Silicon Anode Battery Market

Silicon Anode Battery Market Size, Share & Trends Analysis Report by Capacity (Less than 1500 mAh, 1500 mAh to 2500mAh and Above 2500 mAh), and by Application (Consumer Electronics, Automobile, Medical Devices, Industrial and Energy Harvesting), Forecast Period (2023-2030) Update Available - Forecast 2025-2031

Silicon Anode Battery market is anticipated to grow at a CAGR of 10.1% during the forecast period (2023-2030). Silicon anode batteries are an extension of widely used lithium-ion (Li-Ion) batteries. Silicon anode batteries offer higher energy storage capacity compared to traditional lithium-ion batteries, making them suitable for applications requiring long-lasting power. The growing adoption of high-energy density batteries in various industries such as consumer electronics, automotive, and renewable energy is the key factor supporting the growth of the market globally. Various market players designed, produced, and shipped an advanced silicon-anode lithium-ion battery that combines increased energy density and high cycle life. The market players are also focusing on advanced silicon-anode lithium-ion battery production facilities that further bolster the market growth. For instance, in January 2021, Enovix Corp. equipped its advanced silicon-anode lithium-ion battery production facility in Fremont, California. The first advanced silicon-anode lithium-ion battery production facility in the US provides high-energy-density batteries to mobile device customers and creates Bay Area jobs.

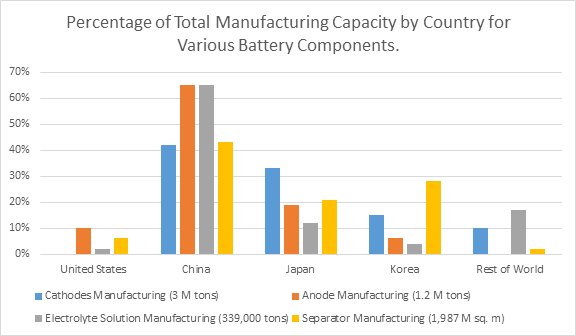

Percentage of Total Manufacturing Capacity by Country for Various Battery Components. (2021-2030)

Source: Federal Consortium for Advanced Batteries (FCAB)

According to the Federal Consortium for Advanced Batteries (FCAB), in January 2021, the percentage of total manufacturing capacity for various battery components for Cathodes Manufacturing (3 M tons), Anode Manufacturing (1.2 M tons), Electrolyte Solution Manufacturing (339,000 tons), Separator Manufacturing (1,987 M sq. m) in China was the highest, with 42.0%, 65.0%, 65.0%, 43.0%, followed by Japan with 33.0%, 19.0%, 12.0%, 21.0%, Korea with 5.0%, 6.0%, 4.0%, 28.0%, US with 10.0%, 2.0%, 6.0%, and Rest of the World with 10.0%, 17.0%, 2.0%

Segmental Outlook

The global silicon anode battery market is segmented on the capacity and application. Based on the capacity, the market is sub-segmented into Less than 1500 mAh, 1500 mAh to 2500mAh and Above 2500 mAh. Further, on the basis of application, the market is sub-segmented into consumer electronics, automobile, medical devices, industrial and energy harvesting. Among the capacity, the 1500 mAh to 2500mAh sub-segment is anticipated to hold a considerable share of the market owing to the rise in the development of nanocomposite of LM/Si showed superior performances as characterized by high capacity utilization. LM and Si nanoparticles had good electrochemical performance together, and the overall cell impedance was lower in the Si-LM anode than in pure LM and pure Si.

The Automobile Sub-Segment is Anticipated to Hold a Considerable Share of the Global Silicon Anode Battery Market

Among the applications, the automobile sub-segment is expected to hold a considerable share of the global silicon anode battery market. The segmental growth is attributed to the growing adoption of solid-state platforms that can enable both high-content silicon and lithium metal in the anode paired with industry-standard and commercially mature cathodes. Solid-state platform technology allows to production of unique batteries for the unique electric vehicles they intend to power. High-content silicon anode cell has major advantages for electric vehicle fast-charging, which is a critical factor in consumers' transition to electric vehicles. For instance, in May 2021, Solid Power launched all-solid-state platform technology, Transitions silicon cells to pilot line. Core technology innovation to power three unique all-solid-state batteries through multiple automotive product life cycles.

Regional Outlook

The global silicon anode battery market is further segmented based on geography including North America (the US, and Canada), Europe (UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia), and the Rest of the World (the Middle East & Africa, and Latin America. Among these, Asia-Pacific is anticipated to hold a prominent share of the market across the globe, owing to the rise in the industries including consumer electronics, automotive and renewable energy.

Global Silicon Anode Battery Market Growth, by Region 2023-2030

![]()

The North America Region is Expected to Grow at a Significant CAGR in the Global Silicon Anode Battery Market

Among all regions, the North America regions is anticipated to grow at a considerable CAGR over the forecast period. Regional growth is attributed to the growing adoption of electric vehicles by consumers. Additionally, the growing investment by government in the battery production is further anticipated to propel the growth of the silicon anode battery market in the region. For instance, in October 2022, the US Department of Energy awarded $2.8 billion in grants from the Bipartisan Infrastructure Law to 20 manufacturing and processing companies for projects across 12 states. President Biden has also announced the American Battery Materials Initiative, a new effort to mobilize the entire government in securing a reliable and sustainable supply of critical minerals used for power, electricity, and electric vehicles (EVs). The funding for the selected projects supports commercial-scale domestic silicon oxide production facilities to supply anode materials for an estimated 600,000 EV batteries annually.

Furthermore, the silicon anode battery market is being driven by industrial automation and the desire for smaller consumer gadgets, such as wearables and IoT-connected devices. The key market player includes ActaCell, Inc., American Battery Materials, Inc., Amprius Technologies, California Lithium Battery, Enevate Corp., OneD Material, Inc., Zeptor Corp. and others.

Market Players Outlook

The major companies serving the silicon anode battery market include Amprius Technologies, BTR New Material Group Co., Ltd., Enovix Corp., NanoXplore Inc., Panasonic Corp., and others. The market players are considerably contributing to the market growth by the adoption of various strategies including mergers and acquisitions, partnerships, collaborations, funding, and new product launches, to stay competitive in the market. For instance, in July 2021, BCG Digital Ventures collaborated with Unifrax and Clearlake to Advance Silicon Anode Technology for Lithium Ion Batteries. The two companies are collaborating on SiFAB™, Unifrax’s patented silicon fibre anode battery technology for improving energy density, accelerating charges, and lengthening battery life.

The Report Covers

- Market value data analysis of 2022 and forecast to 2030.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global Silicon Anode Battery market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. Amprius Technologies,

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. Enovix Corp.

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. Panasonic Corp.

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Key Strategy Analysis

4. Market Segmentation

4.1. Global Silicon Anode Battery Market by Capacity

4.1.1. Less than 1500 mAh

4.1.2. 1500 mAh to 2500mAh

4.1.3. Above 2500 mAh

4.2. Global Silicon Anode Battery Market by Application

4.2.1. Consumer Electronics

4.2.2. Automobile

4.2.3. Medical Devices

4.2.4. Industrial

4.2.5. Energy Harvesting

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

6. Company Profiles

6.1. Adform

6.2. 24M

6.3. Advano

6.4. BTR New Material Group Co., Ltd.

6.5. E-magy

6.6. Enevate Corp.

6.7. Group14 Technologies

6.8. Innolith

6.9. LeydenJar

6.10. NanoGraf Corp.

6.11. NanoXplore Inc.,

6.12. NEO Battery Materials LTD.

6.13. Nexeon® Ltd.

6.14. OneD Battery Sciences

6.15. ProLogium Technology CO., Ltd.

6.16. Sila Nanotechnologies Inc.

6.17. Sionic Energy

6.18. Solid Power

6.19. Targray Technology International Inc.

6.20. Unifrax

1. GLOBAL SILICON ANODE BATTERY MARKET RESEARCH AND ANALYSIS BY CAPACITY, 2022-2030 ($ MILLION)

2. GLOBAL LESS THAN 1500 MAH SILICON ANODE BATTERY MARKET RESEARCH AND ANALYSIS BY REGION,2022-2030 ($ MILLION)

3. GLOBAL 1500 MAH TO 2500MAH SILICON ANODE BATTERY MARKET RESEARCH AND ANALYSIS BY REGION,2022-2030 ($ MILLION)

4. GLOBAL ABOVE 2500 MAH SILICON ANODE BATTERY MARKET RESEARCH AND ANALYSIS BY REGION,2022-2030 ($ MILLION)

5. GLOBAL SILICON ANODE BATTERY MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2022-2030 ($ MILLION)

6. GLOBAL SILICON ANODE BATTERY FOR CONSUMER ELECTRONICS MARKET RESEARCH AND ANALYSIS, 2022-2030 ($ MILLION)

7. GLOBAL SILICON ANODE BATTERY FOR AUTOMOTIVE MARKET RESEARCH AND ANALYSIS, 2022-2030 ($ MILLION)

8. GLOBAL SILICON ANODE BATTERY FOR MEDICAL DEVICES MARKET RESEARCH AND ANALYSIS, 2022-2030 ($ MILLION)

9. GLOBAL SILICON ANODE BATTERY FOR INDUSTRIAL MARKET RESEARCH AND ANALYSIS, 2022-2030 ($ MILLION)

10. GLOBAL SILICON ANODE BATTERY FOR ENERGY HARVESTING MARKET RESEARCH AND ANALYSIS, 2022-2030 ($ MILLION)

11. GLOBAL SILICON ANODE BATTERY MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

12. NORTH AMERICAN SILICON ANODE BATTERY MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2022-2030 ($ MILLION)

13. NORTH AMERICAN SILICON ANODE BATTERY MARKET RESEARCH AND ANALYSIS BY CAPACITY, 2022-2030 ($ MILLION)

14. NORTH AMERICAN SILICON ANODE BATTERY MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2022-2030 ($ MILLION)

15. EUROPEAN SILICON ANODE BATTERY MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2022-2030 ($ MILLION)

16. EUROPEAN SILICON ANODE BATTERY MARKET RESEARCH AND ANALYSIS BY CAPACITY, 2022-2030 ($ MILLION)

17. EUROPEAN SILICON ANODE BATTERY MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2022-2030 ($ MILLION)

18. ASIA- PACIFIC SILICON ANODE BATTERY MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2022-2030 ($ MILLION)

19. ASIA- PACIFIC SILICON ANODE BATTERY MARKET RESEARCH AND ANALYSIS BY CAPACITY, 2022-2030 ($ MILLION)

20. ASIA- PACIFIC SILICON ANODE BATTERY MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2022-2030 ($ MILLION)

21. REST OF THE WORLD SILICON ANODE BATTERY MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

22. REST OF THE WORLD SILICON ANODE BATTERY MARKET RESEARCH AND ANALYSIS BY CAPACITY, 2022-2030 ($ MILLION)

23. REST OF THE WORLD SILICON ANODE BATTERY MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2022-2030 ($ MILLION)

1. GLOBAL SILICON ANODE BATTERY MARKET SHARE BY CAPACITY, 2022 VS 2030 (%)

2. GLOBAL LESS THAN 1500 MAH SILICON ANODE BATTERY MARKET SHARE BY REGION, 2022 VS 2030 (%)

3. GLOBAL 1500 MAH TO 2500MAH SILICON ANODE BATTERY MARKET SHARE BY REGION, 2022 VS 2030 (%)

4. GLOBAL ABOVE 2500 MAH SILICON ANODE BATTERY MARKET SHARE BY REGION, 2022 VS 2030 (%)

5. GLOBAL SILICON ANODE BATTERY MARKET SHARE ANALYSIS BY APPLICATION, 2022-2030 ($ MILLION)

6. GLOBAL SILICON ANODE BATTERY FOR CONSUMER ELECTRONICS MARKET SHARE BY REGION, 2022 VS 2030 (%)

7. GLOBAL SILICON ANODE BATTERY FOR AUTOMOTIVE MARKET SHARE BY REGION, 2022 VS 2030 (%)

8. GLOBAL SILICON ANODE BATTERY FOR MEDICAL DEVICES MARKET SHARE BY REGION, 2022 VS 2030 (%)

9. GLOBAL SILICON ANODE BATTERY FOR INDUSTRIAL MARKET SHARE BY REGION, 2022 VS 2030 (%)

10. GLOBAL SILICON ANODE BATTERY FOR ENERGY HARVESTING MARKET SHARE BY REGION, 2022 VS 2030 (%)

11. GLOBAL SILICON ANODE BATTERY MARKET SHARE BY REGION, 2022 VS 2030 (%)

12. US SILICON ANODE BATTERY MARKET SIZE, 2022-2030 ($ MILLION)

13. CANADA SILICON ANODE BATTERY MARKET SIZE, 2022-2030 ($ MILLION)

14. UK SILICON ANODE BATTERY MARKET SIZE, 2022-2030 ($ MILLION)

15. FRANCE SILICON ANODE BATTERY MARKET SIZE, 2022-2030 ($ MILLION)

16. GERMANY SILICON ANODE BATTERY MARKET SIZE, 2022-2030 ($ MILLION)

17. ITALY SILICON ANODE BATTERY MARKET SIZE, 2022-2030 ($ MILLION)

18. SPAIN SILICON ANODE BATTERY MARKET SIZE, 2022-2030 ($ MILLION)

19. REST OF EUROPE SILICON ANODE BATTERY MARKET SIZE, 2022-2030 ($ MILLION)

20. INDIA SILICON ANODE BATTERY MARKET SIZE, 2022-2030 ($ MILLION)

21. CHINA SILICON ANODE BATTERY MARKET SIZE, 2022-2030 ($ MILLION)

22. JAPAN SILICON ANODE BATTERY MARKET SIZE, 2022-2030 ($ MILLION)

23. SOUTH KOREA SILICON ANODE BATTERY MARKET SIZE, 2022-2030 ($ MILLION)

24. REST OF ASIA-PACIFIC SILICON ANODE BATTERY MARKET SIZE, 2022-2030 ($ MILLION)

25. REST OF THE WORLD SILICON ANODE BATTERY MARKET SIZE, 2022-2030 ($ MILLION)