Saudi Arabia Home Decor Market

Saudi Arabia Home Decor Market Size, Share & Trends Analysis Report By Product (Wall Arts, Mirror, Wall Shelves, Decorated Table, Home Textile, Flooring, Lighting & Lamps, and Others), By Distribution Channel (Supermarkets & Hypermarkets, Home Decor Store, Online, and Other Channel) Forecast 2021-2027 Update Available - Forecast 2025-2031

The Saudi Arabia market home décor is projected to have a considerable CAGR during the forecast period. Post-COVID-19, high disposable income, presence, and the new entrance of global market players are some of the major factors for the growth of the market in the country. Moreover, the government’s aim to increase homeownership is another major factor augmenting the market growth. Apart from this, the growth in ultra-high rich in the country will create a significant demand for luxury furniture in the country as it is perceived as an indication of wealth and social status to them. Besides, a preference for multi-utilitarian furniture is also registered due to the multiple benefits of less space necessity and multi-usage purposes.

Besides, the increasing e-commerce market in the furniture industry is also augmenting the industry growth. In recent years, many home décor retailers such as Home center and IKEA launched online stores in Saudi Arabia which is further benefitting the market by providing more options to the consumers. As per International Telecommunication Union, the mobile-broadband subscription has reached 116.9% of the total population in 2019, supporting e-commerce in the home décor industry.

Segmental Analysis

The Saudi Arabia home décor market is segmented based on product and distribution channels. By product, the market is further segmented into wall arts, mirror, wall shelves, decorated table, home textile, flooring, lighting and lamps, and other. During the forecast period, lighting and lamps are expected to register significant growth in the country. It is owing to the new technological advancement in lighting and lamp segments such as smart lights.

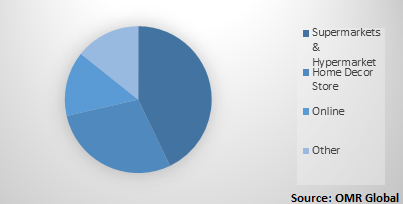

Saudi Arabia Home Decor Market Share by Distribution Channel, 2020 (%)

Supermarket & Hypermarket Still Hold a Major Market Share

By distribution channel, the market is divided into supermarkets & hypermarkets, home decor store, online, and other. Supermarkets and hypermarkets and décor stores still hold the major market share in the country. It is due to the fact that consumer still wants to visually and physically check the product before purchasing it. Moreover, online channels will witness the double-digit fastest growth rate during the forecast period. It is owing to the increasing reach of young consumers to e-commerce channels and rising product offerings by the companies on their e-commerce portals.

Competitive Landscape

The home décor market is a fragmented market with the presence of multiple small players in different segments. However, some of the prominent players in the market include Inter IKEA Systems B.V., Al-Kayan Decor Company, Koninklijke Philips N.V., KARE Design GmbH among others. These market players are focusing on strategic initiatives to accelerate their market shares such as product innovation, geographical and product expansions, and mergers and acquisitions, to establish a strong consumer base, and in turn, an esteemed position in the market. IKEA is a major retailer present in the country for decades with the first store in Jeddah in 1983. As of 2020, the company was operating six major retail stores in the country.

The Report Covers

- Market value data analysis of 2020 and forecast to 2027.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the Saudi Arabia Home Decor market. Based on the availability of data, information related to pipeline products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where in the market.

1. Report Summary

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Market Determinants

3.1. Motivators

3.2. Restraints

3.3. Opportunities

4. Market Segmentation

4.1. By Product

4.1.1. Wall Arts

4.1.2. Mirror

4.1.3. Wall Shelves

4.1.4. Decorated Table

4.1.5. Home Textile

4.1.6. Flooring

4.1.7. Lighting & Lamps

4.1.8. Other

4.2. By Distribution Channel

4.2.1. Supermarkets & Hypermarkets

4.2.2. Home Decor Store

4.2.3. Online

4.2.4. Other Channel

5. Company Profiles

5.1. Ace Hardware Corp.

5.2. Alfanar Group

5.3. Al-Kayan Decor Co.

5.4. Armstrong World Industries, Inc.

5.5. Battoyor Group (Heba Lighting)

5.6. Brabbu Design Forces

5.7. Forbo International SA

5.8. Gautier Online Ltd. (Galipette)

5.9. General Electric Co.

5.10. Hennes & Mauritz AB

5.11. Inara Lighting Company.

5.12. Inter Ikea Systems B.V.

5.13. Kare Design GmbH

5.14. Koninklijke Philips N.V.

5.15. La-Z-Boy Inc.

5.16. Marina Gulf Trading Co LLC (Marina Home)

5.17. Mohawk Industries Inc.

5.18. Retail World Ltd. (Home Centre)

1. SAUDI ARABIA HOME DECOR MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2021-2027 ($ MILLION)

2. SAUDI ARABIA HOME DECOR MARKET RESEARCH AND ANALYSIS BY DISTRIBUTION CHANNEL, 2021-2027 ($ MILLION)

1. SAUDI ARABIA HOME DECOR MARKET SHARE BY PRODUCT, 2020 VS 2027 (%)

2. SAUDI ARABIA HOME DECOR MARKET SHARE BY DISTRIBUTION CHANNEL, 2020 VS 2027 (%)

3. SAUDI ARABIA WALL ARTS MARKET SIZE 2021-2027 ($ MILLION)

4. SAUDI ARABIA MIRROR MARKET SIZE 2021-2027 ($ MILLION)

5. SAUDI ARABIA WALL SHELVES MARKET SIZE 2021-2027 ($ MILLION)

6. SAUDI ARABIA DECORATED TABLE MARKET SIZE 2021-2027 ($ MILLION)

7. SAUDI ARABIA HOME TEXTILE MARKET SIZE 2021-2027 ($ MILLION)

8. SAUDI ARABIA FLOORING MARKET SIZE 2021-2027 ($ MILLION)

9. SAUDI ARABIA LIGHTING & LAMPS MARKET SIZE 2021-2027 ($ MILLION)

10. SAUDI ARABIA OTHER MARKET SIZE 2021-2027 ($ MILLION)

11. SAUDI ARABIA SUPERMARKETS & HYPERMARKETS HOME DÉCOR MARKET SIZE 2021-2027 ($ MILLION)

12. SAUDI ARABIA HOME DECOR STORE HOME DÉCOR MARKET SIZE 2021-2027 ($ MILLION)

13. SAUDI ARABIA ONLINE HOME DÉCOR MARKET SIZE 2021-2027 ($ MILLION)

14. SAUDI ARABIA OTHER CHANNEL HOME DÉCOR MARKET SIZE 2021-2027 ($ MILLION)