi-Autonomous Robotics

4.2. Global Retail Robotics Market by Deployment

4.2.1. Independent Deployment

4.2.2. Third-Party Deployment

4.3. Global Retail Robotics Market by Application

4.3.1. Inventory Management

4.3.2. Delivery Management

4.3.3. In-Store Services

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

5.4.1. Latin America

5.4.2. Middle East and Africa

6. Company Profiles

6.1. Addverb Technologies Ltd.

6.2. Bastian Solutions, LLC

6.3. Bossa Nova

6.4. dacuro GmbH

6.5. Daifuku Co., Ltd.

6.6. Dematic Group – KION Group AG

6.7. GreyOrange India Pvt Ltd.

6.8. Honda Motor Co., Ltd.

6.9. Honeywell International Inc

6.10. ICE Cobotics

6.11. Intel Corp.

6.12. Locus Robotics Corp.

6.13. RightHand Robotics, Inc.

6.14. Robotiq Inc.

6.15. Siemens

6.16. SoftBank Robotics Group

6.17. ST Engineering

6.18. SZ DJI Technology Co., Ltd.

6.19. Universal Robots A/S

6.20. Zebra Technologies Corp.

1. Global Retail Robotics Market Research And Analysis By Type, 2023-2031 ($ Million)

2. Global Mobile Robotics Market Research And Analysis By Region, 2023-2031 ($ Million)

3. Global Autonomous Robotics Market Research And Analysis By Region, 2023-2031 ($ Million)

4. Global Semi-Autonomous Robotics Market Research And Analysis By Region, 2023-2031 ($ Million)

5. Global Retail Robotics Market Research And Analysis By Deployment, 2023-2031 ($ Million)

6. Global Independent Deployment Based Retail Robotics Market Research And Analysis By Region, 2023-2031 ($ Million)

7. Global Third-Party Deployment Based Retail Robotics Market Research And Analysis By Region, 2023-2031 ($ Million)

8. Global Retail Robotics Market Research And Analysis By Application, 2023-2031 ($ Million)

9. Global Retail Robotics In Inventory Management Market Research And Analysis By Region, 2023-2031 ($ Million)

10. Global Retail Robotics In Delivery Management Market Research And Analysis By Region, 2023-2031 ($ Million)

11. Global Retail Robotics In In-Store Services Market Research And Analysis By Region, 2023-2031 ($ Million)

12. Global Retail Robotics Market Research And Analysis By Region, 2023-2031 ($ Million)

13. North American Retail Robotics Market Research And Analysis By Country, 2023-2031 ($ Million)

14. North American Retail Robotics Market Research And Analysis By Type, 2023-2031 ($ Million)

15. North American Retail Robotics Market Research And Analysis By Deployment, 2023-2031 ($ Million)

16. North American Retail Robotics Market Research And Analysis By Application, 2023-2031 ($ Million)

17. European Retail Robotics Market Research And Analysis By Country, 2023-2031 ($ Million)

18. European Retail Robotics Market Research And Analysis By Type, 2023-2031 ($ Million)

19. European Retail Robotics Market Research And Analysis By Deployment, 2023-2031 ($ Million)

20. European Retail Robotics Market Research And Analysis By Application, 2023-2031 ($ Million)

21. Asia-Pacific Retail Robotics Market Research And Analysis By Country, 2023-2031 ($ Million)

22. Asia-Pacific Retail Robotics Market Research And Analysis By Type, 2023-2031 ($ Million)

23. Asia-Pacific Retail Robotics Market Research And Analysis By Deployment, 2023-2031 ($ Million)

24. Asia-Pacific Retail Robotics Market Research And Analysis By Application, 2023-2031 ($ Million)

25. Rest Of The World Retail Robotics Market Research And Analysis By Region, 2023-2031 ($ Million)

26. Rest Of The World Retail Robotics Market Research And Analysis By Type, 2023-2031 ($ Million)

27. Rest Of The World Retail Robotics Market Research And Analysis By Deployment, 2023-2031 ($ Million)

28. Rest Of The World Retail Robotics Market Research And Analysis By Application, 2023-2031 ($ Million)

1. Global Retail Robotics Market Share By Type, 2023 Vs 2031 (%)

2. Global Mobile Robotics Market Share By Region, 2023 Vs 2031 (%)

3. Global Autonomous Robotics Market Share By Region, 2023 Vs 2031 (%)

4. Global Semi-Autonomous Robotics Market Share By Region, 2023 Vs 2031 (%)

5. Global Retail Robotics Market Share By Deployment, 2023 Vs 2031 (%)

6. Global Independent Deployment Based Retail Robotics Market Share By Region, 2023 Vs 2031 (%)

7. Global Third-Party Deployment Based Retail Robotics Market Share By Region, 2023 Vs 2031 (%)

8. Global Retail Robotics Market Share By Application, 2023 Vs 2031 (%)

9. Global Retail Robotics In Inventory Management Market Share By Region, 2023 Vs 2031 (%)

10. Global Retail Robotics In Delivery Management Market Share By Region, 2023 Vs 2031 (%)

11. Global Retail Robotics In In-Store Services Market Share By Region, 2023 Vs 2031 (%)

12. Global Retail Robotics Market Share By Region, 2023 Vs 2031 (%)

13. US Retail Robotics Market Size, 2023-2031 ($ Million)

14. Canada Retail Robotics Market Size, 2023-2031 ($ Million)

15. UK Retail Robotics Market Size, 2023-2031 ($ Million)

16. France Retail Robotics Market Size, 2023-2031 ($ Million)

17. Germany Retail Robotics Market Size, 2023-2031 ($ Million)

18. Italy Retail Robotics Market Size, 2023-2031 ($ Million)

19. Spain Retail Robotics Market Size, 2023-2031 ($ Million)

20. Rest Of Europe Retail Robotics Market Size, 2023-2031 ($ Million)

21. India Retail Robotics Market Size, 2023-2031 ($ Million)

22. China Retail Robotics Market Size, 2023-2031 ($ Million)

23. Japan Retail Robotics Market Size, 2023-2031 ($ Million)

24. South Korea Retail Robotics Market Size, 2023-2031 ($ Million)

25. Rest Of Asia-Pacific Retail Robotics Market Size, 2023-2031 ($ Million)

26. Latin America Retail Robotics Market Size, 2023-2031 ($ Million)

27. Middle East And Africa Retail Robotics Market Size, 2023-2031 ($ Million)