Shipping Containers Market

Shipping Containers Market Size, Share & Trends Analysis Report by Size (Small containers (20 feet), Large containers (40 feet), and High Cube Containers), by Container (Dry Storage Container, Tank Container, Reefer Container, and Offshore Container), and by End-User (Automotive, Food and beverages, Consumer goods, Healthcare, Industrial products, Oil and gas, Chemicals and Other) Forecast Period (2024-2031)

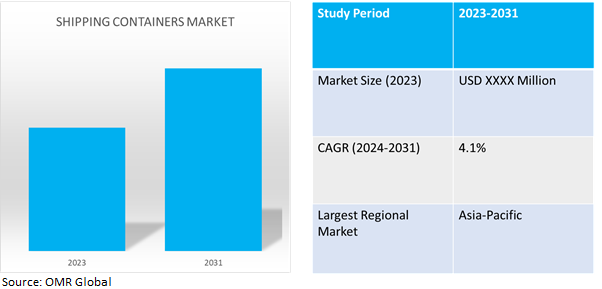

Shipping containers market is anticipated to grow at a CAGR of 4.1% during the forecast period (2024-2031). The global shipping container market is driven by the continuous growth of international trade and globalization, which has led to increased demand for efficient and reliable transportation of goods across borders. As trade volumes rise, companies seek more cost-effective and secure ways to transport their products, boosting the demand for shipping containers. Additionally, advancements in container design and technology, such as eco-friendly and smart containers with tracking and monitoring capabilities, are further propelling market growth. The rise of e-commerce and the need for rapid and efficient logistics solutions also contribute to the expansion of the shipping container market. Furthermore, the adoption of intermodal transportation, where containers can be seamlessly transferred across different modes of transport like ships, trains, and trucks, enhances efficiency and cost savings, thereby stimulating market demand.

Market Dynamics

Growing technological advancement

New technologies like big data, the Internet of Things (loT), and Artificial Intelligence (Al) have modernized ships and containers. Better tracking, enhanced environmental management, and the ability for captains and customers to identify possible issues before they become emergencies are all made possible by this. The outcome of this technology is Remote Container Management (RCM), which makes it possible to track containers' present locations, their internal temperature and humidity, and the state of their electrical connections at any time, from any point globally, during their transportation. When it comes to the transportation of goods in the food service and healthcare industries, where environmental concerns are paramount, this RCM is helpful. In August 2023, Evergreen inaugurated Taiwan's premier fully automated container terminal, the largest of its kind, with remote-controlled gantry cranes. Developed with Taiwan International Ports Corporation (TIPC), it aligns with industry trends and operational needs for mega container ships. Over time, it is anticipated that this cutting-edge container will create a substantial amount of demand.

Increasing international trade and adoption of dual-temperature containers

Globally, the increasing volume of international trade and the growing use of dual-temperature containers are driving expansion in the shipping container market. The need for containers that can carry a range of commodities, particularly perishables, is growing as world trade grows. This demand is met by containers with dual-temperature capabilities, which enable the transportation of items that are sensitive to temperature. This, in turn, propels market expansion in response to changing logistics requirements. In February 2024, Ocean Network Express (ONE) announced the launch of the world’s first dual-temperature refrigerated container trial equipped with Controlled Atmosphere (CA) functions in collaboration with Pan Pacific International Holdings Inc. (PPIH) and NAX Japan. It is the world's first use of marine transportation of the dual-temperature refrigerated container equipped with CA functions.

Market Segmentation

Our in-depth analysis of the global shipping containers market includes the following segments by size, container, and end-user:

- Based on size, the market is sub-segmented into small containers (20 feet), large containers (40 feet), and high cube containers.

- Based on the container, the market is segmented into dry storage, tank, offshore, and refrigerated/reefer containers.

- Based on end-users, the market is segmented into automotive, food and beverages, consumer goods, healthcare, industrial products, oil and gas, and chemicals.

Large Containers (40 Feet) are Projected to Emerge as the Largest Segment

Among these, the large containers sub-segment is expected to hold the largest share of the market. The primary factor supporting the segment's growth includes the use of these containers in large-scale international cargo transportation of everything from consumer goods to industrial equipment. They are essential in the logistics sector because of their uniform dimensions, which make handling and transfer between trucks, trains, and ships more efficient. Large containers rule the market as the go-to option for a variety of freight demands due to their extensive use and usefulness.

Industrial Products Sub-segment to Hold a Considerable Market Share

The industrial sub-segment holds a considerable market share because there is a need to carry raw materials, machinery, and equipment globally. Shipping containers are essential to the global industry because of their strength and security. They guarantee safe passage across continents and oceans for everything from heavy machinery to car parts. The industrial products sector continues to be the backbone of container shipping, enabling the transfer of necessities that power economies even as global production expands.

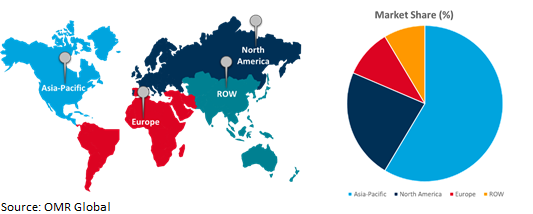

Regional Outlook

The global shipping containers market is further segmented based on geography including North America (the US, and Canada), Europe (UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia), and the Rest of the World (the Middle East & Africa, and Latin America).

North American countries to invest in the shipping containers market

- The US has one of the largest pharmaceutical markets globally which provides opportunities for shipping container vendors in the US.

Global Shipping Containers Market Growth by Region 2024-2031

Asia-Pacific Holds Major Market Share

Asia-Pacific holds a significant share driven by robust economic growth and strategic geographical advantages. The region's importance has been aided by important manufacturing centers and booming trade routes. With its vast port infrastructure and effective logistical networks, Asia-Pacific is already a major player in the global shipping market. Its dominance highlights the important part it plays in facilitating the effective global transportation of products.

To improve productivity, sustainability, and customer value, China International Marine Containers Co. Ltd. makes significant R&D investments to develop innovative container designs, materials, and technologies, such as lightweight materials, smart containers, and eco-friendly solutions. To increase operational efficiency, optimize container utilization, and improve fleet management, Triton International Limited makes significant investments in digital technologies and data analytics. Initiatives for digital transformation make it possible to detect, monitor, and predict maintenance needs for container assets in real-time.

Market Players Outlook

*Note: Major Players Sorted in No Particular Order.

The major companies serving the global Shipping Containers market include A.P. Moller–Maersk A/S, China International Marine Containers Co., Ltd., COSCO SHIPPING Development Co., Ltd., Evergreen Marine Corporation (Taiwan) LTD., and Singamas Container Holdings Limited, among others. The market players are increasingly focusing on business expansion and product development by applying strategies such as collaborations, mergers, and acquisitions to stay competitive in the market. For instance, in July 2022, Monoflo International unveiled a new 48" x 40" collapsible bulk container catering to food processing and distribution needs. This durable, high-pressure injection molded container boasts smooth surfaces for strength and ease of use. The collapsible design of the BC 4840 improves storage and backhaul efficiency, fitting 240 units on a 53’ truck.

The Report Covers

- Market value data analysis of 2023 and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global shipping containers market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. A.P. Moller-Maersk A/S

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. China International Marine Containers Co., Ltd.

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. COSCO SHIPPING Development Co., Ltd.

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Key Strategy Analysis

4. Market Segmentation

4.1. Global Shipping Containers Market by Size

4.1.1. Small containers (20 feet)

4.1.2. Large containers (40 feet)

4.1.3. High Cube Containers

4.2. Global Shipping Containers Market by Container

4.2.1. Dry Shipping Containers

4.2.2. Reefer Shipping Containers

4.2.3. Tank Shipping Containers

4.2.4. Offshore Shipping Containers

4.3. Global Shipping Containers Market by End-User

4.3.1. Automotive

4.3.2. Food and beverages

4.3.3. Consumer goods

4.3.4. Healthcare

4.3.5. Industrial Products

4.3.6. Oil and gas

4.3.7. Chemicals

4.3.8. Other

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

5.4.1. Latin America

5.4.2. Middle East and Africa

6. Company Profiles

6.1. ALMAR Container Group

6.2. BD Containers BV

6.3. BSL Containers Ltd.

6.4. CARU Containers B.V.

6.5. China Eastern Containers (CEC)

6.6. China International Marine Container Group Co., Ltd.

6.7. CXIC Group Containers Co., Ltd. (CXIC)

6.8. DCM Hyundai Ltd.

6.9. Evergreen Marine (Taiwan) Ltd.

6.10. Hapag-Lloyd AG

6.11. IPL Management

6.12. IWES Ltd.

6.13. Klinge Corp.

6.14. OEG OFFSHORE

6.15. Ritveyraaj Cargo Shipping Containers

6.16. Sea Box, Inc.

6.17. Singamas Container Holdings Limited

6.18. Triton International, Ltd.

6.19. W&K Containers, Inc.

6.20. YMC Container Solutions

1. GLOBAL SHIPPING CONTAINERS MARKET RESEARCH AND ANALYSIS BY SIZE, 2023-2031 ($ MILLION)

2. GLOBAL SMALL (20 FEET) SHIPPING CONTAINERS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

3. GLOBAL LARGE (40 FEET) SHIPPING CONTAINERS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

4. GLOBAL HIGH CUBE SHIPPING CONTAINERS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

5. GLOBAL SHIPPING CONTAINERS MARKET RESEARCH AND ANALYSIS BY CONTAINER, 2023-2031 ($ MILLION)

6. GLOBAL DRY STORAGE SHIPPING CONTAINERS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

7. GLOBAL TANK SHIPPING CONTAINERS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

8. GLOBAL REEFER/REFRIGERATED SHIPPING CONTAINERS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

9. GLOBAL OFFSHORE SHIPPING CONTAINERS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

10. GLOBAL SHIPPING CONTAINERS MARKET RESEARCH AND ANALYSIS BY END-USER, 2023-2031 ($ MILLION)

11. GLOBAL SHIPPING CONTAINERS FOR AUTOMOTIVE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

12. GLOBAL SHIPPING CONTAINERS FOR FOOD AND BEVERAGES MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

13. GLOBAL SHIPPING CONTAINERS FOR CONSUMER GOODS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

14. GLOBAL SHIPPING CONTAINERS FOR HEALTHCARE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

15. GLOBAL SHIPPING CONTAINERS FOR INDUSTRIAL PRODUCTS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

16. GLOBAL SHIPPING CONTAINERS FOR OIL AND GAS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

17. GLOBAL SHIPPING CONTAINERS FOR CHEMICALS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

18. GLOBAL SHIPPING CONTAINERS FOR OTHER MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

19. GLOBAL SHIPPING CONTAINERS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

20. NORTH AMERICAN SHIPPING CONTAINERS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

21. NORTH AMERICAN SHIPPING CONTAINERS MARKET RESEARCH AND ANALYSIS BY SIZE, 2023-2031 ($ MILLION)

22. NORTH AMERICAN SHIPPING CONTAINERS MARKET RESEARCH AND ANALYSIS BY CONTAINER, 2023-2031 ($ MILLION)

23. NORTH AMERICAN SHIPPING CONTAINERS MARKET RESEARCH AND ANALYSIS BY END-USER, 2023-2031 ($ MILLION)

24. EUROPEAN SHIPPING CONTAINERS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

25. EUROPEAN SHIPPING CONTAINERS MARKET RESEARCH AND ANALYSIS BY SIZE, 2023-2031 ($ MILLION)

26. EUROPEAN SHIPPING CONTAINERS MARKET RESEARCH AND ANALYSIS BY CONTAINER, 2023-2031 ($ MILLION)

27. EUROPEAN SHIPPING CONTAINERS MARKET RESEARCH AND ANALYSIS BY END-USER, 2023-2031 ($ MILLION)

28. ASIA-PACIFIC SHIPPING CONTAINERS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

29. ASIA-PACIFIC SHIPPING CONTAINERS MARKET RESEARCH AND ANALYSIS BY SIZE, 2023-2031 ($ MILLION)

30. ASIA-PACIFIC SHIPPING CONTAINERS MARKET RESEARCH AND ANALYSIS BY CONTAINER, 2023-2031 ($ MILLION)

31. ASIA-PACIFIC SHIPPING CONTAINERS MARKET RESEARCH AND ANALYSIS BY END-USER, 2023-2031 ($ MILLION)

32. REST OF THE WORLD SHIPPING CONTAINERS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

33. REST OF THE WORLD SHIPPING CONTAINERS MARKET RESEARCH AND ANALYSIS BY SIZE, 2023-2031 ($ MILLION)

34. REST OF THE WORLD SHIPPING CONTAINERS MARKET RESEARCH AND ANALYSIS BY CONTAINER, 2023-2031 ($ MILLION)

35. REST OF THE WORLD SHIPPING CONTAINERS MARKET RESEARCH AND ANALYSIS BY END-USER, 2023-2031 ($ MILLION)

1. GLOBAL SHIPPING CONTAINERS MARKET SHARE BY SIZE, 2023 VS 2031 (%)

2. GLOBAL SMALL (20 FEET) SHIPPING CONTAINERS MARKET SHARE BY REGION, 2023 VS 2031 (%)

3. GLOBAL LARGE (40 FEET) SHIPPING CONTAINERS MARKET SHARE BY REGION, 2023 VS 2031 (%)

4. GLOBAL HIGH CUBE SHIPPING CONTAINERS MARKET SHARE BY REGION, 2023 VS 2031 (%)

5. GLOBAL SHIPPING CONTAINERS MARKET SHARE BY CONTAINER, 2023 VS 2031 (%)

6. GLOBAL DRY STORAGE SHIPPING CONTAINERS MARKET SHARE BY REGION, 2023 VS 2031 (%)

7. GLOBAL TANK SHIPPING CONTAINERS MARKET SHARE BY REGION, 2023 VS 2031 (%)

8. GLOBAL REEFER/REFRIGERATED SHIPPING CONTAINERS MARKET SHARE BY REGION, 2023 VS 2031 (%)

9. GLOBAL SHIPPING CONTAINERS MARKET SHARE BY END-USER, 2023 VS 2031 (%)

10. GLOBAL SHIPPING CONTAINERS FOR AUTOMOTIVE MARKET SHARE BY REGION, 2023 VS 2031 (%)

11. GLOBAL SHIPPING CONTAINERS FOR FOOD AND BEVERAGES MARKET SHARE BY REGION, 2023 VS 2031 (%)

12. GLOBAL SHIPPING CONTAINERS FOR CONSUMER GOODS MARKET SHARE BY REGION, 2023 VS 2031 (%)

13. GLOBAL SHIPPING CONTAINERS FOR HEALTHCARE MARKET SHARE BY REGION, 2023 VS 2031 (%)

14. GLOBAL SHIPPING CONTAINERS FOR INDUSTRIAL PRODUCTS MARKET SHARE BY REGION, 2023 VS 2031 (%)

15. GLOBAL SHIPPING CONTAINERS FOR OIL AND GAS MARKET SHARE BY REGION, 2023 VS 2031 (%)

16. GLOBAL SHIPPING CONTAINERS FOR CHEMICALS MARKET SHARE BY REGION, 2023 VS 2031 (%)

17. GLOBAL SHIPPING CONTAINERS FOR OTHER MARKET SHARE BY REGION, 2023 VS 2031 (%)

18. GLOBAL SHIPPING CONTAINERS MARKET SHARE BY REGION, 2023 VS 2031 (%)

19. US SHIPPING CONTAINERS MARKET SIZE, 2023-2031 ($ MILLION)

20. CANADA SHIPPING CONTAINERS MARKET SIZE, 2023-2031 ($ MILLION)

21. UK SHIPPING CONTAINERS MARKET SIZE, 2023-2031 ($ MILLION)

22. FRANCE SHIPPING CONTAINERS MARKET SIZE, 2023-2031 ($ MILLION)

23. GERMANY SHIPPING CONTAINERS MARKET SIZE, 2023-2031 ($ MILLION)

24. ITALY SHIPPING CONTAINERS MARKET SIZE, 2023-2031 ($ MILLION)

25. SPAIN SHIPPING CONTAINERS MARKET SIZE, 2023-2031 ($ MILLION)

26. REST OF EUROPE SHIPPING CONTAINERS MARKET SIZE, 2023-2031 ($ MILLION)

27. INDIA SHIPPING CONTAINERS MARKET SIZE, 2023-2031 ($ MILLION)

28. CHINA SHIPPING CONTAINERS MARKET SIZE, 2023-2031 ($ MILLION)

29. JAPAN SHIPPING CONTAINERS MARKET SIZE, 2023-2031 ($ MILLION)

30. SOUTH KOREA SHIPPING CONTAINERS MARKET SIZE, 2023-2031 ($ MILLION)

31. REST OF ASIA-PACIFIC SHIPPING CONTAINERS MARKET SIZE, 2023-2031 ($ MILLION)

32. LATIN AMERICA SHIPPING CONTAINERS MARKET SIZE, 2023-2031 ($ MILLION)

33. MIDDLE EAST AND AFRICA SHIPPING CONTAINERS MARKET SIZE, 2023-2031 ($ MILLION)