Selective Laser Sintering (SLS) Technology Market

Global Selective Laser Sintering (SLS) Technology Market Size, Share & Trends Analysis Report by Material Type (Polymer, Metal, and Other), by End-User Industry (Automobile, Aerospace and Defense, Healthcare, Electronics, Others), Forecast 2019-2025 Update Available - Forecast 2025-2031

Selective laser sintering (SLS) technology market is projected to grow at a considerable CAGR of around 12% during the forecast period. The increase in demand for 3D printing in aerospace & defense, automotive, medical & dental, and other industrial sectors coupled with the advantage of using SLS technology is the key driver of the market growth. This is due to the fact that the possibility of the customized manufacturing of parts has offered manufacturers to unlock new revenue streams in a variety of applications. Further, reduced prices of 3D printers along with the availability of advanced raw materials including stainless steel powder have made major contributions to the market growth across the globe.

The aerospace industry was one of the early adopters of 3D printing technology, thus looking towards the huge potential of 3D printing metal technology in the aerospace industry hence, the major aerospace industry players are actively involved in using additive manufacturing technology. For instance, EOS GmbH Electro Optical Systems and Airbus Group had collaborated to design titanium-based 3D printed nacelle hinges that save 40% more fuel than their traditionally manufactured counterparts.

Moreover, rising investments in R&D activities by government and manufacturing companies are estimated to propel the utilization of metals in additive manufacturing, thereby contributing to the SLS technology market growth. However, high maintenances costs, high energy consumption, and difficulties in using the SLS software are some factors that may restrict the growth of the global SLS technology market. However, the emerging applications of SLS technology in the manufacturing sector to offer significant opportunities for the growth of the global market

Segmental Outlook

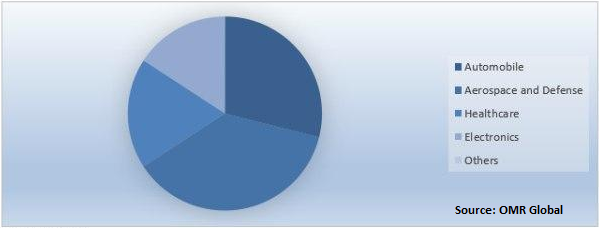

The SLS technology market is segmented on the basis of material type, and end-user industry. Based on the material type the market is segmented into polymer, metal, and other. Based on material type, metal-based SLS technology shows significant market growth during the forecast period. The increasing demand for SLS technology for the functional prototyping of metallic objects owing to its ability to produce parts with appropriate mechanical properties is a major factor to propel the growth of this segment. Further, unlike other 3D printing technologies, SLS technology does not require any additional support for building objects that makes it more useful across diverse dimensional areas. Based on the end-user industry, the market is segmented into automobile, aerospace and defense, healthcare, electronics, and others.

Aerospace & Defense will be considerable segment by End-user industry

Based on the end-user industry, the aerospace & defense segment is projected to have a considerable share in the market. This is supported by the fact that a huge amount of 3D printed metal is utilized for aircraft manufacturing and in the aerospace and defense sector. Moreover, due to the high accuracy and precision, metal 3D printing is utilized to print huge and heavy aircraft components including wings, jigs, and engine components. The accessibility of new materials for tooling and prototyping along with the high investments for new product development considerably contributed to the market growth of this segment.

Global SLS Technology Market Share by End-User Industry, 2018 (%)

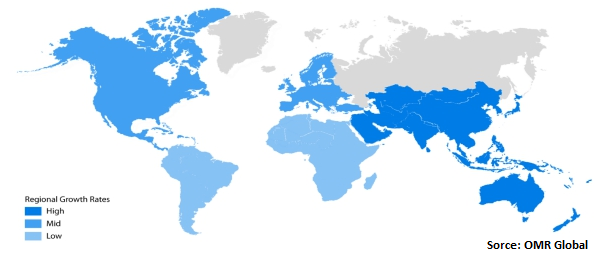

Regional Outlook

The global SLS technology market is further segmented on the basis of geography including North America, Europe, Asia-Pacific and Rest of the World. North America is anticipated to hold a considerable market share in the global market during the forecast period. The presence of key market players of the SLS technology market including 3D Systems, Inc., Autodesk, Inc., FARO Technologies, Inc., Proto Labs, Inc., Realize, Inc, Renishaw plc, and XYZPRINTING, Inc., in the region, have been a catalyzing agent to the growth of the market.

The rising investments from governments in 3D printing also play a vital role in the development of the regional market. For instance, as per the Organization for Economic Co-operation and Development OECD, in 2019; the US Federal Government had invested $773 million in manufacturing technology R&D funds to promote new technology in the manufacturing sector. Europe is also making considerable contributions to the high market share of the global SLS market. North America is followed by Europe and the Asia-Pacific is projected to be the fastest-growing market during the forecast period.

Global SLS Technology Market Growth, by Region 2019-2025

Asia-Pacific will augment with the significant growth rate in the SLS technology market

Asia-Pacific is projected to witness a significant growth rate over the forecast period. The increasing adoption of SLS technology in several verticals including construction, jewelry, consumer goods, aerospace, automotive, and healthcare among others is expected to drive the growth of the SLS market in the region.

Market Players Outlook

The key players of the SLS technology market include 3D Systems Inc., EOS GmbH, Prodways Group, Ricoh Co., Renishaw plc, ExOne Co., FARO Technologies, Inc., Formlabs GmbH, Proto Labs, Sculpteo, Stratasys Ltd., SLM Solutions Group AG, Materialise NV, and so on. These key market players are actively adopting strategic growth activities including mergers and acquisitions, partnerships and collaboration among others to increase their market share. The new product launches arethe core strength of these key market players to remain competitive in the market. For instance, in June 2018, EOS GmbH has launched FORMIGA P 110 for additive manufacturing (AM) with plastic materials. FORMIGA P 110 offers increases in productivity of up to 20%, along with more homogeneous part quality.

The Report Covers

- Market value data analysis of 2018 and forecast to 2025.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global SLS technology market. Based on the availability of data, information related to pipeline products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

2.3. Rules & Regulations

3. Competitive Landscape

3.1. Company Share Analysis

3.2. Key Strategy Analysis

3.3. Key Company Analysis

3.3.1. 3D Systems, Inc.

3.3.1.1. Overview

3.3.1.2. Financial Analysis

3.3.1.3. SWOT Analysis

3.3.1.4. Recent Developments

3.3.2. EOS GmbHElectro Optical Systems

3.3.2.1. Overview

3.3.2.2. Financial Analysis

3.3.2.3. SWOT Analysis

3.3.2.4. Recent Developments

3.3.3. XYZPRINTING, Inc.

3.3.3.1. Overview

3.3.3.2. Financial Analysis

3.3.3.3. SWOT Analysis

3.3.3.4. Recent Developments

3.3.4. Dassault Systèmes SE

3.3.4.1. Overview

3.3.4.2. Financial Analysis

3.3.4.3. SWOT Analysis

3.3.4.4. Recent Developments

3.3.5. Remishaw plc

3.3.5.1. Overview

3.3.5.2. Financial Analysis

3.3.5.3. SWOT Analysis

3.3.5.4. Recent Developments

4. Market Determinants

4.1 Motivators

4.2 Restraints

4.1. Opportunities

5. Market Segmentation

5.1. Global SLS Technology Market by Material Type

5.1.1. Polymer

5.1.2. Metal

5.1.3. Other (Ceramic and Composite)

5.2. Global SLS Technology Market by End-User industry

5.2.1. Automobile

5.2.2. Aerospace and Defense

5.2.3. Healthcare

5.2.4. Electronics

5.2.5. Others

6. Regional Analysis

6.1. North America

6.1.1. US

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. 3D Hubs B.V.

7.2. 3D Systems, Inc.

7.3. ASPECT, Inc.

7.4. Autodesk, Inc.

7.5. BASF SE

7.6. Dassault Systèmes SE

7.7. EnvisionTec, Inc.

7.8. EOS GmbH Electro Optical Systems

7.9. FARO Technologies, Inc.

7.10. Formlabs GmbH

7.11. Materialise NV

7.12. Proadways Group

7.13. Proto Labs, Inc.

7.14. Realize, Inc.

7.15. Renishaw plc.

7.16. Ricoh UK Products, Ltd.

7.17. Sinterit sp. z o.o.

7.18. SLM Solutions Group AG

7.19. Stratasys, Ltd.

7.20. The ExOne Co.

7.21. XYZPRINTING, Inc.

1. GLOBAL SLS TECHNOLOGY MARKET RESEARCH AND ANALYSIS BY MATERIAL TYPE, 2018-2025 ($ MILLION)

2. GLOBAL POLYMER MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

3. GLOBAL METAL MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

4. GLOBAL OTHER MATERIAL MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

5. GLOBAL SLS TECHNOLOGY MARKET RESEARCH AND ANALYSIS BY END-USER INDUSTRY, 2018-2025 ($ MILLION)

6. GLOBAL AUTOMOBILE MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

7. GLOBAL AEROSPACE AND DEFENSE MARKET RESEARCH AND ANALYSIS BY REGION,2018-2025 ($ MILLION)

8. GLOBAL HEALTHCARE MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

9. GLOBAL ELECTRONICS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

10. GLOBAL OTHERS END-USER INDUSTRY MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

11. NORTH AMERICAN SLS TECHNOLOGY MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

12. NORTH AMERICAN SLS TECHNOLOGY MARKET RESEARCH AND ANALYSIS BY MATERIAL TYPE, 2018-2025 ($ MILLION)

13. NORTH AMERICAN SLS TECHNOLOGY MARKET RESEARCH AND ANALYSIS BY END-USER INDUSTRY, 2018-2025 ($ MILLION)

14. EUROPEAN SLS TECHNOLOGY MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

15. EUROPEAN SLS TECHNOLOGY MARKET RESEARCH AND ANALYSIS BY MATERIAL TYPE, 2018-2025 ($ MILLION)

16. EUROPEAN SLS TECHNOLOGY MARKET RESEARCH AND ANALYSIS BY END-USER INDUSTRY, 2018-2025 ($ MILLION)

17. ASIA PACIFIC SLS TECHNOLOGY MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

18. ASIA PACIFIC SLS TECHNOLOGY MARKET RESEARCH AND ANALYSIS BY MATERIAL TYPE, 2018-2025 ($ MILLION)

19. ASIA PACIFIC SLS TECHNOLOGY MARKET RESEARCH AND ANALYSIS BY END-USER INDUSTRY, 2018-2025 ($ MILLION)

20. REST OF THE WORLD SLS TECHNOLOGY MARKET RESEARCH AND ANALYSIS BY MATERIAL TYPE, 2018-2025 ($ MILLION)

21. REST OF THE WORLD SLS TECHNOLOGY MARKET RESEARCH AND ANALYSIS BY END-USER INDUSTRY, 2018-2025 ($ MILLION)

1. GLOBAL SLS TECHNOLOGY MARKET SHARE BY MATERIAL TYPE, 2018 VS 2025 (%)

2. GLOBAL SLS TECHNOLOGY MARKET SHARE BY END-USER INDUSTRY, 2018 VS 2025 (%)

3. GLOBAL SLS TECHNOLOGY MARKET SHARE BY GEOGRAPHY, 2018 VS 2025 (%)

4. THE US SLS TECHNOLOGY MARKET SIZE, 2018-2025 ($ MILLION)

5. CANADA SLS TECHNOLOGY MARKET SIZE, 2018-2025 ($ MILLION)

6. UK SLS TECHNOLOGY MARKET SIZE, 2018-2025 ($ MILLION)

7. FRANCE SLS TECHNOLOGY MARKET SIZE, 2018-2025 ($ MILLION)

8. GERMANY SLS TECHNOLOGY MARKET SIZE, 2018-2025 ($ MILLION)

9. ITALY SLS TECHNOLOGY MARKET SIZE, 2018-2025 ($ MILLION)

10. SPAIN SLS TECHNOLOGY MARKET SIZE, 2018-2025 ($ MILLION)

11. ROE SLS TECHNOLOGY MARKET SIZE, 2018-2025 ($ MILLION)

12. INDIA SLS TECHNOLOGY MARKET SIZE, 2018-2025 ($ MILLION)

13. CHINA SLS TECHNOLOGY MARKET SIZE, 2018-2025 ($ MILLION)

14. JAPAN SLS TECHNOLOGY MARKET SIZE, 2018-2025 ($ MILLION)

15. REST OF ASIA-PACIFIC SLS TECHNOLOGY MARKET SIZE, 2018-2025 ($ MILLION)

16. REST OF THE WORLD SLS TECHNOLOGY MARKET SIZE, 2018-2025 ($ MILLION)