Secure Logistics Market

Secure Logistics Market Size, Share & Trends Analysis Report by Mode of Transport (Roadways, Railways and Airways).by Application (Cash Management, Diamonds, Jewelry & Precious Metals and Manufacturing).and by End-Users (Financial Institutions, Retailers and Government).Forecast Period (2024-2031).

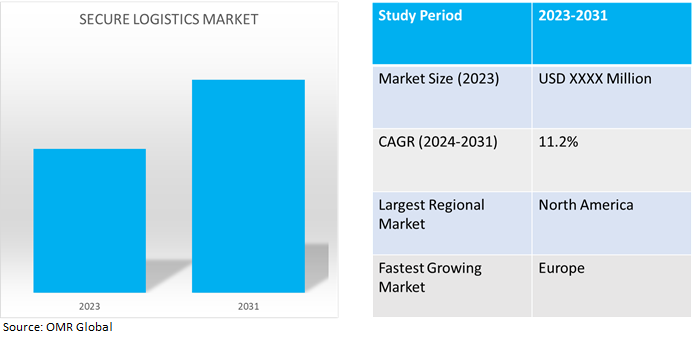

Secure logistics market is anticipated to grow at a significant CAGR of 11.2% during the forecast period (2024-2031).The growth of the secure logistics market is attributed to increasing technical advancements that improve the efficiency of services and goods provided by secure logistics including digital technology, manufacturing techniques, and materials globally driving the growth of the market. The increasing application of secure logistics in cash and precious assets is handled carefully to avoid loss, theft, or manipulation are driving market growth. With innovative security features like armored cars, GPS tracking, and real-time monitoring, secure logistics are essential to protecting cash during transit.

Market Dynamics

Increasing Adoption of Blockchain Technology

Global secure logistics supply chains are being advanced by blockchain technology as it provides more precise information on the origin and journey of goods from manufacture to distribution. Market players use blockchain to track fresh goods, improve traceability, and give customers accurate information about the origins and quality of products, Additionally, blockchain creates a transparent and safe network for sharing critical data, which enhances the effectiveness of reverse logistics and promotes greater supplier collaboration. Blockchain's potential to ease daily operations and guarantee transaction integrity is demonstrated by its integration with logistical systems, which enables enhanced tracking, considerable cost reductions, and effective financing choices.

Advanced Tracking and Monitoring Systems

Real-time asset and product location tracking is made possible by smart logistics through the use of technologies like RFID (Radio-Frequency Identification), GPS (Global Positioning System), and Internet of Things (IoT) sensors. This makes it possible for logistics managers to keep track of the exact whereabouts of items at all times. Businesses may follow the movement of items in real time with the use of sophisticated tracking devices. This involves monitoring the whereabouts, temperature, and state of shipments. Businesses are better equipped to recognize and evaluate possible supply chain risks with increased visibility provided by tracking and monitoring systems.

Market Segmentation

Our in-depth analysis of the global secure logistics market includes the following segments by mode of transport, application, and end-users.

- Based on the mode of transport, the market is sub-segmented into roadways, railways, and airways.

- Based on application, the market is sub-segmented into cash management, diamonds, jewelry & precious metals, and manufacturing.

- Based on end-users, the market is sub-segmented into financial institutions, retailers, and government.

Roadways are Projected to Emerge as the Largest Segment

Based on the mode of transport, the global secure logistics market is sub-segmented into roadways, railways, and airways. Among these roadways sub-segment is expected to hold the largest share of the market. The primary factors supporting the segment's growth include increasing flexibility and accessibility provided by road transport for the transit of safe shipments is the main factor driving this segment's growth. With the development of GPS technologies, vehicle tracking systems, and safe convoy protocols, road transport has emerged as the go-to option for secure logistics providers. For instance, in November 2023, XPO Logistics continued to expand its intermodal services in Europe with a new route between Italy and Germany. The company improves the efficiency of the service and offers greater precision and security to the customer, who is always informed of the status and location of the product.

Financial Institutions Sub-segment to Hold a Considerable Market Share

Based on the end-users, the global secure logistics market is sub-segmented into financial institutions, retailers, and government. Among these, the financial institutions sub-segment is expected to hold a considerable share of the market. The increasing demand for secure logistics in the banks and other financial institutions often handle high-value currency, sensitive documents, and precious commodities, secure logistics businesses are crucial to ensuring the safe and secure transit of valuables. Solutions for managing currency and specific secure transportation services, such as safe vaulting, are necessary. Transporting any tools or materials needed by the financial industry can therefore be considered a part of financial services logistics. This can entail moving large amounts of cash securely and safely or delivering cash machines straight from the manufacturer to a bank branch.

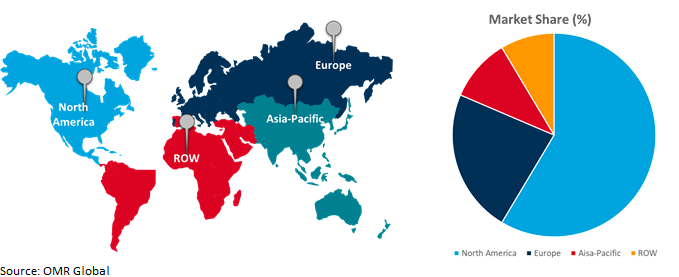

Regional Outlook

The global secure logistics market is further segmented based on geography including North America (the US, and Canada), Europe (UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia-Pacific), and the Rest of the World (the Middle East & Africa, and Latin America).

Increasing Secure Logistics Adoption in Europe

- The regional growth is attributed to increasing e-commerce, demand from the financial industry, and cross-border trading. The UK has emerged as a major hub for international finance, home to many banks, financial institutions, and other enterprises that need to move and store cash, documents, and other valuables securely. Providers of secure logistics are essential to the financial sector's success because they make asset management and transportation safe.

- According to the Logistics Report Summary 2023, in 2022, the UK traded over £1.0 trillion ($1.1 trillion) in goods, consisting of £414.0 billion ($436.2 billion) in exports and £644 ($678.6) billion in imports. The connectivity of the UK to global markets through logistics is crucial for driving innovation and productivity within the economy, which, in turn, boosts growth.

Global Secure Logistics Market Growth by Region 2024-2031

North America Holds Major Market Share

Among all the regions, North America holds a significant share owing to numerous prominent companies and secure logistics providers. The growth is attributed to the growing increased cash usage, expanding e-commerce, needing to comply with regulations, security issues, and a varied range of industries. The US continues to rely heavily on cash for transactions, even despite the expansion of digital payment options. The need for secure logistics services to move, store, and handle cash securely is fueled by this increased cash usage. According to the U.S. Department of Transportation, Bureau of Transportation Statistics, Freight Facts and Figures, in 2021, a daily average of about 53.6 million tons of freight was valued at more than $54.0 billion. The value of freight is forecast to increase faster than tonnage, rising from $1,001.0 per ton in 2023 to $1,256.0 per ton in 2050.

Market Players Outlook

*Note: Major Players Sorted in No Particular Order.

The major companies serving the global secure logistics market include Brink's Company, Etihad Secure Logistics, G4S Ltd., Phoenix International Ltd. Securitas AB, among others. The market players are increasingly focusing on business expansion and product development by applying strategies such as collaborations, mergers, and acquisitions to stay competitive in the market. For instance, in April 2024, Sheer Logistics, a provider of 4PL/managed transportation services, value-based logistics, freight brokerage, TMS technology, and integration platform as a service (IPaaS) solutions purpose-built for mid-market companies, announced the acquisition of CargoBarn, a tech-enabled third-party logistics provider (3PL) based in Atlanta, GA. CargoBarn provides full Truckload freight brokerage, expedited, drayage, and other specialized services.

Recent Development

- In January 2022, Sequel Logistics launched India’s first blockchain solution for digital gold. The new-age, disruptive digital technology like blockchain. Sequel has partnered with Chainflux to provide unmatched security and digital transparency to all participants in the digital gold value chain.

The Report Covers

- Market value data analysis of 2023 and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global secure logistics market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. Brink's Company

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. Etihad Secure Logistics

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. G4S Ltd.

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Lemuir Group

3.5.1. Overview

3.5.2. Financial Analysis

3.5.3. SWOT Analysis

3.5.4. Recent Developments

3.6. Securitas AB

3.6.1. Overview

3.6.2. Financial Analysis

3.6.3. SWOT Analysis

3.6.4. Recent Developments

3.7. Key Strategy Analysis

4. Market Segmentation

4.1. Global Secure Logistics Market by Mode of Transport

4.1.1. Roadways

4.1.2. Railways

4.1.3. Airways

4.2. Global Secure Logistics Market by Application

4.2.1. Cash Management

4.2.2. Diamonds, Jewelry & Precious Metals

4.2.3. Manufacturing

4.2.4. Others

4.3. Global Secure Logistics Market by End-Users

4.3.1. Financial Institutions

4.3.2. Retailers

4.3.3. Government

4.3.4. Others

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

5.4.1. Latin America

5.4.2. Middle East & Africa

6. Company Profiles

6.1. Armour Logistics LLC

6.2. Bond Safe Deposit Company

6.3. BULLET EXPRESS LTD.

6.4. BVC Logistics Pvt. Ltd.

6.5. CMS Info Systems Pvt. Ltd.

6.6. CoinWrap Inc.

6.7. GardaWorld

6.8. Guardforce Group

6.9. Loomis Armored US, LLC.

6.10. Malca-Amit

6.11. Phoenix International Co.

6.12. Phoenix International Ltd.

6.13. Secure Logistics Solutions Pvt. Ltd.

6.14. SHIELD Security Systems

6.15. The Armored Group, LLC

1. GLOBAL SECURE LOGISTICS MARKET RESEARCH AND ANALYSIS BY MODE OF TRANSPORT, 2023-2031 ($ MILLION)

2. GLOBAL SECURE ROADWAYS LOGISTICS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

3. GLOBAL SECURE RAILWAYS LOGISTICS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

4. GLOBAL SECURE AIRWAYS LOGISTICS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

5. GLOBAL SECURE LOGISTICS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

6. GLOBAL SECURE CASH MANAGEMENT LOGISTICS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

7. GLOBAL SECURE DIAMONDS, JEWELRY & PRECIOUS METALS LOGISTICS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

8. GLOBAL SECURE MANUFACTURING LOGISTICS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

9. GLOBAL SECURE LOGISTICS MARKET RESEARCH AND ANALYSIS BY END-USER, 2023-2031 ($ MILLION)

10. GLOBAL SECURE LOGISTICS FOR FINANCIAL INSTITUTIONS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

11. GLOBAL SECURE LOGISTICS FOR RETAILERS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

12. GLOBAL SECURE LOGISTICS FOR GOVERNMENT MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

13. GLOBAL SECURE LOGISTICS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

14. NORTH AMERICAN SECURE LOGISTICS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

15. NORTH AMERICAN SECURE LOGISTICS MARKET RESEARCH AND ANALYSIS BY MODE OF TRANSPORT, 2023-2031 ($ MILLION)

16. NORTH AMERICAN SECURE LOGISTICS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

17. NORTH AMERICAN SECURE LOGISTICS MARKET RESEARCH AND ANALYSIS BY END-USERS, 2023-2031 ($ MILLION)

18. EUROPEAN SECURE LOGISTICS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

19. EUROPEAN SECURE LOGISTICS MARKET RESEARCH AND ANALYSIS BY MODE OF TRANSPORT, 2023-2031 ($ MILLION)

20. EUROPEAN SECURE LOGISTICS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

21. EUROPEAN SECURE LOGISTICS MARKET RESEARCH AND ANALYSIS BY END-USERS, 2023-2031 ($ MILLION)

22. ASIA-PACIFIC SECURE LOGISTICS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

23. ASIA-PACIFIC SECURE LOGISTICS MARKET RESEARCH AND ANALYSIS BY MODE OF TRANSPORT, 2023-2031 ($ MILLION)

24. ASIA-PACIFIC SECURE LOGISTICS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

25. ASIA-PACIFIC SECURE LOGISTICS MARKET RESEARCH AND ANALYSIS BY END-USERS, 2023-2031 ($ MILLION)

26. REST OF THE WORLD SECURE LOGISTICS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

27. REST OF THE WORLD SECURE LOGISTICS MARKET RESEARCH AND ANALYSIS BY MODE OF TRANSPORT, 2023-2031 ($ MILLION)

28. REST OF THE WORLD SECURE LOGISTICS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

29. REST OF THE WORLD SECURE LOGISTICS MARKET RESEARCH AND ANALYSIS BY END-USERS, 2023-2031 ($ MILLION)

1. GLOBAL SECURE LOGISTICS MARKET SHARE BY MODE OF TRANSPORT, 2023 VS 2031 (%)

2. GLOBAL SECURE ROADWAYS LOGISTICS MARKET SHARE BY REGION, 2023 VS 2031 (%)

3. GLOBAL SECURE RAILWAYS LOGISTICS MARKET SHARE BY REGION, 2023 VS 2031 (%)

4. GLOBAL SECURE AIRWAYS LOGISTICS MARKET SHARE BY REGION, 2023 VS 2031 (%)

5. GLOBAL SECURE LOGISTICS MARKET SHARE BY APPLICATION, 2023 VS 2031 (%)

6. GLOBAL SECURE CASH MANAGEMENT LOGISTICS MARKET SHARE BY REGION, 2023 VS 2031 (%)

7. GLOBAL SECURE CASH MANAGEMENT LOGISTICS MARKET SHARE BY REGION, 2023 VS 2031 (%)

8. GLOBAL SECURE DIAMONDS, JEWELRY & PRECIOUS METALS LOGISTICS MARKET SHARE BY REGION, 2023 VS 2031 (%)

9. GLOBAL SECURE MANUFACTURING LOGISTICS MARKET SHARE BY REGION, 2023 VS 2031 (%)

10. GLOBAL SECURE LOGISTICS MARKET SHARE BY END-USERS, 2023 VS 2031 (%)

11. GLOBAL SECURE LOGISTICS FOR FINANCIAL INSTITUTIONS MARKET SHARE BY REGION, 2023 VS 2031 (%)

12. GLOBAL SECURE LOGISTICS FOR RETAILERS MARKET SHARE BY REGION, 2023 VS 2031 (%)

13. GLOBAL SECURE LOGISTICS FOR GOVERNMENT MARKET SHARE BY REGION, 2023 VS 2031 (%)

14. US SECURE LOGISTICS MARKET SIZE, 2023-2031 ($ MILLION)

15. CANADA SECURE LOGISTICS MARKET SIZE, 2023-2031 ($ MILLION)

16. UK SECURE LOGISTICS MARKET SIZE, 2023-2031 ($ MILLION)

17. FRANCE SECURE LOGISTICS MARKET SIZE, 2023-2031 ($ MILLION)

18. GERMANY SECURE LOGISTICS MARKET SIZE, 2023-2031 ($ MILLION)

19. ITALY SECURE LOGISTICS MARKET SIZE, 2023-2031 ($ MILLION)

20. SPAIN SECURE LOGISTICS MARKET SIZE, 2023-2031 ($ MILLION)

21. REST OF EUROPE SECURE LOGISTICS MARKET SIZE, 2023-2031 ($ MILLION)

22. INDIA SECURE LOGISTICS MARKET SIZE, 2023-2031 ($ MILLION)

23. CHINA SECURE LOGISTICS MARKET SIZE, 2023-2031 ($ MILLION)

24. JAPAN SECURE LOGISTICS MARKET SIZE, 2023-2031 ($ MILLION)

25. SOUTH KOREA SECURE LOGISTICS MARKET SIZE, 2023-2031 ($ MILLION)

26. REST OF ASIA-PACIFIC SECURE LOGISTICS MARKET SIZE, 2023-2031 ($ MILLION)

27. LATIN AMERICA SECURE LOGISTICS MARKET SIZE, 2023-2031 ($ MILLION)

28. MIDDLE EAST AND AFRICA SECURE LOGISTICS MARKET SIZE, 2023-2031 ($ MILLION)