Ride Hailing Market

Global Ride Hailing Market Size, Share & Trends Analysis Report, by Vehicle Type (Passenger Vehicle, Two-Wheeler, Other), By Propulsion Technology (IC Engine Vehicle, Electric Vehicle) and Forecast, 2020-2026 Update Available - Forecast 2025-2031

The ride-hailing market is anticipated to showcase exponential growth for the next couple of years (2021 & 2022) and lucrative growth in the next years during the forecast period. A number of factors are working for the growth of the ride hailing market which includes high smartphone and internet penetration all across the globe, the rising cost of vehicle ownership, and huge funding to the ride hailing startups. Moreover, better safety and comfort especially for children and women are also driving the ride-hailing market. Besides, increasing growth in domestic and international tourism is also a pivotal factor in the market growth. The continuous introduction of new players is also one of is also driving the ride hailing industry. For instance, the Japanese multinational conglomerate Sony Corp. launched S.Ride taxi-hailing services in Tokyo.

However, with the increase in the ride hailing trips, the concern of road congestions, and pollution has emerged in the major cities globally. Due to this, the companies started focusing on ride sharing, the result of which vehicles need less space to transport more people, which is also environmentally friendly and economical to the customers. Growth in the ride-sharing market is a restraining factor for the ride hailing market however; most of the major global taxi services players are operating both rides hailing and ride sharing services. Besides, strict regulatory compliance related to ride hailing is one of the major restraining factors for the market. For instance, Uber taxi services are illegal in Japan.

Moreover, an impact of the COVID-19 pandemic has been registered in the ride hailing industry. In order to curb the spread of COVID-19, lockdowns have been introduced in various countries with different timelines and people are encourages to work from their residence. Due to this, a significant downfall in the number of trips has been registered all across the globe. For instance, as per Uber, its ride-hailing business is around 80% down. The company has suffered a loss of $2.9 billion in Q1 2020 with revenue of $3.54 billion. Result of this, the company has laid off around a quarter of its 14,000 workforces. Though, until the vaccine doesn’t arrive at the market, to maintain social distancing a preference will be given to ride hailing over ride sharing for a couple of years.

Market Segmentation

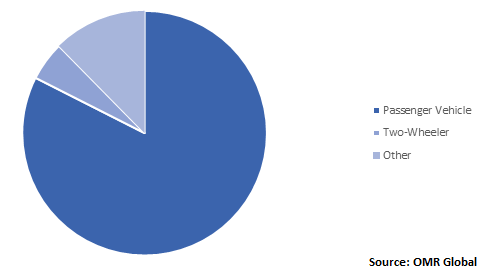

The ride hailing market is segmented on the basis of vehicle type and vehicle propulsion technology. By vehicle type, the market is segmented into passenger vehicles, two-wheeler, other. Passenger vehicle is expected to have a major market share all across the globe. It includes hatchback, sedan, SUV, and other utility vehicles. Two-wheeler market is expected to have a small market share in the emerging price-sensitive economies such as India, Uganda, and Malaysia. Others include auto-rickshaw which is highly prominent in South Asia.

By propulsion technology, the market is segmented into IC engine vehicles and electric vehicles. IC engine vehicles will hold the major market share whereas electric vehicles for the ride hailing services will show a lucrative growth rate during the forecast period. Countries such as China allow only electric cars to be used a taxi in some cities which is propelling the market growth of the electric vehicle ride hailing market.

Global Ride hailing Market Share by Vehicle Type, 2019 (%)

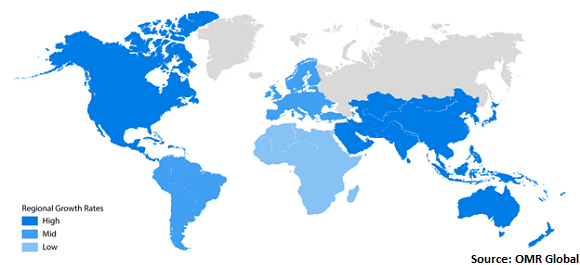

Regional Outlook

On the basis of geography, the global ride hailing market is studied in North America, Europe, Asia-Pacific, and the Rest of the World (RoW). North America holds the major market share during the forecast period. A significant market will be witnessed in Europe also. The high cost of trips per km in the developed economies is a major factor for the significant market share. Moreover, Asia-Pacific will register a lucrative growth due to significant growth in China, India, and other emerging economies.

Global Ride hailing Market Growth, by Region 2020-2026

Market Players Outlook

Significant number of players are operating in the global ride hailing market, the major one is the American giant Uber Technologies, Inc. The company has a presence in more than 69 countries, 10,000 cities with 7 billion trips in 2019. In many countries, the company also has some minority stakes in its competitor. Some of the other major companies operating in the ride hailing market include ANI Technologies Pvt. Ltd., Baidu Inc., Didi Chuxing Technology Co., Grab Holdings Inc., Lyft, Inc., Via Transportation, Inc. and Maxi Mobility S.L. These market players are adopting growth strategies including mergers & acquisitions, expansions, partnerships & collaborations, high discounts, and better services to remain competitive in the market. For instance, in March 2020, Via Transportation, Inc. secured a funding of $200 million under the Series E funding from different investors. After the funding, the market valuation of the company has increased to $2.25 billion.

The Report Covers

- Market value data analysis of 2019 and forecast to 2026.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global Ride hailing market. Based on the availability of data, information related to pipeline products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

1.1. Research Methods and Tools

1.2. Market Breakdowns

1.2.1. By Segments

1.2.2. By Geography

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

2.3. Rules & Regulations

3. Competitive Landscape

3.1. Company Share Analysis

3.2. Key Strategy Analysis

3.3. Key Company Analysis

3.3.1. Uber Technologies, Inc.

3.3.1.1. Overview

3.3.1.2. Financial Analysis

3.3.1.3. SWOT Analysis

3.3.1.4. Recent Developments

3.3.2. Lyft, Inc.

3.3.2.1. Overview

3.3.2.2. Financial Analysis

3.3.2.3. SWOT Analysis

3.3.2.4. Recent Developments

3.3.3. Grab Holdings Inc.

3.3.3.1. Overview

3.3.3.2. Financial Analysis

3.3.3.3. SWOT Analysis

3.3.3.4. Recent Developments

3.3.4. Didi Chuxing Technology Co.

3.3.4.1. Overview

3.3.4.2. Financial Analysis

3.3.4.3. SWOT Analysis

3.3.4.4. Recent Developments

3.3.5. ANI Technologies Pvt. Ltd.

3.3.5.1. Overview

3.3.5.2. Financial Analysis

3.3.5.3. SWOT Analysis

3.3.5.4. Recent Developments

4. Market Determinants

4.1 Motivators

4.2 Restraints

4.3 Opportunities

5. Market Segmentation

5.1. Global Ride Hailing Market By Vehicle Type

5.1.1. Passenger Vehicle

5.1.2. Two-Wheeler

5.1.3. Other (Auto Rickshaw)

5.2. Global Ride Hailing Market by Propulsion Technology

5.2.1. IC Engine Vehicle

5.2.2. Electric Vehicle

6. Regional Analysis

6.1. North America

6.1.1. United States

6.1.2. Rest of North America

6.2. Europe

6.2.1. UK

6.2.2. Italy

6.2.3. France

6.2.4. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. ANI Technologies Pvt. Ltd.

7.2. Baidu Inc.

7.3. Bolt Technology OÜ

7.4. BYKEA Technologies Pvt. Ltd.

7.5. Carma Technology Corp.

7.6. Comuto SA

7.7. Curb Mobility, LLC

7.8. Didi Chuxing Technology Co.

7.9. Gett Inc.

7.10. Grab Holdings Inc.

7.11. Japan Taxi Co., Ltd.

7.12. Lyft, Inc.

7.13. Maxi Mobility S.L.

7.14. MLU B.V.

7.15. PT Aplikasi Karya Anak Bangsa

7.16. Transcovo SAS

7.17. Uber Technologies, Inc.

7.18. Via Transportation, Inc.

7.19. Wheely Technologies Ltd.

7.20. Wingz, Inc.

1. GLOBAL RIDE HAILING MARKET RESEARCH AND ANALYSIS BY VEHICLE TYPE, 2019-2026 ($ MILLION)

2. GLOBAL PASSENGER VEHICLE MARKET RESEARCH AND ANALYSIS, 2019-2026 ($ MILLION)

3. GLOBAL TWO-WHEELER MARKET RESEARCH AND ANALYSIS, 2019-2026 ($ MILLION)

4. GLOBAL OTHER MARKET RESEARCH AND ANALYSIS, 2019-2026 ($ MILLION)

5. GLOBAL RIDE HAILING MARKET RESEARCH AND ANALYSIS BY PROPULSION TECHNOLOGY, 2019-2026 ($ MILLION)

6. GLOBAL IC ENGINE VEHICLE MARKET RESEARCH AND ANALYSIS, 2019-2026 ($ MILLION)

7. GLOBAL ELECTRIC VEHICLE MARKET RESEARCH AND ANALYSIS, 2019-2026 ($ MILLION)

8. NORTH AMERICAN RIDE HAILING MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

9. NORTH AMERICAN RIDE HAILING MARKET RESEARCH AND ANALYSIS BY VEHICLE TYPE, 2019-2026 ($ MILLION)

10. NORTH AMERICAN RIDE HAILING MARKET RESEARCH AND ANALYSIS BY PROPULSION TECHNOLOGY, 2019-2026 ($ MILLION)

11. EUROPEAN RIDE HAILING MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

12. EUROPEAN RIDE HAILING MARKET RESEARCH AND ANALYSIS BY VEHICLE TYPE, 2019-2026 ($ MILLION)

13. EUROPEAN RIDE HAILING MARKET RESEARCH AND ANALYSIS BY PROPULSION TECHNOLOGY, 2019-2026 ($ MILLION)

14. ASIA PACIFIC RIDE HAILING MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

15. ASIA PACIFIC RIDE HAILING MARKET RESEARCH AND ANALYSIS BY VEHICLE TYPE, 2019-2026 ($ MILLION)

16. ASIA PACIFIC RIDE HAILING MARKET RESEARCH AND ANALYSIS BY PROPULSION TECHNOLOGY, 2019-2026 ($ MILLION)

17. REST OF THE WORLD RIDE HAILING MARKET RESEARCH AND ANALYSIS BY VEHICLE TYPE, 2019-2026 ($ MILLION)

18. REST OF THE WORLD RIDE HAILING MARKET RESEARCH AND ANALYSIS BY PROPULSION TECHNOLOGY, 2019-2026 ($ MILLION)

1. GLOBAL RIDE-HAILING MARKET SHARE BY VEHICLE TYPE, 2019 VS 2026 (%)

2. GLOBAL RIDE-HAILING MARKET SHARE BY PROPORTION TECHNOLOGY, 2019 VS 2026 (%)

3. GLOBAL RIDE-HAILING MARKET SHARE BY GEOGRAPHY, 2019 VS 2026 (%)

4. US RIDE-HAILING MARKET SIZE, 2019-2026 ($ MILLION)

5. CANADA RIDE-HAILING MARKET SIZE, 2019-2026 ($ MILLION)

6. UK RIDE-HAILING MARKET SIZE, 2019-2026 ($ MILLION)

7. FRANCE RIDE-HAILING MARKET SIZE, 2019-2026 ($ MILLION)

8. GERMANY RIDE-HAILING MARKET SIZE, 2019-2026 ($ MILLION)

9. SPAIN RIDE-HAILING MARKET SIZE, 2019-2026 ($ MILLION)

10. ITALY RIDE-HAILING MARKET SIZE, 2019-2026 ($ MILLION)

11. REST OF EUROPE RIDE-HAILING MARKET SIZE, 2019-2026 ($ MILLION)

12. INDIA RIDE-HAILING MARKET SIZE, 2019-2026 ($ MILLION)

13. CHINA RIDE-HAILING MARKET SIZE, 2019-2026 ($ MILLION)

14. JAPAN RIDE-HAILING MARKET SIZE, 2019-2026 ($ MILLION)

15. REST OF WORLD RIDE-HAILING MARKET SIZE, 2019-2026 ($ MILLION)