Rocket Propulsion Market

Rocket Propulsion Market Size, Share & Trends Analysis Report by Type (Rocket Motor And Rocket Engine), by Orbit Type (LEO and Elliptical, GEO and MEO) by Propulsion Type (Solid, Liquid and Hybrid) by Application Type (Communication, Earth Observation, Navigation, Global Positioning System (GPS) and Surveillance, and Technology Development and Education) and by End Users (Civil and Government, Commercial,and Military) Forecast Period (2024-2031)

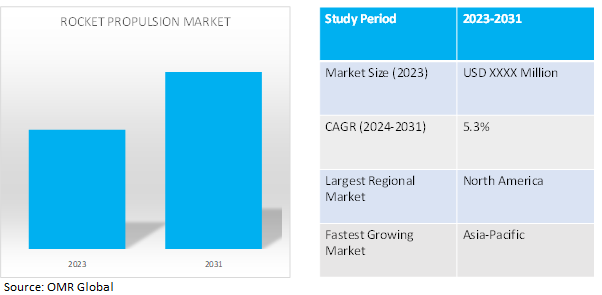

Rocket propulsion market is anticipated to grow at a considerable CAGR of 5.3% during the forecast period (2024-2031).Rocket propulsion is a method used to send a projectile and out space while breaking earth’s gravity. The propulsion system used in rockets generate an enormous forwards push thus lifting the rocket from ground and propelling it towards space. A rocket can be aircraft, spacecraft, missile, or a vehicle which generates thrust. Thrust is generated by propulsion system of the rocket.

Market Dynamics

Expansion of Commercial Space Industry

The expanding commercial space industry provides significant opportunities for the liquid rocket propulsion market. Private space firms such as SpaceX, Blue Origin, and Rocket Lab are increasingly relying on high-efficiency propulsion systems to support various missions like satellite installations/launches, space tourism operations, cargo transportation, etc. across the globe. Station (ISS) and research beyond Earth orbit.

This demand is the increasing number of satellites launches for communication, Earth observation, and scientific purposes. The need for advanced fluid propulsion systems to transport payloads into low Earth orbit and beyond will be amplified by the emergence of new markets like space exploration and lunar exploration.As competition in the commercial space sector intensifies, companies are looking for innovative propulsion solutions to achieve a competitive advantage in terms of cost efficiency, reliability, and performance. Manufacturers and suppliers of rocket propulsion systems can now develop innovative technology to capture a larger portion of the growing market.

Increased Spending and Capital Investment from Government Bodies and Space companies

The growth of the rocket propulsion market is significantly propelled by increased spending and capital investment from government bodies and space companies. Capital investment involves acquiring physical assets to further long-term business goals. Industries are channeling substantial capital into space exploration, technological innovation, and research and development initiatives, supported by government agencies. Space Capital LP reports that in Q1 2022, venture capital invested $7.2 billion, contributing to a total of $17.1 billion in 2021 across 328 space companies, comprising 3% of the global venture capital flows. According to USAspending, NASA had a budgetary allocation of $30.44 billion in FY 2022, distributed among its sub-components, aiming to drive advancements in technology, aeronautics, and space exploration. This increased spending and investment are expected to boost the demand for rocket propulsion systems in the forecast period.

Market Segmentation

Our in-depth analysis of the global rocket propulsion market includes the following segments by type, product, and technology:

- Based on type, the market is segmented into rocket motor and rocket engine.

- Based on orbit type, the market is segmented into LEO and Elliptical, GEO and MEO.

- Based on propulsion, the market is segmented intosolid,liquid and hybrid.

- Based on application, the market is segmented into Communication, Earth Observation, Navigation, Global Positioning System (GPS) and Surveillance, and Technology Development and Education.

- Based on end users, the market is segmented into civil and government, commercial and military.

LEO Segment is Projected to Emerge as the Largest Segment

Based on orbit, the LEO and elliptical segment emerged as the largest segment, contributing to more than three-fourths of the global rocket propulsion market, and is expected to maintain its dominance during the forecast period.This is due to the benefits offered by LEO and elliptical-based rockets, such as shorter orbital periods, higher orbital velocities, shorter trips, low cost, and reduced latency. The increased satellite launching activities are also expected to supplement the segmental growth during the forecast period.

Communication Sub-segment to Hold a Considerable Market Share

Thee communication segment hold the largest market share and is expected to maintain its dominance during the forecast period. This is due to the high demand for satellite communication systems from various industries and the increase in the installation of satellite connectivity systems by the defense and aviation industry.

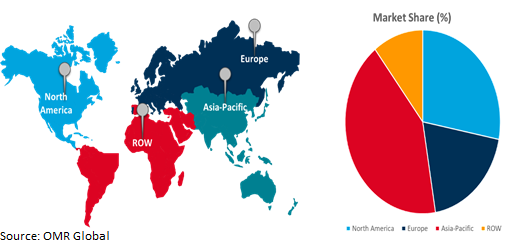

Regional Outlook

The globalrocket propulsionmarket is further segmented based on geography including North America (the US, and Canada), Europe (UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia-Pacific), and the Rest of the World (the Middle East & Africa, and Latin America). North America is estimated to hold the largest share of the global rocket propulsion market over the forecast period. The rising demand for aerospace launch providers for different payloads including human spacecraft, satellites, missions to the International Space Station, and testing probes is projected to fuel the expansion of the rocket propulsion market in North America. The region is investing significantly in the development of space tourism and exploration and space probe missions, which is adding to the growth of the rocket propulsion market.

Global Rocket Propulsion Market Growth by Region 2024-2031

Aia-Pacific Holds Major Market Share

Among all the regions, Asia-Pacific holds a significant share as countries in the Asia-Pacific region, such as China and India, are investing heavily in space exploration activities, and they are expected to continue the same during the forecast period. The Indian Space agency is currently focused on developing the indigenous space launch industry. For instance, in 2018, the Government of India approved USD 1.31 billion for building 40 PSLV and GSLV rockets over the next 5-year span to launch communication satellites and increase broadband connectivity for rural areas. This may strengthen the space infrastructure and reduce the dependence on procured launches from foreign countries. In addition, there are many projects from the region that are lined up during the forecast period. For instance, from India, there are projects like Chandrayaan-3 in 2021 and the Gaganyaan in 2021, in which the agency is planning to send astronauts to space.

Market Players Outlook

*Note: Major Players Sorted in No Particular Order.

The major companies serving the global rocket propulsionmarket includeAntrix Corporation Ltd., Mitsubishi Heavy Industries, Northrop Grumman and Safran SA,among others. The market players are increasingly focusing on business expansion and product development by applying strategies such as collaborations, mergers, and acquisitions to stay competitive in the market. In March 2021, NASA has awarded the Mars Ascent Propulsion System (MAPS) contract to Northrop Grumman Systems Corporation , to provide propulsion support and products for spaceflight missions at the agency's Marshall Space Flight Center in Huntsville.

The Report Covers

- Market value data analysis of 2023 and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global rocket propulsionmarket. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. Antrix Corporation Ltd.

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. Mitsubishi Heavy Industries

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. Northrop Grumman Corp.

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Safran SA

3.5.1. Overview

3.5.2. Financial Analysis

3.5.3. SWOT Analysis

3.5.4. Recent Developments

3.6. Key Strategy Analysis

4. Market Segmentation

4.1. Global Rocket Propulsion Market by Type

4.1.1. Rocket Motor

4.1.2. Rocket Engine

4.2. Global Rocket Propulsion Market by Orbit Type

4.2.1. LEO and Elliptical

4.2.2. GEO

4.2.3. MEO

4.3. Global Rocket Propulsion Market by Propulsion

4.3.1. Solid

4.3.2. Liquid

4.3.3. Hybrid

4.4. Global Rocket Propulsion Market by Application

4.4.1. Communication

4.4.2. Earth Observation

4.4.3. Navigation, Global Positioning System (GPS) and Surveillance

4.4.4. Technology Development and Education

4.5. Global Rocket Propulsion Market by End-User

4.5.1. Civil and Government

4.5.2. Commercial

4.5.3. Military

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

6. Company Profiles

6.1. Aerojet Rocketdyne

6.2. Airbus SE

6.3. Blue Origin Federation LLC

6.4. Boeing Company

6.5. IHI Corp.

6.6. Land SpaceTechnology Co. Ltd

6.7. Moog Inc.

6.8. NPO Energomash

6.9. Rocket Lab USA Inc.

6.10. Space Exploration Technologies Corp.

6.11. Spacex

6.12. Virgin Galactic

1. GLOBAL ROCKET PROPULSION MARKET RESEARCH AND ANALYSIS BY TYPE, 2023-2031 ($ MILLION)

2. GLOBAL ROCKET MOTOR PROPULSION MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

3. GLOBAL ROCKET ENGINE PROPULSION MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

4. GLOBAL ROCKET PROPULSION MARKET RESEARCH AND ANALYSIS BY ORBIT TYPE, 2023-2031 ($ MILLION)

5. GLOBAL ROCKET LEO AND ELLIPTICAL PROPULSION MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

6. GLOBAL ROCKET GEO PROPULSION MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

7. GLOBAL ROCKET MEO PROPULSION MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

8. GLOBAL ROCKET PROPULSION MARKET RESEARCH AND ANALYSIS BY PROPULSION, 2023-2031 ($ MILLION)

9. GLOBAL ROCKET SOLID PROPULSION MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

10. GLOBAL ROCKET LIQUID PROPULSION MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

11. GLOBAL ROCKET HYBRID PROPULSION MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

12. GLOBAL ROCKET PROPULSION MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

13. GLOBAL ROCKET PROPULSION FOR COMMUNICATION MARKET COMMUNICATION RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

14. GLOBAL ROCKET PROPULSION FOR EARTH OBSERVATION MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

15. GLOBAL ROCKET PROPULSION FOR NAVIGATION, GLOBAL POSITIONING SYSTEM (GPS) AND SURVEILLANCE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

16. GLOBAL ROCKET PROPULSION FOR TECHNOLOGY DEVELOPMENT AND EDUCATION MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

17. GLOBAL ROCKET PROPULSION MARKET RESEARCH AND ANALYSIS BY END USERS, 2023-2031 ($ MILLION)

18. GLOBAL ROCKET PROPULSION FOR CIVIL AND GOVERNMENT MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

19. GLOBAL ROCKET PROPULSION FOR COMMERCIAL MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

20. GLOBAL ROCKET PROPULSION FOR MILITARY MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

21. GLOBAL ROCKET PROPULSION MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

22. NORTH AMERICAN ROCKET PROPULSION MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

23. NORTH AMERICAN ROCKET PROPULSION MARKET RESEARCH AND ANALYSIS BY TYPE, 2023-2031 ($ MILLION)

24. NORTH AMERICAN ROCKET PROPULSION MARKET RESEARCH AND ANALYSIS BY ORBIT TYPE, 2023-2031 ($ MILLION)

25. NORTH AMERICAN ROCKET PROPULSION MARKET RESEARCH AND ANALYSIS BY PROPULSION, 2023-2031 ($ MILLION)

26. NORTH AMERICAN ROCKET PROPULSION MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

27. NORTH AMERICAN ROCKET PROPULSION MARKET RESEARCH AND ANALYSIS BY END USERS, 2023-2031 ($ MILLION)

28. EUROPEAN ROCKET PROPULSION MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

29. EUROPEAN ROCKET PROPULSION MARKET RESEARCH AND ANALYSIS BY TYPE, 2023-2031 ($ MILLION)

30. EUROPEAN ROCKET PROPULSION MARKET RESEARCH AND ANALYSIS BY ORBIT TYPE, 2023-2031 ($ MILLION)

31. EUROPEAN ROCKET PROPULSION MARKET RESEARCH AND ANALYSIS BY PROPULSION, 2023-2031 ($ MILLION)

32. EUROPEAN ROCKET PROPULSION MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

33. EUROPEAN ROCKET PROPULSION MARKET RESEARCH AND ANALYSIS BY END USERS, 2023-2031 ($ MILLION)

34. ASIA-PACIFIC ROCKET PROPULSION MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

35. ASIA-PACIFIC ROCKET PROPULSION MARKET RESEARCH AND ANALYSIS BY TYPE, 2023-2031 ($ MILLION)

36. ASIA-PACIFIC ROCKET PROPULSION MARKET RESEARCH AND ANALYSIS BY ORBIT TYPE, 2023-2031 ($ MILLION)

37. ASIA-PACIFIC ROCKET PROPULSION MARKET RESEARCH AND ANALYSIS BY PROPULSION, 2023-2031 ($ MILLION)

38. ASIA-PACIFIC ROCKET PROPULSION MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

39. ASIA-PACIFIC ROCKET PROPULSION MARKET RESEARCH AND ANALYSIS BY END USERS, 2023-2031 ($ MILLION)

40. REST OF THE WORLD ROCKET PROPULSION MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

41. REST OF THE WORLD ROCKET PROPULSION MARKET RESEARCH AND ANALYSIS BY TYPE, 2023-2031 ($ MILLION)

42. REST OF THE WORLD ROCKET PROPULSION MARKET RESEARCH AND ANALYSIS BY ORBIT TYPE, 2023-2031 ($ MILLION)

43. REST OF THE WORLD ROCKET PROPULSION MARKET RESEARCH AND ANALYSIS BY PROPULSION, 2023-2031 ($ MILLION)

44. REST OF THE WORLD ROCKET PROPULSION MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

45. REST OF THE WORLD ROCKET PROPULSION MARKET RESEARCH AND ANALYSIS BY END USERS, 2023-2031 ($ MILLION)

1. GLOBAL ROCKET PROPULSION MARKET SHARE BY TYPE, 2023 VS 2031 (%)

2. GLOBAL ROCKET MOTOR PROPULSION MARKET SHARE BY REGION, 2023 VS 2031 (%)

3. GLOBAL ROCKETENGINE PROPULSION MARKET SHARE BY REGION, 2023 VS 2031 (%)

4. GLOBAL ROCKET PROPULSION MARKET SHARE BY ORBIT TYPE, 2023 VS 2031 (%)

5. GLOBAL ROCKETLEO AND ELLIPTICALPROPULSION MARKET SHARE BY REGION, 2023 VS 2031 (%)

6. GLOBAL ROCKETGEOPROPULSION MARKET SHARE BY REGION, 2023 VS 2031 (%)

7. GLOBAL ROCKETMEO PROPULSION MARKET SHARE BY REGION, 2023 VS 2031 (%)

8. GLOBAL ROCKET PROPULSION MARKET SHARE BY PROPULSION, 2023 VS 2031 (%)

9. GLOBAL ROCKET SOLIDPROPULSION MARKET SHARE BY REGION, 2023 VS 2031 (%)

10. GLOBAL ROCKETLIQUIDPROPULSION MARKET SHARE BY REGION, 2023 VS 2031 (%)

11. GLOBAL ROCKET HYBRID PROPULSION MARKET SHARE BY REGION, 2023 VS 2031 (%)

12. GLOBAL ROCKET PROPULSION MARKET SHARE BY APPLICATION, 2023 VS 2031 (%)

13. GLOBAL ROCKET PROPULSION FOR COMMUNICATION MARKET SHARE BY REGION, 2023 VS 2031 (%)

14. GLOBAL ROCKET PROPULSION FOR EARTH OBSERVATION MARKET SHARE BY REGION, 2023 VS 2031 (%)

15. GLOBAL ROCKET PROPULSION FOR NAVIGATION MARKET SHARE BY REGION, 2023 VS 2031 (%)

16. GLOBAL ROCKET PROPULSION FOR GLOBAL POSITIONING SYSTEM (GPS) AND SURVEILLANCE MARKET SHARE BY REGION, 2023 VS 2031 (%)

17. GLOBAL ROCKET PROPULSION FOR TECHNOLOGY DEVELOPMENT AND EDUCATION MARKET SHARE BY REGION, 2023 VS 2031 (%)

18. GLOBAL ROCKET PROPULSION MARKET SHARE BY END USERS, 2023 VS 2031 (%)

19. GLOBAL ROCKET PROPULSION FOR CIVIL AND GOVERNMENT MARKET SHARE BY REGION, 2023 VS 2031 (%)

20. GLOBAL ROCKET PROPULSION FOR COMMERCIAL MARKET SHARE BY REGION, 2023 VS 2031 (%)

21. GLOBAL ROCKET PROPULSION FOR MILITARY MARKET SHARE BY REGION, 2023 VS 2031 (%)

22. GLOBAL ROCKET PROPULSION MARKET SHARE BY REGION, 2023 VS 2031 (%)

23. US ROCKET PROPULSION MARKET SIZE, 2023-2031 ($ MILLION)

24. CANADA ROCKET PROPULSION MARKET SIZE, 2023-2031 ($ MILLION)

25. UK ROCKET PROPULSION MARKET SIZE, 2023-2031 ($ MILLION)

26. FRANCE ROCKET PROPULSION MARKET SIZE, 2023-2031 ($ MILLION)

27. GERMANY ROCKET PROPULSION MARKET SIZE, 2023-2031 ($ MILLION)

28. ITALY ROCKET PROPULSION MARKET SIZE, 2023-2031 ($ MILLION)

29. SPAIN ROCKET PROPULSION MARKET SIZE, 2023-2031 ($ MILLION)

30. REST OF EUROPE ROCKET PROPULSIONMARKET SIZE, 2023-2031 ($ MILLION)

31. INDIA ROCKET PROPULSION MARKET SIZE, 2023-2031 ($ MILLION)

32. CHINA ROCKET PROPULSION MARKET SIZE, 2023-2031 ($ MILLION)

33. JAPAN ROCKET PROPULSION MARKET SIZE, 2023-2031 ($ MILLION)

34. SOUTH KOREA ROCKET PROPULSION MARKET SIZE, 2023-2031 ($ MILLION)

35. REST OF ASIA-PACIFIC ROCKET PROPULSION MARKET SIZE, 2023-2031 ($ MILLION)

36. LATIN AMERICAROCKET PROPULSION MARKET SIZE, 2023-2031 ($ MILLION)

37. MIDDLE EAST AND AFRICAROCKET PROPULSION MARKET SIZE, 2023-2031 ($ MILLION)