Small Satellite Market

Global Small Satellite Market Size, Share & Trends Analysis Report by Type (Minisatellite, Microsatellite, Nanosatellite, Picosatellite, and Femtosatellite), By End-user (Civil, Commercial, and Military) Forecast Period 2022-2028 Update Available - Forecast 2025-2031

The global market for small satellites is projected to have a considerable CAGR of around 10.1% during the forecast period. The small satellite market is likely to grow as demand for high-resolution image services increases around the globe. Small satellites are equipped with high-resolution cameras that can record video at a rate of 25 frames per second. The video data and images from this satellite will be used to monitor agriculture, forestry, urban growth, and marine transport. The increased focus of commercial organizations on the deployment of advanced satellite services represents a growth potential for the small satellite market. Small satellites have been used in commercial enterprises to deliver cutting-edge services such as satellite TV, broadband internet, and other services. Moreover, the increase in demand for satellite services in the commercial sector, as well as the surge in demand for satellite data, are projected to create new opportunities for market players in the future. However, the lack of dedicated small satellite launch vehicles and the payload capacity limitations of small satellites may constrain market growth.

Segmental Outlook

The global small satellite market is segmented based on type, and end-user. Based on the type, the market is further classified into minisatellite, microsatellite, nanosatellite, picosatellite, and Femto satellite. Further, based on end-user, the market is segregated into civil, commercial, and military.

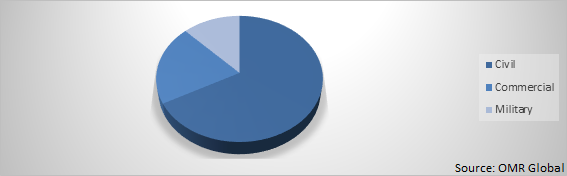

Global Small Satellite Market Share by End-User, 2021 (%)

The military segment is considered the dominating segment in the global small satellite market.

Among end-user, the military segment is estimated as dominating segment during the forecast period. Military satellites are used for two specific mission profiles surveillance and reconnaissance. The increased threat of terrorism has prompted military forces all around the world to develop more advanced military communication systems. Modern military communication networks rely heavily on military satellites. Military communication satellites are used in the development of tactical communication systems, modern network-centric battle force capabilities, tactical data connections, and advanced SATCOMs. An advanced Ka-band called SATCOM solutions was developed to tackle the issues faced by computers, control, command, surveillance, intelligence, and reconnaissance.

Regional Outlook

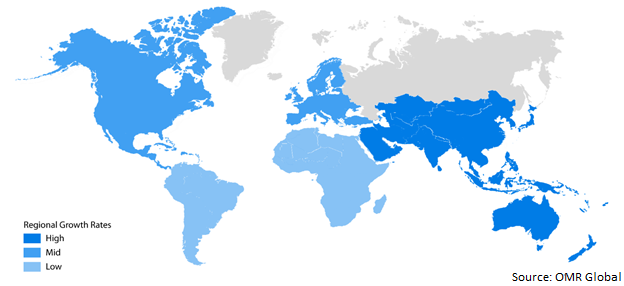

Geographically, the global Small Satellite market is classified into four major regions including North America (the US and Canada), Europe (UK, Germany, France, Italy, Spain, and Rest of Europe), Asia-Pacific (India, China, Japan, and Rest of Asia-Pacific), and Rest of the World (Latin America and the Middle East and Africa (MEA)). Asia-Pacific is projected to have a significant CAGR in the small satellite market due to growth in military satellite development in this region by countries such as China, India, and South Korea. For instance, under the "Project 425" initiative, South Korea is also developing a constellation of five high-power military surveillance satellites. The Defense Acquisition Program Administration (DAPA) of the Republic of Korea (ROK) has invested around USD 900 million into this project.

Global Small Satellite Market Growth, by region 2022-2028

North America to hold a considerable share in the global small satellite market

Geographically, North America is projected to hold a significant share in the global small satellite market. The factors that are contributing to the growth of the market include the increased number of research laboratories and base camps in the developed nations of the U.S. and Canada. The North American market is also expected to develop as demand for high-resolution imaging services and high-speed connectivity increases. Moreover, several development projects are currently underway in this region, and these could result in new market opportunities. For instance, the US Defense Advanced Research Projects Agency (DARPA) is developing a prototype line of cost-effective reconnaissance satellites, as part of a program known as Blackjack.

Market Players Outlook

The key players in the small satellite market contribute significantly by providing different types of products and increasing their geographical presence across the globe. Northrop Grumman Corp, Millennium Space Systems, Inc. Thales Alenia Space, Planet Labs, Inc., Adcole Maryland Aerospace, LLC among others. These market players adopt various strategies such as product launches, partnerships, collaborations, mergers, and acquisitions to sustain a strong position in the market. In February 2020, Astrocast announced the signing of a new contract with Spaceflight Inc. for the launch of 10 additional IoT nanosatellites. The new contract represents Astrocast’s sixth launch order from Spaceflight. Astrocast's 100 CubeSat IoT Nanosatellite Network is specifically designed to broadcast and receive low-bandwidth data from IoT devices anywhere on the globe. Astrocast will enable enterprises to communicate data with millions of devices throughout the world, whether it's a marine buoy in the deep sea or a water purification unit in the world's most remote village.

The Report Covers

- Market value data analysis of 2021 and forecast to 2028.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global Small Satellite market. Based on the availability of data, information related to pipeline products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying 'who-stands-where in the market.

1. Report Summary

1.1. Research Methods and Tools

• Current Industry Analysis and Growth Potential Outlook

• Impact of COVID-19 on the Global Small Satellite Industry

• Recovery Scenario of Global Small Satellite Industry

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Competitive Dashboard

3.2. Key Strategy Analysis

3.3. Key Company Analysis

3.4. Impact of COVID-19 on key players

4. Market Determinants

4.1. Motivators

4.2. Restraints

4.3. Opportunities

5. Market Segmentation

5.1. Global Small Satellite Market by Type

5.1.1. Minisatellite

5.1.2. Microsatellite

5.1.3. Nanosatellite

5.1.4. Picosatellite

5.1.5. Femtosatellite

5.2. Global Small Satellite Market by End-user

5.2.1. Civil

5.2.2. Commercial

5.2.3. Military

6. Regional Analysis

6.1. North America

6.1.1. US

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. ASEAN

6.3.5. South Korea

6.3.6. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. Adcole Maryland Aerospace LLC

7.2. Airbus SE

7.3. Blue Canyon Technologies Inc.

7.4. GomSpace Group AB

7.5. L3Harris Technologies Inc.

7.6. Lockheed Martin Corp

7.7. Maxar Technologies Inc

7.8. Millennium Space Systems Inc. (The Boeing Company)

7.9. Mitsubishi Electric Corp

7.10. Northrop Grumman Corp

7.11. OHB SE

7.12. Planet Labs Inc.

7.13. Pumpkin, Inc

7.14. Raytheon Technologies Corp

7.15. Sierra Nevada Corporation

7.16. Singapore Technologies Engineering Ltd

7.17. Space Exploration Technologies Corp.

7.18. Spire Global Inc.

7.19. Surrey Satellite Technology Ltd (Airbus SE)

7.20. Thales Alenia Space

1. GLOBAL SMALL SATELLITE MARKET RESEARCH AND ANALYSIS BY TYPE, 2021-2028 ($ MILLION)

2. GLOBAL MINISATELLITE MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

3. GLOBAL MICROSATELLITE MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

4. GLOBAL NANOSATELLITE MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

5. GLOBAL PICOSATELLITE MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

6. GLOBAL FEMTOSATELLITE MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

7. GLOBAL SMALL SATELLITE MARKET RESEARCH AND ANALYSIS BY END-USER, 2021-2028 ($ MILLION)

8. GLOBAL SMALL SATELLITE FOR CIVIL MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

9. GLOBAL SMALL SATELLITE FOR COMMERCIAL MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

10. GLOBAL SMALL SATELLITE FOR MILITARY MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

11. GLOBAL SMALL SATELLITE MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2021-2028 ($ MILLION)

12. NORTH AMERICAN MICROSATELLITE MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

13. NORTH AMERICAN SMALL SATELLITE MARKET RESEARCH AND ANALYSIS BY TYPE, 2021-2028 ($ MILLION)

14. NORTH AMERICAN SMALL SATELLITE MARKET RESEARCH AND ANALYSIS BY END-USER, 2021-2028 ($ MILLION)

15. EUROPEAN SMALL SATELLITE MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

16. EUROPEAN SMALL SATELLITE MARKET RESEARCH AND ANALYSIS BY TYPE, 2021-2028 ($ MILLION)

17. EUROPEAN SMALL SATELLITE MARKET RESEARCH AND ANALYSIS BY END-USER, 2021-2028 ($ MILLION)

18. ASIA-PACIFIC SMALL SATELLITE MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

19. ASIA-PACIFIC SMALL SATELLITE MARKET RESEARCH AND ANALYSIS BY TYPE, 2021-2028 ($ MILLION)

20. ASIA-PACIFIC SMALL SATELLITE MARKET RESEARCH AND ANALYSIS BY END-USER, 2021-2028 ($ MILLION)

21. REST OF THE WORLD SMALL SATELLITE MARKET RESEARCH AND ANALYSIS BY TYPE, 2021-2028 ($ MILLION)

22. REST OF THE WORLD SMALL SATELLITE MARKET RESEARCH AND ANALYSIS BY END-USER, 2021-2028 ($ MILLION)

1. IMPACT OF COVID-19 ON GLOBAL SMALL SATELLITE MARKET, 2021-2028 (% MILLION)

2. IMPACT OF COVID-19 ON GLOBAL SMALL SATELLITE MARKET BY SEGMENT, 2021-2028 (% MILLION)

3. RECOVERY OF GLOBAL SMALL SATELLITE MARKET, 2021-2028 (%)

4. GLOBAL SMALL SATELLITE MARKET SHARE BY TYPE, 2021 VS 2028 (%)

5. GLOBAL SMALL SATELLITE MARKET SHARE BY END-USER, 2021 VS 2028 (%)

6. GLOBAL SMALL SATELLITE MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

7. GLOBAL MINISATELLITE MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

8. GLOBAL MICROSATELLITE MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

9. GLOBAL NANOSATELLITE MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

10. GLOBAL PICOSATELLITE MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

11. GLOBAL FEMTOSATELLITE MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

12. GLOBAL SMALL SATELLITE FOR CIVIL MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

13. GLOBAL SMALL SATELLITE FOR COMMERCIAL MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

14. GLOBAL SMALL SATELLITE FOR MILITARY MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

15. US SMALL SATELLITE MARKET SIZE, 2021-2028 ($ MILLION)

16. CANADA SMALL SATELLITE MARKET SIZE, 2021-2028 ($ MILLION)

17. UK SMALL SATELLITE MARKET SIZE, 2021-2028 ($ MILLION)

18. FRANCE SMALL SATELLITE MARKET SIZE, 2021-2028 ($ MILLION)

19. GERMANY SMALL SATELLITE MARKET SIZE, 2021-2028 ($ MILLION)

20. ITALY SMALL SATELLITE MARKET SIZE, 2021-2028 ($ MILLION)

21. SPAIN SMALL SATELLITE MARKET SIZE, 2021-2028 ($ MILLION)

22. ROE SMALL SATELLITE MARKET SIZE, 2021-2028 ($ MILLION)

23. INDIA SMALL SATELLITE MARKET SIZE, 2021-2028 ($ MILLION)

24. CHINA SMALL SATELLITE MARKET SIZE, 2021-2028 ($ MILLION)

25. JAPAN SMALL SATELLITE MARKET SIZE, 2021-2028 ($ MILLION)

26. ASEAN SMALL SATELLITE MARKET SIZE, 2021-2028 ($ MILLION)

27. SOUTH KOREA SMALL SATELLITE MARKET SIZE, 2021-2028 ($ MILLION)

28. REST OF ASIA-PACIFIC SMALL SATELLITE MARKET SIZE, 2021-2028 ($ MILLION)

29. REST OF THE WORLD SMALL SATELLITE MARKET SIZE, 2021-2028 ($ MILLION)