SIC Powder Market

Global SIC Powder Market Size, Share & Trends Analysis Report by Product (Green SIC, Black SIC, and Others), and by Application (Steel Manufacturing, Energy, Automotive, Aerospace And Defense, Electronics And Semiconductor, And Other) Forecast Period (2022-2028) Update Available - Forecast 2025-2031

The global SIC powder market is anticipated to grow at a significant CAGR of around 16.1% during the forecast period. The increasing steel industry is anticipated to the SIC Powder market growth owing to the silicon carbide being used as a deoxidizing agent in the steel industry and majorly used raw material in refractories production. In the Financial year(FY) 2021, India was the second-largest producer of steel with an output of 9.8 million tonnes. Moreover, in FY21, the production of crude steel and finished steel stood a 102.49 MT and 94.66 MT. The increase in the steel sector is driven by the domestic availability of raw materials such as iron ore and cost-effective labor. Furthermore, increasing steel production is likely to grow the demand for refractories is augmented by the growth SIC powder market. For instance, in October 2021, ArcelorMittal and Nippon Steel Corp., invest about $13.4 billion over 10 years to expand their operations in India. The company has also signed an initial pact with the Odisha government to build a 12 mt steel mill.

Impact of COVID-19 Pandemic on Global SIC Powder Market

COVID-19 has impacted negatively the market due to disruption in the global supply chain with reduced demand from various end-user industries. Moreover, reduction in demand of other industries such as aerospace and defense, electronics industry among others owing to the stoppages, supply chain disruption, and labor shortages has majorly the demand for SIC powder market.

Segmental Outlook

The global SIC powder market is segmented based on the product and application. Based on the product, the market is segmented into green SIC, black SIC, and others. On the basis of application, the market is sub-classified into steel manufacturing, energy, automotive, aerospace and defense, electronics and semiconductor, and others. Among the type segment, Black SiC is dominating owing to the growing consumption of steel and growing automobile and construction industries due to its crystalline nature. Moreover, it also has various applications in abrasives, polishing, wear-resistant, and refractory products on account of its properties, and also it is cost-effective in comparison to green sic.

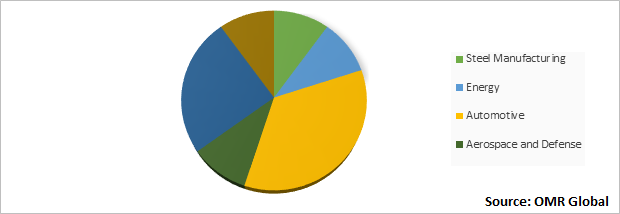

Global SIC Powder Market Share by Application, 2021 (%)

The Automotive Segment is Dominating in the Global SIC Powder Market

The automotive segment is dominating due to the growing penetration of electric vehicles, in that SIC is used for power electronics devices that are operated at elevated temperatures. As per the International Energy Agency, the global sales of electric vehicles are expected to reach 44 million by 2030, and by that the demand for electronics devices used in EVs will also grow. Moreover, the growing demand for devices such as inverters and MOSFET to meet the demand from the automotive industry to propel market growth. For instance, in December 2021, STMicroelectronics launched the third generation of STPOWER silicon carbide (SiC) MOSFETs, that are the third generation of STPOWER silicon carbides (SiC) MOSFETs such as STPAK, H2PAK-7L, HiP247-4L, and HU3PAK and power modules of the ACEPACK family, targeting advanced power applications (such as EV powertrains) and other applications. The power electronics devices are used in EVs, as well as in many industrial applications such as EV charging stations, industrial drives, power supply for data centers, energy generation, and storage.

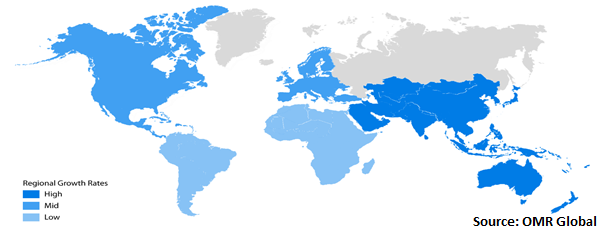

Regional Outlooks

The global SIC powder market is further segmented based on geography including North America (the US, and Canada), Europe (UK, Italy, Spain, Germany, France, and Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia), and the Rest of the World (the Middle East &Africa, and Latin America. Asia-Pacific region is dominating owing to growing manufacturing sectors in countries such as India and China. For instance, in October 2021, Evonik and Wynca started their new fumed silica plant Located in the Zhenjiang New Material Industry Park in Jiangsu province. Both the companies will produce fumed silica marketed under the brand name AEROSIL.?

Global SIC Powder Market Growth, by Region 2022-2028

The North America Region is Fastest Growing in the Global SIC Powder Market

Geographically, the North American region is anticipated to dominate the SIC powder market owing to leading automobile makers are manufacturing lightweight vehicles that are economical ad emit low carbon dioxide due to rising environmental concerns in the region. Furthermore, the growing electronic industry and demand for new technological products are anticipated to help the powder market to grow in the future. Moreover, increasing demand for lightweight vehicles is encouraging silicone carbide manufacturers to engage themselves in long-term contracts by offering various products to meet automakers' demand. For instance, in July 2021, STMicroelectronics has manufactured the first 200mm (8-inch) Silicon-Carbide (SiC) bulk wafers for prototyping next-generation power devices. The transition to 200mm SiC wafers marks an important milestone in the capacity build-up for the company's programs in automotive and industrial sectors for customers.

Market Players Outlook

The major companies serving the global SIC powder market include AGSCO Corp, Entegris, Fuji Electric Co., Ltd., Infineon Technologies AG, STMicroelectronics, Sublime Technologies, WOLFSPEED, INC., and others. The market players are considerably contributing to the market growth by the adoption of various strategies including mergers & acquisitions, collaborations, funding, and new product launches, to stay competitive in the market. For instance, in February 2021, Evonik launched silicon-carbon composite material, Siridion Black, as a new anode material for lithium-ion batteries. It is a material with structures in a unique carbon concentration gradient for superior stability and high capacity and SIC powder produced by gas-phase synthesis. Moreover, it also consists of isolated unsintered spherical particles that are a few hundred nanometers in size.?

The Report Covers

- Market value data analysis of 2021 and forecast to 2028.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global SIC Powder market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

- Current Industry Analysis and Growth Potential Outlook

- Impact of COVID-19 on the Global SIC Powder Market

- Recovery Scenario of Global SIC Powder Market

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. BY Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. AGSCO Corp.

3.1.1. Overview

3.1.2. Financial Analysis

3.1.3. SWOT Analysis

3.1.4. Recent Developments

3.2. Entegris Inc.

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. Fuji Electric Co., Ltd.

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. Infineon Technologies AG

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Wolfspeed, Inc.

3.5.1. Overview

3.5.2. Financial Analysis

3.5.3. SWOT Analysis

3.5.4. Recent Developments

3.6. Key Strategy Analysis

3.7. Impact of Covid-19 on Key Players

4. Market Segmentation

4.1. Global SIC Powder Market by Product

4.1.1. Green SiC

4.1.2. Black SiC

4.1.3. Other

4.2. Global SIC Powder Market by Applications

4.2.1. Steel Manufacturing

4.2.2. Energy

4.2.3. Automotive

4.2.4. Aerospace and Defense

4.2.5. Electronics and Semiconductor

4.2.6. Others

5. Regional Analysis

5.1. North America

5.1.1. US

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World?

6. Company Profiles

6.1. Carborundum Universal Ltd.

6.2. ESD-SIC B.V.

6.3. ESK-SIC GmbH

6.4. Electro Abrasives, LLC.

6.5. Fiven GmbH

6.6. Hefei Kaier Nano Energy Technology Co., Ltd

6.7. Ingentec Corp

6.8. KYOCERA Corp.

6.9. Nanomakers SA

6.10. Navarro SiC

6.11. Ningxia Tianjing LD Silicon Carbide Co.,Ltd,,

6.12. Pacific Rundum Co., Ltd.,

6.13. Renesas Electronics Corp

6.14. ROHM CO., LTD.

6.15. Saint-Gobain

6.16. Shin-Etsu Chemical Co., Ltd.

6.17. SINOSI SCI-TECH BEIJING CO., LTD.

6.18. SNAM Group

6.19. STMicroelectronics

6.20. Sublime Technologies

6.21. The Dow Chemical Co

6.22. WASHINGTON MILLS

6.23. Zaporozhsky Abrasivny combinat

6.24. Zhejiang Jicheng Advanced Ceramics Co., Ltd.

1. GLOBAL SIC POWDER MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2021-2028 ($ MILLION)

2. GLOBAL GREEN SIC POWDER MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

3. GLOBAL BLACK SIC POWDER MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($

4. MILLION)

5. GLOBAL OTHER SIC POWDER MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($

6. MILLION)

7. GLOBAL SIC POWDER MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2021-2028 ($ MILLION)

8. GLOBAL SIC POWDER IN STEEL MANUFACTURING MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

9. GLOBAL SIC POWDER IN ENERGY MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

10. GLOBAL SIC POWDER IN AUTOMOTIVE MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

11. GLOBAL SIC POWDER IN AEROSPACE AND DEFENSE MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

12. GLOBAL SIC POWDER IN ELECTRONICS AND SEMICONDUCTOR MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

13. NORTH AMERICAN SIC POWDER MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

14. NORTH AMERICAN SIC POWDER MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2021-2028 ($ MILLION)

15. NORTH AMERICAN SIC POWDER MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2021-2028 ($ MILLION)

16. EUROPEAN SIC POWDER MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

17. EUROPEAN SIC POWDER MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2021-2028 ($ MILLION)

18. EUROPEAN SIC POWDER MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2021-2028 ($ MILLION)

19. ASIA-PACIFIC SIC POWDER MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

20. ASIA-PACIFIC SIC POWDER MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2021-2028 ($ MILLION)

21. ASIA-PACIFIC SIC POWDER MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2021-2028 ($ MILLION)

22. REST OF THE WORLD SIC POWDER MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

23. REST OF THE WORLD SIC POWDER MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2021-2028 ($ MILLION)

24. REST OF THE WORLD SIC POWDER MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2021-2028 ($ MILLION)

1. IMPACT OF COVID-19 ON GLOBAL SIC POWDER MARKET, 2021-2028 ($ MILLION)

2. IMPACT OF COVID-19 ON GLOBAL SIC POWDER MARKET BY SEGMENT, 2021-2028 ($ MILLION)

3. RECOVERY OF GLOBAL SIC POWDER MARKET, 2021-2028 (%)

4. GLOBAL SIC POWDER MARKET SHARE BY PRODUCT, 2021 VS 2028 (%)

5. GLOBAL GREEN SIC POWDER MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

6. GLOBAL BLACK SIC POWDER MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

7. GLOBAL OTHER SIC POWDER MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%

8. GLOBAL SIC POWDER MARKET SHARE BY APPLICATION, 2021 VS 2028 (%)

9. GLOBAL SIC POWDER IN STEEL MANUFACTURING MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

10. GLOBAL SIC POWDER IN ENERGY MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

11. GLOBAL SIC POWDER IN AUTOMOTIVE MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

12. GLOBAL SIC POWDER IN AEROSPACE AND DEFENSE MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

13. GLOBAL SIC POWDER IN ELECTRONICS AND SEMICONDUCTOR MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

14. GLOBAL SIC POWDER IN OTHER APPLICATIONS MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

15. GLOBAL SIC POWDER MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

16. US SIC POWDER MARKET SIZE, 2021-2028 ($ MILLION)

17. CANADA SIC POWDER MARKET SIZE, 2021-2028 ($ MILLION)

18. UK SIC POWDER MARKET SIZE, 2021-2028 ($ MILLION)

19. FRANCE SIC POWDER MARKET SIZE, 2021-2028 ($ MILLION)

20. GERMANY SIC POWDER MARKET SIZE, 2021-2028 ($ MILLION)

21. ITALY SIC POWDER MARKET SIZE, 2021-2028 ($ MILLION)

22. SPAIN SIC POWDER MARKET SIZE, 2021-2028 ($ MILLION)

23. REST OF EUROPE SIC POWDER MARKET SIZE, 2021-2028 ($ MILLION)

24. INDIA SIC POWDER MARKET SIZE, 2021-2028 ($ MILLION)

25. CHINA SIC POWDER MARKET SIZE, 2021-2028 ($ MILLION)

26. JAPAN SIC POWDER MARKET SIZE, 2021-2028 ($ MILLION)

27. SOUTH KOREA SIC POWDER MARKET SIZE, 2021-2028 ($ MILLION)

28. REST OF ASIA-PACIFIC SIC POWDER MARKET SIZE, 2021-2028 ($ MILLION)

29. REST OF THE WORLD SIC POWDER MARKET SIZE, 2021-2028 ($ MILLION)