Silica Flour Market

Silica Flour Market Size, Share & Trends Analysis Report, By Type (Quartz and Cristobalite), By Application (Fiberglass, Foundry, Glass & Clay, Ceramic & Refractory, and Oil Well Cement), Forecast Period (2022-2028) Update Available - Forecast 2025-2035

Silica flour market is anticipated to grow at a CAGR of 3.6% during the forecast period. The rising fiberglass demand from the construction and automobile industry is a key factor driving the growth of the global silica flour market. Moreover, the emerging focus on increasing disposable income along with luxury construction being demanded is also one of the key factors that are creating opportunities for market growth. New product launches in the market are likely to create demand for the growth of the global silica flour market. For instance, in March 2020, AGC Inc. introduced its Lacobel T Warm Grey Spandrel, which is considered the newest addition to the portfolio of the company of back-painted decorative glass. Lacobel T Warm Grey Spandrel does not get fade owing to the presence of temperable paint that is fused into the glass and it also provides the architects and designers with a fully opaque, neutral-colored spandrel.

Segmental Outlook

The global silica flour market is segmented by type and application. The market segmentation based on the type includes quartz and cristobalite. Based on type, quartz held a considerable share in the market. Quartz silica, often called quartz sand, white sand, industrial sand, and silica sand includes sand with high silicon dioxide (SiO2) content. It is a hard, crystalline mineral that consists of silicon and oxygen atoms.

The extensive usage of quartz in the production of paints, cosmetics, fiberglass, silicone rubber, and ceramic and oil well cementing is a key factor contributing to the growth of this segment. The hardness, high density, and high chemical resistance offered by quartz flour are likely to contribute to the potential demand of this segment. Based on application, the market is segmented into fiberglass, foundry, glass & clay, ceramic & refractory, and oil well cement.

Fiberglass Segment Holds Considerable Share in the Global Silica Flour Market

In 2021, fiberglass segment held a considerable share in the silica flour market. The extensive use of fiberglass for manufacturing applications in the construction and automobile industry is a key factor attributing to the growth of this market segment. Additionally, fiberglass is used on a large scale in industries such as aerospace and defense, marine, food, electronics body part, and more to produce lightweight body parts.

Fiberglass has significant applications in the construction sector. It is used in commercial, industrial as well as in residential construction for both exterior and interior components. From the swimming pool fence to the skylight to solar heating elements, it is largely used for making its body parts. Vetrotex fiberglass is one of the fiberglasses that is used in the construction industry, owing to its flexible, hard, water-resistant, and fire-resistant properties. Additionally, owing to its lightweight property, fiberglass is used as a structural shell.

Regional Outlook

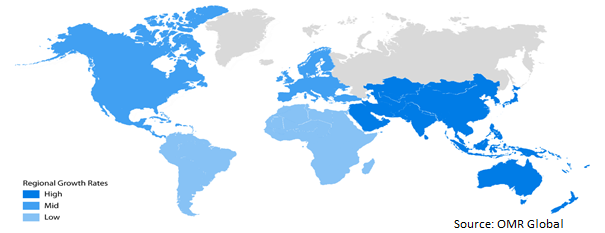

The global silica flour market is further segmented based on geography including North America (the US and Canada), Europe (UK, Italy, Spain, Germany, France, and Others), Asia-Pacific (India, China, Japan, South Korea, and Others), and the Rest of the World (the Middle East & Africa and Latin America). The market can be analyzed for a particular region or country level as per the requirement. North America is anticipated to exhibit considerable growth in the global silica flour market.

Global Silica Flour Market Growth, by Region 2022-2028

Asia-Pacific to Exhibit Considerable Growth in the Global Silica Flour Market

Asia-Pacific region is anticipated to exhibit considerable growth in the global silica flour market during the forecast period. The growing demand for silica flour from the construction and automobile industry is a key factor contributing to the growth of the regional growth. Japan is one of the key players in the automobile industry and is a major contributor to the demand for the silica flour market across the region.

Market Players Outlook

The major companies serving the global silica flour market include U.S. Silica Holdings, Inc., Sibelco Group, Adwan Chemical Industries Company, and AGSCO Corp. among others. The companies are focusing on product launches, geographical expansions, mergers and acquisitions, and partnerships and collaborations.

For instance, in March 2021, SOMEVAM, a subsidiary of the Tunisian Sebri Group, announced plans for a significant investment in the development of its second CDE wet processing solution to produce high-specification silica sand products. The state-of-the-art silica sand wash plant can treat up to 200tph of sand, producing 100tph of silica glass sand for the glass industry, as well as a range of secondary products including fine silica sand for silica flour production, foundry sand, concrete sand and road base.

The Report Covers

- Market value data analysis of 2021 and forecast to 2028.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global silica flour market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.1.1. Overview

3.1.2. Financial Analysis

3.1.3. SWOT Analysis

3.1.4. Recent Developments

3.2. Key Strategy Analysis

4. Market Segmentation

4.1. Global Silica Flour Market, By Type

4.1.1. Quartz

4.1.2. Cristobalite

4.2. Global Silica Flour Market, By Application

4.2.1. Fiberglass

4.2.2. Foundry

4.2.3. Glass & Clay

4.2.4. Ceramic & Refractory

4.2.5. Oil Well Cement

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

6. Company Profiles

6.1. Adinath Industries

6.2. Adwan Chemical Industries Co.

6.3. AGSCO Corp.

6.4. Cairo Minerals

6.5. Covia

6.6. Hi-Crush

6.7. Karnataka Silicates

6.8. Sibelco Group

6.9. Sil Industrial Minerals

6.10. U.S. Silica Holdings, Inc.

6.11. Volza

1. GLOBAL SILICA FLOUR MARKET RESEARCH AND ANALYSIS BY TYPE, 2021-2028 ($ MILLION)

2. GLOBAL QUARTZ SILICA FLOUR MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

3. GLOBAL CRISTOBALITE SILICA FLOUR MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

4. GLOBAL SILICA FLOUR MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2021-2028 ($ MILLION)

5. GLOBAL SILICA FLOUR FOR FIBERGLASS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

6. GLOBAL SILICA FLOUR FOR FOUNDRY MARKET RESEARCH, AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

7. GLOBAL SILICA FLOUR FOR GLASS & CLAY MARKET RESEARCH, AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

8. GLOBAL SILICA FLOUR FOR CERAMIC & REFRACTORY MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

9. GLOBAL SILICA FLOUR FOR OIL WELL CEMENT MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

10. NORTH AMERICAN SILICA FLOUR MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

11. NORTH AMERICAN SILICA FLOUR MARKET RESEARCH AND ANALYSIS BY TYPE, 2021-2028 ($ MILLION)

12. NORTH AMERICAN SILICA FLOUR MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2021-2028 ($ MILLION)

13. EUROPEAN SILICA FLOUR MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

14. EUROPEAN SILICA FLOUR MARKET RESEARCH AND ANALYSIS BY TYPE, 2021-2028 ($ MILLION)

15. EUROPEAN SILICA FLOUR MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2021-2028 ($ MILLION)

16. ASIA-PACIFIC SILICA FLOUR MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

17. ASIA-PACIFIC SILICA FLOUR MARKET RESEARCH AND ANALYSIS BY TYPE, 2021-2028 ($ MILLION)

18. ASIA-PACIFIC SILICA FLOUR MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2021-2028 ($ MILLION)

19. REST OF THE WORLD SILICA FLOUR MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

20. REST OF THE WORLD SILICA FLOUR MARKET RESEARCH AND ANALYSIS BY TYPE, 2021-2028 ($ MILLION)

21. REST OF THE WORLD SILICA FLOUR MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2021-2028 ($ MILLION)

1. GLOBAL SILICA FLOUR MARKET SHARE BY TYPE, 2021 VS 2028 (%)

2. GLOBAL SILICA FLOUR MARKET SHARE BY APPLICATION, 2021 VS 2028 (%)

3. GLOBAL SILICA FLOUR MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

4. GLOBAL QUARTZ SILICA FLOUR MARKET SHARE BY REGION, 2021 VS 2028 (%)

5. GLOBAL CRISTOBALITE SILICA FLOUR MARKET SHARE BY REGION, 2021 VS 2028 (%)

6. GLOBAL SILICA FLOUR FOR FIBERGLASS MARKET SHARE BY REGION, 2021 VS 2028 (%)

7. GLOBAL SILICA FLOUR FOR FOUNDRY MARKET SHARE BY REGION, 2021 VS 2028 (%)

8. GLOBAL SILICA FLOUR FOR GLASS & CLAY MARKET SHARE BY REGION, 2021 VS 2028 (%)

9. GLOBAL SILICA FLOUR FOR MARKET SHARE BY REGION, 2021 VS 2028 (%)

10. GLOBAL SILICA FLOUR FOR OIL WELL CEMENT MARKET SHARE BY REGION, 2021 VS 2028 (%)

11. US SILICA FLOUR MARKET SIZE, 2021-2028 ($ MILLION)

12. CANADA SILICA FLOUR MARKET SIZE, 2021-2028 ($ MILLION)

13. UK SILICA FLOUR MARKET SIZE, 2021-2028 ($ MILLION)

14. FRANCE SILICA FLOUR MARKET SIZE, 2021-2028 ($ MILLION)

15. GERMANY SILICA FLOUR MARKET SIZE, 2021-2028 ($ MILLION)

16. ITALY SILICA FLOUR MARKET SIZE, 2021-2028 ($ MILLION)

17. SPAIN SILICA FLOUR MARKET SIZE, 2021-2028 ($ MILLION)

18. REST OF EUROPE SILICA FLOUR MARKET SIZE, 2021-2028 ($ MILLION)

19. INDIA SILICA FLOUR MARKET SIZE, 2021-2028 ($ MILLION)

20. CHINA SILICA FLOUR MARKET SIZE, 2021-2028 ($ MILLION)

21. JAPAN SILICA FLOUR MARKET SIZE, 2021-2028 ($ MILLION)

22. SOUTH KOREA SILICA FLOUR MARKET SIZE, 2021-2028 ($ MILLION)

23. REST OF ASIA-PACIFIC SILICA FLOUR MARKET SIZE, 2021-2028 ($ MILLION)

24. REST OF THE WORLD SILICA FLOUR MARKET SIZE, 2021-2028 ($ MILLION)