Screw Pump Market

Screw Pump Market Size, Share & Trends Analysis Report by Type (Single Screw/Eccentric Screw/ Progressive Cavity Pumps, Twin Screw Pumps, Three Screw Pumps and Multiple Screw Pumps), Design Configuration (Vertical Screw Pumps and Horizontal Screw Pumps) and End-Use (Oil & Gas, Power, Water and Wastewater Treatment, Food & Beverage, Chemicals and Others) Forecast Period (2025-2035)

Industry Overview

The screw pump market was valued at $2,730 million in 2024 and is projected to reach $4,670 million in 2035, growing at a CAGR of 5.0% during the forecast period (2025-2035). The growing adoption of efficient fluid transfer solutions in a range of industries, including food processing, chemicals, water treatment, and oil and gas, has led to the development of high-performance screw pumps. Technological innovation and increased demand for reliable and persistent pumping systems have been key drivers for these developments. Energy efficiency and lower maintenance costs have grown into important market drivers as companies look to save operational expenses and streamline their operations.

Market Dynamics

Growing Adoption of Smart Monitoring Screw Pumps with IoT

Screw pumps with Internet of Things (IoT) capabilities are transforming the market's operational landscape. Advanced smart screw pumps monitor performances, flow rates, temperatures, and pressures in real-time. Predictive maintenance guarantees high end-user productivity and helps prevent sudden downtime. The various industries can use the same pumps to assess the availability and reliability through cloud-based platforms to avoid any unplanned downtime and ensure smooth operations. Industry 4.0 brings with it the penetration of IoT to its devices and equipment, including screw pumps, regarding automation and digital connectivity. The increasing trend for smart pump solutions to provide increased efficiencies and reliability in operation.

Increasing Demand for Energy-Efficient Screw Pumps

The screw pumps market is showing significant shifts towards more energy-efficient products owing to general global energy conservations. Industries sectors such as oil and gas, chemicals, and wastewater are increasingly adopting screw pumps having advanced designs and low energy-consuming performance. Additionally, with reduced operating costs and achievement of sustainability goals as well as keeping up with stringent regulations on environmental controls, the end-users prefer using these pumps in their systems. Manufacturers are innovating screw pump technologies with new variable frequency drives and optimized rotor designs. This allows for greater control over the flow and less energy waste. The need for green energy initiatives and a reduction in carbon footprint is adding to the industrial demand for efficient screw pumps.

Market Segmentation

- Based on the type, the market is segmented into single screw/eccentric screw/ progressive cavity pumps, twin screw pumps, three screw pumps, and multiple screw pumps.

- Based on the design configuration, the market is segmented into vertical screw pumps and horizontal screw pumps.

- Based on the end-user, the market is segmented into oil & gas, power, water and wastewater treatment, food & beverage, chemicals, and others (pharmaceuticals).

Three Screw Pumps Segment to Lead the Market with the Largest Share

The market for three-screw pumps is expanding significantly as they are highly effective in pumping lubricating, non-abrasive, and chemically inert liquids. It is consequently ideal for various industrial applications including oil & gas, lubrication, power, and marine sectors. For instance, Alfa Laval provides 3S three-screw pumps that have a broad range and are low-maintenance in design. The 3S series comes in 29 different sizes, from 5 liters per minute up to 2,900 liters per minute at 1,450 rpm, thereby meeting many different operational needs. This means there is bound to be some level of flexibility and adaptability to suit virtually all industries.

Oil & Gas: A Key Segment in Market Growth

The screw pump market globally is currently experiencing growth mainly through increasing demand from the oil and gas sector. Screw pumps are commonly used in the industry for high-viscosity fluids, along with consistent flow rates, and operate well with changes in pressure. Increasing activity in the field of oil exploration coupled with advances in extraction technology have spurred demand for such pumps. Screw pumps have emerged as the standard solution for critical operations owing to the growing concern for efficient fluid-handling solutions. For instance, KRAL GmbH is offering KRAL Screw Pumps for Oil and Gas. KRAL GmbH offers positive displacement screw pumps that offer the best possible intake capabilities with the lowest pulsation transmission. The company provides pumps that comply with API designs, specifically designed for the oil and gas industry.

Regional Outlook

The global screw pump market is further divided by geography, including North America (the US and Canada), Europe (the UK, Germany, France, Italy, Spain, Russia, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, Australia and New Zealand, ASEAN Countries, and the Rest of Asia-Pacific), and the Rest of the World (the Middle East & Africa, and Latin America)

Growing Demand for Screw Pumps in Asia-Pacific Key Industries

The screw pumps market in the Asia Pacific region is witnessing high growth rates owing to significant industrialization and an increase in key industries such as oil and gas, wastewater treatment, and chemicals. Growing infrastructure projects in nations such as China, India, Japan, and South Korea have given a boost to the demand for advanced pumping solutions. High industrial demand for cost-effectiveness and efficiency has further led to the adoption of screw pumps as they have a standing for reliability and withstand demanding application conditions.

Europe Region Dominates the Market with Major Share

Europe holds a significant share owing to higher demand from oil and gas, wastewater treatment, and chemicals, which require more energy as well as pump reliability. European countries' quick industrialization along with infrastructure further boosts the demand for advanced technologies in pumps. Stricter environmental regulations have been in direct encouragement of their adoption owing to the screw pump's capability for viscous as well as abrasive fluids without severe disruption to the environment. Additionally, improvements in pump technology have led to the development of a more powerful and efficient device in production. There has been growing interest in the cost-effective and low-energy industrial process with the reduction in operational cost, which is enhancing the demand in the market. The pharmaceutical and food processing industry is on the increase in Europe, and screw pumps are widely used.

Market Players Outlook

The major companies operating in the global screw pump market include Alfa Laval AB, Dover Corp. (PSG Dover), EBARA Corp., ITT Inc., and Parker Hannifin Corp., among others. Market players are leveraging partnerships, collaborations, mergers and acquisition strategies for business expansion and innovative product development to maintain their market positioning.

Recent Developments

- In June 2024, CIRCOR International, Inc. introduced new IMO LB6D 3-screw pumps, available for oil and gas industry use in lease automatic custody transfer LACT applications. It was engineered toward maximum functional performance plus a minimum of the operating expenses as possible. The new pump technology produces protective closures on contaminants, giving less downtime maintenance intervals normally experienced from wear gear pumps.

- In June 2024, Roto Pumps announced a new innovative development in Progressive Cavity Pump technology new Wear Compensation Stator. Roto's Wear Compensation Stator design allows the control and regulation of Progressive Cavity Pump efficiency over a very long period. Roto's Wear Compensation Stator heralds a new advance in pump technology, promising industries reliant on Progressive Cavity Pumps to be more durable and efficient in their operations.

The Report Covers

- Market value data analysis of 2024 and forecast to 2035.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global screw pump market. Based on the availability of data, information related to new products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

• Global Screw Pump Market Sales Analysis – Type| Design Configuration| End-Use ($ Million)

• Screw Pump Market Sales Performance of Top Countries

1.1. Research Methodology

• Primary Research Approach

• Secondary Research Approach

1.2. Market Snapshot

2. Market Overview and Insights

2.1. Scope of the Study

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Screw Pump Industry Trends

2.2.2. Market Recommendations

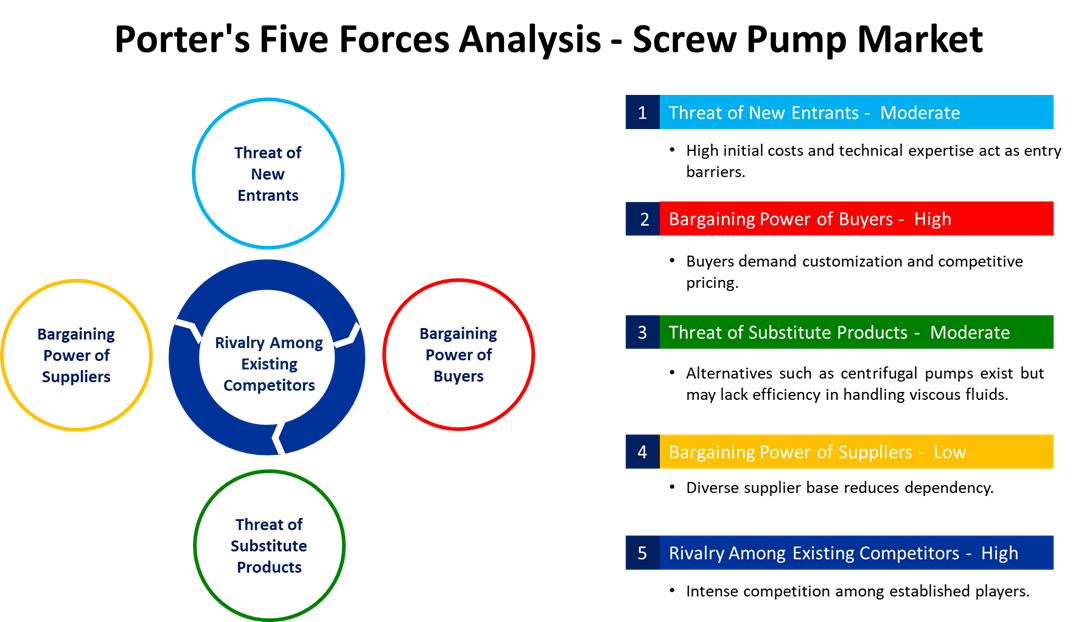

2.3. Porter's Five Forces Analysis for the Screw Pump Market

2.3.1. Competitive Rivalry

2.3.2. Threat of New Entrants

2.3.3. Bargaining Power of Suppliers

2.3.4. Bargaining Power of Buyers

2.3.5. Threat of Substitutes

3. Market Determinants

3.1. Market Drivers

3.1.1. Drivers For Global Screw Pump Market: Impact Analysis

3.2. Market Pain Points and Challenges

3.2.1. Restraints For Global Screw Pump Market: Impact Analysis

3.3. Market Opportunities

4. Competitive Landscape

4.1. Competitive Dashboard – Screw Pump Market Revenue and Share by Manufacturers

• Screw Pump Product Comparison Analysis

• Top Market Player Ranking Matrix

4.2. Key Company Analysis

4.2.1. Alfa Laval AB

4.2.1.1. Overview

4.2.1.2. Product Portfolio

4.2.1.3. Financial Analysis (Subject to Data Availability)

4.2.1.4. SWOT Analysis

4.2.1.5. Business Strategy

4.2.2. Dover Corp. (PSG Dover)

4.2.2.1. Overview

4.2.2.2. Product Portfolio

4.2.2.3. Financial Analysis (Subject to Data Availability)

4.2.2.4. SWOT Analysis

4.2.2.5. Business Strategy

4.2.3. EBARA Corp.

4.2.3.1. Overview

4.2.3.2. Product Portfolio

4.2.3.3. Financial Analysis (Subject to Data Availability)

4.2.3.4. SWOT Analysis

4.2.3.5. Business Strategy

4.2.4. ITT Inc.

4.2.4.1. Overview

4.2.4.2. Product Portfolio

4.2.4.3. Financial Analysis (Subject to Data Availability)

4.2.4.4. SWOT Analysis

4.2.4.5. Business Strategy

4.2.5. Parker Hannifin Corp.

4.2.5.1. Overview

4.2.5.2. Product Portfolio

4.2.5.3. Financial Analysis (Subject to Data Availability)

4.2.5.4. SWOT Analysis

4.2.5.5. Business Strategy

4.3. Top Winning Strategies by Market Players

4.3.1. Merger and Acquisition

4.3.2. Product Launch

4.3.3. Partnership And Collaboration

5. Global Screw Pump Market Sales Analysis by Type ($ Million)

5.1. Single Screw/Eccentric Screw/ Progressive Cavity Pumps

5.2. Twin Screw Pumps

5.3. Three Screw Pumps

5.4. Multiple Screw Pumps

6. Global Screw Pump Market Sales Analysis by Design Configuration ($ Million)

6.1. Vertical Screw Pumps

6.2. Horizontal Screw Pumps

7. Global Screw Pump Market Sales Analysis by End-Use ($ Million)

7.1. Oil & Gas

7.2. Power

7.3. Water and Wastewater Treatment

7.4. Food & Beverage

7.5. Chemicals

7.6. Others (Pharmaceuticals)

8. Regional Analysis

8.1. North American Screw Pump Market Sales Analysis – Type| Design Configuration| End-Use | Country ($ Million)

• Macroeconomic Factors for North America

8.1.1. United States

8.1.2. Canada

8.2. European Screw Pump Market Sales Analysis – Type| Design Configuration| End-Use| Country ($ Million)

• Macroeconomic Factors for North America

8.2.1. UK

8.2.2. Germany

8.2.3. Italy

8.2.4. Spain

8.2.5. France

8.2.6. Russia

8.2.7. Rest of Europe

8.3. Asia-Pacific Screw Pump Market Sales Analysis – Type| Design Configuration| End-Use| Country ($ Million)

• Macroeconomic Factors for Asia-Pacific

8.3.1. China

8.3.2. Japan

8.3.3. South Korea

8.3.4. India

8.3.5. Australia & New Zealand

8.3.6. ASEAN Countries (Thailand, Indonesia, Vietnam, Singapore, And Other)

8.3.7. Rest of Asia-Pacific

8.4. Rest of the World Screw Pump Market Sales Analysis – Type| Design Configuration| End-Use| Country ($ Million)

• Macroeconomic Factors for Rest of the World

8.4.1. Latin America

8.4.2. Middle East and Africa

9. Company Profiles

9.1. Alfa Laval AB

9.1.1. Quick Facts

9.1.2. Company Overview

9.1.3. Product Portfolio

9.1.4. Business Strategies

9.2. CIRCOR International, Inc.

9.2.1. Quick Facts

9.2.2. Company Overview

9.2.3. Product Portfolio

9.2.4. Business Strategies

9.3. Donjoy Technology Co., Ltd.

9.3.1. Quick Facts

9.3.2. Company Overview

9.3.3. Product Portfolio

9.3.4. Business Strategies

9.4. Dover Corp. (PSG Dover)

9.4.1. Quick Facts

9.4.2. Company Overview

9.4.3. Product Portfolio

9.4.4. Business Strategies

9.5. Dr. Jessberger GmbH

9.5.1. Quick Facts

9.5.2. Company Overview

9.5.3. Product Portfolio

9.5.4. Business Strategies

9.6. EBARA Corp.

9.6.1. Quick Facts

9.6.2. Company Overview

9.6.3. Product Portfolio

9.6.4. Business Strategies

9.7. Flexachem

9.7.1. Quick Facts

9.7.2. Company Overview

9.7.3. Product Portfolio

9.7.4. Business Strategies

9.8. FUKKO KINZOKU Industry Co., Ltd.

9.8.1. Quick Facts

9.8.2. Company Overview

9.8.3. Product Portfolio

9.8.4. Business Strategies

9.9. Hebei Hoffwell Industrial Pump Co., Ltd.

9.9.1. Quick Facts

9.9.2. Company Overview

9.9.3. Product Portfolio

9.9.4. Business Strategies

9.10. ITT Inc.

9.10.1. Quick Facts

9.10.2. Company Overview

9.10.3. Product Portfolio

9.10.4. Business Strategies

9.11. Jung Process Systems GmbH

9.11.1. Quick Facts

9.11.2. Company Overview

9.11.3. Product Portfolio

9.11.4. Business Strategies

9.12. KRAL GmbH

9.12.1. Quick Facts

9.12.2. Company Overview

9.12.3. Product Portfolio

9.12.4. Business Strategies

9.13. KUHN GmbH

9.13.1. Quick Facts

9.13.2. Company Overview

9.13.3. Product Portfolio

9.13.4. Business Strategies

9.14. Lakeside Equipment Corp.

9.14.1. Quick Facts

9.14.2. Company Overview

9.14.3. Product Portfolio

9.14.4. Business Strategies

9.15. Leistritz Advanced Technologies Corp.

9.15.1. Quick Facts

9.15.2. Company Overview

9.15.3. Product Portfolio

9.15.4. Business Strategies

9.16. Lutz Pumpen GmbH

9.16.1. Quick Facts

9.16.2. Company Overview

9.16.3. Product Portfolio

9.16.4. Business Strategies

9.17. NEWECO Machinery sp. z o.o.

9.17.1. Quick Facts

9.17.2. Company Overview

9.17.3. Product Portfolio

9.17.4. Business Strategies

9.18. Parker Hannifin Corp.

9.18.1. Quick Facts

9.18.2. Company Overview

9.18.3. Product Portfolio

9.18.4. Business Strategies

9.19. Roto Pumps Ltd.

9.19.1. Quick Facts

9.19.2. Company Overview

9.19.3. Product Portfolio

9.19.4. Business Strategies

9.20. SPX FLOW, Inc.

9.20.1. Quick Facts

9.20.2. Company Overview

9.20.3. Product Portfolio

9.20.4. Business Strategies

9.21. Star Pump Alliance GmbH

9.21.1. Quick Facts

9.21.2. Company Overview

9.21.3. Product Portfolio

9.21.4. Business Strategies

9.22. Sulzer Ltd.

9.22.1. Quick Facts

9.22.2. Company Overview

9.22.3. Product Portfolio

9.22.4. Business Strategies

9.23. Tianjin Pump Machinery Group Co., Ltd.

9.23.1. Quick Facts

9.23.2. Company Overview

9.23.3. Product Portfolio

9.23.4. Business Strategies

9.24. VERDER SCIENTIFIC GmbH & Co. KG

9.24.1. Quick Facts

9.24.2. Company Overview

9.24.3. Product Portfolio

9.24.4. Business Strategies

9.25. Wamgroup SpA

9.25.1. Quick Facts

9.25.2. Company Overview

9.25.3. Product Portfolio

9.25.4. Business Strategies

9.26. Zhejiang Yonjou Technology Co., Ltd.

9.26.1. Quick Facts

9.26.2. Company Overview

9.26.3. Product Portfolio

9.26.4. Business Strategies

1. Global Screw Pump Market Research And Analysis By Type, 2024-2035 ($ Million)

2. Global Single Screw/Eccentric Screw/ Progressive Cavity Pumps Market Research And Analysis By Region, 2024-2035 ($ Million)

3. Global Twin Screw Pumps Market Research And Analysis By Region, 2024-2035 ($ Million)

4. Global Three Screw Pumps Market Research And Analysis By Region, 2024-2035 ($ Million)

5. Global Multiple Screw Pumps Market Research And Analysis By Region, 2024-2035 ($ Million)

6. Global Screw Pump Market Research And Analysis By Design Configuration, 2024-2035 ($ Million)

7. Global Vertical Screw Pumps Market Research And Analysis By Region, 2024-2035 ($ Million)

8. Global Horizontal Screw Pumps Market Research And Analysis By Region, 2024-2035 ($ Million)

9. Global Screw Pump Market Research And Analysis By End-Use, 2024-2035 ($ Million)

10. Global Screw Pump For Oil & Gas Market Research And Analysis By Region, 2024-2035 ($ Million)

11. Global Screw Pump For Power Market Research And Analysis By Region, 2024-2035 ($ Million)

12. Global Screw Pump For Water and Wastewater Treatment Market Research And Analysis By Region, 2024-2035 ($ Million)

13. Global Screw Pump For Food & Beverage Market Research And Analysis By Region, 2024-2035 ($ Million)

14. Global Screw Pump For Chemicals Market Research And Analysis By Region, 2024-2035 ($ Million)

15. Global Screw Pump For Other End-User Market Research And Analysis By Region, 2024-2035 ($ Million)

16. Global Screw Pump Market Research And Analysis By Region, 2024-2035 ($ Million)

17. North American Screw Pump Market Research And Analysis By Country, 2024-2035 ($ Million)

18. North American Screw Pump Market Research And Analysis By Type, 2024-2035 ($ Million)

19. North American Screw Pump Market Research And Analysis By Design Configuration, 2024-2035 ($ Million)

20. North American Screw Pump Market Research And Analysis By End-Use, 2024-2035 ($ Million)

21. European Screw Pump Market Research And Analysis By Country, 2024-2035 ($ Million)

22. European Screw Pump Market Research And Analysis By Type, 2024-2035 ($ Million)

23. European Screw Pump Market Research And Analysis By Design Configuration, 2024-2035 ($ Million)

24. European Screw Pump Market Research And Analysis By End-Use, 2024-2035 ($ Million)

25. Asia-Pacific Screw Pump Market Research And Analysis By Country, 2024-2035 ($ Million)

26. Asia-Pacific Screw Pump Market Research And Analysis By Type, 2024-2035 ($ Million)

27. Asia-Pacific Screw Pump Market Research And Analysis By Design Configuration, 2024-2035 ($ Million)

28. Asia-Pacific Screw Pump Market Research And Analysis By End-Use, 2024-2035 ($ Million)

29. Rest Of The World Screw Pump Market Research And Analysis By Region, 2024-2035 ($ Million)

30. Rest Of The World Screw Pump Market Research And Analysis By Type, 2024-2035 ($ Million)

31. Rest Of The World Screw Pump Market Research And Analysis By Design Configuration, 2024-2035 ($ Million)

32. Rest Of The World Screw Pump Market Research And Analysis By End-Use, 2024-2035 ($ Million)

1. Global Screw Pump Market Share By Type, 2024 Vs 2035 (%)

2. Global Single Screw/Eccentric Screw/ Progressive Cavity Pumps Market Share By Region, 2024 Vs 2035 (%)

3. Global Twin Screw Pumps Market Share By Region, 2024 Vs 2035 (%)

4. Global Three Screw Pumps Market Share By Region, 2024 Vs 2035 (%)

5. Global Multiple Screw Pumps Market Share By Region, 2024 Vs 2035 (%)

6. Global Screw Pump Market Share By Design Configuration, 2024 Vs 2035 (%)

7. Global Vertical Screw Pumps Market Share By Region, 2024 Vs 2035 (%)

8. Global Horizontal Screw Pumps Market Share By Region, 2024 Vs 2035 (%)

9. Global Screw Pump Market Share By End-Use, 2024 Vs 2035 (%)

10. Global Screw Pump For Oil & Gas Market Share By Region, 2024 Vs 2035 (%)

11. Global Screw Pump For Power Market Share By Region, 2024 Vs 2035 (%)

12. Global Screw Pump For Water and Wastewater Treatment Market Share By Region, 2024 Vs 2035 (%)

13. Global Screw Pump For Food & Beverage Market Share By Region, 2024 Vs 2035 (%)

14. Global Screw Pump For Chemicals Market Share By Region, 2024 Vs 2035 (%)

15. Global Screw Pump For Other End-Use Market Share By Region, 2024 Vs 2035 (%)

16. Global Screw Pump Market Share By Region, 2024 Vs 2035 (%)

17. US Screw Pump Market Size, 2024-2035 ($ Million)

18. Canada Screw Pump Market Size, 2024-2035 ($ Million)

19. UK Screw Pump Market Size, 2024-2035 ($ Million)

20. France Screw Pump Market Size, 2024-2035 ($ Million)

21. Germany Screw Pump Market Size, 2024-2035 ($ Million)

22. Italy Screw Pump Market Size, 2024-2035 ($ Million)

23. Spain Screw Pump Market Size, 2024-2035 ($ Million)

24. Russia Screw Pump Market Size, 2024-2035 ($ Million)

25. Rest Of Europe Screw Pump Market Size, 2024-2035 ($ Million)

26. India Screw Pump Market Size, 2024-2035 ($ Million)

27. China Screw Pump Market Size, 2024-2035 ($ Million)

28. Japan Screw Pump Market Size, 2024-2035 ($ Million)

29. South Korea Screw Pump Market Size, 2024-2035 ($ Million)

30. Australia and New Zealand Screw Pump Market Size, 2024-2035 ($ Million)

31. ASEAN Countries Screw Pump Market Size, 2024-2035 ($ Million)

32. Rest Of Asia-Pacific Screw Pump Market Size, 2024-2035 ($ Million)

33. Latin America Screw Pump Market Size, 2024-2035 ($ Million)

34. Middle East And Africa Screw Pump Market Size, 2024-2035 ($ Million)

FAQS

The size of the Screw Pump market in 2024 is estimated to be around $2,730 million.

Europe holds the largest share in the Screw Pump market.

Leading players in the Screw Pump market include Alfa Laval AB, Dover Corp. (PSG Dover), EBARA Corp., ITT Inc., and Parker Hannifin Corp., among others.

Screw Pump market is expected to grow at a CAGR of 5.0% from 2025 to 2035.

The Screw Pump Market is growing due to rising demand in oil & gas, chemical, and water treatment industries for efficient fluid handling.