Semiconductor Chemicals Market

Semiconductor Chemicals Market Size, Share & Trends Analysis Report by Type (High-performance Polymers, Acid & Base Chemicals, Adhesives, Solvents, and Others) By Application (Photoresist, Etching, Deposition, Cleaning, Doping, and Others) and By End-User (Integrated Circuits, Discrete Semiconductors, Sensors, and Optoelectronics) Forecast Period (2025-2035)

Industry Overview

Global semiconductor chemicals market valued at $13.4 billion in 2024 and is projected to reach $34.9 billion in 2035, is growing at a CAGR of 9.1% during the forecast period (2025-2035). The demand for semiconductors is increasing due to the growth in consumer electronics, 5G and IoT expansion, EVs, miniaturization of devices, advanced node technology, AI, cloud computing, government support, and geopolitical shifts. These factors drive the need for specialized chemicals, ultra-clean etchants, and high-density chips in the semiconductor industry.

![]()

Market Dynamics

Surge in Global Semiconductor Demand

The global semiconductor market is experiencing a surge owing to increased demand from AI, IoT, EVs, and cloud computing, resulting in increased wafer production. According to the Semiconductor Industry Association, in February 2025, the Semiconductor Industry Association (SIA) reported that global semiconductor sales reached $627.6 billion in 2024, marking a 19.1% increase from 2023's total of $526.8 billion. Fourth-quarter sales were recorded at $170.9 billion, up 17.1% from the same period in 2023 and 3.0% higher than the third quarter of 2024, while December 2024 sales were $57.0 billion, a 1.2% decrease from November 2024. Compiled by the World Semiconductor Trade Statistics (WSTS), these figures reflect a three-month moving average. SIA, representing 99% of US semiconductor revenue and nearly two-thirds of non-US chip companies, highlights that America aims to triple domestic chip production capacity by 2032 to strengthen supply chains and address global demand, with an emphasis on advancing policies that support semiconductor innovation and manufacturing.

Boom in Electronics and Consumer Devices

The global demand for electronic devices such as smartphones, smart TVs, wearables, and home automation is causing a surge in semiconductor chip demand. According to the India Brand Equity Foundation (IBEF), in November 2024, the Indian appliance and consumer electronics industry is anticipated to nearly double its market size over the next three years, aiming for approximately $ 17.93 billion by 2025. In 2022, the industry was valued at $9.09 billion, with projections indicating a rise to $21.18 billion by 2025. Meanwhile, electronics hardware production in India reached $87 billion in 2022. The consumer electronics and home appliances market in India is expected to expand by $2.3 billion from 2022 to 2027. Additionally, smartphones have become the fourth-largest export category in India, with a 42% increase, reaching $15.6 billion in FY24.

Market Segmentation

- Based on the type, the market is segmented into high-performance polymers, acid & base chemicals, adhesives, solvents, and others (gases, strippers and cleaners, and passivation and coating materials).

- Based on the application, the market is segmented into photoresist, etching, deposition, cleaning, doping, and others (chemical mechanical planarization (CMP) and packaging).

- Based on the end-user, the market is segmented into integrated circuits, discrete semiconductors, sensors, and optoelectronics.

Photoresist: A Key Segment in Market Growth

Photoresists, essential in semiconductor manufacturing, are expected to continue growing due to advancements in AI, IoT, and data centers, bolstering the semiconductor chemical market. For instance, in February 2025, Sumitomo Chemical is expanding its photoresist development and quality evaluation facilities at its Osaka Works in Japan to strengthen its systems for developing and evaluating new photoresists for advanced semiconductor manufacturing processes. The new facilities will begin operations sequentially from fiscal year 2025 to the first half of fiscal year 2026, aiming to win more orders from advanced semiconductor manufacturers. Sumitomo Chemical has established world-class product design and evaluation technologies, leveraging its organic synthesis technology in fine chemical businesses. The company has implemented initiatives to strengthen its photoresist business, including capacity expansion at its production plants, the establishment of new development and mass production evaluation buildings, and the construction of new lines at its South Korean base.

Regional Outlook

The global semiconductor chemicals market is further divided by geography, including North America (the US and Canada), Asia-Pacific (India, China, Japan, South Korea, Australia and New Zealand, ASEAN Countries, and the Rest of Asia-Pacific), Europe (the UK, Germany, France, Italy, Spain, Russia, and the Rest of Europe), and the Rest of the World (the Middle East & Africa, and Latin America).

Rising Investments in Chip Fabrication in North America

Governments and private companies are increasing investments in semiconductor fabs, boosting demand for etching agents, deposition precursors, and CMP slurries, driving market growth. For instance, in November 2024, the CHIPS for America initiative planned to allocate up to $300 million in funding for advanced semiconductor packaging research projects in Georgia, California, and Arizona. The expected recipients, Absolics Inc., Applied Materials Inc., and Arizona State University, will each potentially receive up to $100 million to advance substrate technology. These projects aim to boost domestic production capabilities, with additional private sector investments bringing the total funding to over $470 million, enhancing US competitiveness in the global semiconductor industry.

Asia-Pacific Region Dominates the Market with Major Share

Asia-Pacific holds a significant share, owing to the market growth in India being fueled by the growing demand for advanced semiconductor materials, particularly high-purity etching, and doping chemicals, driven by the growth of AI, 5G, automotive chips, and IoT devices. For instance, in March 2025, the Indian government introduced a $10 billion incentive program to support domestic semiconductor manufacturing, aiming to subsidize around 50% of project expenses for chip and display fabrication facilities and testing infrastructures. Some states offer additional incentives of up to 20%, resulting in total fiscal support of up to 70%. These initiatives have attracted investments exceeding $18 billion across five major projects, including Tata Electronics' $11 billion chip fabrication plant in partnership with Taiwan's Powerchip Semiconductor Manufacturing Corporation. India's strategy encompasses the entire semiconductor supply chain, from raw materials to high-end packaging and testing, with efforts to boost domestic production of critical materials such as silicon wafers, specialty gases, and chemicals to lessen import reliance.

![]()

Market Players Outlook

The major companies operating in the global semiconductor chemicals market include BASF SE, FUJIFILM Holdings Corp., Merck KGaA, Sumitomo Chemical Co., Ltd., Mitsubishi Chemical Group, Asia Union Electronic Chemical Corp., Daikin Industries Ltd., DuPont de Nemours, Inc., Eastman Chemical Company, Solvay SA, and Wacker Chemie AG, among others. Market players are leveraging partnerships, collaborations, mergers and acquisition strategies for business expansion and innovative product development to maintain their market positioning.

Recent Developments

- In February 2025, Emerson and The University of Texas at Austin formed a three-year partnership to support advanced research in artificial intelligence, automation, energy, semiconductors, and other scientific disciplines. The agreement includes lab upgrades, contributions to the new Semiconductor Science and Engineering master's degree program, and talent development.

- In April 2025, Tokyo Electron and IBM extended the joint research and development agreement for advanced semiconductor technology. The new 5-year agreement focuses on developing next-generation semiconductor nodes and architectures for generative AI. Building on a two-decade partnership, the companies aim to explore technology for smaller nodes and chipset architectures, aiming to achieve performance and energy efficiency requirements for AI.

- In May 2023, Fujifilm is set to acquire KMG's semiconductor high-purity chemicals business for $700 million. This acquisition will enable Fujifilm to offer a broader range of electronic chemicals, including KMG's HPPCs, which are used in semiconductor production. This expansion complements Fujifilm's existing products, including Photoresists, photolithography materials, CMP slurry, post-CMP cleaner, Thin Film Precursors, Polyimide, and Wave Control Mosaic. The combined resources will better meet the needs of semiconductor manufacturers for innovative products.

- In August 2022, Merck acquired Mecaro Co. Ltd., a Korea-based chemical business for semiconductor heater blocks and precursors. The acquisition is part of Merck's Level Up growth program, which includes over €3 billion in innovation and capacities from 2021 to 2025.

The Report Covers

- Market value data analysis for 2024 and forecast to 2035.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global semiconductor chemicals market. Based on the availability of data, information related to new products and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

• Global Semiconductor Chemicals Market Sales Analysis – Type| Application | End-User ($ Million)

• Semiconductor Chemicals Market Sales Performance of Top Countries

1.1. Research Methodology

• Primary Research Approach

• Secondary Research Approach

1.2. Market Snapshot

2. Market Overview and Insights

2.1. Scope of the Study

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Semiconductor Chemicals Industry Trends

2.2.2. Market Recommendations

2.3. Porter's Five Forces Analysis for the Semiconductor Chemicals Market

2.3.1. Competitive Rivalry

2.3.2. Threat of New Entrants

2.3.3. Bargaining Power of Suppliers

2.3.4. Bargaining Power of Buyers

2.3.5. Threat of Substitutes

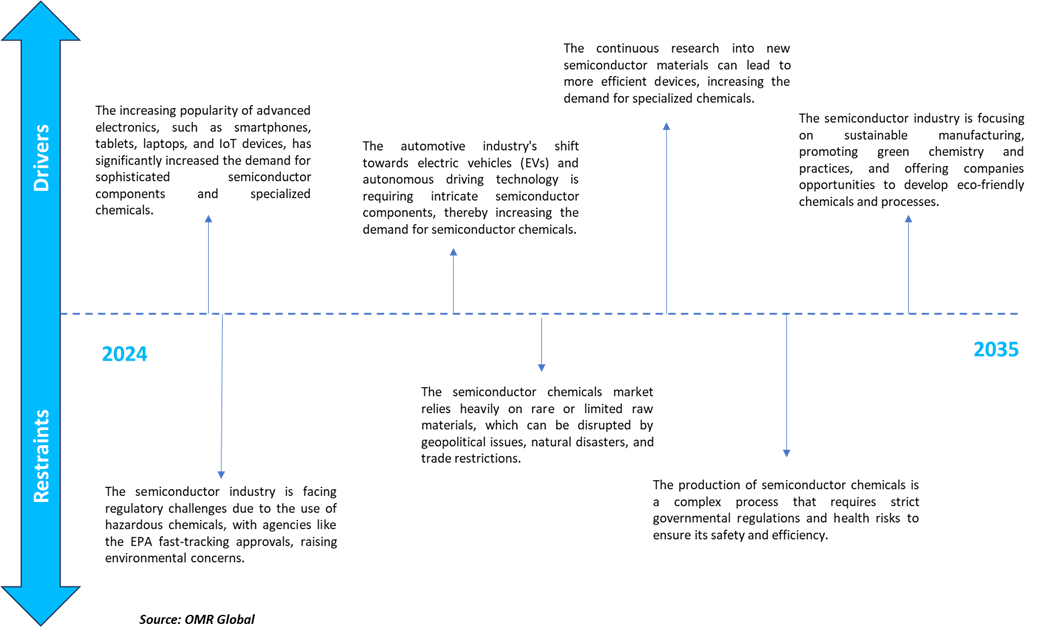

3. Market Determinants

3.1. Market Drivers

3.1.1. Drivers For Global Semiconductor Chemicals Market: Impact Analysis

3.2. Market Pain Points and Challenges

3.2.1. Restraints For Global Semiconductor Chemicals Market: Impact Analysis

3.3. Market Opportunities

4. Competitive Landscape

4.1. Competitive Dashboard – Semiconductor Chemicals Market Revenue and Share by Manufacturers

• Semiconductor Chemicals Product Comparison Analysis

• Top Market Player Ranking Matrix

4.2. Key Company Analysis

4.2.1. BASF SE

4.2.1.1. Overview

4.2.1.2. Product Portfolio

4.2.1.3. Financial Analysis (Subject to Data Availability)

4.2.1.4. SWOT Analysis

4.2.1.5. Business Strategy

4.2.2. FUJIFILM Holdings Corp.

4.2.2.1. Overview

4.2.2.2. Product Portfolio

4.2.2.3. Financial Analysis (Subject to Data Availability)

4.2.2.4. SWOT Analysis

4.2.2.5. Business Strategy

4.2.3. Sumitomo Chemical Co., Ltd.

4.2.3.1. Overview

4.2.3.2. Product Portfolio

4.2.3.3. Financial Analysis (Subject to Data Availability)

4.2.3.4. SWOT Analysis

4.2.3.5. Business Strategy

4.2.4. Merck KGaA

4.2.4.1. Overview

4.2.4.2. Product Portfolio

4.2.4.3. Financial Analysis (Subject to Data Availability)

4.2.4.4. SWOT Analysis

4.2.4.5. Business Strategy

4.2.5. Mitsubishi Chemical Group

4.2.5.1. Overview

4.2.5.2. Product Portfolio

4.2.5.3. Financial Analysis (Subject to Data Availability)

4.2.5.4. SWOT Analysis

4.2.5.5. Business Strategy

4.3. Top Winning Strategies by Market Players

4.3.1. Merger and Acquisition

4.3.2. Product Launch

4.3.3. Partnership And Collaboration

5. Global Semiconductor Chemicals Market Sales Analysis by Type ($ Million)

5.1. High-Performance Polymers

5.2. Acid & Base Chemicals

5.3. Adhesives

5.4. Solvents

5.5. Others (Gases, Strippers and Cleaners, and Passivation and Coating Materials)

6. Global Semiconductor Chemicals Market Sales Analysis by Application ($ Million)

6.1. Photoresist

6.2. Etching

6.3. Deposition

6.4. Cleaning

6.5. Doping

6.6. Others (Chemical Mechanical Planarization (CMP) and Packaging)

7. Global Semiconductor Chemicals Market Sales Analysis by End-User ($ Million)

7.1. Integrated Circuits

7.2. Discrete Semiconductors

7.3. Sensors

7.4. Optoelectronics

8. Regional Analysis

8.1. North American Semiconductor Chemicals Market Sales Analysis – Type | Application | End-User| Country ($ Million)

• Macroeconomic Factors for North America

8.1.1. United States

8.1.2. Canada

8.2. European Semiconductor Chemicals Market Sales Analysis – Type | Application | End-User| Country ($ Million)

• Macroeconomic Factors for Europe

8.2.1. UK

8.2.2. Germany

8.2.3. Italy

8.2.4. Spain

8.2.5. France

8.2.6. Russia

8.2.7. Rest of Europe

8.3. Asia-Pacific Semiconductor Chemicals Market Sales Analysis – Type | Application | End-User| Country ($ Million)

• Macroeconomic Factors for Asia-Pacific

8.3.1. China

8.3.2. Japan

8.3.3. South Korea

8.3.4. India

8.3.5. Australia & New Zealand

8.3.6. ASEAN Countries (Thailand, Indonesia, Vietnam, Singapore, And Others)

8.3.7. Rest of Asia-Pacific

8.4. Rest of the World Semiconductor Chemicals Market Sales Analysis – Type | Application | End-User| Country ($ Million)

• Macroeconomic Factors for the Rest of the World

8.4.1. Latin America

8.4.2. Middle East and Africa

9. Company Profiles

9.1. Asia Union Electronic Chemical Corp.

9.1.1. Quick Facts

9.1.2. Company Overview

9.1.3. Product Portfolio

9.1.4. Business Strategies

9.2. Alfa Chemistry

9.2.1. Quick Facts

9.2.2. Company Overview

9.2.3. Product Portfolio

9.2.4. Business Strategies

9.3. BASF SE

9.3.1. Quick Facts

9.3.2. Company Overview

9.3.3. Product Portfolio

9.3.4. Business Strategies

9.4. Daikin Industries, Ltd.

9.4.1. Quick Facts

9.4.2. Company Overview

9.4.3. Product Portfolio

9.4.4. Business Strategies

9.5. Daken Chemical Ltd.

9.5.1. Quick Facts

9.5.2. Company Overview

9.5.3. Product Portfolio

9.5.4. Business Strategies

9.6. Dow Chemical Co.

9.6.1. Quick Facts

9.6.2. Company Overview

9.6.3. Product Portfolio

9.6.4. Business Strategies

9.7. DuPont de Nemours, Inc.

9.7.1. Quick Facts

9.7.2. Company Overview

9.7.3. Product Portfolio

9.7.4. Business Strategies

9.8. Eastman Chemical Company

9.8.1. Quick Facts

9.8.2. Company Overview

9.8.3. Product Portfolio

9.8.4. Business Strategies

9.9. Entegris, Inc

9.9.1. Quick Facts

9.9.2. Company Overview

9.9.3. Product Portfolio

9.9.4. Business Strategies

9.10. FUJIFILM Holdings Corp.

9.10.1. Quick Facts

9.10.2. Company Overview

9.10.3. Product Portfolio

9.10.4. Business Strategies

9.11. Honeywell International Inc.

9.11.1. Quick Facts

9.11.2. Company Overview

9.11.3. Product Portfolio

9.11.4. Business Strategies

9.12. JSR Corp.

9.12.1. Quick Facts

9.12.2. Company Overview

9.12.3. Product Portfolio

9.12.4. Business Strategies

9.13. Kanematsu Corporation

9.13.1. Quick Facts

9.13.2. Company Overview

9.13.3. Product Portfolio

9.13.4. Business Strategies

9.14. Kao Corp.

9.14.1. Quick Facts

9.14.2. Company Overview

9.14.3. Product Portfolio

9.14.4. Business Strategies

9.15. Merck KGaA

9.15.1. Quick Facts

9.15.2. Company Overview

9.15.3. Product Portfolio

9.15.4. Business Strategies

9.16. Mitsubishi Chemical Group Corp.

9.16.1. Quick Facts

9.16.2. Company Overview

9.16.3. Product Portfolio

9.16.4. Business Strategies

9.17. Nippon Shokubai Co., Ltd.

9.17.1. Quick Facts

9.17.2. Company Overview

9.17.3. Product Portfolio

9.17.4. Business Strategies

9.18. Nishimura Chemitech Co., Ltd.

9.18.1. Quick Facts

9.18.2. Company Overview

9.18.3. Product Portfolio

9.18.4. Business Strategies

9.19. Resonac Holdings Corp.

9.19.1. Quick Facts

9.19.2. Company Overview

9.19.3. Product Portfolio

9.19.4. Business Strategies

9.20. Solvay SA

9.20.1. Quick Facts

9.20.2. Company Overview

9.20.3. Product Portfolio

9.20.4. Business Strategies

9.21. Sumitomo Chemical Co., Ltd.

9.21.1. Quick Facts

9.21.2. Company Overview

9.21.3. Product Portfolio

9.21.4. Business Strategies

9.22. The Chemours Company

9.22.1. Quick Facts

9.22.2. Company Overview

9.22.3. Product Portfolio

9.22.4. Business Strategies

9.23. Tokuyama Corp.

9.23.1. Quick Facts

9.23.2. Company Overview

9.23.3. Product Portfolio

9.23.4. Business Strategies

9.24. Tokyo Ohka Kogyo Co., Ltd.

9.24.1. Quick Facts

9.24.2. Company Overview

9.24.3. Product Portfolio

9.24.4. Business Strategies

9.25. Tosoh Finechem Corp.

9.25.1. Quick Facts

9.25.2. Company Overview

9.25.3. Product Portfolio

9.25.4. Business Strategies

9.26. Wacker Chemie AG

9.26.1. Quick Facts

9.26.2. Company Overview

9.26.3. Product Portfolio

9.26.4. Business Strategies

1. Global Semiconductor Chemicals Market Research And Analysis By Type, 2024-2035 ($ Million)

2. Global High-Performance Polymers Semiconductor Chemicals Market Research And Analysis By Region, 2024-2035 ($ Million)

3. Global Acid & Base Chemicals For Semiconductor Market Research And Analysis By Region, 2024-2035 ($ Million)

4. Global Adhesives For Semiconductor Market Research And Analysis By Region, 2024-2035 ($ Million)

5. Global Solvents For Semiconductor Market Research And Analysis By Region, 2024-2035 ($ Million)

6. Global Other Type Semiconductor Chemicals Market Research And Analysis By Region, 2024-2035 ($ Million)

7. Global Semiconductor Chemicals Market Research And Analysis By Application, 2024-2035 ($ Million)

8. Global Semiconductor Chemicals In Photoresist Market Research And Analysis By Region, 2024-2035 ($ Million)

9. Global Semiconductor Chemicals In Etching Market Research And Analysis By Region, 2024-2035 ($ Million)

10. Global Semiconductor Chemicals In Deposition Market Research And Analysis By Region, 2024-2035 ($ Million)

11. Global Semiconductor Chemicals In Cleaning Market Research And Analysis By Region, 2024-2035 ($ Million)

12. Global Semiconductor Chemicals In Doping Market Research And Analysis By Region, 2024-2035 ($ Million)

13. Global Semiconductor Chemicals In Other Application Market Research And Analysis By Region, 2024-2035 ($ Million)

14. Global Semiconductor Chemicals Market Research And Analysis By End-User, 2024-2035 ($ Million)

15. Global Semiconductor Chemicals For Integrated Circuits Market Research And Analysis By Region, 2024-2035 ($ Million)

16. Global Semiconductor Chemicals For Discrete Semiconductors Market Research And Analysis By Region, 2024-2035 ($ Million)

17. Global Semiconductor Chemicals For Sensors Market Research And Analysis By Region, 2024-2035 ($ Million)

18. Global Semiconductor Chemicals For Optoelectronics Market Research And Analysis By Region, 2024-2035 ($ Million)

19. Global Semiconductor Chemicals Market Research And Analysis By Region, 2024-2035 ($ Million)

20. North American Semiconductor Chemicals Market Research And Analysis By Country, 2024-2035 ($ Million)

21. North American Semiconductor Chemicals Market Research And Analysis By Type, 2024-2035 ($ Million)

22. North American Semiconductor Chemicals Market Research And Analysis By Application, 2024-2035 ($ Million)

23. North American Semiconductor Chemicals Market Research And Analysis By End-User, 2024-2035 ($ Million)

24. European Semiconductor Chemicals Market Research And Analysis By Country, 2024-2035 ($ Million)

25. European Semiconductor Chemicals Market Research And Analysis By Type, 2024-2035 ($ Million)

26. European Semiconductor Chemicals Market Research And Analysis By Application, 2024-2035 ($ Million)

27. European Semiconductor Chemicals Market Research And Analysis By End-User, 2024-2035 ($ Million)

28. Asia-Pacific Semiconductor Chemicals Market Research And Analysis By Country, 2024-2035 ($ Million)

29. Asia-Pacific Semiconductor Chemicals Market Research And Analysis By Type, 2024-2035 ($ Million)

30. Asia-Pacific Semiconductor Chemicals Market Research And Analysis By Application, 2024-2035 ($ Million)

31. Asia-Pacific Semiconductor Chemicals Market Research And Analysis By End-User, 2024-2035 ($ Million)

32. Rest Of The World Semiconductor Chemicals Market Research And Analysis By Region, 2024-2035 ($ Million)

33. Rest Of The World Semiconductor Chemicals Market Research And Analysis By Type, 2024-2035 ($ Million)

34. Rest Of The World Semiconductor Chemicals Market Research And Analysis By Application, 2024-2035 ($ Million)

35. Rest Of The World Semiconductor Chemicals Market Research And Analysis By End-User, 2024-2035 ($ Million)

1. Global Semiconductor Chemicals Market Research And Analysis By Type, 2024 Vs 2035 (%)

2. Global High-performance Polymers Semiconductor Chemicals Market Share By Region, 2024 Vs 2035 (%)

3. Global Acid & Base Chemicals For Semiconductor Market Share By Region, 2024 Vs 2035 (%)

4. Global Adhesives For Semiconductor Market Share By Region, 2024 Vs 2035 (%)

5. Global Solvents For Semiconductor Market Share By Region, 2024 Vs 2035 (%)

6. Global Other Type Semiconductor Chemicals Market Share By Region, 2024 Vs 2035 (%)

7. Global Semiconductor Chemicals Market Research And Analysis By Application, 2024 Vs 2035 (%)

8. Global Semiconductor Chemicals In Photoresist Market Share By Region, 2024 Vs 2035 (%)

9. Global Semiconductor Chemicals In Etching Market Share By Region, 2024 Vs 2035 (%)

10. Global Semiconductor Chemicals In Deposition Market Share By Region, 2024 Vs 2035 (%)

11. Global Semiconductor Chemicals In Cleaning Market Share By Region, 2024 Vs 2035 (%)

12. Global Semiconductor Chemicals In Doping Market Share By Region, 2024 Vs 2035 (%)

13. Global Semiconductor Chemicals Other Application Market Share By Region, 2024 Vs 2035 (%)

14. Global Semiconductor Chemicals Market Research And Analysis By End-User, 2024 Vs 2035 (%)

15. Global Semiconductor Chemicals For Integrated Circuits Market Share By Region, 2024 Vs 2035 (%)

16. Global Semiconductor Chemicals For Discrete Semiconductors Market Share By Region, 2024 Vs 2035 (%)

17. Global Semiconductor Chemicals For Sensors Market Share By Region, 2024 Vs 2035 (%)

18. Global Semiconductor Chemicals For Optoelectronics Market Share By Region, 2024 Vs 2035 (%)

19. Global Semiconductor Chemicals Market Share By Region, 2024 Vs 2035 (%)

20. US Semiconductor Chemicals Market Size, 2024-2035 ($ Million)

21. Canada Semiconductor Chemicals Market Size, 2024-2035 ($ Million)

22. UK Semiconductor Chemicals Market Size, 2024-2035 ($ Million)

23. France Semiconductor Chemicals Market Size, 2024-2035 ($ Million)

24. Germany Semiconductor Chemicals Market Size, 2024-2035 ($ Million)

25. Italy Semiconductor Chemicals Market Size, 2024-2035 ($ Million)

26. Spain Semiconductor Chemicals Market Size, 2024-2035 ($ Million)

27. Russia Semiconductor Chemicals Market Size, 2024-2035 ($ Million)

28. Rest Of Europe Semiconductor Chemicals Market Size, 2024-2035 ($ Million)

29. India Semiconductor Chemicals Market Size, 2024-2035 ($ Million)

30. China Semiconductor Chemicals Market Size, 2024-2035 ($ Million)

31. Japan Semiconductor Chemicals Market Size, 2024-2035 ($ Million)

32. South Korea Semiconductor Chemicals Market Size, 2024-2035 ($ Million)

33. ASEAN Semiconductor Chemicals Market Size, 2024-2035 ($ Million)

34. Australia and New Zealand Semiconductor Chemicals Market Size, 2024-2035 ($ Million)

35. Rest Of Asia-Pacific Semiconductor Chemicals Market Size, 2024-2035 ($ Million)

36. Latin America Semiconductor Chemicals Market Size, 2024-2035 ($ Million)

37. Middle East And Africa Semiconductor Chemicals Market Size, 2024-2035 ($ Million)

FAQS

The size of the Semiconductor Chemicals market in 2024 is estimated to be around $13.4 billion.

Asia-Pacific holds the largest share in the Semiconductor Chemicals market.

Leading players in the Semiconductor Chemicals market include BASF SE, FUJIFILM Holdings Corp., Merck KGaA, Sumitomo Chemical Co., Ltd., Mitsubishi Chemical Group, Asia Union Electronic Chemical Corp., Daikin Industries Ltd., DuPont de Nemours, Inc., East

Semiconductor Chemicals market is expected to grow at a CAGR of 9.1% from 2025 to 2035.

The semiconductor chemicals market is growing due to increasing demand for advanced electronics, EVs, 5G, and semiconductor miniaturization.