Serology Test Market

Global Serology Test Market Size, Share & Trends Analysis Report By Type (Primary Serology Testing and Secondary Serology Testing), By Application (Rotavirus Infections, Hepatitis, HIV-AIDS, Endotoxins, and Others), Forecast 2020-2026 Update Available - Forecast 2025-2035

The global serology test market is expected to gain traction during the forecast period. Serology refers to the diagnostic identification of the antibodies in the body fluids. Serological tests aids in forming the response to the infection in the body. Serological tests are performed for the diagnosis of any infection or virus suspected in the body. The key factors that are influencing the growth of the market include the need for the diagnosis of various fungal, bacterial, and viral infections. The increasing prevalence of infectious diseases across the globe is primarily driving the growth of the market during the forecast period.

The increased trends of personalized medicines may also affect market growth, as, in personalized medicines, there is the development of the drug according to body infection and disease. Thus, these are expected to fuel the market growth during the forecast period. However, lack of awareness among the peoples and lack of skilled personnel for the detection as well as to perform tests, are the growth hampering factors for the market. While new product development and approvals for serological tests are creating scope for the market growth and providing ample opportunities for market growth. Further, the emergence of the novel COVID-19 has increased the demand for serology testing in the market.

Segmental Outlook

The global serological test market is segmented on the basis of type and application. Based on the type, the market is bifurcated into primary serology testing and secondary serology testing. Primary serology testing that includes the analysis of enzyme-linked immunosorbent assay (ELISA), immunofluorescent antibody technique (IFAT), and radioimmunoassay (RIA), contribute a prominent share to the market. Further, secondary serology testing includes serum neutralization tests (SNT), agglutination tests, precipitation tests, complement fixation tests (CFT), and toxin-antitoxin tests. Based on the application, the market is segmented as rotavirus infections, hepatitis, HIV-AIDS, endotoxins, and others. The outbreak of the novel COVID-19 has significantly increased the demand for serology testing across the globe.

Rotavirus Infection & HIV-AIDS Segment Contribute Significant Share in the Market

Amongst the applications of the global serological test, rotavirus infection, and the HIV-AIDS segment contribute a significant share. The segmental growth is attributed to the increased prevalence of the rotavirus infection across the globe, majorly in the US. As per the study, in the US almost every child faces the rotavirus infection under the age of 5 years. While HIV-AIDS is also one of the severe diseases impacting people's health. Thus, the high prevalence of infectious diseases is projected to provide scope for market growth during the forecast period.

Regional Outlook

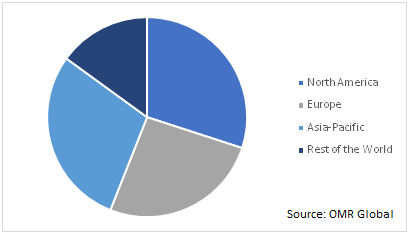

The global serology test market is geographically segmented into North America, Europe, Asia-Pacific, and the Rest of the World. The Asia Pacific is estimated to exhibit significant growth in the market during the forecast period. This is attributed to the increased prevalence of infectious and viral diseases across the region. For instance, the outbreak of novel Coronavirus has encouraged the demand for the increased number of tests and diagnosis for the treatment and development of the desired vaccine. China is one of the largely impacted countries of the region, from where the spread began, following which India, Japan, and various countries were affected, which in turn, created a scope for the market growth.

Global Serology test Market, by Region 2018 (%)

Further, the North American region is severely affected by the disease. In addition, the companies in the region are mainly focused on the development of the drugs for the treatment. Thus, this is again anticipated to propel the growth of the market during the forecast period. Further, Europe is also expected to witness significant growth in the market owing to rising government support for the development of the drug for the treatment, especially in the countries.

Market Players Outlook

Some of the prominent players operating in the global Serology test market include Becton, Dickinson and Co., Eli Lilly and Co., Thermo Fisher Scientific Inc., Abbott Laboratories, Inc., Advanced Diagnostics, Inc., Alere Inc., Beckman Coulter, Inc., Biomerica, Inc., Quest Diagnostics, Randox Laboratories Ltd., and others. These are the key companies adopting several organic and inorganic growth strategies such as product launches & developments, partnerships, agreements, and acquisitions to strengthen their product portfolios and maintain a competitive position in the global serology test market.

For instance, in April 2020, Abbott Laboratories Inc. announced the launch of its third COVID-19 test, a lab-based serology blood test for the detection of the antibody, IgG, that identifies if a person has had the novel coronavirus (COVID-19). This antibody test adds to Abbott's existing COVID-19 tests that are already being used, including its m2000 molecular laboratory system and its ID NOW molecular point-of-care device.

The Report Covers

- Market value data analysis of 2018 and forecast to 2025.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global Serology test market. Based on the availability of data, information related to pipeline products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

2.3. Rules & Regulations

3. Competitive Landscape

3.1. Key Strategy Analysis

3.2. Key Company Analysis

3.2.1. Becton Dickinson and Co.

3.2.1.1. Overview

3.2.1.2. Financial Analysis

3.2.1.3. SWOT Analysis

3.2.1.4. Recent Developments

3.2.2. Eli Lilly and Co.

3.2.2.1. Overview

3.2.2.2. Financial Analysis

3.2.2.3. SWOT Analysis

3.2.2.4. Recent Developments

3.2.3. Thermo Fisher Scientific Inc.

3.2.3.1. Overview

3.2.3.2. Financial Analysis

3.2.3.3. SWOT Analysis

3.2.3.4. Recent Developments

3.2.4. Abbott Laboratories Inc.

3.2.4.1. Overview

3.2.4.2. Financial Analysis

3.2.4.3. SWOT Analysis

3.2.4.4. Recent Developments

4. Market Determinants

4.1. Motivators

4.2. Restraints

4.3. Opportunities

5. Market Segmentation

5.1. Global Serology Test Market by Type

5.1.1. Primary Serology Testing

5.1.2. Secondary Serology Testing

5.2. Global Serology Test Market by Application

5.2.1. Rotavirus Infections

5.2.2. Hepatitis

5.2.3. HIV-AIDS

5.2.4. Endotoxins

5.2.5. Others (COVID-19)

6. Regional Analysis

6.1. North America

6.1.1. United States

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. Abbott laboratories Inc.

7.2. ACROBIOSYSTEMS INC.

7.3. Alere Inc.

7.4. Beckman Coulter, Inc.

7.5. Becton, Dickinson and Co.

7.6. Biomerica, Inc.

7.7. Certest Biotec S.L.

7.8. Charles River Laboratories International, Inc.

7.9. Chembio Diagnostic Systems, Inc.

7.10. Diasorin SPA

7.11. ELITechGroup

7.12. Eurofins Scientific

7.13. Eli Lilly & Co.

7.14. Exalenz Bioscience Ltd.

7.15. F Hoffmann La Roche Ltd.

7.16. Laboratory Corp. of America Holdings

7.17. Meridian Bioscience, Inc.

7.18. PerkinElmer Inc.

7.19. Quest Diagnostics

7.20. Randox Laboratories Ltd.

7.21. Sekisui Diagnostics, LLC

7.22. Thermo Fisher Scientific Inc.

1. GLOBAL SEROLOGY TEST MARKET RESEARCH AND ANALYSIS BY TYPE, 2019-2026 ($ MILLION)

2. GLOBAL PRIMARY SEROLOGY TESTINGMARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

3. GLOBALSECONDARY SEROLOGY TESTINGMARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

4. GLOBAL SEROLOGY TEST MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2019-2026 ($ MILLION)

5. GLOBAL SEROLOGY TEST FOR ROTAVIRUS INFECTIONSMARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

6. GLOBALSEROLOGY TEST FORHEPATITISMARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

7. GLOBALSEROLOGY TEST FOR HIV-AIDSMARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

8. GLOBALSEROLOGY TEST FOR ENDOTOXINSMARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

9. GLOBALSEROLOGY TEST FOROTHER APPLICATIONSMARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

10. GLOBAL SEROLOGY TEST MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2019-2026 ($ MILLION)

11. NORTH AMERICAN SEROLOGY TEST MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

12. NORTH AMERICAN SEROLOGY TEST MARKET RESEARCH AND ANALYSIS BY TYPE, 2019-2026 ($ MILLION)

13. NORTH AMERICAN SEROLOGY TEST MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2019-2026 ($ MILLION)

14. EUROPEAN SEROLOGY TEST MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

15. EUROPEAN SEROLOGY TEST MARKET RESEARCH AND ANALYSIS BY TYPE, 2019-2026 ($ MILLION)

16. EUROPEAN SEROLOGY TEST MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2019-2026 ($ MILLION)

17. ASIA-PACIFIC SEROLOGY TEST MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

18. ASIA-PACIFIC SEROLOGY TEST MARKET RESEARCH AND ANALYSIS BY TYPE, 2019-2026 ($ MILLION)

19. ASIA-PACIFIC SEROLOGY TEST MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2019-2026 ($ MILLION)

20. REST OF THE WORLD SEROLOGY TEST MARKET RESEARCH AND ANALYSIS BY TYPE, 2019-2026 ($ MILLION)

21. REST OF THE WORLD SEROLOGY TEST MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2019-2026 ($ MILLION)

1. GLOBAL SEROLOGY TEST MARKET SHARE BY TYPE, 2019VS 2026(%)

2. GLOBAL SEROLOGY TEST MARKET SHARE BY APPLICATION, 2019VS 2026(%)

3. GLOBAL SEROLOGY TEST MARKET SHARE BY GEOGRAPHY, 2019VS 2026(%)

4. US SEROLOGY TEST MARKET SIZE, 2019-2026 ($ MILLION)

5. CANADA SEROLOGY TEST MARKET SIZE, 2019-2026 ($ MILLION)

6. UK SEROLOGY TEST MARKET SIZE, 2019-2026 ($ MILLION)

7. FRANCE SEROLOGY TEST MARKET SIZE, 2019-2026 ($ MILLION)

8. GERMANY SEROLOGY TEST MARKET SIZE, 2019-2026 ($ MILLION)

9. ITALY SEROLOGY TEST MARKET SIZE, 2019-2026 ($ MILLION)

10. SPAIN SEROLOGY TEST MARKET SIZE, 2019-2026 ($ MILLION)

11. ROE SEROLOGY TEST MARKET SIZE, 2019-2026 ($ MILLION)

12. INDIA SEROLOGY TEST MARKET SIZE, 2019-2026 ($ MILLION)

13. CHINA SEROLOGY TEST MARKET SIZE, 2019-2026 ($ MILLION)

14. JAPAN SEROLOGY TEST MARKET SIZE, 2019-2026 ($ MILLION)

15. REST OF ASIA-PACIFIC SEROLOGY TEST MARKET SIZE, 2019-2026 ($ MILLION)

16. REST OF THE WORLD SEROLOGY TEST MARKET SIZE, 2019-2026 ($ MILLION)