Robotics Market

Robotics Market Size, Share & Trends Analysis Report by Type (Industrial Robots and Service Robots), By Application (Handling, Welding & Soldering, Assembling & Disassembling, Dispensing, Processing, and Others), and by End-Users (Manufacturing, Food & Beverage, Aerospace, Healthcare, Logistics, and Others) Forecast Period (2022-2028) Update Available - Forecast 2025-2031

Robotics market is anticipated to grow at a CAGR of 18.1% during the forecast period. Robot installations across the globe are expected to propel the robotics market during the forecast period. The ongoing trend toward automation and rising next-generation technologies is expected to support market growth. For instance, according to the International Federation of Robotics, sales of industrial robots have reached a strong recovery. A new record of 4,86,800 units was shipped globally in 2021 – an increase of 27% compared to the year 2020. Asia/Australia saw the largest growth in demand installations up 33% reaching 354,500 units. The Americas increased by 27% with 49,400 units sold. The Europe region saw double-digit growth of 15% with 78,000 units installed.

The strong demand across the industries for robot installations is expected to accelerate market growth during the forecast period. For instance, in 2021, the electronics industry (132,000 installations, +21%), surpassed the automotive industry. The industrial industry (109,000 installations +37%) is the largest customer of industrial robots already in 2020. Metal and machinery (57,000 installations, +38%), plastics and chemical products (22,500 installations, +21%) and food and beverages (15,300 installations, +24%).

Segmental Outlook

The global robotics market is segmented based on the type, application, and end-users. Based on the type, the market is bifurcated into industrial robots and service robots. Industrial robots are further sub-segmented into articulated, SCARA, Cartesian, collaborative, and others. The service robots are again augmented into handling, welding & soldering, assembling & disassembling, dispensing, processing, and others. Based on the application, the market is segmented into handling, welding & soldering, assembling & disassembling, dispensing, processing, and others. Based on the end-users, the market is augmented into manufacturing, food & beverage, aerospace, healthcare, logistics, and others. Among the industrial robots segment, articulated robots are expected to grow at a substantial rate during the forecast period. Articulated robots allow for the flexibility to shift or rotate parts during operation, unlike hard automation systems which are inflexible and do not allow for process changes. For instance, in April 2022, Italian robotics supplier Comau (Turin) introduced the first of a new generation of 6-axis articulated robots, the N-220. The robot applies Nodal speech-based coding language for open, easy programming, and it has two separate, flexible harnesses for the robot and application power supply.

The service segment is expected to hold a contributable share in the market over the forecast period due to the growing consumer service robots across the globe. The demand for further professional cleaning robots is increasing which is expected to drive the market growth. For instance, according to World Robotics 2021, the demand for professional cleaning robots grew by 92% to 34,400 units sold. In response to increasing hygiene requirements due to the COVID-19 pandemic, more than 50 service robot providers developed disinfection robots, spraying disinfectant fluids, or using ultraviolet light. Often, existing mobile robots were modified to serve as disinfection robots.

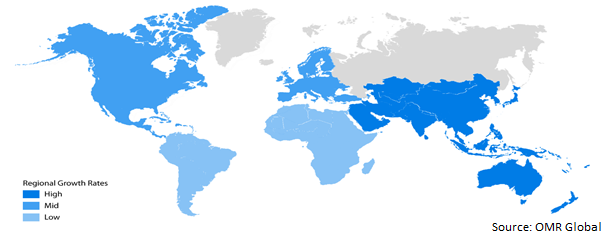

Regional Outlooks

The global robotics market is further segmented based on geography including North America (the US, and Canada), Europe (Italy, Spain, Germany, France, and Others), Asia-Pacific (India, China, Japan, South Korea, and Others), and the Rest of the World (the Middle East & Africa, and Latin America). The market can be analyzed for a particular region or country level as per the requirement. The North American region is expected to hold a remarkable share during the forecast period. A growing number of robot suppliers coupled with a well-developed technological infrastructure is promoting growth in the market during the forecast period. According to Instrument Flight Rules (IFR), the US shipped 33,800 units and is the second-largest supplier across the globe.

Global Robotics Market Growth, by Region 2022-2028

The Asia-Pacific region is Expected to Hold a Significant Share in the Global Robotics Market

The Asia-Pacific region is expected to hold a significant share in the market during the forecast period. The growing number of industrial robots across the industries is driving the growth of the market during the forecast period. As per Instrument Flight Rules (IFR), Asia-Pacific is the largest market for industrial robots, and 73% of newly deployed robots were installed. A total of 354,500 units were shipped in 2021, up 33% compared to 2020. The electronics industry adopted by far the most units (123,800 installations, +22%), followed by strong demand from the automotive industry (72,600 installations, +57%), and the metal and machinery industry (36,400 installations, +29%).

Market Players Outlook

The major companies serving the global robotics market include ABB Group, Autonox Robotics Gmbh, AV&R, Bastain Solutions LLC, Bosch Rexroth AG, Denso Corp., Diligent Robotics Inc., Electroimpact Inc., FANUC Corp., General Dynamics Mission Systems, Inc., Gudel Group AG, and others. The market players are considerably contributing to the market growth by the adoption of various strategies including mergers and acquisitions, partnerships, collaborations, funding, and new product launches, to stay competitive in the market. For instance, in July 2021, Alphabet launched a new robotics company, Intrinsic which will focus on building software for industrial robots. Intrinsic is developing software tools intending to make industrial robots easier to use, less costly, and more flexible.

The Report Covers

- Market value data analysis of 2021 and forecast to 2028.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global robotics market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.1.1. Overview

3.1.2. Financial Analysis

3.1.3. SWOT Analysis

3.1.4. Recent Developments

3.2. Key Strategy Analysis

4. Market Segmentation

4.1. Global Robotics Market by Type

4.1.1. Industrial Robots

4.1.1.1. Articulates

4.1.1.2. SCARA

4.1.1.3. Cartesian

4.1.1.4. Collaborative

4.1.1.5. Others (Parallel)

4.1.2. Service Robots

4.1.2.1. Logistics

4.1.2.2. Medical

4.1.2.3. Domestics

4.1.2.4. Others (Security, Rescue)

4.2. Global Robotics Market by Application

4.2.1. Handling

4.2.2. Welding & Soldering

4.2.3. Assembling & Disassembling

4.2.4. Dispensing

4.2.5. Processing

4.2.6. Others (Inspections & Quality Testing and Die Casting & Molding)

4.3. Global Robotics Market by End-Users

4.3.1. Manufacturing

4.3.2. Food & Beverage

4.3.3. Aerospace

4.3.4. Healthcare

4.3.5. Logistics

4.3.6. Others (Military & Defense)

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

6. Company Profiles

6.1. ABB Group

6.2. Autonox Robotics GmbH

6.3. AV&R

6.4. Bastain Solutions LLC

6.5. Bosch Rexroth AG

6.6. Denso Corp.

6.7. Diligent Robotics Inc.

6.8. Electroimpact Inc.

6.9. FANUC Corp.

6.10. General Dynamics Mission Systems, Inc.

6.11. Gudel Group AG

6.12. Hyundai Robotics Europe GmbH

6.13. JH Robotics, Inc.

6.14. Kuka AG

6.15. Kawasaki Heavy Industries Ltd.

6.16. Mayekawa Mfg. Co. Ltd.

6.17. Mitsubishi Electric Corp.

6.18. Mtorres Disenos Industriales S.A.U.

6.19. Nachi-Fujikoshi Corp.

6.20. Oliver Crispin Robotics Ltd.

6.21. Omron Corp.

6.22. Panasonic Corp.

6.23. Rockwell Automation Inc.

6.24. Rethink Robotics

6.25. Schneider Electric

6.26. Seiko Epson Corp.

6.27. Staubli International AG

6.28. Toshiba Corp.

6.29. Universal Robotics A/S

6.30. Yaskawa Electric Corp.

1. GLOBAL ROBOTICS MARKET RESEARCH AND ANALYSIS BY TYPE, 2021-2028 ($ MILLION)

2. GLOBAL INDUSTRIAL ROBOTS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

3. GLOBAL SERVICE ROBOTS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

4. GLOBAL ROBOTICS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2021-2028 ($ MILLION)

5. GLOBAL ROBOTICS FOR HANDLING MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

6. GLOBAL ROBOTICS FOR WELDING & SOLDERING MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

7. GLOBAL ROBOTICS FOR ASSEMBLING & DISASSEMBLING MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

8. GLOBAL ROBOTICS FOR DISPENSING MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

9. GLOBAL ROBOTICS FOR PROCESSING MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

10. GLOBAL ROBOTICS FOR OTHER MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

11. GLOBAL ROBOTICS MARKET RESEARCH AND ANALYSIS BY END-USERS, 2021-2028 ($ MILLION)

12. GLOBAL ROBOTICS IN MANUFACTURING MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

13. GLOBAL ROBOTICS IN FOOD & BEVERAGE MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

14. GLOBAL ROBOTICS IN AEROSPACE MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

15. GLOBAL ROBOTICS IN HEALTHCARE MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

16. GLOBAL ROBOTICS IN LOGISTICS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

17. GLOBAL ROBOTICS IN OTHER MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

18. GLOBAL ROBOTICS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

19. NORTH AMERICAN ROBOTICS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

20. NORTH AMERICAN ROBOTICS MARKET RESEARCH AND ANALYSIS BY TYPE, 2021-2028 ($ MILLION)

21. NORTH AMERICAN ROBOTICS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2021-2028 ($ MILLION)

22. NORTH AMERICAN ROBOTICS MARKET RESEARCH AND ANALYSIS BY END-USERS, 2021-2028 ($ MILLION)

23. EUROPEAN ROBOTICS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

24. EUROPEAN ROBOTICS MARKET RESEARCH AND ANALYSIS BY TYPE, 2021-2028 ($ MILLION)

25. EUROPEAN ROBOTICS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2021-2028 ($ MILLION)

26. EUROPEAN ROBOTICS MARKET RESEARCH AND ANALYSIS BY END-USERS, 2021-2028 ($ MILLION)

27. ASIA-PACIFIC ROBOTICS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

28. ASIA-PACIFIC ROBOTICS MARKET RESEARCH AND ANALYSIS BY TYPE, 2021-2028 ($ MILLION)

29. ASIA-PACIFIC ROBOTICS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2021-2028 ($ MILLION)

30. ASIA-PACIFIC ROBOTICS MARKET RESEARCH AND ANALYSIS BY END-USERS, 2021-2028 ($ MILLION)

31. REST OF THE WORLD ROBOTICS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

32. REST OF THE WORLD ROBOTICS MARKET RESEARCH AND ANALYSIS BY TYPE, 2021-2028 ($ MILLION)

33. REST OF THE WORLD ROBOTICS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2021-2028 ($ MILLION)

34. REST OF THE WORLD ROBOTICS MARKET RESEARCH AND ANALYSIS BY END-USERS, 2021-2028 ($ MILLION)

1. GLOBAL ROBOTICS MARKET SHARE BY TYPE, 2021 VS 2028 (%)

2. GLOBAL INDUSTRIAL ROBOTS MARKET SHARE BY REGION, 2021 VS 2028 (%)

3. GLOBAL ARTICULATES FOR ROBOTICS MARKET SHARE BY REGION, 2021 VS 2028 (%)

4. GLOBAL SCARA FOR ROBOTICS MARKET SHARE BY REGION, 2021 VS 2028 (%)

5. GLOBAL CARTESIAN FOR ROBOTICS MARKET SHARE BY REGION, 2021 VS 2028 (%)

6. GLOBAL COLLABORATIVE FOR ROBOTICS MARKET SHARE BY REGION, 2021 VS 2028 (%)

7. GLOBAL OTHER FOR ROBOTICS MARKET SHARE BY REGION, 2021 VS 2028 (%)

8. GLOBAL SERVICE ROBOTS MARKET SHARE BY REGION, 2021 VS 2028 (%)

9. GLOBAL LOGISTICS FOR ROBOTICS MARKET SHARE BY REGION, 2021 VS 2028 (%)

10. GLOBAL MEDICAL FOR ROBOTICS MARKET SHARE BY REGION, 2021 VS 2028 (%)

11. GLOBAL DOMESTIC FOR ROBOTICS MARKET SHARE BY REGION, 2021 VS 2028 (%)

12. GLOBAL OTHER FOR ROBOTICS MARKET SHARE BY REGION, 2021 VS 2028 (%)

13. GLOBAL ROBOTICS MARKET SHARE BY APPLICATION, 2021 VS 2028 (%)

14. GLOBAL ROBOTICS FOR HANDLING MARKET SHARE BY REGION, 2021 VS 2028 (%)

15. GLOBAL ROBOTICS FOR WELDING & SOLDERING MARKET SHARE BY REGION, 2021 VS 2028 (%)

16. GLOBAL ROBOTICS FOR ASSEMBLING & DISASSEMBLING MARKET SHARE BY REGION, 2021 VS 2028 (%)

17. GLOBAL ROBOTICS FOR DISPENSING MARKET SHARE BY REGION, 2021 VS 2028 (%)

18. GLOBAL ROBOTICS FOR PROCESSING MARKET SHARE BY REGION, 2021 VS 2028 (%)

19. GLOBAL ROBOTICS FOR OTHER MARKET SHARE BY REGION, 2021 VS 2028 (%)

20. GLOBAL ROBOTICS MARKET SHARE BY END-USERS, 2021 VS 2028 (%)

21. GLOBAL ROBOTICS IN MANUFACTURING MARKET SHARE BY REGION, 2021 VS 2028 (%)

22. GLOBAL ROBOTICS IN FOOD & BEVERAGE MARKET SHARE BY REGION, 2021 VS 2028 (%)

23. GLOBAL ROBOTICS IN AEROSPACE MARKET SHARE BY REGION, 2021 VS 2028 (%)

24. GLOBAL ROBOTICS IN HEALTHCARE MARKET SHARE BY REGION, 2021 VS 2028 (%)

25. GLOBAL ROBOTICS IN LOGISTICS MARKET SHARE BY REGION, 2021 VS 2028 (%)

26. GLOBAL ROBOTICS IN OTHER MARKET SHARE BY REGION, 2021 VS 2028 (%)

27. GLOBAL ROBOTICS MARKET SHARE BY REGION, 2021 VS 2028 (%)

28. US ROBOTICS MARKET SIZE, 2021-2028 ($ MILLION)

29. CANADA ROBOTICS MARKET SIZE, 2021-2028 ($ MILLION)

30. UK ROBOTICS MARKET SIZE, 2021-2028 ($ MILLION)

31. FRANCE ROBOTICS MARKET SIZE, 2021-2028 ($ MILLION)

32. GERMANY ROBOTICS MARKET SIZE, 2021-2028 ($ MILLION)

33. ITALY ROBOTICS MARKET SIZE, 2021-2028 ($ MILLION)

34. SPAIN ROBOTICS MARKET SIZE, 2021-2028 ($ MILLION)

35. REST OF EUROPE ROBOTICS MARKET SIZE, 2021-2028 ($ MILLION)

36. INDIA ROBOTICS MARKET SIZE, 2021-2028 ($ MILLION)

37. CHINA ROBOTICS MARKET SIZE, 2021-2028 ($ MILLION)

38. JAPAN ROBOTICS MARKET SIZE, 2021-2028 ($ MILLION)

39. SOUTH KOREA ROBOTICS MARKET SIZE, 2021-2028 ($ MILLION)

40. REST OF ASIA-PACIFIC ROBOTICS MARKET SIZE, 2021-2028 ($ MILLION)

41. REST OF THE WORLD ROBOTICS MARKET SIZE, 2021-2028 ($ MILLION)