Shock Absorber Market

Shock Absorber Market Size, Share & Trends Analysis Report by Type (Twin Tube, and Mono Tube), and by Vehicle Type (Passenger Vehicles, and Commercial Vehicles) and by Sales Channel (Original Equipment Manufacturer (OEM), and Aftermarket) Forecast Period (2024-2031)

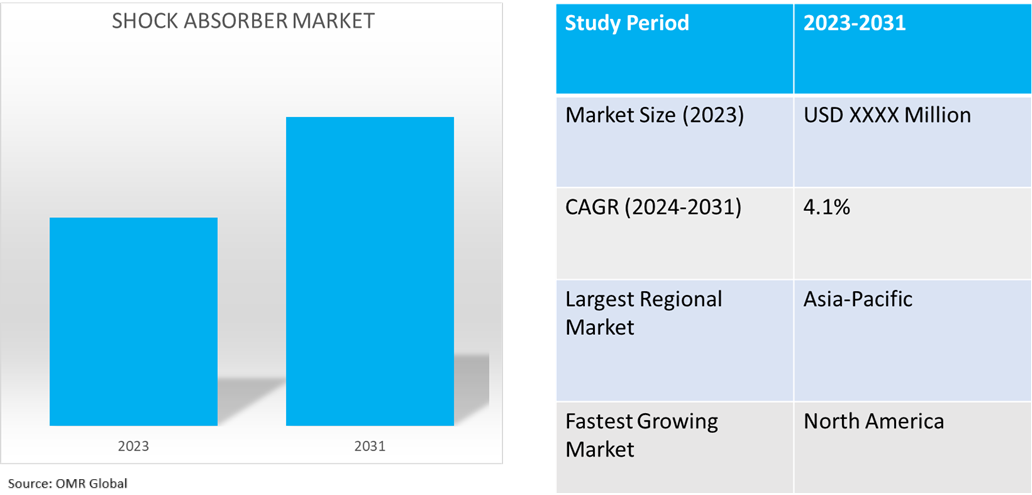

Shock absorber market is anticipated to grow at a CAGR of 4.1% during the forecast period (2024-2031). The rise in ride comfort and vehicle stability, especially in challenging road conditions, is driving the integration of advanced suspension systems and specialized shock absorbers. Technological advancements, the rise of electric vehicles, and regulatory pressure for safety are driving market growth. The automotive industry is additionally focusing on lightweight and sustainable materials which creates demand for recycled shock absorbers.

Market Dynamics

Technological Advancements in Suspension Systems

Technological developments in suspension systems have been essential for the performance, comfort, and safety of a vehicle. The popularity of electric and hybrid vehicles in the current market allows for an option to increase demand for solutions that can easily adapt according to the real-time changing road conditions. Among these, adaptive suspension systems and custom-designed shock absorbers are essential components in meeting changing market demands and consumer expectations. For instance, in December 2023, NTN launched its 100% gas-filled range of SNR shock absorbers. SNR shock absorbers provide superior performance and increased longevity along with adaptability to assure changing market demands. By grouping various shock absorber parts, such as those for light automobiles with a spring cup, MacPherson strut, and cartridge, the company's product range simplifies routine operations.

Increased Electric Vehicle Adoption

The demand for advanced suspension systems is increasing with the rising sales of electric vehicles. To provide effortless driving and energy efficiency, shock absorbers desire to be able to accommodate more substantial battery packs and weight distribution. According to the International Energy Agency (IEA) Org., in 2024, electric car sales are estimated to hit nearly 17 million in 2024. Approximately 1.4 million new electric light-duty cars were sold in the US in 2023, up from almost 1 million in 2022, resulting in a sales share of about 9%. The industry continues to advance toward becoming a large-scale market in many countries despite the obstacles it faces, including tight margins, fluctuating battery metal prices, high inflation and decreased purchase incentives in some regions. In the first quarter of 2024, sales rose by about 25% from the same period in 2023. Furthermore, market players Like Gabriel India are exploring innovative applications such as solar dampers and e-bikes. The organization is working with professionals in Taiwan to develop e-bike products that have been well accepted. With a focus on innovation, exports, local expansion, and strategic acquisitions, Gabriel aims to be among the top 5 shock absorber manufacturers globally by 2025.

Market Segmentation

- Based on the type, the market is segmented into twin tubes and monotubes.

- Based on the vehicle type, the market is segmented into passenger vehicles and commercial vehicles.

- Based on the sales channel, the market is segmented into original equipment manufacturer (OEM), and aftermarket.

Commercial Vehicles Segment is projected to Hold the Largest Market Share.

The demand for durable, high-performance shock absorbers is rising as a result of the expansion of the commercial vehicle market and the global logistics and e-commerce sectors. The shock absorbers are especially useful in the expanding market since they offer superior ride control and cargo protection and are made for high-load cars. In May 2021, Dayton Parts introduced its new CARGOMAXX HD premium shock absorbers for commercial vehicles that deliver high-quality ride control and cargo protection. The product has a nitrogen gas-charged system, an innovative sealing system, superior welds, and thick-shouldered bushings with an exclusive rubber compound. The parts are available in three models: steering damper shocks, cab shocks, and standard duty shocks.

Original Equipment Manufacturer (OEM) Segment to Hold a Considerable Market Share

OEMs are companies that manufacture parts or products used in the final assembly of a larger product. It directly supplies shock absorbers to the automakers for installation in new vehicles during production. These shock absorbers are used in passenger vehicles, commercial vehicles, and racing cars. The OEMs also manufacture high-performance shock absorbers specific to certain track conditions.

Regional Outlook

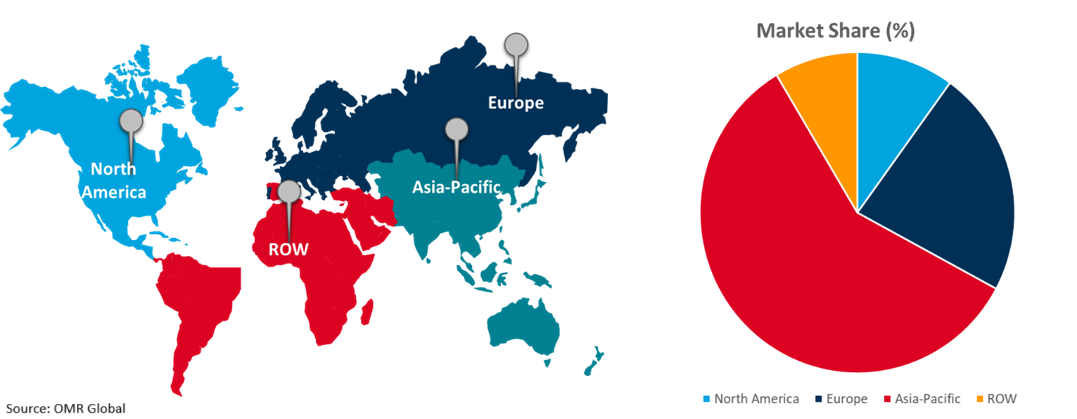

The global shock absorber market is further segmented based on geography including North America (the US, and Canada), Europe (the UK, Germany, France, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (China, India, Japan, South Korea, and Rest of Asia-Pacific), and the Rest of the World (the Middle East & Africa, and Latin America).

Strict Regulations for Automobile Safety In the North American Region

The US companies are enforcing stronger vehicle safety standards, mandating manufacturers to install high-performance suspension technologies in new vehicles and replacement parts for increasing market growth. ZF has increased its SACHS CDC shock line for the US and Canada by more than 70% in response to the growing demand for advanced damping technology in the aftermarket for 33 new part numbers on approximately 1.6 million passenger vehicles.

Global Shock Absorber Market Growth by Region 2024-2031

Asia-Pacific Holds Major Market Share

Asia-Pacific holds a significant share owing to the expanding automotive industry, advancements in suspension technology, stringent safety and comfort standards, and more. Nations such as China, India, and Japan have been witnessing significant growth in their automotive industries. China remains the largest automobile market in terms of both yearly sales and production across the globe, with domestic production expected to reach 35 million vehicles by 2025. According to the Ministry of Industry and Information Technology, over 26 million vehicles were sold in 2021. The domestic-brand passenger car sales increased 5.3% year over year to reach 2.68 million units in the first quarter of this year, making up 52.2% of total passenger car sales in China according to data from the China Association of Automobile Manufacturers. Furthermore, India is a major exporter of automobiles and is expected to see a rapid increase in its exports soon. Additionally, the government of India is anticipated to make India one of the top markets for two-wheelers and four-wheelers through several measures, including the Automotive Mission Plan 2026, scrappage policy, and production-linked incentive plan.

Market Players Outlook

*Note: Major Players Sorted in No Particular Order.

The major companies serving the shock absorber market include KYB Corp., Tenneco Inc., ZF Friedrichshafen AG, Hitachi Astemo, Ltd., ThyssenKrupp AG, and others. The market players are increasingly focusing on business expansion and product development by applying strategies such as collaborations, mergers and acquisitions to stay competitive in the market.

Recent Developments

- In August 2024, VI-grade and Step Lab collaborated to develop a turnkey mHiL testing technology for automotive shock absorbers to reduce complexity and time. This is to be used with active as well as semi-active suspension systems together with advanced control strategies.

The Report Covers

- Market value data analysis of 2023 and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global shock absorber market. Based on the availability of data, information related to new products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Industry Trends

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. KYB Corp.

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. Tenneco Inc.

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. ZF Friedrichshafen AG

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. ThyssenKrupp AG

3.5.1. Overview

3.5.2. Financial Analysis

3.5.3. SWOT Analysis

3.5.4. Recent Developments

3.6. Hitachi Astemo, Ltd.

3.6.1. Overview

3.6.2. Financial Analysis

3.6.3. SWOT Analysis

3.6.4. Recent Developments

3.7. Key Strategy Analysis

4. Market Segmentation

4.1. Global Shock Absorber Market by Type

4.1.1. Twin Tube

4.1.2. Mono Tube

4.2. Global Shock Absorber Market by Vehicle Type

4.2.1. Passenger Vehicles

4.2.2. Commercial Vehicles

4.3. Global Shock Absorber Market by Sales Channel

4.3.1. Original Equipment Manufacturer (OEM)

4.3.2. Aftermarket

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

5.4.1. Latin America

5.4.2. Middle East and Africa

6. Company Profiles

6.1. ACE Controls Inc.

6.2. ALOIS KOBER GMBH

6.3. Arnott LLC

6.4. BorgWarner Inc.

6.5. ContiTech Deutschland GmbH

6.6. Danfoss A/S

6.7. Dayton Parts LLC.

6.8. Fuji Electric Co., Ltd.

6.9. Gabriel

6.10. Hutchinson SA

6.11. ITT INC

6.12. Marelli Aftermarket Italy S.p.A.

6.13. Munjal Showa Ltd.

6.14. PRT Performance Ride Technology USA

6.15. QA1 Precision Products, Inc.

6.16. Ridon Shock Absorber Ltd.

6.17. Wheel Pros, LLC

1. Global Shock Absorber Market Research And Analysis By Type, 2023-2031 ($ Million)

2. Global Twin Tube Shock Absorber Market Research And Analysis By Region, 2023-2031 ($ Million)

3. Global Mono Tube Shock Absorber Market Research And Analysis By Region, 2023-2031 ($ Million)

4. Global Shock Absorber Market Research And Analysis By Vehicle Type, 2023-2031 ($ Million)

5. Global Passenger Vehicles Shock Absorber Market Research And Analysis By Region, 2023-2031 ($ Million)

6. Global Commercial Vehicles Shock Absorber Market Research And Analysis By Region, 2023-2031 ($ Million)

7. Global Shock Absorber Market Research And Analysis By Sales Channel, 2023-2031 ($ Million)

8. Global Shock Absorber For Original Equipment Manufacturer (OEM) Market Research And Analysis By Region, 2023-2031 ($ Million)

9. Global Shock Absorber For Aftersales Market Research And Analysis By Region, 2023-2031 ($ Million)

10. Global Shock Absorber Market Research And Analysis By Region, 2023-2031 ($ Million)

11. North American Shock Absorber Market Research And Analysis By Country, 2023-2031 ($ Million)

12. North American Shock Absorber Market Research And Analysis By Type, 2023-2031 ($ Million)

13. North American Shock Absorber Market Research And Analysis By Vehicle Type, 2023-2031 ($ Million)

14. North American Shock Absorber Market Research And Analysis By Sales Channel, 2023-2031 ($ Million)

15. European Shock Absorber Market Research And Analysis By Country, 2023-2031 ($ Million)

16. European Shock Absorber Market Research And Analysis By Type, 2023-2031 ($ Million)

17. European Shock Absorber Market Research And Analysis By Vehicle Type, 2023-2031 ($ Million)

18. European Shock Absorber Market Research And Analysis By Sales Channel, 2023-2031 ($ Million)

19. Asia-Pacific Shock Absorber Market Research And Analysis By Country, 2023-2031 ($ Million)

20. Asia-Pacific Shock Absorber Market Research And Analysis By Type, 2023-2031 ($ Million)

21. Asia-Pacific Shock Absorber Market Research And Analysis By Vehicle Type, 2023-2031 ($ Million)

22. Asia-Pacific Shock Absorber Market Research And Analysis By Sales Channel, 2023-2031 ($ Million)

23. Rest Of The World Shock Absorber Market Research And Analysis By Region, 2023-2031 ($ Million)

24. Rest Of The World Shock Absorber Market Research And Analysis By Type, 2023-2031 ($ Million)

25. Rest Of The World Shock Absorber Market Research And Analysis By Vehicle Type, 2023-2031 ($ Million)

26. Rest Of The World Shock Absorber Market Research And Analysis By Sales Channel, 2023-2031 ($ Million)

1. Global Shock Absorber Market Share By Type, 2023 Vs 2031 (%)

2. Global Twin Tube Shock Absorber Market Share By Region, 2023 Vs 2031 (%)

3. Global Mono Tube Shock Absorber Market Share By Region, 2023 Vs 2031 (%)

4. Global Shock Absorber Market Share By Vehicle Type, 2023 Vs 2031 (%)

5. Global Passenger Vehicles Shock Absorber Market Share By Region, 2023 Vs 2031 (%)

6. Global Commercial Vehicles Shock Absorber Market Share By Region, 2023 Vs 2031 (%)

7. Global Others Sales Channel Type Shock Absorber Market Share By Region, 2023 Vs 2031 (%)

8. Global Shock Absorber Market Share By Sales Channel, 2023 Vs 2031 (%)

9. Global Shock Absorber For Original Equipment Manufacturer (OEM) Market Share By Region, 2023 Vs 2031 (%)

10. Global Shock Absorber For Aftermarket Market Share By Region, 2023 Vs 2031 (%)

11. Global Shock Absorber Market Share By Region, 2023 Vs 2031 (%)

12. US Shock Absorber Market Size, 2023-2031 ($ Million)

13. Canada Shock Absorber Market Size, 2023-2031 ($ Million)

14. UK Shock Absorber Market Size, 2023-2031 ($ Million)

15. France Shock Absorber Market Size, 2023-2031 ($ Million)

16. Germany Shock Absorber Market Size, 2023-2031 ($ Million)

17. Italy Shock Absorber Market Size, 2023-2031 ($ Million)

18. Spain Shock Absorber Market Size, 2023-2031 ($ Million)

19. Rest Of Europe Shock Absorber Market Size, 2023-2031 ($ Million)

20. India Shock Absorber Market Size, 2023-2031 ($ Million)

21. China Shock Absorber Market Size, 2023-2031 ($ Million)

22. Japan Shock Absorber Market Size, 2023-2031 ($ Million)

23. South Korea Shock Absorber Market Size, 2023-2031 ($ Million)

24. Rest Of Asia-Pacific Shock Absorber Market Size, 2023-2031 ($ Million)

25. Latin America Shock Absorber Market Size, 2023-2031 ($ Million)

26. Middle East And Africa Shock Absorber Market Size, 2023-2031 ($ Million)