Rum Market

Rum Market Size, Share & Trends Analysis Report by Product (White Rum, Light or Gold Rum, and Dark Rum), and by Distribution Channel (Online and Offline) Forecast Period (2024-2031)

Rum market is anticipated to grow at a CAGR of 5.5% during the forecast period (2024-2031). Rum is a popular alcoholic beverage worldwide, known for its unique flavors and rich history. As incomes rise globally, there has been a noticeable increase in the consumption of all types of alcoholic beverages, including rum, reflecting a growing appreciation for quality drinks and indulgence among consumers, leading to market growth.

Market Dynamics

Rising Disposable Income

Rising disposable income in emerging markets has led to increased spending on premium spirits, including rum. Consumers seek quality, unique flavor profiles, and sophistication in their drinking choices. The spirit industry has responded with a diverse range of premium and aged rums. The growth of middle-class populations has further fueled demand for luxury goods, including premium spirits. Emerging markets are increasingly important in driving global spirits consumption and shaping industry trends.

Rum's Role in the Growing Cocktail Culture

At present time, more customers are accepting mixology and unique drinking events thus increasing the request for rum. The growing mega cocktail culture across the globe has been driven by the rise of more mixology fans as well as unique cocktail drinking events. Rum’s diverse nature has resulted in its use as a mandatory component in various cocktails including traditional favorites and modern creations. Moreover, attributing to social media and online communities, enthusiasts' cocktail culture and home bartending have thrived a lot. Due to that, rum demand is on the rise thus making sure it takes a central place in alcoholic drinks worldwide.

Market Segmentation

Our in-depth analysis of the global rum market includes the following segments by product and distribution channel.

- Based on product, the market is segmented into white rum, light or gold rum, and dark rum.

- Based on the distribution channel, the market is bifurcated into online and offline.

Offline Channels Lead Rum Market Growth

Offline channel of distribution leads the market. Offline channels include liquor stores, supermarkets, and specialty shops which have a strong market share in the rum industry. In accordance with, their easy accessibility and capacity to peruse a large selection of rum brands and kinds, offline purchase empowers customers to make well-informed purchasing judgments. Thus, consumers find offline channels appealing. Extending market penetration and driving segment growth, industry leaders utilize offline channels to launch new rum brands. Furthermore, cooperation between suppliers and retailers encourages creativity in marketing plans and promotional events such as in-store tastings and new product introductions, which boosts customer involvement and boosts commerce.

Dark Rum Segment Securing a Significant Market Share

The dark rum segment dominates the market, they stand out as full of strong rich taste. They are kept maturing properly in oak barrels until they attain maturity and attain refined taste as well as smoothness. These offerings are meant for the more notable drinkers’ market which includes perceptive amateurs who like their drink to be mature or full of depth and intricacy. There has been a growing preference for dark rum that has been aged among the youth, especially the present generation customers. This generation is known to have very peculiar tastes as they tend to appreciate real craftsmanship as opposed to commercial imitations. Therefore, young individuals particularly in the ages of eighteen to thirty-five (18-35) like these drinks. For instance, in August 2023, BACARDÍ Rum launched its new limited-edition premium variant, the BACARDÍ Reserva Ocho Sevillian Orange Cask Finish. This expression, which follows the popularity of the Sherry Cask and Rye Cask Finish releases, is a part of the brand's aged rum series. After aging for a minimum of eight years in American oak barrels exposed to the Caribbean sun, the mix is refined for a further three to six months in Seville, Spain Vino de Naranja barrels. The end product is a citrus-forward, silky rum that smells of smokey wood, orange peel, and dried stone fruits.

Regional Outlook

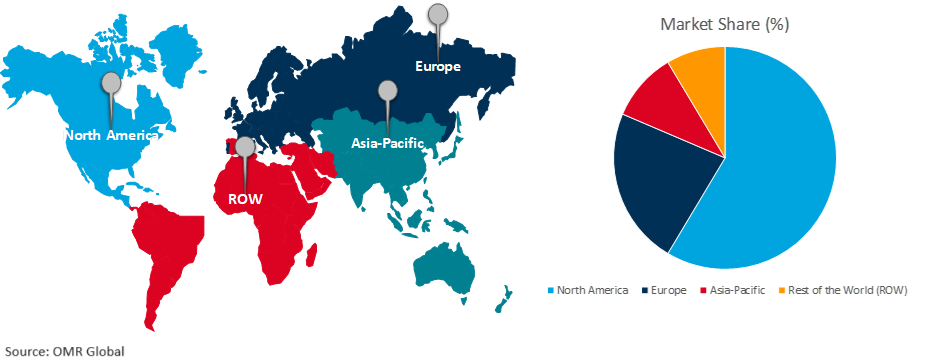

The global rum market is further segmented based on geography including North America (the US, and Canada), Europe (the UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia-Pacific), and the Rest of the World (the Middle East & Africa, and Latin America).

Increased Consumer Demand for Rum in Asia Pacific

The Asia Pacific rum market is growing significantly owing to factors such as rising disposable incomes, a large population, and the increasing popularity of rum among younger demographics. India, the Philippines, Australia, and China present exciting growth opportunities, with the rise of experiential liquor retail outlets expected to further boost sales. Overall, the Asia Pacific rum market is characterized by dynamic growth and innovation driven by changing consumer preferences and evolving retail landscape.

Global Rum Market Growth by Region 2024-2031

North America Holds Major Market Share

The North American rum market has significant growth potential, driven by a diverse range of international rum producers, increased demand for premium rum, and the popularity of flavored and spiced rum in cocktails. This trend towards premiumization is also reflected in the UK and France, where younger consumers are showing a growing interest in rum, supported by targeted marketing and product innovation. The North American rum market is well-positioned to drive growth in the global spirits industry, due to evolving consumer behaviors and strategic marketing initiatives.

Market Players Outlook

*Note: Major Players Sorted in No Particular Order.

The major companies serving the global rum market include Asahi Group Holdings Ltd., Bacardi Global Brands Ltd., Davide Campari-Milano Spa, Demerara Distillers Ltd., and Diageo Plc., among others. The market players are increasingly focusing on business expansion and product development by applying strategies such as collaborations, mergers and acquisitions to stay competitive in the market. For instance, in April 2024, La Martiniquaise-Bardinet-owned agricole rum brand Saint James released an 18-year-old limited release. The new edition joins the Martinique-based distillery’s range of seven-, 12- and 15-year-old age-statement rums.

The Report Covers

- Market value data analysis of 2023 and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global rum market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. Asahi Group Holdings, Ltd.

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. Bacardi & Co. Ltd.

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. Davide Campari-Milano N.V.

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Demerara Distillers Ltd.

3.5.1. Overview

3.5.2. Financial Analysis

3.5.3. SWOT Analysis

3.5.4. Recent Developments

3.6. Diageo plc

3.6.1. Overview

3.6.2. Financial Analysis

3.6.3. SWOT Analysis

3.6.4. Recent Developments

3.7. Key Strategy Analysis

4. Market Segmentation

4.1. Global Rum Market by Products

4.1.1. White Rum

4.1.2. Light or Gold Rum

4.1.3. Dark Rum

4.2. Global Rum Market by Distribution Channel

4.2.1. Online

4.2.2. Offline

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

5.4.1. Latin America

5.4.2. Middle East & Africa

6. Company Profiles

6.1. Admiral Rodney

6.2. Captain Morgan

6.3. Cayman Spirits Co.

6.4. Cruzan Rum Distillery (Suntory Global Spirits Inc.)

6.5. Demerara Distillers Ltd.

6.6. Destilerías Arehucas S.A.

6.7. Edrington Group Ltd.

6.8. Elements Eight Rum Co.

6.9. Goslings Rum®

6.10. Halewood Artisanal Spirits PLC

6.11. Havana Club

6.12. Mount Gay Distilleries Ltd

6.13. Nova Scotia Spirit Co.

6.14. Radico Khaitan Ltd.

6.15. Rhum J.M

6.16. RON BARCELO, SRL

6.17. Ron del Barrilito

6.18. Rhum Saint James

6.19. Tanduay Distillers, Inc.

6.20. West Indies Rum Distillery

6.21. William Grant & Sons Group

1. GLOBAL RUM MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2023-2031 ($ MILLION)

2. GLOBAL WHITE RUM MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

3. GLOBAL LIGHT OR GOLD RUM MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

4. GLOBAL DARK RUM MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

5. GLOBAL RUM MARKET RESEARCH AND ANALYSIS BY DISTRIBUTION CHANNEL, 2023-2031 ($ MILLION)

6. GLOBAL ONLINE RUM MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

7. GLOBAL OFFLINE RUM MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

8. GLOBAL RUM MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

9. NORTH AMERICAN RUM MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

10. NORTH AMERICAN RUM MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2023-2031 ($ MILLION)

11. NORTH AMERICAN RUM MARKET RESEARCH AND ANALYSIS BY DISTRIBUTION CHANNEL, 2023-2031 ($ MILLION)

12. EUROPEAN RUM MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

13. EUROPEAN RUM MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2023-2031 ($ MILLION)

14. EUROPEAN RUM MARKET RESEARCH AND ANALYSIS BY DISTRIBUTION CHANNEL, 2023-2031 ($ MILLION)

15. ASIA-PACIFIC RUM MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

16. ASIA-PACIFIC RUM MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2023-2031 ($ MILLION)

17. ASIA-PACIFIC RUM MARKET RESEARCH AND ANALYSIS BY DISTRIBUTION CHANNEL, 2023-2031 ($ MILLION)

18. REST OF THE WORLD RUM MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

19. REST OF THE WORLD RUM MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2023-2031 ($ MILLION)

20. REST OF THE WORLD RUM MARKET RESEARCH AND ANALYSIS BY DISTRIBUTION CHANNEL, 2023-2031 ($ MILLION)

1. GLOBAL RUM MARKET SHARE BY PRODUCT, 2023 VS 2031 (%)

2. GLOBAL WHITE RUM MARKET SHARE BY REGION, 2023 VS 2031 (%)

3. GLOBAL LIGHT OR GOLD RUM MARKET SHARE BY REGION, 2023 VS 2031 (%)

4. GLOBAL DARK RUM MARKET SHARE BY REGION, 2023 VS 2031 (%)

5. GLOBAL RUM MARKET SHARE BY DISTRIBUTION CHANNEL, 2023 VS 2031 (%)

6. GLOBAL ONLINE RUM MARKET SHARE BY REGION, 2023 VS 2031 (%)

7. GLOBAL OFFLINE RUM MARKET SHARE BY REGION, 2023 VS 2031 (%)

8. GLOBAL RUM MARKET SHARE BY REGION, 2023 VS 2031 (%)

9. US RUM MARKET SIZE, 2023-2031 ($ MILLION)

10. CANADA RUM MARKET SIZE, 2023-2031 ($ MILLION)

11. UK RUM MARKET SIZE, 2023-2031 ($ MILLION)

12. FRANCE RUM MARKET SIZE, 2023-2031 ($ MILLION)

13. GERMANY RUM MARKET SIZE, 2023-2031 ($ MILLION)

14. ITALY RUM MARKET SIZE, 2023-2031 ($ MILLION)

15. SPAIN RUM MARKET SIZE, 2023-2031 ($ MILLION)

16. REST OF EUROPE RUM MARKET SIZE, 2023-2031 ($ MILLION)

17. INDIA RUM MARKET SIZE, 2023-2031 ($ MILLION)

18. CHINA RUM MARKET SIZE, 2023-2031 ($ MILLION)

19. JAPAN RUM MARKET SIZE, 2023-2031 ($ MILLION)

20. SOUTH KOREA RUM MARKET SIZE, 2023-2031 ($ MILLION)

21. REST OF ASIA-PACIFIC RUM MARKET SIZE, 2023-2031 ($ MILLION)

22. LATIN AMERICA RUM MARKET SIZE, 2023-2031 ($ MILLION)

23. MIDDLE EAST AND AFRICA RUM MARKET SIZE, 2023-2031 ($ MILLION)