Sexually Transmitted Disease (STD ) Diagnosis Market

Sexually Transmitted Diseases (STD) Diagnostics Market Size, Share & Trends Analysis Report, By Disease Type (Chlamydia, Syphilis, Gonorrhea, Herpes Simplex Virus, Human Papilloma Virus, Human Immunodeficiency Virus and Others), By Product (Laboratory Testing Devices and Point-Of-Care Testing Devices), By End-User (Hospitals and Clinics, Diagnostic Centers and Homecare) and Forecast 2019-2025. Update Available - Forecast 2025-2031

Global Sexually Transmitted Disease (STD) diagnostics market is expected to grow at a CAGR of 8.7% during the forecast period. The major factors that are driving the market growth include increasing prevalence of HIV/HPV infected population across the globe, increased rates of unsafe sex and increasing awareness regarding STDs. STDs are infections caused by organisms that transmit from one person to another through sexual activity. More than 30 different parasites, bacteria, and viruses can cause STDs. Bacterial sexually transmitted infections (STIs) include syphilis, chlamydia, and gonorrhea. Viral STIs include genital herpes and HIV/AIDS.

Moreover, various regulatory authorities have recommended sexually active men and women to have STD screening, which further accelerates the demand for STD testing. Under healthcare services, STD screening services are widely covered which is likely to augment the growth of the global STD diagnostics market. Regulatory authorities such as the WHO have outlined strategies for the prevention and control of STDs. Research activities are being carried out to understand the growing prevalence of STDs, which in turn, is creating scope for the development of advanced STD testing devices. The government organizations such as STD Surveillance Network (SSuN), CDC’s (Centres for Disease Control and Prevention) Division of STD Prevention (DSTDP), and Gonococcal Isolate Surveillance Project (GISP) are taking initiatives to provide access to healthcare services, prevention strategies, and educate the local public regarding STDs.

Segment Outlook

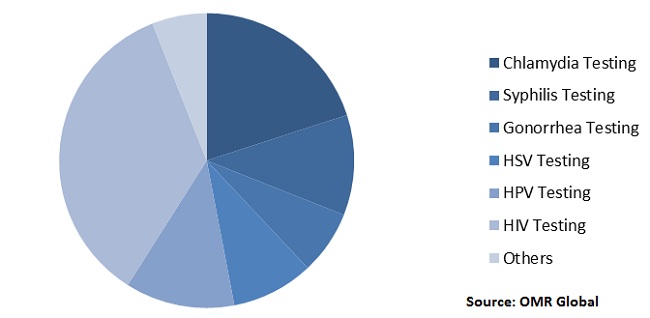

The global STD diagnostics market is segmented on the basis of disease type, product, and end-user. Based on disease type, the market is segmented into chlamydia, syphilis, gonorrhea, herpes simplex virus (HSV), human papillomavirus (HPV), human immunodeficiency virus (HIV) and others. Based on the product, the market is bifurcated into the laboratory and Point-of-Care (POC) testing devices. Based on end-user, the market is segmented into hospitals and clinics, diagnostic centers and homecare.

Global STD Diagnostics Market Share by Disease Type, 2018 (%)

STD Diagnostics Market: By Disease Type

HIV is anticipated to hold a significant share in the market in 2018, owing to the significant prevalence of HIV and significant awareness for the condition. As per WHO, globally, 37.9 million people were living with HIV at the end of 2018. Further, the number of mortalities reported due to HIV in 2018 was 770,000. Due to this significant prevalence of HIV, the government is taking initiatives for HIV testing. For instance, in July 2015, in the US, the National HIV/AIDS Strategy was released that prioritizes widespread HIV testing to decrease the cases of undiagnosed HIV infection. Several federal agencies are involved in the activities to offer more people with testing. These government initiatives to make HIV testing accessible to the people are primarily supporting the growth of HIV testing.

Regional Outlook

Geographically, the global sexually transmitted diseases (STD) diagnostics market is segmented on the basis of four major regions, including North America, Europe, Asia-Pacific, and RoW. Significant R&D for development of novel STD diagnostic tests and increasing government initiatives to rising access of HIV testing is estimated to offer significant opportunity for the market growth in these regions.

Asia-Pacific is Estimated to Witness Lucrative Growth During the Forecast Period

Asia-pacific is expected to exhibit significant growth during the forecast period. The common STDs reported in China and India includes gonorrhea, syphilis, and HIV/AIDS. In 2016, China implemented sex education classes for middle and high school students to fight the rise in new HIV infections among young people. The classes involve information about HIV prevention and HIV testing alongside issues of sexual responsibility. China took the active-testing approach, in which high-risk groups such as pregnant women, and people who inject drugs are invited to take free HIV tests. This approach has been found to be an effective approach for key affected populations. This has resulted in increasing awareness among people for STD testing and thereby fuels the regional growth of the market.

Global STD Diagnostics Market Growth by Region, 2019-2025

Competitive Landscape

The major players operating in the global STD diagnostics market include Abbott Laboratories, Inc., Bio-Rad Laboratories, Inc., F. Hoffman-La Roche Ltd., bioMerieux SA, Hologic Inc., and Danaher Corp. To increase their competitiveness, these players are adopting strategies, such as mergers and acquisitions, product launches and partnerships and collaborations. For instance, in May 2019, Abbott Laboratories, Inc. received the WHO Prequalification approval for m-PIMA HIV-1/2 VL, which is the first point-of-care viral load diagnostic test of the globe. The test received CE Mark in December 2018.

The Report Covers

- Market value data analysis of 2018 and forecast to 2025.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global STD diagnostics market. Based on the availability of data, information related to pipeline products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

2.3. Rules & Regulations

3. Competitive Landscape

3.1. Company Share Analysis

3.2. Key Strategy Analysis

3.3. Key Company Analysis

3.3.1. Abbott Laboratories, Inc.

3.3.1.1. Overview

3.3.1.2. Financial Analysis

3.3.1.3. SWOT Analysis

3.3.1.4. Recent Developments

3.3.2. Bio-Rad Laboratories, Inc.

3.3.2.1. Overview

3.3.2.2. Financial Analysis

3.3.2.3. SWOT Analysis

3.3.2.4. Recent Developments

3.3.3. F. Hoffmann-La Roche Ltd.

3.3.3.1. Overview

3.3.3.2. Financial Analysis

3.3.3.3. SWOT Analysis

3.3.3.4. Recent Developments

3.3.4. Becton, Dickinson, and Co.

3.3.4.1. Overview

3.3.4.2. Financial Analysis

3.3.4.3. SWOT Analysis

3.3.4.4. Recent Developments

3.3.5. Danaher Corp.

3.3.5.1. Overview

3.3.5.2. Financial Analysis

3.3.5.3. SWOT Analysis

3.3.5.4. Recent Developments

4. Market Determinants

4.1. Motivators

4.2. Restraints

4.3. Opportunities

5. Market Segmentation

5.1. Global STD Diagnostics Market by Disease Type

5.1.1. Chlamydia

5.1.2. Syphilis

5.1.3. Gonorrhea

5.1.4. Herpes Simplex Virus (HSV)

5.1.5. Human Papilloma Virus (HPV)

5.1.6. Human Immunodeficiency Virus (HIV)

5.1.7. Others

5.2. Global STD Diagnostics Market by Product

5.2.1. Laboratory Testing Devices

5.2.2. Point-of-Care (POC) Testing Devices

5.3. Global STD Diagnostics Market by End-User

5.3.1. Hospitals and Clinics

5.3.2. Diagnostic Centers

5.3.3. Homecare

6. Regional Analysis

6.1. North America

6.1.1. United States

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. Abbott Laboratories, Inc.

7.2. AbbVie Inc.

7.3. AITbiotech Pte Ltd.

7.4. Becton, Dickinson and Co.

7.5. Binx Health, Inc.

7.6. Biocartis NV

7.7. bioMérieux SA

7.8. Bio-Rad Laboratories, Inc.

7.9. Bristol-Myers Squibb Co.

7.10. Danaher Corp.

7.11. DiaSorin S.p.A.

7.12. Eli Lilly and Co.

7.13. F. Hoffmann-La Roche Ltd.

7.14. GenMark Diagnostics, Inc.

7.15. Hologic, Inc.

7.16. Merck KGaA

7.17. NOWDiagnostics, Inc.

7.18. OraSure Technologies, Inc.

7.19. Qualigen, Inc.

7.20. Quidel Corp.

7.21. SpeeDx Pty. Ltd.

7.22. Thermo Fisher Scientific, Inc.

- GLOBAL STD DIAGNOSTICS MARKET RESEARCH AND ANALYSIS BY DISEASE TYPE, 2018-2025 ($ MILLION)

- GLOBAL CHLAMYDIA MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

- GLOBAL SYPHILIS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

- GLOBAL GONORRHEA MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

- GLOBAL HERPES SIMPLEX VIRUS (HSV) MARKET RESEARCH AND ANALYSIS BY TREATMENT, 2018-2025 ($ MILLION)

- GLOBAL HUMAN PAPILLOMA VIRUS (HPV) MARKET RESEARCH AND ANALYSIS BY TREATMENT, 2018-2025 ($ MILLION)

- GLOBAL HUMAN IMMUNODEFICIENCY VIRUS (HIV) MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

- GLOBAL OTHER STD DIAGNOSTICS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

- GLOBAL STD DIAGNOSTICS MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2018-2025 ($ MILLION)

- GLOBAL LABORATORY STD DIAGNOSTICS DEVICES MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2018-2025 ($ MILLION)

- GLOBAL POINT-OF-CARE STD DIAGNOSTICS DEVICES MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2018-2025 ($ MILLION)

- GLOBAL STD DIAGNOSTICS MARKET RESEARCH AND ANALYSIS BY END-USER, 2018-2025 ($ MILLION)

- GLOBAL STD DIAGNOSTICS IN HOSPITALS AND CLINICS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

- GLOBAL STD DIAGNOSTICS IN DIAGNOSTIC CENTERS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

- GLOBAL STD DIAGNOSTICS IN HOMECARE MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

- GLOBAL STD DIAGNOSTICS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

- NORTH AMERICAN STD DIAGNOSTICS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

- NORTH AMERICAN STD DIAGNOSTICS MARKET RESEARCH AND ANALYSIS BY DISEASE TYPE, 2018-2025 ($ MILLION)

- NORTH AMERICAN STD DIAGNOSTICS MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2018-2025 ($ MILLION)

- NORTH AMERICAN STD DIAGNOSTICS MARKET RESEARCH AND ANALYSIS BY END-USER, 2018-2025 ($ MILLION)

- EUROPEAN STD DIAGNOSTICS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

- EUROPEAN STD DIAGNOSTICS MARKET RESEARCH AND ANALYSIS BY DISEASE TYPE, 2018-2025 ($ MILLION)

- EUROPEAN STD DIAGNOSTICS MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2018-2025 ($ MILLION)

- EUROPEAN STD DIAGNOSTICS MARKET RESEARCH AND ANALYSIS BY END-USER, 2018-2025 ($ MILLION)

- ASIA-PACIFIC STD DIAGNOSTICS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

- ASIA-PACIFIC STD DIAGNOSTICS MARKET RESEARCH AND ANALYSIS BY DISEASE TYPE, 2018-2025 ($ MILLION)

- ASIA-PACIFIC STD DIAGNOSTICS MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2018-2025 ($ MILLION)

- ASIA-PACIFIC STD DIAGNOSTICS MARKET RESEARCH AND ANALYSIS BY END-USER, 2018-2025 ($ MILLION)

- REST OF THE WORLD STD DIAGNOSTICS MARKET RESEARCH AND ANALYSIS BY DISEASE TYPE, 2018-2025 ($ MILLION)

- REST OF THE WORLD STD DIAGNOSTICS MARKET RESEARCH AND ANALYSIS BY DISEASE PRODUCT, 2018-2025 ($ MILLION)

- REST OF THE WORLD STD DIAGNOSTICS MARKET RESEARCH AND ANALYSIS BY END-USER, 2018-2025 ($ MILLION)

- GLOBAL STD DIAGNOSTICS MARKET SHARE BY DISEASE TYPE, 2018 VS 2025 (%)

- GLOBAL STD DIAGNOSTICS MARKET SHARE BY PRODUCT, 2018 VS 2025 (%)

- GLOBAL STD DIAGNOSTICS MARKET SHARE BY END-USER, 2018 VS 2025 (%)

- GLOBAL STD DIAGNOSTICS MARKET SHARE BY GEOGRAPHY, 2018 VS 2025 (%)

- US STD DIAGNOSTICS MARKET SIZE, 2018-2025 ($ MILLION)

- CANADA STD DIAGNOSTICS MARKET SIZE, 2018-2025 ($ MILLION)

- UK STD DIAGNOSTICS MARKET SIZE, 2018-2025 ($ MILLION)

- FRANCE STD DIAGNOSTICS MARKET SIZE, 2018-2025 ($ MILLION)

- GERMANY STD DIAGNOSTICS MARKET SIZE, 2018-2025 ($ MILLION)

- ITALY STD DIAGNOSTICS MARKET SIZE, 2018-2025 ($ MILLION)

- SPAIN STD DIAGNOSTICS MARKET SIZE, 2018-2025 ($ MILLION)

- ROE STD DIAGNOSTICS MARKET SIZE, 2018-2025 ($ MILLION)

- INDIA STD DIAGNOSTICS MARKET SIZE, 2018-2025 ($ MILLION)

- CHINA STD DIAGNOSTICS MARKET SIZE, 2018-2025 ($ MILLION)

- JAPAN STD DIAGNOSTICS MARKET SIZE, 2018-2025 ($ MILLION)

- REST OF ASIA-PACIFIC STD DIAGNOSTICS MARKET SIZE, 2018-2025 ($ MILLION)

- REST OF THE WORLD STD DIAGNOSTICS MARKET SIZE, 2018-2025 ($ MILLION)