Roofing Underlayment Market

Global Roofing Underlayment Market Size, Share & Trends Analysis Report, By Product (Asphalt-Saturated Felt, Rubberized Asphalt, Non-Bitumen Synthetic), By Application (Residential Construction and Non-Residential Construction) Update Available - Forecast 2025-2031

The global roofing underlayment market is estimated to grow at a CAGR of nearly 5.0% during the forecast period. Roofing underlayment is a water-resistant material that places directly onto the roof deck. It is applied under the roofing materials as a protection layer from the weather. The roofing underlay act as a protection layer against the rain, condensing water and leakage, and the snow blown under the roofing. There are several key factors are attributing to the growth of the global roofing underlayment market, which includes the growth in the construction sector and the increasing installation of flame-resistant and water-resistant underlayment in commercial and residential structures. As per Statistics Canada, total investment in the construction of buildings in Canada reached $15.6 billion in September 2019, increased 1.0% from August 2019.

The construction investment has witnessed rise for both residential and non-residential construction with 1.2% and 0.4%, respectively. This contributes to the demand for roofing underlayment as a protection against environmental conditions. The roofing underlay acts as a water-resistant and water vapor permeable that is located on the cold side of the insulation and enables to prevent the moisture, snow, wind, and contaminants of the dust that may have been driven through the roof tiles and impacting positively towards the growth of the global roofing underlay market. In addition, rising industrialization across the globe is further encouraging the adoption of roofing underlayment to protect a roof deck from moisture.

Segmental Outlook

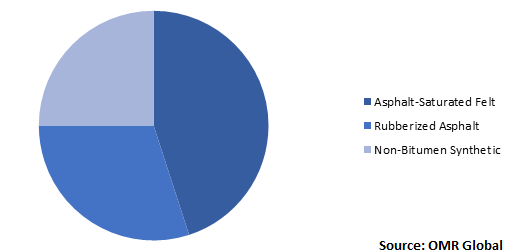

The global roofing underlayment market is segmented based on product and application. Based on the product, the market is segmented into asphalt-saturated felt, rubberized asphalt, and non-bitumen synthetic. Based on the application, the market is diversified into residential construction and non- residential construction. The non-residential construction is expected to hold a significant market share during the forecast period. This is due to escalating maintenance and refurbishing activities, high productivity at low cost, and growth in industrial operations.

Asphalt-Saturated Felt is expected to hold a significant share in the product segment

The asphalt-saturated felt has a significant demand in residential building construction owing to its cost-efficiency. It has a significant application in the residential roof system between the primary roof covering and roof deck. Felts are also utilized between the primary exterior wall and exterior sub-walls covering for controlling moisture. It is normally less costly as compared to synthetic underlayment and offers a better seepage barrier, primarily while applied in thicker layers. Architects and builders use asphalt-saturated felt underlayment as it is easy to install and is a low-cost material. Importantly, it is commonly allowed by local building codes.

Global Roofing Underlayment Market Share by Product, 2018 (%)

Regional Outlook

The global roofing underlayment market is analyzed based on the geographical regions that are contributing significantly towards the growth of the market. Based on geography, the market is segmented into North America, Europe, Asia-Pacific and the Rest of the World. Asia-Pacific is estimated to be the dominating region in the global roofing underlay market. The region has led by rapid industrialization and urbanization in the region including India, China, Thailand, and South Korea. This will open growth avenues in the construction industry and fuel the demand for roofing underlayment during the forecast period. The rising number of construction projects across the region and increasing industrialization and commercialization drive the demand for waterproofing material during construction and maintenance of buildings.

Global Roofing Underlayment Market Growth, by Region 2019-2025

Market Players Outlook

The major players in the global roofing underlayment market include Owens Corning, DuPont de Nemours, Inc., GCP Applied Technologies, Inc., Carlisle Companies Inc., and IKO Industries Ltd. Key players are constantly focusing on gaining major market share by adopting some crucial strategies, including mergers & acquisitions, product launches, partnerships, and collaborations. For instance, in June 2018, Atlas Roofing Corp. declared collaboration with HOVER, a platform that produces accurate, interactive 3D models of any property. The shingle product lines of Atlas Roofing will be available within the HOVER platform that will support to provide more flexibility to its customer base when it comes to project estimation and customer engagement.

Atlas will combine several roofing products that feature Scotchgard Protector from 3M, into the HOVER platform. Such products comprise Atlas Pinnacle Pristine with the all-new Natural Expressions color palette, GlassMaster shingles, StormMaster Slate, Legend designer 3-tab shingles, and StormMaster Shake. Atlas product offering within the HOVER platform will offer its contractors with a strong interface to accelerate its businesses and engage homeowners.

The Report Covers

- Market value data analysis of 2018 and forecast to 2025.

- Annualized market revenues ($ million) for each market segment.

- Company share and market share data for the global roofing underlayment market.

- Key companies operating in the global roofing underlayment market. Based on the availability of data, information related to products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

2.3. Rules & Regulations

3. Competitive Landscape

3.1. Company Share Analysis

3.2. Key Strategy Analysis

3.3. Key Company Analysis

3.3.1. Owens Corning

3.3.1.1. Overview

3.3.1.2. Financial Analysis

3.3.1.3. SWOT Analysis

3.3.1.4. Recent Developments

3.3.2. DuPont de Nemours, Inc.

3.3.2.1. Overview

3.3.2.2. Financial Analysis

3.3.2.3. SWOT Analysis

3.3.2.4. Recent Developments

3.3.3. GCP Applied Technologies Inc.

3.3.3.1. Overview

3.3.3.2. Financial Analysis

3.3.3.3. SWOT Analysis

3.3.3.4. Recent Developments

3.3.4. Carlisle Companies Inc.

3.3.4.1. Overview

3.3.4.2. Financial Analysis

3.3.4.3. SWOT Analysis

3.3.4.4. Recent Developments

3.3.5. IKO Industries Ltd.

3.3.5.1. Overview

3.3.5.2. Financial Analysis

3.3.5.3. SWOT Analysis

3.3.5.4. Recent Developments

4. Market Determinants

4.1 Motivators

4.2 Restraints

4.3 Opportunities

5. Market Segmentation

5.1. Global Roofing Underlayment Market by Product

5.1.1. Asphalt-Saturated Felt

5.1.2. Rubberized Asphalt

5.1.3. Non-Bitumen Synthetic

5.2. Global Roofing Underlayment Market by Application

5.2.1. Residential Construction

5.2.2. Non-Residential Construction

6. Regional Analysis

6.1. North America

6.1.1. United States

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. Atlas Roofing Corp.

7.2. BMI Group Management UK Ltd.

7.3. Boral Roofing LLC

7.4. Carlisle Companies Inc.

7.5. CertainTeed Corp. (Compagnie de Saint-Gobain S.A.)

7.6. DuPont de Nemours, Inc.

7.7. Duro-Last Roofing, Inc.

7.8. GAF Materials LLC d/b/a GAF

7.9. Gardner-Gibson Co.

7.10. GCP Applied Technologies Inc.

7.11. IKO Industries Ltd.

7.12. Intertape Polymer Group Inc.

7.13. Keene Building Products

7.14. MFM Building Products Corp.

7.15. Owens Corning

7.16. Polyglass S.p.A.

7.17. Tamko Building Products LLC

7.18. VaproShield LLC

1. GLOBAL ROOFING UNDERLAYMENT MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2018-2025 ($ MILLION)

2. GLOBAL ASPHALT-SATURATED FELT UNDERLAYMENT MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

3. GLOBAL RUBBERIZED ASPHALT UNDERLAYMENT MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

4. GLOBAL NON-BITUMEN SYNTHETIC UNDERLAYMENT MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

5. GLOBAL ROOFING UNDERLAYMENT MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2018-2025 ($ MILLION)

6. GLOBAL ROOFING UNDERLAYMENT IN RESIDENTIAL CONSTRUCTION MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

7. GLOBAL ROOFING UNDERLAYMENT IN NON-RESIDENTIAL CONSTRUCTION MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

8. GLOBAL ROOFING UNDERLAYMENT MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2018-2025 ($ MILLION)

9. NORTH AMERICA ROOFING UNDERLAYMENT MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

10. NORTH AMERICA ROOFING UNDERLAYMENT MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2018-2025 ($ MILLION)

11. NORTH AMERICA ROOFING UNDERLAYMENT MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2018-2025 ($ MILLION)

12. EUROPE ROOFING UNDERLAYMENT MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

13. EUROPE ROOFING UNDERLAYMENT MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2018-2025 ($ MILLION)

14. EUROPE ROOFING UNDERLAYMENT MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2018-2025 ($ MILLION)

15. ASIA PACIFIC ROOFING UNDERLAYMENT MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

16. ASIA PACIFIC ROOFING UNDERLAYMENT MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2018-2025 ($ MILLION)

17. ASIA PACIFIC ROOFING UNDERLAYMENT MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2018-2025 ($ MILLION)

18. REST OF THE WORLD ROOFING UNDERLAYMENT MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2018-2025 ($ MILLION)

19. REST OF THE WORLD ROOFING UNDERLAYMENT MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2018-2025 ($ MILLION)

1. GLOBAL ROOFING UNDERLAYMENT MARKET SHARE BY PRODUCT, 2018 VS 2025 (%)

2. GLOBAL ROOFING UNDERLAYMENT MARKET SHARE BY APPLICATION, 2018 VS 2025 (%)

3. GLOBAL ROOFING UNDERLAYMENT MARKET SHARE BY GEOGRAPHY, 2018 VS 2025 (%)

4. US ROOFING UNDERLAYMENT MARKET SIZE, 2018-2025 ($ MILLION)

5. CANADA ROOFING UNDERLAYMENT MARKET SIZE, 2018-2025 ($ MILLION)

6. UK ROOFING UNDERLAYMENT MARKET SIZE, 2018-2025 ($ MILLION)

7. FRANCE ROOFING UNDERLAYMENT MARKET SIZE, 2018-2025 ($ MILLION)

8. GERMANY ROOFING UNDERLAYMENT MARKET SIZE, 2018-2025 ($ MILLION)

9. ITALY ROOFING UNDERLAYMENT MARKET SIZE, 2018-2025 ($ MILLION)

10. SPAIN ROOFING UNDERLAYMENT MARKET SIZE, 2018-2025 ($ MILLION)

11. ROE ROOFING UNDERLAYMENT MARKET SIZE, 2018-2025 ($ MILLION)

12. INDIA ROOFING UNDERLAYMENT MARKET SIZE, 2018-2025 ($ MILLION)

13. CHINA ROOFING UNDERLAYMENT MARKET SIZE, 2018-2025 ($ MILLION)

14. JAPAN ROOFING UNDERLAYMENT MARKET SIZE, 2018-2025 ($ MILLION)

15. REST OF ASIA-PACIFIC ROOFING UNDERLAYMENT MARKET SIZE, 2018-2025 ($ MILLION)

16. REST OF THE WORLD ROOFING UNDERLAYMENT MARKET SIZE, 2018-2025 ($ MILLION)