Safety Laser Scanner Market

Safety Laser Scanner Market Size, Share & Trends Analysis Report by Type (Mobile Safety Laser Scanner and Stationary Safety Laser Scanner), and by End-Use (Automotive, Food and Beverages, Healthcare and Pharmaceuticals, and Consumer Electronics), Forecast Period (2024-2031)

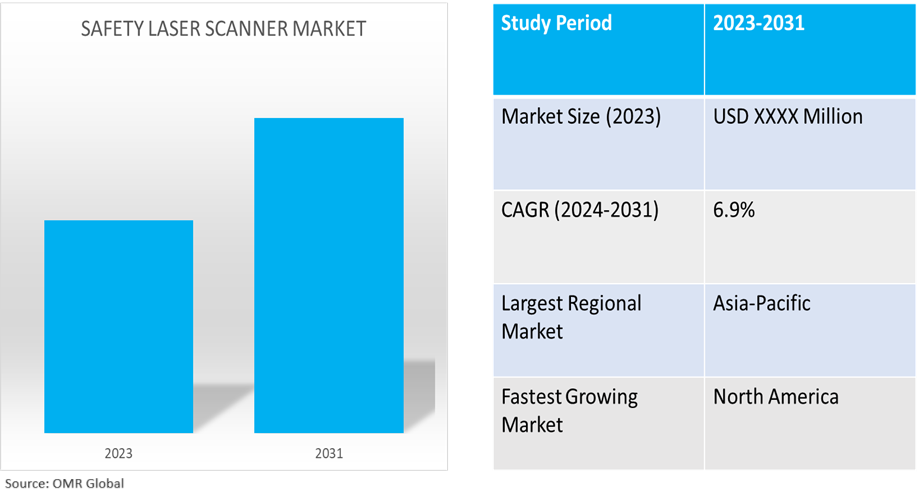

Safety laser scanner market is anticipated to grow at a CAGR of 6.9% during the forecast period (2024-2031). Safety laser scanners are most used in manufacturing for machine guarding to protect personnel from injury. Safety laser scanners offer non-contact protection while scanning a large area. The protection (safety) zone is also 100.0% customizable. This technology often has clear advantages over hard guarding, fencing, or pressure-sensitive safety mats.

Market Dynamics

Advancements in Safety Laser Scanner

Technological advancements in safety laser scanner are analyzed to drive the market growth in the forecast period. Several companies are investing heavily in the advancements in safety laser scanners. For instance, in April 2024, Smiths Detection, a global leader in threat detection and security screening technologies, and part of the Smiths Group, announced it is supplying Belfast International Airport with the industry-leading HI-SCAN 6040 CTiX carry-on baggage X-ray scanners and the iLane A20SC ATRS, the smart automatic tray return system. The 3D images produced by the HI-SCAN 6040 CTiX will allow passengers to leave liquids and large electronics in their carry-on baggage as they pass through security. Coupled with an automatic tray return system, the technological upgrades will revolutionize the passenger experience at the airport. The systems will be rolled out in line with the UK government’s mandate to introduce computed tomography (CT) X-ray scanners.

Rising Adoption of Safety Laser Scanners for Safeguarding Machines in Industries

Globally, one of the major driving factors for the growth of the global safety laser scanner market is the increasing adoption of infrared laser beam-based safety devices in industrial automation. In industrial automation, there are huge numbers of machines working on assembly lines. To safeguard machines, laser safety scanners are widely used due to their versatility. The scanners can be mounted vertically or horizontally to cover various types of hazards. Moreover, the sensor detects are mounted on an automated guide vehicle to reduce the risk of accidents with objects or people. Additionally, the scanner prevents hazards from operating when a person or an object is in a dangerous area. Owing to these advantages safety laser scanners are increasingly used in industrial automation applications. As a result of this, the rising adoption of safety laser scanners in industrial automation for safeguarding machines is expected to drive the market during the forecast period.

Market Segmentation

- Based on type, the market is segmented into mobile safety laser scanners and stationary safety laser scanners.

- Based on end-use, the market is segmented into automotive, food and beverages, healthcare and pharmaceuticals, and consumer electronics.

Automotive is Projected to Emerge as the Largest Segment

The automotive segment is expected to hold the largest share of the market. The increasing usage of safety laser scanners for automotive applications such as vehicle navigation, robotic work cells, automated guided vehicles (AGV), and others drives market growth. Usually, there are two kinds of lasers used on the AGVs, one for navigation and the other for detecting obstacles in the path by safety laser scanners; and is used to move trolleys through the workshop and warehouse especially when combined with lean system trolleys and gravity-fed flow rack. In manufacturing facilities such as semi-automatic painting, the machine requires the frequent entry of operators to move out of the painted parts. In such cases, an advanced safety laser scanner enables two-way protection to the machine allowing entry to the operator for replacing the finished part and simultaneously protecting the area where it is working on another part.

Mobile Segment to Hold a Considerable Market Share

The mobile segment procured a considerable growth rate in the safety laser scanner market. The segment is growing as more end-user businesses adopt it, including those in the automotive, electronics, healthcare, and pharmaceutical sectors. For example, mobile safety laser scanners enhance patient security and satisfaction in the healthcare industry. Also, these safety laser scanners are widely employed in the pharmaceutical manufacturing sector, which makes substantial use of infrared laser beam-based safety equipment.

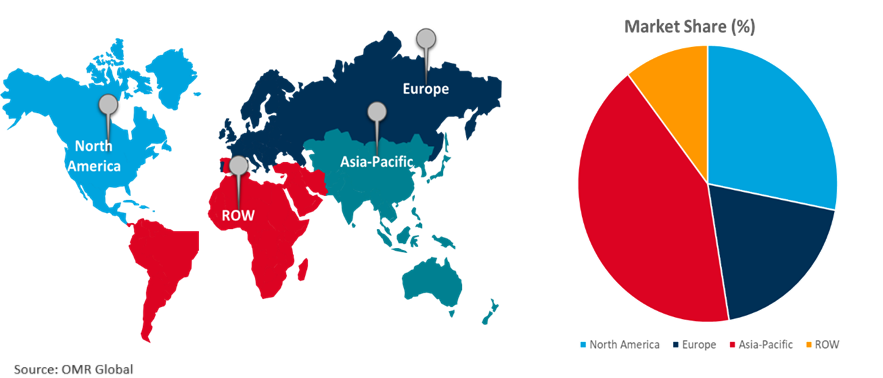

Regional Outlook

The global safety laser scanner market is further segmented based on geography including North America (the US, and Canada), Europe (UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia-Pacific), and the Rest of the World (the Middle East & Africa, and Latin America).

North America to Grow at Fastest CAGR

In North America, the US acquired a prime share in the safety laser scanner market in the North America region and is expected to grow at a high CAGR during the forecast period of 2022-2031. The US holds a dominant position in the safety laser scanner market due to the high adoption of the scanner in the region. The US laser scanner market has dominated the region as there is the increased use of 3D laser scanner cameras to look into tragic traffic accidents and in various other industries like automobile and healthcare and owing to the presence of prime players such as SACK AG, AMRON Corporation, Rockwell Automation, Inc., Leuze Electronics, and others that have significant investments in next-generation machine safety systems.

Global Safety Laser Scanner Market Growth by Region 2024-2031

Asia-Pacific Holds Major Market Share

Among all the regions, Asia-Pacific holds a significant share as China holds a dominant market share in the Asia-Pacific region and is expected to follow the same trend during the forecast period, owing to a significant rise in investment by prime players in next-generation machine safety systems to boost the safety laser scanner market. Recently, China has been facing a rise in labor wages and tighter regulations resulting in higher operating costs for manufacturing companies. Hence these companies are seeking opportunities in Southern East Asia for a lower-value production network which would be largely integrated into the global manufacturing value chain. Moreover, mega trade policies like RCEP (Regional Comprehensive Economic Partnership) are helping free cross-border trade in the region for automotive and consumer goods & electronics.

Market Players Outlook

*Note: Major Players Sorted in No Particular Order.

The major companies serving the global safety laser scanner market include Leuze Electronic Pvt. Ltd., OMRON Corp., Rockwell Automation, and SICK AG, among others. The market players are increasingly focusing on business expansion and product development by applying strategies such as collaborations, mergers, and acquisitions to stay competitive in the market. For instance, in April 2022, Leuze developed the new 36-sensor series including a safety sensor. These sensors are suitable for the demanding requirements in intralogistics, packaging systems, and the automotive industry. They detect objects with different optical properties even at a great distance, with vibration, ambient lighting, or soiling.

The Report Covers

- Market value data analysis of 2023 and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global safety laser scanner market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. Leuze Electronic Pvt. Ltd.

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. OMRON Corporation

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. Rockwell Automation

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. SICK AG

3.5.1. Overview

3.5.2. Financial Analysis

3.5.3. SWOT Analysis

3.5.4. Recent Developments

3.6. Key Strategy Analysis

4. Market Segmentation

4.1. Global Safety Laser Scanner Market by Type

4.1.1. Mobile Safety Laser Scanner

4.1.2. Stationary Safety Laser Scanner

4.2. Global Safety Laser Scanner Market by End-Use

4.2.1. Automotive

4.2.2. Food and Beverages

4.2.3. Healthcare and Pharmaceuticals

4.2.4. Consumer Electronics

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

5.4.1. Latin America

5.4.2. Middle East & Africa

6. Company Profiles

6.1. AEROTECH US

6.2. Arcus Automation Pvt. Ltd.

6.3. Banner Engineering Corporation

6.4. Clairex Technologies, Inc.

6.5. Datalogic S.p.A.

6.6. Datum Tech Solutions

6.7. Hans Turck GmbH & Co. KG

6.8. Hokuyo Automatic Co. Ltd

6.9. IDEC Corporation

6.10. Keyence Corporation

6.11. Panasonic Corporation

6.12. Pepperl+Fuchs Pvt. Ltd.

6.13. Pilz GmbH & Co. KG

6.14. ReeR SpA

6.15. Trimble Inc.

6.16. Vitrek Corporation

1. GLOBAL SAFETY LASER SCANNER MARKET RESEARCH AND ANALYSIS BY TYPE, 2023-2031 ($ MILLION)

2. GLOBAL MOBILE SAFETY LASER SCANNER MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

3. GLOBAL STATIONARY SAFETY LASER SCANNER MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

4. GLOBAL SAFETY LASER SCANNER MARKET RESEARCH AND ANALYSIS BY END-USE, 2023-2031 ($ MILLION)

5. GLOBAL SAFETY LASER SCANNER MARKET FOR AUTOMOTIVE RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

6. GLOBAL SAFETY LASER SCANNER MARKET FOR FOOD AND BEVERAGES RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

7. GLOBAL SAFETY LASER SCANNER MARKET FOR HEALTHCARE AND PHARMACEUTICALS RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

8. GLOBAL SAFETY LASER SCANNER MARKET FOR CONSUMER ELECTRONICS RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

9. GLOBAL SAFETY LASER SCANNER MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

10. NORTH AMERICAN SAFETY LASER SCANNER MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

11. NORTH AMERICAN SAFETY LASER SCANNER MARKET RESEARCH AND ANALYSIS BY TYPE, 2023-2031 ($ MILLION)

12. NORTH AMERICAN SAFETY LASER SCANNER MARKET RESEARCH AND ANALYSIS BY END-USE, 2023-2031 ($ MILLION)

13. EUROPEAN SAFETY LASER SCANNER MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

14. EUROPEAN SAFETY LASER SCANNER MARKET RESEARCH AND ANALYSIS BY TYPE, 2023-2031 ($ MILLION)

15. EUROPEAN SAFETY LASER SCANNER MARKET RESEARCH AND ANALYSIS BY END-USE, 2023-2031 ($ MILLION)

16. ASIA-PACIFIC SAFETY LASER SCANNER MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

17. ASIA-PACIFIC SAFETY LASER SCANNER MARKET RESEARCH AND ANALYSIS BY TYPE, 2023-2031 ($ MILLION)

18. ASIA-PACIFIC SAFETY LASER SCANNER MARKET RESEARCH AND ANALYSIS BY END-USE, 2023-2031 ($ MILLION)

19. REST OF THE WORLD SAFETY LASER SCANNER MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

20. REST OF THE WORLD SAFETY LASER SCANNER MARKET RESEARCH AND ANALYSIS BY TYPE, 2023-2031 ($ MILLION)

21. REST OF THE WORLD SAFETY LASER SCANNER MARKET RESEARCH AND ANALYSIS BY END-USE, 2023-2031 ($ MILLION)

1. GLOBAL SAFETY LASER SCANNER MARKET SHARE BY TYPE, 2023 VS 2031 (%)

2. GLOBAL MOBILE SAFETY LASER SCANNER MARKET SHARE BY REGION, 2023 VS 2031 (%)

3. GLOBAL STATIONARY SAFETY LASER SCANNER MARKET SHARE BY REGION, 2023 VS 2031 (%)

4. GLOBAL SAFETY LASER SCANNER MARKET SHARE BY END-USE, 2023 VS 2031 (%)

5. GLOBAL SAFETY LASER SCANNER MARKET FOR AUTOMOTIVE MARKET SHARE BY REGION, 2023 VS 2031 (%)

6. GLOBAL SAFETY LASER SCANNER MARKET FOR FOOD AND BEVERAGES SHARE BY REGION, 2023 VS 2031 (%)

7. GLOBAL SAFETY LASER SCANNER MARKET FOR HEALTHCARE AND PHARMACEUTICALS SHARE BY REGION, 2023 VS 2031 (%)

8. GLOBAL SAFETY LASER SCANNER MARKET FOR CONSUMER ELECTRONICS SHARE BY REGION, 2023 VS 2031 (%)

9. GLOBAL SAFETY LASER SCANNER MARKET SHARE BY REGION, 2023 VS 2031 (%)

10. US SAFETY LASER SCANNER MARKET SIZE, 2023-2031 ($ MILLION)

11. CANADA SAFETY LASER SCANNER MARKET SIZE, 2023-2031 ($ MILLION)

12. UK SAFETY LASER SCANNER MARKET SIZE, 2023-2031 ($ MILLION)

13. FRANCE SAFETY LASER SCANNER MARKET SIZE, 2023-2031 ($ MILLION)

14. GERMANY SAFETY LASER SCANNER MARKET SIZE, 2023-2031 ($ MILLION)

15. ITALY SAFETY LASER SCANNER MARKET SIZE, 2023-2031 ($ MILLION)

16. SPAIN SAFETY LASER SCANNER MARKET SIZE, 2023-2031 ($ MILLION)

17. REST OF EUROPE SAFETY LASER SCANNER MARKET SIZE, 2023-2031 ($ MILLION)

18. INDIA SAFETY LASER SCANNER MARKET SIZE, 2023-2031 ($ MILLION)

19. CHINA SAFETY LASER SCANNER MARKET SIZE, 2023-2031 ($ MILLION)

20. JAPAN SAFETY LASER SCANNER MARKET SIZE, 2023-2031 ($ MILLION)

21. SOUTH KOREA SAFETY LASER SCANNER MARKET SIZE, 2023-2031 ($ MILLION)

22. REST OF ASIA-PACIFIC SAFETY LASER SCANNER MARKET SIZE, 2023-2031 ($ MILLION)

23. LATIN AMERICA SAFETY LASER SCANNER MARKET SIZE, 2023-2031 ($ MILLION)

24. MIDDLE EAST AND AFRICA SAFETY LASER SCANNER MARKET SIZE, 2023-2031 ($ MILLION)