Satellite Launch Vehicle Market

Satellite Launch Vehicle Market Size, Share & Trends Analysis Report by Vehicle (Small and Medium to Heavy), by Launch (Single use/expendable, and Reusable), by Stage (Single Stage, Two Stage, and Three Stage), by Sub-Systems (Structure, Guidance, Navigation & Control System, Propulsion System, Telemetry, Tracking & Command System, Electrical Power System, And Separation System)., by Payload (<500 Kg, 500-2,500 Kg, and > 2,500 Kg), and by Orbit (Low Earth Orbit (LEO), Medium Earth Orbit (MEO), and Geostationary Orbit (GEO)) Forecast Period (2024-2031)

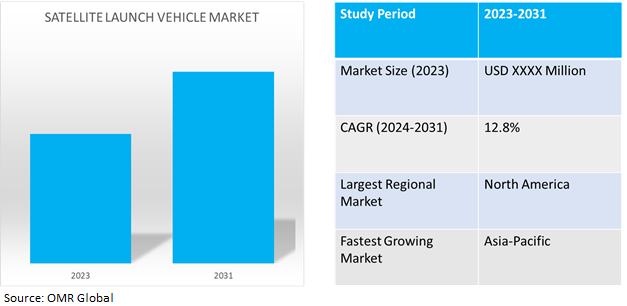

Satellite launch vehicle market is anticipated to grow at a significant CAGR of 12.8% during the forecast period (2024-2031). A satellite launch vehicle is a kind of launch vehicle used to deploy satellites into space and place them in their specific orbits. It serves the crucial purpose of transporting satellites and payloads from Earth’s surface or lower atmosphere to outer space. These vehicles are of various types based on weight, payload capacity, and orbital reach including small-lift satellite vehicles, reusable launch vehicles, geostationary satellite launch vehicles, and others.

Market Dynamics

Rising Demand for Small Satellites

Demand for small satellites has exponentially increased in recent years due to reduced cost, wider coverage, increasing application of small satellites, and less development time, which has positively impacted the satellite launch vehicle market, as most space organizations are willing to launch space missions at lower cost. For instance, In January 2024, the Indian cabinet approved a memorandum of understanding (MOU) between the Indian Space Research Organization (ISRO) and the Mauritius Research and Innovation Council (MRIC) concerning cooperation on the development of a joint small satellite. The MoU will help to establish a framework for cooperation between ISRO and MRIC on the development of a joint satellite as well as for cooperation on the use of the MRIC’s ground station.

Growth in the Commercial Satellite Market

With the entry of private players such as SpaceX, Blue Origin, and others in the satellite launch industry, there is an increase in the frequency of satellite launches, especially in commercial satellite segments. A wide range of commercial satellites for communication, navigation, weather monitoring, and other purposes have been launched to date. For instance, per the 26th annual State of the Satellite Industry Report (SSIR), for a fifth consecutive year, the commercial satellite industry launched a record number of commercial satellites into orbit, a total of 2,325 commercial satellites were deployed during 2022, an increase of over 35.0% compared to the previous year, while the space industry once again conducted the most launches (161) in history. By the end of 2022, a total of 7,316 active satellites circled the earth, an increase of approximately 51.0% over 2021 and 321.0% over the past five years.

Segmental Outlook

Our in-depth analysis of the global satellite launch vehicle market includes the following segments by vehicle, component, stage, sub-systems, payload, and orbit.

- Based on vehicles, the market is bifurcated into small and medium to heavy.

- Based on components, the market is bifurcated into single-use/expendable, and reusable.

- Based on stage, the market is sub-segmented into single-stage, two-stage, and three-stage.

- Based on sub-systems, the market is sub-segmented into structure, guidance, navigation & control system, propulsion system, telemetry, tracking & command system, electrical power system, and separation system.

- Based on payloads, the market is sub-segmented into <500 Kg, 500-2,500 Kg, and > 2,500 Kg.

- Based on orbit, the market is sub-segmented into low earth orbit (LEO), medium earth orbit (MEO), and geostationary orbit (GEO).

Small Size SLV Projected to Emerge as a Bigger Market

The small satellite launch vehicle has gained a lot of traction from government agencies as well as private companies due to its low development and launch cost, wider utility, and adaptability to various space missions. Wherein, small satellites can be launched as a secondary payload in a large or medium launch vehicle or on their own using a specialized launch vehicle which highly impacts the cost of space missions making it an emerging SLV type in the space vehicle launch industry.

Reusable SLVsmay dominate the Market

The partial reusable SLV types have been in existence since the 1980s but are being worked upon rapidly post entry of private players to reduce space missions' cost and reuse the technology to save on R&D. The sub-segment is moving towards fully reusable with the involvement of companies such as SpaceX, and Blue Origin. For instance, in March 2024, ISRO achieved a major milestone in reusable launch vehicle (RLV) technology, through the RLV LEX-02 landing experiment, the second of the series, conducted at the Aeronautical Test Range (ATR). After the RLV-LEX-01 mission was accomplished last year, RLV-LEX-02 demonstrated the autonomous landing capability of RLV from off-nominal initial conditions at release from a helicopter.

Propulsion Systems are Constantly Innovating

The propulsion system is at the core of most launch vehicles as it generates the required thrust for the rocket to launch using fuel and oxidizer. The space agencies have constantly worked on more efficient propulsion methods to complement present solid, liquid, and hybrid propulsion systems with efforts to develop systems consuming alternate energy sources that are more efficient such as methane-based propulsion systems, electric propulsion systems, non-toxic propulsion systems, and others.

Geostationary Orbit (GEO) remains a Dominant Sub-Segment

The GEO satellites sub-segment is in high demand due to its utility in communication, television, and weather-based services. Geostationary satellites are extensively utilized for communication and broadcasting because of their fixed position relative to the Earth. The global demand for satellite-based communication services, such as internet access, television transmission, and voice communication, is increasing. As more countries and areas seek reliable connections, the demand for satellite launches into GEO is projected to rise.

Regional Outlook

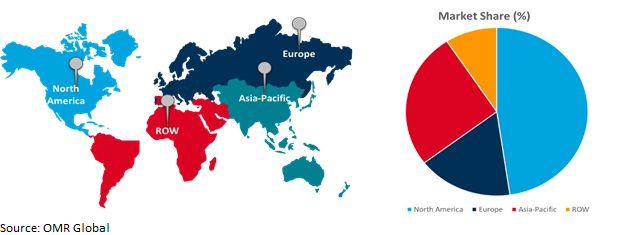

The global satellite launch vehicle market is further segmented based on geography including North America (the US, and Canada), Europe (UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia-Pacific), and the Rest of the World (the Middle East & Africa, and Latin America).

North America Holds Highest Share in Global Satellite Launch Vehicle Market

North America holds the highest share of the global satellite launch vehicle market share. The key factor contributing to the growth is the strong market demand for communication satellites, technological advancement in space exploration devices, and strategic initiatives by space agencies to strengthen their space exploration capabilities, Moreover, North America specifically the US has heavily invested in satellite launch vehicles, technology, and projects. For instance, in February 2024, NASA launched a satellite mission named PACE (Plankton, Aerosol, Cloud, ocean Ecosystem) to study ocean health, air quality, and the effects of a changing climate for the benefit of humanity. The satellite was launched using a SpaceX Falcon 9 rocket from Space Launch Complex 40 at CapeCanaveral Space Force Station in Florida, US.

Global Satellite Launch Vehicle Market Growth by Region 2024-2031

Asia-pacific is the Fastest Growing Satellite Launch Vehicle market

- The Asia-Pacific region is the space-tech outsourcing market for Western countries as they launch and collaborate for low-cost space missions with space agencies such as ISRO.

- Asia-Pacific governments have heavily invested in developing their commercial space capabilities including wireless communication, navigation, space exploration, and earth monitoring alongside allowing private companies to launch commercial projects in space.

Market Players Outlook

*Note: Major Players Sorted in No Particular Order.

The major companies serving the global satellite launch vehicle market includeSpace Exploration Technologies Corp., Blue Origin Enterprises, L.P., United Launch Alliance, LLC, Indian Space Research Organization (ISRO), and National Aeronautics and Space Administration (NASA),among others. The market players are focusing on capitalizing on growth by adopting strategies such as collaboration, partnerships, and market expansion among others. For instance, in January 2024, NewSpace India Limited (NSIL), the commercial arm of ISRO announced that it will be using SpaceX's Falcon 9 rocket for a mission launch in the second quarter of 2024, GSAT-20, NSIL's second ‘demand-driven’ satellite mission aims to offer cost-effective ‘Ka-Ka band’ HTS (High Throughput Satellite) capacity, primarily for broadband and cellular backhaul service needs. It will cover the entire country, going as far as both the Andaman and Nicobar Islands and Lakshadweep.

The Report Covers

- Market value data analysis of 2023 and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global satellite launch vehicle market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. Blue Origin Enterprises, L.P.

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. Indian Space Research Organization (ISRO)

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. National Aeronautics and Space Administration (NASA)

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Space Exploration Technologies Corp.

3.5.1. Overview

3.5.2. Financial Analysis

3.5.3. SWOT Analysis

3.5.4. Recent Developments

3.6. United Launch Alliance, LLC.

3.6.1. Overview

3.6.2. Financial Analysis

3.6.3. SWOT Analysis

3.6.4. Recent Developments

3.7. Key Strategy Analysis

4. Market Segmentation

4.1. Global Satellite Launch Vehicle Market by Vehicle

4.1.1. Small (<350,000 Kg)

4.1.2. Medium to Heavy (> 350,000 Kg)

4.2. Global Satellite Launch Vehicle Market by Launch

4.2.1. Single-Use/Expendable

4.2.2. Reusable

4.3. Global Satellite Launch Vehicle Market by Stage

4.3.1. Single Stage

4.3.2. Two Stage

4.3.3. Three Stage

4.4. Global Satellite Launch Vehicle Market by Sub-Systems

4.4.1. Structure

4.4.2. Guidance, Navigation & Control System

4.4.3. Propulsion System

4.4.4. Telemetry, Tracking & Command System

4.4.5. Electrical Power System

4.4.6. Separation System

4.5. Global Satellite Launch Vehicle Market by Payload

4.5.1. <500 Kg

4.5.2. 500-2,500 Kg

4.5.3. > 2,500 Kg

4.6. Global Satellite Launch Vehicle Market by Orbit

4.6.1. Low Earth Orbit (LEO)

4.6.2. Medium Earth Orbit (MEO)

4.6.3. Geostationary Orbit (GEO)

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

5.4.1. Latin America

5.4.2. Middle East and Africa

6. Company Profiles

6.1. Airbus SE

6.2. Ariane Group

6.3. Arianespace

6.4. China Aerospace Science and Technology Corp.

6.5. Eurockot Launch Services

6.6. ISIS- Innovative Solution in Space B.V.

6.7. Linkspace Aerospace Technology Group

6.8. Lockheed Martin Corp.

6.9. Mitsubishi Heavy Industries, Ltd.

6.10. Northrop Grumman Corp.

6.11. Relativity Space Inc.

6.12. Roscosmos

6.13. Skyroot Aerospace Pvt. Ltd.

6.14. The Boeing Co.

6.15. Virgin Galactic LLC

1. GLOBAL SATELLITE LAUNCH VEHICLE MARKET RESEARCH AND ANALYSIS BY VEHICLE, 2023-2031 ($ MILLION)

2. GLOBAL SMALL SATELLITE LAUNCH VEHICLE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

3. GLOBAL MEDIUM TO HEAVY SATELLITE LAUNCH VEHICLE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

4. GLOBAL SATELLITE LAUNCH VEHICLE MARKET RESEARCH AND ANALYSIS BY LAUNCH, 2023-2031 ($ MILLION)

5. GLOBAL SINGLE-USE/EXPENDABLE SATELLITE LAUNCH VEHICLE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

6. GLOBAL REUSABLE SATELLITE LAUNCH VEHICLE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

7. GLOBAL SATELLITE LAUNCH VEHICLE MARKET RESEARCH AND ANALYSIS BY STAGE, 2023-2031 ($ MILLION)

8. GLOBAL SINGLE STAGE SATELLITE LAUNCH VEHICLE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

9. GLOBAL TWO STAGE SATELLITE LAUNCH VEHICLE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

10. GLOBAL THREE STAGE SATELLITE LAUNCH VEHICLE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

11. GLOBAL SATELLITE LAUNCH VEHICLE MARKET RESEARCH AND ANALYSIS BY SUB-SYSTEMS, 2023-2031 ($ MILLION)

12. GLOBAL SATELLITE LAUNCH VEHICLE STRUCTURE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

13. GLOBAL SATELLITE LAUNCH VEHICLE GUIDANCE, NAVIGATION & CONTROL SYSTEM MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

14. GLOBAL SATELLITE LAUNCH VEHICLE PROPULSION SYSTEM MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

15. GLOBAL SATELLITE LAUNCH VEHICLE TELEMETRY, TRACKING & COMMAND SYSTEM MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

16. GLOBAL SATELLITE LAUNCH VEHICLE ELECTRICAL POWER SYSTEM MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

17. GLOBAL SATELLITE LAUNCH VEHICLE SEPARATION SYSTEM MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

18. GLOBAL SATELLITE LAUNCH VEHICLE MARKET RESEARCH AND ANALYSIS BY PAYLOAD, 2023-2031 ($ MILLION)

19. GLOBAL <500 Kg PAYLOAD SATELLITE LAUNCH VEHICLE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

20. GLOBAL 500-2,500 KG PAYLOAD SATELLITE LAUNCH VEHICLE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

21. GLOBAL > 2,500 Kg PAYLOAD SATELLITE LAUNCH VEHICLE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

22. GLOBAL SATELLITE LAUNCH VEHICLE MARKET RESEARCH AND ANALYSIS BY ORBIT, 2023-2031 ($ MILLION)

23. GLOBAL LOW EARTH ORBIT (LEO) SATELLITE LAUNCH VEHICLE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

24. GLOBAL MEDIUM EARTH ORBIT (MEO) SATELLITE LAUNCH VEHICLE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

25. GLOBAL GEOSTATIONARY ORBIT (GEO) SATELLITE LAUNCH VEHICLE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

26. GLOBAL SATELLITE LAUNCH VEHICLE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

27. NORTH AMERICAN SATELLITE LAUNCH VEHICLE MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

28. NORTH AMERICAN SATELLITE LAUNCH VEHICLE MARKET RESEARCH AND ANALYSIS BY VEHICLE, 2023-2031 ($ MILLION)

29. NORTH AMERICAN SATELLITE LAUNCH VEHICLE MARKET RESEARCH AND ANALYSIS BY LAUNCH, 2023-2031 ($ MILLION)

30. NORTH AMERICAN SATELLITE LAUNCH VEHICLE MARKET RESEARCH AND ANALYSIS BY STAGE, 2023-2031 ($ MILLION)

31. NORTH AMERICAN SATELLITE LAUNCH VEHICLE MARKET RESEARCH AND ANALYSIS BY SUB-SYSTEMS, 2023-2031 ($ MILLION)

32. NORTH AMERICAN SATELLITE LAUNCH VEHICLE MARKET RESEARCH AND ANALYSIS BY PAYLOAD, 2023-2031 ($ MILLION)

33. NORTH AMERICAN SATELLITE LAUNCH VEHICLE MARKET RESEARCH AND ANALYSIS BY ORBIT, 2023-2031 ($ MILLION)

34. EUROPEAN SATELLITE LAUNCH VEHICLE MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

35. EUROPEAN SATELLITE LAUNCH VEHICLE MARKET RESEARCH AND ANALYSIS BY VEHICLE, 2023-2031 ($ MILLION)

36. EUROPEAN SATELLITE LAUNCH VEHICLE MARKET RESEARCH AND ANALYSIS BY LAUNCH, 2023-2031 ($ MILLION)

37. EUROPEAN SATELLITE LAUNCH VEHICLE MARKET RESEARCH AND ANALYSIS BY STAGE, 2023-2031 ($ MILLION)

38. EUROPEAN SATELLITE LAUNCH VEHICLE MARKET RESEARCH AND ANALYSIS BY SUB-SYSTEM, 2023-2031 ($ MILLION)

39. EUROPEAN SATELLITE LAUNCH VEHICLE MARKET RESEARCH AND ANALYSIS BY PAYLOAD, 2023-2031 ($ MILLION)

40. EUROPEAN SATELLITE LAUNCH VEHICLE MARKET RESEARCH AND ANALYSIS BY ORBIT, 2023-2031 ($ MILLION)

41. ASIA-PACIFIC SATELLITE LAUNCH VEHICLE MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

42. ASIA-PACIFIC SATELLITE LAUNCH VEHICLE MARKET RESEARCH AND ANALYSIS BY VEHICLE, 2023-2031 ($ MILLION)

43. ASIA-PACIFIC SATELLITE LAUNCH VEHICLE MARKET RESEARCH AND ANALYSIS BY LAUNCH, 2023-2031 ($ MILLION)

44. ASIA-PACIFIC SATELLITE LAUNCH VEHICLE MARKET RESEARCH AND ANALYSIS BY STAGE, 2023-2031 ($ MILLION)

45. ASIA-PACIFIC SATELLITE LAUNCH VEHICLE MARKET RESEARCH AND ANALYSIS BY SUB-SYSTEM, 2023-2031 ($ MILLION)

46. ASIA-PACIFIC SATELLITE LAUNCH VEHICLE MARKET RESEARCH AND ANALYSIS BY PAYLOAD, 2023-2031 ($ MILLION)

47. ASIA-PACIFIC SATELLITE LAUNCH VEHICLE MARKET RESEARCH AND ANALYSIS BY ORBIT, 2023-2031 ($ MILLION)

48. REST OF THE WORLD SATELLITE LAUNCH VEHICLE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

49. REST OF THE WORLD SATELLITE LAUNCH VEHICLE MARKET RESEARCH AND ANALYSIS BY VEHICLE, 2023-2031 ($ MILLION)

50. REST OF THE WORLD SATELLITE LAUNCH VEHICLE MARKET RESEARCH AND ANALYSIS BY LAUNCH, 2023-2031 ($ MILLION)

51. REST OF THE WORLD SATELLITE LAUNCH VEHICLE MARKET RESEARCH AND ANALYSIS BY STAGE, 2023-2031 ($ MILLION)

52. REST OF THE WORLD SATELLITE LAUNCH VEHICLE MARKET RESEARCH AND ANALYSIS BY SUB-SYSTEM, 2023-2031 ($ MILLION)

53. REST OF THE WORLD SATELLITE LAUNCH VEHICLE MARKET RESEARCH AND ANALYSIS BY PAYLOAD, 2023-2031 ($ MILLION)

54. REST OF THE WORLD SATELLITE LAUNCH VEHICLE MARKET RESEARCH AND ANALYSIS BY ORBIT, 2023-2031 ($ MILLION)

1. GLOBAL SATELLITE LAUNCH VEHICLE MARKET SHARE BY VEHICLE, 2023 VS 2031 (%)

2. GLOBAL SMALL SATELLITE LAUNCH VEHICLE MARKET SHARE BY REGION, 2023 VS 2031 (%)

3. GLOBAL MEDIUM TO HEAVY SATELLITE LAUNCH VEHICLE MARKET SHARE BY REGION, 2023 VS 2031 (%)

4. GLOBAL SATELLITE LAUNCH VEHICLE MARKET SHARE BY LAUNCH, 2023 VS 2031 (%)

5. GLOBAL SINGLE-USE/EXPENDABLE SATELLITE LAUNCH VEHICLE MARKET SHARE BY REGION, 2023 VS 2031 (%)

6. GLOBAL REUSABLE SATELLITE LAUNCH VEHICLE DRIVEN MARKET SHARE BY REGION, 2023 VS 2031 (%)

7. GLOBAL SATELLITE LAUNCH VEHICLE MARKET SHARE BY STAGE, 2023 VS 2031 (%)

8. GLOBAL SINGLE STAGE SATELLITE LAUNCH VEHICLE MARKET SHARE BY REGION, 2023 VS 2031 (%)

9. GLOBAL TWO STAGE SATELLITE LAUNCH VEHICLE MARKET SHARE BY REGION, 2023 VS 2031 (%)

10. GLOBAL THREE STAGE SATELLITE LAUNCH VEHICLE MARKET SHARE BY REGION, 2023 VS 2031 (%)

11. GLOBAL SATELLITE LAUNCH VEHICLE MARKET SHARE BY SUB-SYSTEM, 2023 VS 2031 (%)

12. GLOBAL SATELLITE LAUNCH VEHICLE STRUCTURE MARKET SHARE BY REGION, 2023 VS 2031 (%)

13. GLOBAL SATELLITE LAUNCH VEHICLE GUIDANCE, NAVIGATION & CONTROL SYSTEM MARKET SHARE BY REGION, 2023 VS 2031 (%)

14. GLOBAL SATELLITE LAUNCH VEHICLE PROPULSION SYSTEM MARKET SHARE BY REGION, 2023 VS 2031 (%)

15. GLOBAL SATELLITE LAUNCH VEHICLE TELEMETRY, TRACKING & COMMAND SYSTEM MARKET SHARE BY REGION, 2023 VS 2031 (%)

16. GLOBAL SATELLITE LAUNCH VEHICLE ELECTRICAL POWER SYSTEM MARKET SHARE BY REGION, 2023 VS 2031 (%)

17. GLOBAL SATELLITE LAUNCH VEHICLE ELECTRICAL SEPARATION SYSTEM MARKET SHARE BY REGION, 2023 VS 2031 (%)

18. GLOBAL SATELLITE LAUNCH VEHICLE MARKET SHARE BY PAYLOAD, 2023 VS 2031 (%)

19. GLOBAL <500 Kg PAYLOAD SATELLITE LAUNCH VEHICLE MARKET SHARE BY REGION, 2023 VS 2031 (%)

20. GLOBAL 500-2,500 KG PAYLOAD SATELLITE LAUNCH VEHICLE MARKET SHARE BY REGION, 2023 VS 2031 (%)

21. GLOBAL > 2,500 KG PAYLOAD SATELLITE LAUNCH VEHICLE MARKET SHARE BY REGION, 2023 VS 2031 (%)

22. GLOBAL SATELLITE LAUNCH VEHICLE MARKET SHARE BY ORBIT, 2023 VS 2031 (%)

23. GLOBAL LOW EARTH ORBIT (LEO) SATELLITE LAUNCH VEHICLE MARKET SHARE BY REGION, 2023 VS 2031 (%)

24. GLOBAL MEDIUM EARTH ORBIT (MEO) SATELLITE LAUNCH VEHICLE MARKET SHARE BY REGION, 2023 VS 2031 (%)

25. GLOBAL GEOSTATIONARY ORBIT (GEO) SATELLITE LAUNCH VEHICLE MARKET SHARE BY REGION, 2023 VS 2031 (%)

26. GLOBAL SATELLITE LAUNCH VEHICLE MARKET SHARE BY REGION, 2023 VS 2031 (%)

27. US SATELLITE LAUNCH VEHICLE MARKET SIZE, 2023-2031 ($ MILLION)

28. CANADA SATELLITE LAUNCH VEHICLE MARKET SIZE, 2023-2031 ($ MILLION)

29. UK SATELLITE LAUNCH VEHICLE MARKET SIZE, 2023-2031 ($ MILLION)

30. FRANCE SATELLITE LAUNCH VEHICLE MARKET SIZE, 2023-2031 ($ MILLION)

31. GERMANY SATELLITE LAUNCH VEHICLE MARKET SIZE, 2023-2031 ($ MILLION)

32. ITALY SATELLITE LAUNCH VEHICLE MARKET SIZE, 2023-2031 ($ MILLION)

33. SPAIN SATELLITE LAUNCH VEHICLE MARKET SIZE, 2023-2031 ($ MILLION)

34. REST OF EUROPE SATELLITE LAUNCH VEHICLE MARKET SIZE, 2023-2031 ($ MILLION)

35. INDIA SATELLITE LAUNCH VEHICLE MARKET SIZE, 2023-2031 ($ MILLION)

36. CHINA SATELLITE LAUNCH VEHICLE MARKET SIZE, 2023-2031 ($ MILLION)

37. JAPAN SATELLITE LAUNCH VEHICLE MARKET SIZE, 2023-2031 ($ MILLION)

38. SOUTH KOREA SATELLITE LAUNCH VEHICLE MARKET SIZE, 2023-2031 ($ MILLION)

39. REST OF ASIA-PACIFIC SATELLITE LAUNCH VEHICLE MARKET SIZE, 2023-2031 ($ MILLION)

40. LATIN AMERICA SATELLITE LAUNCH VEHICLE MARKET SIZE, 2023-2031 ($ MILLION)

41. THE MIDDLE EAST AND AFRICA SATELLITE LAUNCH VEHICLE MARKET SIZE, 2023-2031 ($ MILLION)