Silver Based Battery Market

Global Silver Based Battery Market Size; Share & Trends Analysis Report by End User (Automotive Applications, Consumer Electronics, and Industrial Applications) Forecast Period (2022-2028) Update Available - Forecast 2025-2031

The global silver-based battery market is anticipated to grow at a significant CAGR of 3.2% during the forecast period. There are different types of silver-based batteries which include silver oxide, silver-zinc, and silver aluminum batteries. Silver oxide batteries are small-sized batteries that have high capacity and stable discharge characteristics. Silver oxide batteries are used in medical devices, IoT-based devices, electronic devices such as pagers, cameras, hearing aids, photographic equipment, electric watches, and precision instruments. Silver zinc batteries provide stable operating voltage and are used in a demanding environment that is associated with missile and space launch vehicle applications. In addition, silver aluminum batteries are used in underwater applications, torpedoes (HWT), lightweight torpedoes (LWT), and high power and high energy applications.

The factor responsible for the growth of the silver-based market is the increasing use of silver-based batteries in industrial appliances and electronics. For instance, silver-zinc batteries are used on launch vehicles for the aerospace industry as silver-zinc batteries have a long life and offer flexible configurations and meet various packaging requirements. It powers multiple systems on launch vehicles. Another factor contributing to the demand for the silver-zinc battery is its advantage over other batteries as silver-zinc batteries have high energy-to-weight and volume ratios and extremely high reliability due to which they are desirable for applications such as in the aerospace industry.

Impact of COVID-19 Pandemic on Silver Based battery Market

The global silver-based battery market is hit by the outbreak of COVID-19 in December 2019. It has a sudden on the supply chain and production of batteries. The lockdown due to the COVID-19 pandemic led to the shutdown of production houses and manufacturing units as people were not allowed to gather at the same place to follow social distancing in order not to spread the virus. The pandemic has had an impact on consumer choice of shopping, it shifted from offline to online. Therefore, the demand for silver-based batteries decreased a bit due to the non-availability of laborers and supply chain disruptions, although during lockdown people were at their homes watching TV and playing games which means using electronic devices which required batteries and silver-based batteries are the most reliable battery as they have high capacity.

Moreover, people also started doing photography at home resulting in a demand for silver-based battery as they are used in photographic equipment and maintains nominal voltage, and has more battery life than other lithium or aluminum batteries. Although the battery industry did not have any adverse effects due to the COVID-19 pandemic.

Segmental Outlook

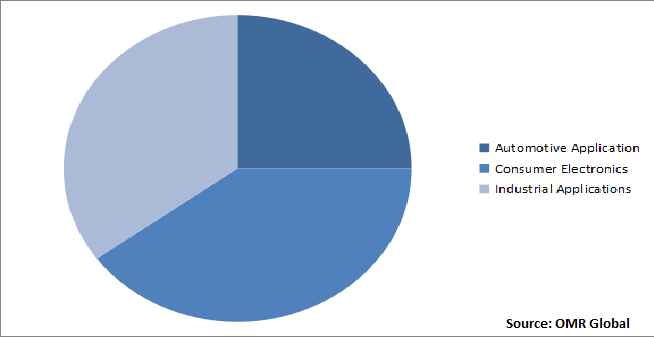

The global silver-based battery market is segmented based on end-user. Based on end-user, the market is sub-segmented into automotive applications, consumer electronics, and industrial applications. The silver-based battery is used in electronics such as watches, toys, calculators, remote control, and laser pointers. According to Silver Institute Organization, over 36 million ounces of silver are used in motor vehicles. In automotive applications, the silver-based battery is used in vehicles and cars which are run electrically, and lastly, in industrial applications, in the healthcare industry, the silver-based battery is used in making medical equipment.

Global Silver Based Battery Market Share by End-User 2021 (%)

Consumer Electronics Segment Holds a Significant Share in the Market

Among the silver-based battery market, the consumer electronics segment holds a significant share of the market and is also anticipated to grow during the forecast period. Silver-based batteries are used in consumer electronics to provide more run time to the products and also are more reliable as they have high capacity. In electronics, these batteries are used in smartwatches, remote controls, cameras, toys, and medical devices. Factor such as increasing demand for electric watches, TVs, and cameras is contributing to the demand of the silver-based battery market. In addition, the use of silver oxide cells for Bluetooth and other connected sensors is another factor in increasing the demand for silver-based batteries in the market. The use of silver-based batteries in medical devices is also anticipating market growth during the forecast year.

Furthermore, the increase in the adoption of electric vehicles is also boosting the demand for silver-based batteries across emerging economies in the world as they are high capacity and more reliable and also decrease the air pollution caused by non-electric vehicles in the environment. Also, electric vehicle does not make any noise pollution.

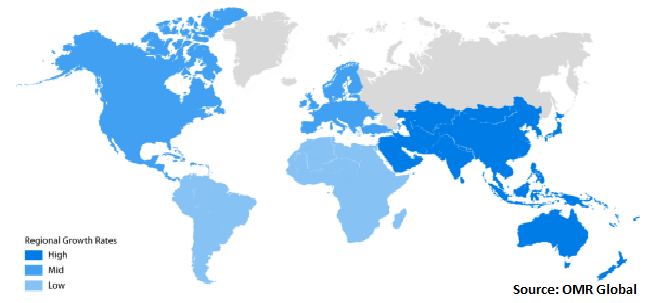

Regional Outlooks

The global colorectal cancer diagnosis and therapeutics market are further segmented based on geography including North America (the US, and Canada), Europe (Italy, Spain, Germany, France, and Others), Asia-Pacific (India, China, Japan, and Others, and the Rest of the World (the Middle East and Africa, and Latin America). The silver-based battery market has been predicted to dominate the Asia-Pacific region due to increasing demand for consumer electronics such as wearable devices including smartwatches and GPS trackers, and toys and cameras.

Global Silver Based Battery Market Growth, by Region

Asia-Pacific is Projected to Have a Considerable Share in the Global Silver-Based Battery Market

Asia-Pacific is anticipated to hold a considerable market share in the global silver-based battery market. Silver-based batteries are used in electronics such as smartwatches, remote controls, toys, and photographic equipment. There is an increasing demand for wearables in the market due to the use of watches, and TV in the Asia-Pacific region. For instance, according to India Brand Equity Fund (IBEF), the Government of India, the market share of consumer electronics held the highest in India which was 29.7% in the total production of electronic goods. Furthermore, the electronics market in India is anticipated to reach US$ 400 billion by 2020.

In Addition, in India, silver-based batteries are used in space launch vehicles due to their high energy-density characteristics, high current capabilities, and good reliability. For Instance, Eaglepicher supports commercial launch vehicle applications and NASA trusted it with Mercury, Skylab, Gemini, and Apollo. The silver-zinc battery used in space vehicles offers long active life and powers multiple systems on the launch vehicles.

Market Players Outlook

The key players in the silver-based battery market are Duracell Inc., Eagle Picher Tech, LLC, Kodak Company, Energizer Holdings, Inc., Maxell, Ltd, Panasonic Corp., Sony Corp., and ZPOWER, LLC., and others. The market players are considerably contributing to the market growth by the adoption of various strategies including mergers and acquisitions, collaborations, funding, and new product launches, to stay competitive in the market.

The Report Covers

- Market value data analysis of 2021 and forecast to 2028.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global silver-based battery market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where in the market.

1.Report Summary

- Current Industry Analysis and Growth Potential Outlook

- Impact of COVID-19 on the Global Silver-based Battery Industry

- Recovery Scenario of Global Silver-based Battery Industry

1.1.Research Methods and Tools

1.2.Market Breakdown

1.2.1.By Segments

1.2.2.By Region

2.Market Overview and Insights

2.1.Scope of the Report

2.2.Analyst Insight & Current Market Trends

2.2.1.Key Findings

2.2.2.Recommendations

2.2.3.Conclusion

3.Competitive Landscape

3.1.Key Company Analysis

3.1.1.Overview

3.1.2.Financial Analysis

3.1.3.SWOT Analysis

3.1.4.Recent Developments

3.2.Key Strategy Analysis

3.3.Impact of COVID-19 on Key Players

4.Market Segmentation

4.1.Global Silver-Based Battery Market by End User

4.1.1.Automotive Applications

Consumer Electronics

Industrial Applications

5.Regional Analysis

5.1.North America

5.1.1.United States

5.1.2.Canada

5.2.Europe

5.2.1.UK

5.2.2.Germany

5.2.3.Italy

5.2.4.Spain

5.2.5.France

5.2.6.Rest of Europe

5.3.Asia-Pacific

5.3.1.China

5.3.2.India

5.3.3.Japan

5.3.4.South Korea

5.3.5.Rest of Asia-Pacific

5.4.Rest of the World

6.Company Profiles

6.1.Crosman Corp. ( lasermax)

6.2.Duracell Inc.

6.3.Eagle Picher Tech, LLC

6.4.Kodak Company.

6.5.Energizer Holdings, Inc.

6.6.GPB International Ltd.

6.7.HBL Power Systems Ltd.

6.8.High Energy Batteries (India) Ltd.

6.9. Jhih Hong Technology Co., Ltd.

6.10.Toshiba Corporation

6.11.Maxell Holdings, Ltd

6.12.Mercury Refining, LLC

6.13.Murata Manufacturing Co., Ltd.

6.14. Panasonic Corp.

6.15. Renata SA

6.16.Seiko Instruments Inc.

6.17.Sony Corp.

6.18.VARTA Microbattery GmbH

6.19. ZPOWER, LLC

1.GLOBAL SILVER-BASED BATTERY MARKET RESEARCH AND ANALYSIS BY END-USER, 2021-2028 ($ MILLION)

2.GLOBAL AUTOMOTIVE APPLICATIONS SILVER-BASED BATTERY MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

3.GLOBAL CONSUMER ELECTRONICS SILVER-BASED BATTERY MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

4.GLOBAL INDUSTRIAL APPLICATIONS SILVER-BASED BATTERY MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

5.GLOBAL SILVER-BASED BATTERY MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2021-2028 ($ MILLION)

6.NORTH AMERICAN SILVER-BASED MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

7.NORTH AMERICAN SILVER-BASED BATTERY MARKET RESEARCH AND ANALYSIS BY END-USER, 2021-2028 ($ MILLION)

8.EUROPEAN SILVER-BASED BATTERY MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

9.EUROPEAN SILVER-BASED BATTERY MARKET RESEARCH AND ANALYSIS BY END-USER, 2021-2028 ($ MILLION)

10.ASIA-PACIFIC SILVER-BASED BATTERY MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

11.ASIA-PACIFIC SILVER-BASED BATTERY MARKET RESEARCH AND ANALYSIS BY END-USER, 2021-2028 ($ MILLION)

12.REST OF THE WORLD SILVER-BASED BATTERY MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

13.REST OF THE WORLD SILVER-BASED BATTERY MARKET RESEARCH AND ANALYSIS BY END-USER, 2021-2028 ($ MILLION)

1.IMPACT OF COVID-19 ON GLOBAL SILVER-BASED BATTERY MARKET, 2021-2028($ MILLION)

2.IMPACT OF COVID-19 ON GLOBAL SILVER-BASED BATTERY MARKET BY SEGMENT, 2021-2028($ MILLION)

3.RECOVERY OF GLOBAL SILVER-BASED BATTERY MARKET, 2022-2028(%)

4.GLOBAL SILVER-BASED BATTERY MARKET SHARE BY END-USER, 2021 VS 2028 (%)

5.GLOBAL AUTOMOTIVE APPLICATIONS SILVER-BASED BATTERY MARKET SHARE BY REGION, 2021 VS 2028 (%)

6.GLOBAL CONSUMER ELECTRONICS SILVER-BASED BATTERY MARKET SHARE BY REGION, 2021 VS 2028 (%)

7.GLOBAL INDUSTRIAL APPLICATIONS SILVER-BASED BATTERY MARKET SHARE BY REGION, 2021 VS 2028 (%)

8.GLOBAL SILVER-BASED BATTERY MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

9.UK SILVER-BASED BATTERY MARKET SIZE, 2021-2028 ($ MILLION)

10.FRANCE SILVER-BASED BATTERY MARKET SIZE, 2021-2028 ($ MILLION)

11.GERMANY SILVER-BASED BATTERY MARKET SIZE, 2021-2028 ($ MILLION)

12.ITALY SILVER-BASED BATTERY MARKET SIZE, 2021-2028 ($ MILLION)

13.SPAIN SILVER-BASED BATTERY MARKET SIZE, 2021-2028 ($ MILLION)

14.REST OF EUROPE SILVER-BASED BATTERY MARKET SIZE, 2021-2028 ($ MILLION)

15.INDIA SILVER-BASED BATTERY MARKET SIZE, 2021-2028 ($ MILLION)

16.CHINA SILVER-BASED BATTERY MARKET SIZE, 2021-2028 ($ MILLION)

17.JAPAN SILVER-BASED BATTERY MARKET SIZE, 2021-2028 ($ MILLION)

18.SOUTH KOREA SILVER-BASED BATTERY MARKET SIZE, 2021-2028 ($ MILLION)

19.REST OF ASIA-PACIFIC SILVER-BASED BATTERY MARKET SIZE, 2021-2028 ($ MILLION)

20.REST OF THE WORLD SILVER-BASED BATTERY MARKET SIZE, 2021-2028 ($ MILLION)