Saffron Market

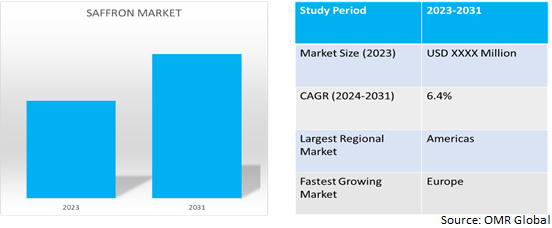

Saffron Market Size, Share & Trends Analysis Report by Type (Organic and Convention), by Form (Thread or Filament, Powder, and Liquid), and by Application (Food & Beverage, Dietary Supplements, Pharmaceutical, Cosmetic and Skincare, and Others) Forecast Period (2024-2031) Update Available - Forecast 2025-2035

Saffron market is anticipated to grow at a CAGR of 6.4% during the forecast period (2024-2031). Primary factor supporting the market growth includes high antioxidant content, health benefits, memory enhancement, and UV-absorbing properties. Its high usage in cosmetic and medical applications is expected to drive its growth.

Market Dynamics

Increasing demand for natural and organic products

The demand for natural and organic saffron in various industries is on the rise owing to health-conscious consumers' preference for natural ingredients. According to the National Institute of Health (NIH) report published in March 2022, the global market for herbal cosmetics is experiencing a rapid growth due to the increasing awareness about the minimal side effects of herbal products. Valued at approximately $11.0 billion in 2016, the natural and organic personal care products market is projected to reach $22.0 billion by 2022.

Furthermore, its a versatile ingredient, is utilized in various industries such as, pharmaceuticals, cosmetics, and food products due to its minimal processing to preserve its flavor and aroma. According to the National Institute of Health (gov.) in June 2023, comprehensively compile the production, chemical composition, transformation, biological activities, health-healing properties, and quality assessment, it is important to consider its various uses and the difficulties associated with its production. With approximately 60,000 flowers required to produce 1 kg of dried stigma, which is estimated at 10,000$ USD, it additionally stands as the most expensive spice on the world market, making it a prime target for adulteration. Therefore, the development of fraud detection methods is essential in ensuring the authenticity and quality of products.

Increasing consumer awareness of health benefits

The growing consumer awareness of health advantages leads to increased demand for natural products such as saffron, that possess antioxidant properties.According to the National Institute of Health (gov.) in March 2024,its a agricultural commodity with a global production estimated at approximately 500 tons in 2019. Iran is the leading producer, followed by India. The global market was valued at US$ 1.07 billion in 2022 and is projected to reach a value of US$ 1.77 billion between 2023 and 2029. its known for its rich content of carotenoids, picrocrocin, safranal, and terpenes, which have various health benefits such as hepatoprotective, anti-viral, anti-inflammatory, and analgesic properties, as well as the potential to reduce the risk of cancer. Additionally, it is a good source of flavonoids, phenolic acids, and phytosterols, and has been found to enhance learning and memory.

Market Segmentation

Our in-depth analysis of the global Saffron market includes the following segments by type, form, and application:

- Based on type, the market is sub-segmented into organic, and convention.

- Based on form, the market is augmented into thread or filament, powder, and liquid.

- Based on application, the market is sub-segmented into food & beverage, dietary supplements, pharmaceutical, cosmetic and skincare, and others (food supplements, and personal care).

Food & Beverage is Projected to Emerge as the Largest Segment

Based on the application, the saffron market is sub-segmented into food & beverage, dietary supplements, pharmaceutical, cosmetic and skincare, and other (food supplements, and personal care). Among these, the food & beverage sub-segment is expected to hold the largest share of the market. The primary factor supporting the segment's growth includes food & beverage companies are leveraging market opportunities through product diversification, geographical expansion, strategic collaborations, and innovative saffron-based formulas to meet increasing demand. For instance, in October 2022, Saffron Co. launched health-oriented food & beverages, including saffron drinks and supplements such as ‘kesar’ flavoured whey protein, targeted the youth and Gen-Z. It provided the most costly and delicate spice in the globe to both domestic and international markets. Its major goal is to expand and diversify its health-related business.

Organic Sub-segment to Hold a Considerable Market Share

The beauty and cosmetic industry is experiencing significant growth owing to rising consumer dem and for innovative skincare products, including individuals infused with organic saffron. For instance, in June 2022, SoulTree has introduced India's first range of products using 100% pure, certified Organic Mogra Saffron. The Advanced Kumkumadi range includes eight skin revitalising products, enriched with exotic ingredients such as, Flame of the Forest, Chandan, Lodhra, Manjishtha, and Lotus. This allows beauty enthusiasts to customize skincare routines.

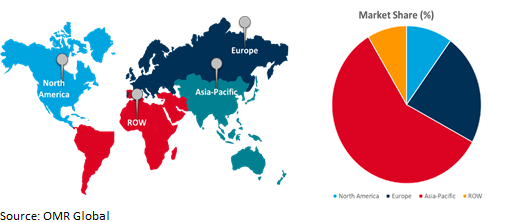

Regional Outlook

The global saffron market is further segmented based on geography including North America (the US, and Canada), Europe (UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia), and the Rest of the World (the Middle East & Africa, and Latin America).

The demand for premium saffron is on the rise in the European market

The Europe market is experiencing a surge in demand for premium ingredients, particularly, owing to its unique flavor profile and high-quality culinary experiences. For instance, in December 2020, Jammu and Kashmir government introduced Kashmiri saffron in the UAE market, promoting it with the Geographical Indication (GI) tag to boost the Valley's global brand.

Global Saffron Market Growth by Region 2024-2031

Asia-Pacific Holds Major Market Share

Among all the regions, Asia-Pacific holds a significant share owing to the growing demand for government laws and regulations possessed an immense influence on the business; it stimulate market access, research, and development of cultivation. According to the Indian Institute of Integrative Medicine , in Janurary 2021, its a highly expensive spice, is a perennial herb from the Iris family, known for its aroma, color, and use in flavoring, medicinal, and pharmaceutical industries. Kashmir saffron is famous globally owing to its high crocin content and rich aroma. It is produced in Jammu and Kashmir, with Iran, India, Spain, and Greece being major producers. Iran contributes 88% of the globe's production, while India produces 7%. The industry faces threats from countries like Iran, Spain, and Greece, who have more intensive production technologies. The industry in J&K needs to expand its cultivation area and productivity to remain competitive. With 3715 hectares under cultivation, production is 16 MT and 3.0 – 4.0 kg/ha. Expanding cultivation to non-traditional areas and improve sustainability and livelihood security for marginally poor farmers.

Market Players Outlook

*Note: Major Players Sorted in No Particular Order

The major companies serving the global saffron market include, Boston Scientific Corp.,Edwards Lifesciences Corp.,Medtronic PLC,Penumbra, Inc., and Teleflex Inc., among others. The market players are increasingly focusing on business expansion and product development by applying strategies such as collaborations, mergers, and acquisitions to stay competitive in the market. For instance, In January 2022, ENTOD Pharma introduced saffron-based eye care product.This French-made natural eye supplement, made from Persianextract, effectively treats eye conditions such as, macular degeneration, glaucoma, diabetic retinopathy, and retinitis pigmentosa.

The Report Covers

- Market value data analysis of 2023 and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global saffron market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. EVEREST Food Products Pvt. Ltd.

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. Flora Saffron

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. Great American Spice Co.

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Key Strategy Analysis

4. Market Segmentation

4.1. Global Saffron Market by Type

4.1.1. Organic

4.1.2. Convention

4.2. Global Saffron Market by Form

4.2.1. Thread or Filament

4.2.2. Powder

4.2.3. Liquid

4.3. Global Saffron Market by Application

4.3.1. Food & Beverage

4.3.2. Dietary Supplements

4.3.3. Pharmaceutical

4.3.4. Cosmetic and Skincare

4.3.5. Others (Food Supplements and Personal Care)

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

6. Company Profiles

6.1. Esfedan Saffron Co.

6.2. Gohar saffron co.

6.3. Indus Organics

6.4. Iran Saffron Co.

6.5. Mehr Saffron

6.6. Mehrab Saffron

6.7. Rowhani Saffron Co.

6.8. Royal Saffron

6.9. Saffron Business

6.10. Safran

6.11. Saharkhiz Saffron Co.

6.12. Tarvand Saffron Ghayen Co.

1. GLOBAL SAFFRON MARKET RESEARCH AND ANALYSIS BY TYPE, 2023-2031 ($ MILLION)

2. GLOBAL ORGANIC SAFFRON MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

3. GLOBAL CONVENTION SAFFRON MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

4. GLOBAL SAFFRON MARKET RESEARCH AND ANALYSIS BY FORM, 2023-2031 ($ MILLION)

5. GLOBAL SAFFRON AS THREAD OR FILAMENT MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

6. GLOBAL SAFFRON AS POWDER MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

7. GLOBAL SAFFRON AS LIQUID MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

8. GLOBAL SAFFRON MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

9. GLOBAL SAFFRON IN FOOD & BEVERAGE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

10. GLOBAL SAFFRON IN DIETARY SUPPLEMENTS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

11. GLOBAL SAFFRON IN PHARMACEUTICAL MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

12. GLOBAL SAFFRON IN COSMETIC AND SKINCARE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

13. GLOBAL SAFFRON IN OTHER APPLICATIONS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

14. GLOBAL SAFFRON MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

15. NORTH AMERICAN SAFFRON MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

16. NORTH AMERICAN SAFFRON MARKET RESEARCH AND ANALYSIS BY TYPE, 2023-2031 ($ MILLION)

17. NORTH AMERICAN SAFFRON MARKET RESEARCH AND ANALYSIS BY FORM, 2023-2031 ($ MILLION)

18. NORTH AMERICAN SAFFRON MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

19. EUROPEAN SAFFRON MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

20. EUROPEAN SAFFRON MARKET RESEARCH AND ANALYSIS BY TYPE, 2023-2031 ($ MILLION)

21. EUROPEAN SAFFRON MARKET RESEARCH AND ANALYSIS BY FORM, 2023-2031 ($ MILLION)

22. EUROPEAN SAFFRON MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

23. ASIA-PACIFIC SAFFRON MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

24. ASIA-PACIFIC SAFFRON MARKET RESEARCH AND ANALYSIS BY TYPE, 2023-2031 ($ MILLION)

25. ASIA-PACIFIC SAFFRON MARKET RESEARCH AND ANALYSIS BY FORM, 2023-2031 ($ MILLION)

26. ASIA-PACIFIC SAFFRON MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

27. REST OF THE WORLD SAFFRON MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

28. REST OF THE WORLD SAFFRON MARKET RESEARCH AND ANALYSIS BY TYPE, 2023-2031 ($ MILLION)

29. REST OF THE WORLD SAFFRON MARKET RESEARCH AND ANALYSIS BY FORM, 2023-2031 ($ MILLION)

30. REST OF THE WORLD SAFFRON MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

1. GLOBAL SAFFRON MARKET SHARE BY TYPE, 2023 VS 2031 (%)

2. GLOBAL ORGANIC SAFFRON MARKET SHARE BY REGION, 2023 VS 2031 (%)

3. GLOBAL CONVENTION SAFFRON MARKET SHARE BY REGION, 2023 VS 2031 (%)

4. GLOBAL SAFFRON MARKET SHARE BY FORM, 2023 VS 2031 (%)

5. GLOBAL SAFFRON AS THREAD OR FILAMENT MARKET SHARE BY REGION, 2023 VS 2031 (%)

6. GLOBAL SAFFRON AS POWDER MARKET SHARE BY REGION, 2023 VS 2031 (%)

7. GLOBAL SAFFRON AS LIQUID MARKET SHARE BY REGION, 2023 VS 2031 (%)

8. GLOBAL SAFFRON MARKET SHARE BY APPLICATION, 2023 VS 2031 (%)

9. GLOBAL SAFFRON IN FOOD & BEVERAGE MARKET SHARE BY REGION, 2023 VS 2031 (%)

10. GLOBAL SAFFRON IN DIETARY SUPPLEMENTS MARKET SHARE BY REGION, 2023 VS 2031 (%)

11. GLOBAL SAFFRON IN PHARMACEUTICAL MARKET SHARE BY REGION, 2023 VS 2031 (%)

12. GLOBAL SAFFRON IN COSMETIC AND SKINCARE MARKET SHARE BY REGION, 2023 VS 2031 (%)

13. GLOBAL SAFFRON IN OTHER APPLICATION MARKET SHARE BY REGION, 2023 VS 2031 (%)

14. GLOBAL SAFFRON MARKET SHARE BY REGION, 2023 VS 2031 (%)

15. US SAFFRON MARKET SIZE, 2023-2031 ($ MILLION)

16. CANADA SAFFRON MARKET SIZE, 2023-2031 ($ MILLION)

17. UK SAFFRON MARKET SIZE, 2023-2031 ($ MILLION)

18. FRANCE SAFFRON MARKET SIZE, 2023-2031 ($ MILLION)

19. GERMANY SAFFRON MARKET SIZE, 2023-2031 ($ MILLION)

20. ITALY SAFFRON MARKET SIZE, 2023-2031 ($ MILLION)

21. SPAIN SAFFRON MARKET SIZE, 2023-2031 ($ MILLION)

22. REST OF EUROPE SAFFRON MARKET SIZE, 2023-2031 ($ MILLION)

23. INDIA SAFFRON MARKET SIZE, 2023-2031 ($ MILLION)

24. CHINA SAFFRON MARKET SIZE, 2023-2031 ($ MILLION)

25. JAPAN SAFFRON MARKET SIZE, 2023-2031 ($ MILLION)

26. SOUTH KOREA SAFFRON MARKET SIZE, 2023-2031 ($ MILLION)

27. REST OF ASIA-PACIFIC SAFFRON MARKET SIZE, 2023-2031 ($ MILLION)

28. LATIN AMERICA SAFFRON MARKET SIZE, 2023-2031 ($ MILLION)

29. THE MIDDLE EAST AND AFRICA SAFFRON MARKET SIZE, 2023-2031 ($ MILLION)