Rugged Server Market

Rugged Server Market Size, Share & Trends Analysis Report, By Type (Dedicated and Standard), By Offering (Hardware and Software & Services), By Application (Military & Aerospace, Telecommunication, Industrial, Energy & Power, Marine, and Others), Forecast Period (2022-2028) Update Available - Forecast 2025-2031

Rugged server market is anticipated to grow at a CAGR of 6.5% during the forecast period. The growing demand for industrial automation, stringent regulatory requirements across various industries, and rising demand for rugged servers in different end-user industries are some key factors driving the growth of the global rugged server market. For instance, in July 2022, Industrial automation providers ABB and SKF, have agreed on a partnership to explore the possibilities for collaboration in the automation of manufacturing processes.

Rugged computers are built to withstand extreme temperatures both hot and cold. They can deal with vibration, dust, and liquid spills. Rugged computers are also designed to run 24/7 and can be stored in places other computers could not. Industrial computer systems are relied upon by manufacturers worldwide in utilizations such as test & measurement, robotics, guidance, visualization, and simulation machines. Such developments in the industrial automation industry are anticipated to drive the global rugged server market. However, the data privacy and security concerns associated with rugged servers deployed at remote locations may restrain their market growth.

Segmental Outlook

The global rugged server market is segmented by type, offering, and application. The market segmentation based on the type includes dedicated and standard. Based on offering, the market is segmented into hardware and software & services. Based on application, the market is segmented into military & aerospace, telecommunication, industrial, energy & power, marine, and others.

Military & Aerospace Segment Holds Considerable Share in the Global Rugged Server Market

Based on application, the market is segmented into military & aerospace, telecommunication, industrial, energy & power, marine, and others. Military & Aerospace held a major market share in the market. Rugged servers are used in all branches of the military. Rugged servers can withstand the intense heat and sand of the desert and can survive the bumps and jolts of an armored vehicle or naval vessel. These servers have been tested according to military standards. The fundamental guideline in rugged computing is the US Military Standard referred to as MIL-STD-810G. Furthermore, in the military world, servers must coexist with all other equipment including powerful radio, radar, and microwave transmitters as well as highly sensitive receivers. Servers must be specially configured to meet the most rigorous military needs. Rugged servers withstand all these requirements and hence are highly used for military applications.

Regional Outlook

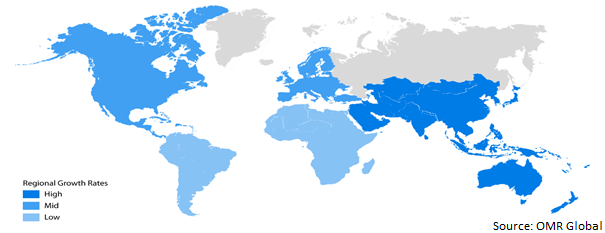

The global rugged server market is further segmented based on geography including North America (the US and Canada), Europe (UK, Italy, Spain, Germany, France, and Others), Asia-Pacific (India, China, Japan, South Korea, and Others), and the Rest of the World (the Middle East & Africa and Latin America). The market can be analyzed for a particular region or country level as per the requirement. North America held a considerable share in the global rugged server market. The high military expenditure along with the high demand for rugged server in the military & defense industry is a key factor driving the growth of the regional market. Additionally, the increasing demand for improved process flexibility and enhanced efficiency, minimizing the operation and maintenance costs in discrete industries for effective supply-chain management is also aiding the market growth.

Global Rugged Server Market Growth, by Region 2022-2028

Asia-Pacific to Exhibit Significant Growth in Rugged Server Market in 2021

Asia-Pacific is anticipated to exhibit significant growth in the market during the forecast period. Extensive migration towards cloud-based business models as a part of business innovations is contributing to the regional market growth. Increased use of high technology and cloud-based services led to significant growth in the market. Additionally, China is likely to present highly attractive growth opportunities for rugged server service providers in the long run. The increasing data center industry is further creating demand for the rugged server market. Indian data centers industry’s capacity is expected to witness a five-fold increase as it is expected to add an overall 3,900-4,100 MW of capacity involving investments of Rs 1.05-1.20 lakh crore in the next five years. To cater to the increasing demand, Indian corporates such as the Hiranandani Group, and Adani Group; foreign investors including Amazon, EdgeConnex, Microsoft, CapitaLand, Mantra Group have started investing in Indian Data Centres, which in turn, is driving the growth of the global rugged server market.

Market Players Outlook

The major companies serving the global rugged server market include Dell Technologies, Mercury Systems, and Siemens AG, among others. The companies are focusing on technology advancements, expansions, mergers and acquisitions, and finding a new market or innovation in their core competency to expand individual market share. For instance, in February 2020, Mercury Systems collaborated with HPE OEM to build the RES-XR6 Alliance rugged rackmount server, based on HPE’s ProLiant server technology. This collaboration brings industry-leading data center to compute capabilities to mission-critical defense and tactical edge applications. By leveraging a hardware and software ecosystem with HPE ProLiant servers that extend threat protection, automation and optimization, RES-XR6 Alliance servers accelerate workloads at the tactical edge by delivering compute technology proven in hyper-scale data centers.

The Report Covers

- Market value data analysis of 2021 and forecast to 2028.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global rugged server market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.1.1. Overview

3.1.2. Financial Analysis

3.1.3. SWOT Analysis

3.1.4. Recent Developments

3.2. Key Strategy Analysis

4. Market Segmentation

4.1. Global Rugged Servers Market, By Type

4.1.1. Dedicated

4.1.2. Standard

4.2. Global Rugged Servers Market, By Offering

4.2.1. Hardware

4.2.2. Software & Services

4.3. Global Rugged Servers Market, By Application

4.3.1. Military & Aerospace

4.3.2. Telecommunication

4.3.3. Industrial

4.3.4. Energy & Power

4.3.5. Marine

4.3.6. Others

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

6. Company Profiles

6.1. Cisco Systems Inc.

6.2. Core Systems

6.3. Crystal Group

6.4. Dell Technologies Inc.

6.5. Fujitsu Ltd.

6.6. Hewlett Packard Enterprise Co.

6.7. Hitachi Ltd

6.8. IBM Corp.

6.9. Lenovo Group Ltd.

6.10. Mercury Systems

6.11. NEC corp.

6.12. Oracle Corp.

6.13. Siemens AG

6.14. Symmetrix

6.15. Systel Corp.

6.16. Toshiba Corp.

6.17. Trenton Systems

6.18. Unisys Corp.

1. GLOBAL RUGGED SERVERS MARKET RESEARCH AND ANALYSIS BY TYPE, 2021-2028 ($ MILLION)

2. GLOBAL DEDICATED RUGGED SERVERS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

3. GLOBAL STANDARD RUGGED SERVERS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

4. GLOBAL RUGGED SERVERS MARKET RESEARCH AND ANALYSIS BY OFFERING, 2021-2028 ($ MILLION)

5. GLOBAL RUGGED SERVERS HARDWARE MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

6. GLOBAL RUGGED SERVERS SOFTWARE & SERVICES MARKET RESEARCH, AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

7. GLOBAL RUGGED SERVERS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2021-2028 ($ MILLION)

8. GLOBAL RUGGED SERVERS FOR MILITARY & AEROSPACE MARKET RESEARCH, AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

9. GLOBAL RUGGED SERVERS FOR TELECOMMUNICATION MARKET RESEARCH, AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

10. GLOBAL RUGGED SERVERS FOR INDUSTRIAL MARKET RESEARCH, AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

11. GLOBAL RUGGED SERVERS FOR ENERGY & POWER MARKET RESEARCH, AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

12. GLOBAL RUGGED SERVERS FOR MARINE MARKET RESEARCH, AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

13. GLOBAL RUGGED SERVERS FOR OTHER MARKET RESEARCH, AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

14. NORTH AMERICAN RUGGED SERVERS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

15. NORTH AMERICAN RUGGED SERVERS MARKET RESEARCH AND ANALYSIS BY TYPE, 2021-2028 ($ MILLION)

16. NORTH AMERICAN RUGGED SERVERS MARKET RESEARCH AND ANALYSIS BY OFFERING, 2021-2028 ($ MILLION)

17. NORTH AMERICAN RUGGED SERVERS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2021-2028 ($ MILLION)

18. EUROPEAN RUGGED SERVERS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

19. EUROPEAN RUGGED SERVERS MARKET RESEARCH AND ANALYSIS BY TYPE, 2021-2028 ($ MILLION)

20. EUROPEAN RUGGED SERVERS MARKET RESEARCH AND ANALYSIS BY OFFERING, 2021-2028 ($ MILLION)

21. EUROPEAN RUGGED SERVERS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2021-2028 ($ MILLION)

22. ASIA-PACIFIC RUGGED SERVERS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

23. ASIA-PACIFIC RUGGED SERVERS MARKET RESEARCH AND ANALYSIS BY TYPE, 2021-2028 ($ MILLION)

24. ASIA-PACIFIC RUGGED SERVERS MARKET RESEARCH AND ANALYSIS BY OFFERING, 2021-2028 ($ MILLION)

25. ASIA-PACIFIC RUGGED SERVERS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2021-2028 ($ MILLION)

26. REST OF THE WORLD RUGGED SERVERS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

27. REST OF THE WORLD RUGGED SERVERS MARKET RESEARCH AND ANALYSIS BY TYPE, 2021-2028 ($ MILLION)

28. REST OF THE WORLD RUGGED SERVERS MARKET RESEARCH AND ANALYSIS BY OFFERING, 2021-2028 ($ MILLION)

29. REST OF THE WORLD RUGGED SERVERS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2021-2028 ($ MILLION)

1. GLOBAL RUGGED SERVERS MARKET SHARE BY TYPE, 2021 VS 2028 (%)

2. GLOBAL RUGGED SERVERS MARKET SHARE BY OFFERING, 2021 VS 2028 (%)

3. GLOBAL RUGGED SERVERS MARKET SHARE BY APPLICATION, 2021 VS 2028 (%)

4. GLOBAL RUGGED SERVERS MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

5. GLOBAL DEDICATED RUGGED SERVERS MARKET SHARE BY REGION, 2021 VS 2028 (%)

6. GLOBAL STANDARD RUGGED SERVERS MARKET SHARE BY REGION, 2021 VS 2028 (%)

7. GLOBAL RUGGED SERVERS HARDWARE MARKET SHARE BY REGION, 2021 VS 2028 (%)

8. GLOBAL RUGGED SERVERS SOFTWARE & SERVICES MARKET SHARE BY REGION, 2021 VS 2028 (%)

9. GLOBAL RUGGED SERVERS FOR MILITARY & AEROSPACE MARKET SHARE BY REGION, 2021 VS 2028 (%)

10. GLOBAL RUGGED SERVERS FOR TELECOMMUNICATION MARKET SHARE BY REGION, 2021 VS 2028 (%)

11. GLOBAL RUGGED SERVERS FOR INDUSTRIAL MARKET SHARE BY REGION, 2021 VS 2028 (%)

12. GLOBAL RUGGED SERVERS FOR ENERGY & POWER MARKET SHARE BY REGION, 2021 VS 2028 (%)

13. GLOBAL RUGGED SERVERS FOR MARINE MARKET SHARE BY REGION, 2021 VS 2028 (%)

14. GLOBAL RUGGED SERVERS FOR OTHER MARKET SHARE BY REGION, 2021 VS 2028 (%)

15. US RUGGED SERVERS MARKET SIZE, 2021-2028 ($ MILLION)

16. CANADA RUGGED SERVERS MARKET SIZE, 2021-2028 ($ MILLION)

17. UK RUGGED SERVERS MARKET SIZE, 2021-2028 ($ MILLION)

18. FRANCE RUGGED SERVERS MARKET SIZE, 2021-2028 ($ MILLION)

19. GERMANY RUGGED SERVERS MARKET SIZE, 2021-2028 ($ MILLION)

20. ITALY RUGGED SERVERS MARKET SIZE, 2021-2028 ($ MILLION)

21. SPAIN RUGGED SERVERS MARKET SIZE, 2021-2028 ($ MILLION)

22. REST OF EUROPE RUGGED SERVERS MARKET SIZE, 2021-2028 ($ MILLION)

23. INDIA RUGGED SERVERS MARKET SIZE, 2021-2028 ($ MILLION)

24. CHINA RUGGED SERVERS MARKET SIZE, 2021-2028 ($ MILLION)

25. JAPAN RUGGED SERVERS MARKET SIZE, 2021-2028 ($ MILLION)

26. SOUTH KOREA RUGGED SERVERS MARKET SIZE, 2021-2028 ($ MILLION)

27. REST OF ASIA-PACIFIC RUGGED SERVERS MARKET SIZE, 2021-2028 ($ MILLION)

28. REST OF THE WORLD RUGGED SERVERS MARKET SIZE, 2021-2028 ($ MILLION)