Robotic Welding Market

Global Robotic Welding Market Size, Share & Trends Analysis Report by Type (Arc Welding, Spot Welding, Laser Welding, and Others), By End-User (Automotive, Metals & Machinery, Electrical & Electronics, Aerospace & Defense, Construction, and Others) Forecast Period (2021-2027)

The global robotic welding market is anticipated to grow at a significant CAGR during the forecast period. According to the American Action Forum, there will be a shortage of around 8.62 million skilled labor force by 2029 in the US. This will cause a loss of around $1.2 trillion in economic output. Thus, the industries are adopting automation processes to replace the need for skilled labor. Additionally, the robotic system is more accurate and precise than humans. Thus, the increasing shortage of skilled labor force and rapid adoption of automation processes will significantly drive the robotic welding market during the forecast period.

The installation cost of procurement, programming, and maintenance of robotic welding is high. Thus, it makes it difficult for new ventures and SMEs to establish robotic welding systems for their operations. This will hinder the market growth during the forecast period.

Impact of COVID-19 Pandemic on Global Robotic Welding Market

The COVID-19 had suspended the operations of various manufacturing industries due to the lockdown and labor shortage. This has reduced the demand for robotic welding systems. However, the post-COVID-19 market is expected to grow substantially as the manufacturers are making their operations automated to sustain the labor shortage situation that may arrive in the future.

Segmental Outlook

The global robotic welding market is segmented based on the type and end-user. Based on the type, the market is segmented into arc welding, spot welding, laser welding, and others (including plasma welding). Based on application, the market is sub-segmented into automotive, metals & machinery, electrical & electronics, aerospace & defense, construction, and others (including Steel Plant, and Wind Turbine).

The Automotive Sector is the Major End-User of the Robotic Welding

The automotive sector is the major user of robotic welding as the automotive industry is aggressively implementing Industry 4.0 (i4.0) capabilities into their manufacturing processes by leveraging advanced communication protocols, new controllers, and cloud computing. The industry is adopting these for real-time data capture and analytics to improve manufacturing quality, productivity, and faster model changeovers. The industry is rapidly adopting robotic resistance welding systems for a broader range of welding operations as it provides faster commissioning, better precision, and process flexibility. However, shifting the operations from one vehicle model to another was a major challenge in such types of robotic welding systems. To address this problem Bosch Rexroth has developed advanced software and processors that can store up to 10,000 welding programs, making it easier for manufacturers to rapidly shift welding operations.

Regional Outlooks

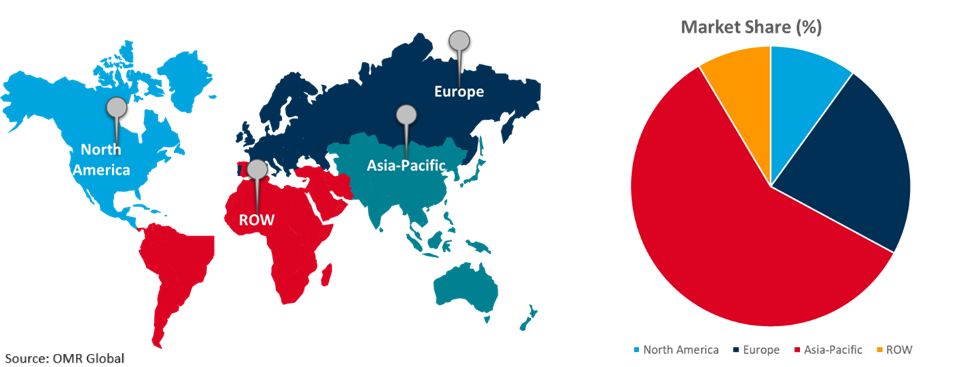

The global robotic welding market is further segmented based on geography including North America (the US, and Canada), Europe (Italy, Spain, Germany, France, and Others), Asia-Pacific (India, China, Japan, and Others), and the Rest of the World (the Middle East and Africa, and Latin America).

Global Robotic Welding Market Growth by Region, 2021-2027

Asia Pacific Region Holds a Prominent Share in the Global Robotic Welding Market

The Asia-Pacific region holds a prominent share in the global robotic welding market as the region is emerging as a manufacturing hub for electronic components, devices, and equipment. Additionally, the maximum number of automobiles are manufactured and sold in this region. The North American region is estimated to exhibit considerable growth in the robotic welding market. The rising investment in industrial automation is the major factor for the market growth in this region.

Market Players Outlook

Some of the companies serving the global robotic welding market include ABB, Ltd., Hyundai Robotics, Fanuc Corp., Panasonic Corp., DAIHEN Corp., Kawasaki Heavy Industries, Ltd., Miller Electric Mfg. LLC, Yaskawa Electric Corp., and others. The market players are considerably contributing to the market growth by adopting various strategies including mergers & acquisitions, collaborations, funding, and new product launches, to stay competitive in the market. For instance,

- In September 2021, K-TIG, an Australian welding company had signed a memorandum with Sheffield University’s Nuclear Advanced Manufacturing Research Centre (NAMRC) to develop a robotic welding system that can be used in the fabrication of nuclear waste containers for the future decommissioning of 17 nuclear sites throughout the UK.

- KUKA AG had launched KR CYBERTECH nano in September 2020, a highly flexible multi-functional robot. In the low payload category between 6 and 10 Kg, the cost-efficient robot stands out for its speed, outstanding precision, and low investment and maintenance costs requirements.

The Report Covers

- Market value data analysis of 2020 and forecast to 2027.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global robotic welding market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. BY Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.1.1. ABB Ltd.

3.1.1.1. Overview

3.1.1.2. Financial Analysis

3.1.1.3. SWOT Analysis

3.1.1.4. Recent Developments

3.1.2. Hyundai Robotics

3.1.2.1. Overview

3.1.2.2. Financial Analysis

3.1.2.3. SWOT Analysis

3.1.2.4. Recent Developments

3.1.3. Fanuc Corp.

3.1.3.1. Overview

3.1.3.2. Financial Analysis

3.1.3.3. SWOT Analysis

3.1.3.4. Recent Developments

3.1.4. Panasonic Corp.

3.1.4.1. Overview

3.1.4.2. Financial Analysis

3.1.4.3. SWOT Analysis

3.1.4.4. Recent Developments

3.1.5. DAIHEN Corp.

3.1.5.1. Overview

3.1.5.2. Financial Analysis

3.1.5.3. SWOT Analysis

3.1.5.4. Recent Developments

3.2. Key Strategy Analysis

4. Market Determinants

4.1. Motivators

4.2. Restraints

4.3. Opportunities

5. Market Segmentation

5.1. Global Robotic Welding Market by Type

5.1.1. Arc Welding

5.1.2. Spot Welding

5.1.3. Laser Welding

5.1.4. Others (including Plasma Welding)

5.2. Global Robotic Welding Market by End-User

5.2.1. Automotive

5.2.2. Metals & Machinery

5.2.3. Electrical & Electronics

5.2.4. Aerospace & Defense

5.2.5. Construction

5.2.6. Others (including Steel Plant, and Wind Turbine)

6. Regional Analysis

6.1. North America

6.1.1. United States

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. ABB, Ltd.

7.2. Acieta LLC

7.3. Comau S.p.A.

7.4. DAIHEN Corp.

7.5. Denso Corp.

7.6. Fanuc Corp.

7.7. Hyundai Robotics

7.8. IGMROBOTERSYSTEME AG

7.9. Kawasaki Heavy Industries, Ltd.

7.10. Kemppi Oy

7.11. KUKA AG

7.12. Miller Electric Mfg. LLC

7.13. Nachi-Fujikoshi Corp.

7.14. OTC DAIHEN Inc.

7.15. Panasonic Corp.

7.16. Siasun Robot & Automation Co. Ltd.

7.17. SMENCO

7.18. The Lincoln Electric Co.

7.19. Yaskawa Electric Corp.

1. GLOBAL ROBOTIC WELDING MARKET RESEARCH AND ANALYSIS BY TYPE, 2020-2027 ($ MILLION)

2. GLOBAL ARC WELDING MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

3. GLOBAL SPOT WELDING MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

4. GLOBAL LASER WELDING MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

5. GLOBAL OTHERS MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

6. GLOBAL ROBOTIC WELDING MARKET RESEARCH AND ANALYSIS BY END-USER, 2020-2027 ($ MILLION)

7. GLOBAL ROBOTIC WELDING FOR AUTOMOTIVE MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

8. GLOBAL ROBOTIC WELDING FOR METALS & MACHINERY MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

9. GLOBAL ROBOTIC WELDING FOR ELECTRICAL & ELECTRONICS MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

10. GLOBAL ROBOTIC WELDING FOR AEROSPACE & DEFENSE MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

11. GLOBAL ROBOTIC WELDING FOR CONSTRUCTION MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

12. GLOBAL ROBOTIC WELDING FOR OTHER END-USER MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

13. GLOBAL ROBOTIC WELDING MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2020-2027 ($ MILLION)

14. NORTH AMERICAN ROBOTIC WELDING MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027 ($ MILLION)

15. NORTH AMERICAN ROBOTIC WELDING MARKET RESEARCH AND ANALYSIS BY TYPE, 2020-2027 ($ MILLION)

16. NORTH AMERICAN ROBOTIC WELDING MARKET RESEARCH AND ANALYSIS BY END-USER, 2020-2027 ($ MILLION)

17. EUROPEAN ROBOTIC WELDING MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027 ($ MILLION)

18. EUROPEAN ROBOTIC WELDING MARKET RESEARCH AND ANALYSIS BY TYPE, 2020-2027 ($ MILLION)

19. EUROPEAN ROBOTIC WELDING MARKET RESEARCH AND ANALYSIS BY END-USER, 2020-2027 ($ MILLION)

20. ASIA-PACIFIC ROBOTIC WELDING MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027 ($ MILLION)

21. ASIA-PACIFIC ROBOTIC WELDING MARKET RESEARCH AND ANALYSIS BY TYPE, 2020-2027 ($ MILLION)

22. ASIA-PACIFIC ROBOTIC WELDING MARKET RESEARCH AND ANALYSIS BY END-USER, 2020-2027 ($ MILLION)

23. REST OF THE WORLD ROBOTIC WELDING MARKET RESEARCH AND ANALYSIS BY TYPE, 2020-2027 ($ MILLION)

24. REST OF THE WORLD ROBOTIC WELDING MARKET RESEARCH AND ANALYSIS BY END-USER, 2020-2027 ($ MILLION)

1. GLOBAL ROBOTIC WELDING MARKET SHARE BY TYPE, 2020 VS 2027 (%)

2. GLOBAL ARC WELDING MARKET REGION BY GEOGRAPHY, 2020 VS 2027 (%)

3. GLOBAL SPOT WELDING MARKET REGION BY GEOGRAPHY, 2020 VS 2027 (%)

4. GLOBAL LASER WELDING MARKET REGION BY GEOGRAPHY, 2020 VS 2027 (%)

5. GLOBAL OTHERS MARKET REGION BY GEOGRAPHY, 2020 VS 2027 (%)

6. GLOBAL ROBOTIC WELDING MARKET SHARE BY END-USER, 2020 VS 2027 (%)

7. GLOBAL ROBOTIC WELDING FOR METALS & MACHINERY MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

8. GLOBAL ROBOTIC WELDING FOR METALS & MACHINERY MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

9. GLOBAL ROBOTIC WELDING FOR ELECTRICAL & ELECTRONICS MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

10. GLOBAL ROBOTIC WELDING FOR AEROSPACE & DEFENSE MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

11. GLOBAL ROBOTIC WELDING FOR CONSTRUCTION MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

12. GLOBAL ROBOTIC WELDING FOR OTHER END-USER MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

13. GLOBAL ROBOTIC WELDING MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

14. US ROBOTIC WELDING MARKET SIZE, 2020-2027 ($ MILLION)

15. CANADA ROBOTIC WELDING MARKET SIZE, 2020-2027 ($ MILLION)

16. UK ROBOTIC WELDING MARKET SIZE, 2020-2027 ($ MILLION)

17. FRANCE ROBOTIC WELDING MARKET SIZE, 2020-2027 ($ MILLION)

18. GERMANY ROBOTIC WELDING MARKET SIZE, 2020-2027 ($ MILLION)

19. ITALY ROBOTIC WELDING MARKET SIZE, 2020-2027 ($ MILLION)

20. SPAIN ROBOTIC WELDING MARKET SIZE, 2020-2027 ($ MILLION)

21. REST OF EUROPE ROBOTIC WELDING MARKET SIZE, 2020-2027 ($ MILLION)

22. INDIA ROBOTIC WELDING MARKET SIZE, 2020-2027 ($ MILLION)

23. CHINA ROBOTIC WELDING MARKET SIZE, 2020-2027 ($ MILLION)

24. JAPAN ROBOTIC WELDING MARKET SIZE, 2020-2027 ($ MILLION)

25. REST OF ASIA-PACIFIC ROBOTIC WELDING MARKET SIZE, 2020-2027 ($ MILLION)

26. REST OF THE WORLD ROBOTIC WELDING MARKET SIZE, 2020-2027 ($ MILLION)