Smart Bed Market

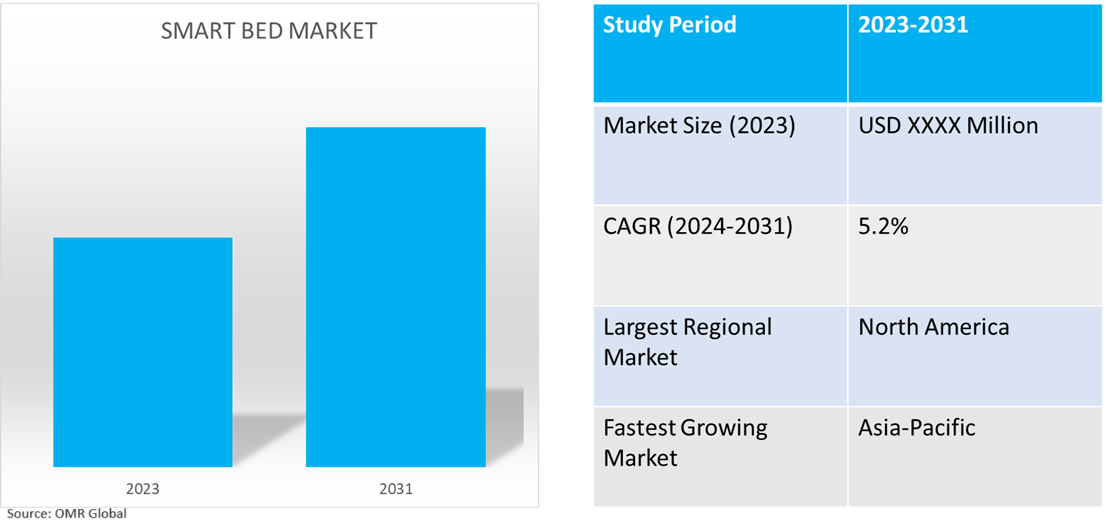

Smart Bed Market Size, Share & Trends Analysis Report by Product Type (Manual, Semi-Automatic, and Fully Automatic), by End-User (Residential, Hospital, and Others), and by Distribution channel (Online, and Offline) Forecast Period (2024-2031)

Smart bed market is anticipated to grow at a CAGR of 5.2% during the forecast period (2024-2031). Smart beds are embedded with advanced technologies such as sensors and connectivity options that facilitate sleep monitoring and management, improved sleep quality, and interconnectivity with other devices. The global market growth is driven by the modernization of healthcare infrastructure to accommodate an increasingly aging population. The rising trend for luxurious consumables in the furniture market is further aiding the global market growth. Furthermore, the market is expected to be positively influenced by the interconnectivity of smart home ecosystems, advancements in health monitoring technology, and the expansion of smart beds in the hospitality sector.

Market Dynamics

Increasing Investment in Healthcare Infrastructure Modernization

One of the pivotal factors driving the demand for smart beds is the modernization of healthcare infrastructure. The initiative to modernize healthcare infrastructure has led to an upgradation of beds across geographic areas. These beds facilitate better monitoring of patients by integration with other smart health devices to offer enhanced use comfort, and preventive healthcare applications. For instance, in March 2024, Hill-Rom, Inc. was awarded contract no. 36C26224P1034 by the Department of Veterans Affairs (VA) Veterans Health Administration worth $1.3 million. This contract is for the provision of hospital smart beds with mattresses and was secured through the Lowest Price Technically Acceptable evaluation process.

Increased Disposable Income and Spending on Smart Goods

The smart bed market is expected to benefit from the rapid change in the relationship between income and spending. This shift is driven by increased disposable income, leading to higher spending by the financially stable population on products that promote well-being, comfort, and luxury. Additionally, this trend reflects the middle- and upper-middle-class preference for upgrading lifestyle products and incorporating smart technology devices into their homes, ultimately benefiting the market. For instance, the US Bureau of Labor Statistics released data on consumer expenditure, revealing that the average annual expenses for all consumer units in 2022 stood at $72,967, marking a 9.0% surge from the previous year. Over the same period, the Consumer Price Index for All Urban Consumers (CPI-U) experienced an 8.0% increase, while the average income before taxes rose by 7.5%. The average annual expenditures for 2022 were categorized into 14 major components, with housing representing the largest share at 33.3%, followed by transportation at 16.8%, food at 12.8%, personal insurance and pensions at 12.0%, and healthcare at 8.0%. The remaining categories individually contributed less than 5.0% of the total expenditures.

Segmental Outlook

- Based on product type, the market is segmented into manual, semi-automatic, and fully automatic.

- Based on end-users, the market is segmented into residential, hospital, and others (hotels, resorts).

- Based on distribution channel, the market is segmented into online, and offline.

Hospital Holds Major Share Based on End-User Segment

Hospitals are the major end-users of smart beds owing to the rising number of critical patient admissions, increasing investment in modernizing hospital infrastructure, the growing need for the integration of smart technology in hospitals, and advancements in healthcare systems. For instance, in February 2021, Stryker, a prominent medical technology firm globally, unveiled the ProCuity, a fully wireless hospital bed, for the EMEA region. This series of beds was created to decrease in-hospital patient falls across all acuity levels and enhance the efficiency and safety of nurse workflow. It is capable of integrating with nurse call systems effortlessly without requiring cables or wires.

Offline Holds Major Share Based on Distribution Channel

Offline distribution channels dominate the market owing to the major share of smart purchases coming from large organizations preferring offline or tender-based purchases, the comparatively higher inclination of retail buyers towards offline stores for lifestyle product purchases, and expansion by major companies in emerging regions through offline channels. For instance, the first experience store in Surat has been opened by The Sleep Company, an influential leader in smart grid technology for promoting peaceful sleep in Asia. This launch builds on the company's successful expansion in Ahmedabad and reflects the high demand for The Sleep Company's products across India. By adding this store, The Sleep Company now has 42 stores nationwide, demonstrating its dedication to reaching the goal of having 100+ stores by the end of the year.

Regional Outlook

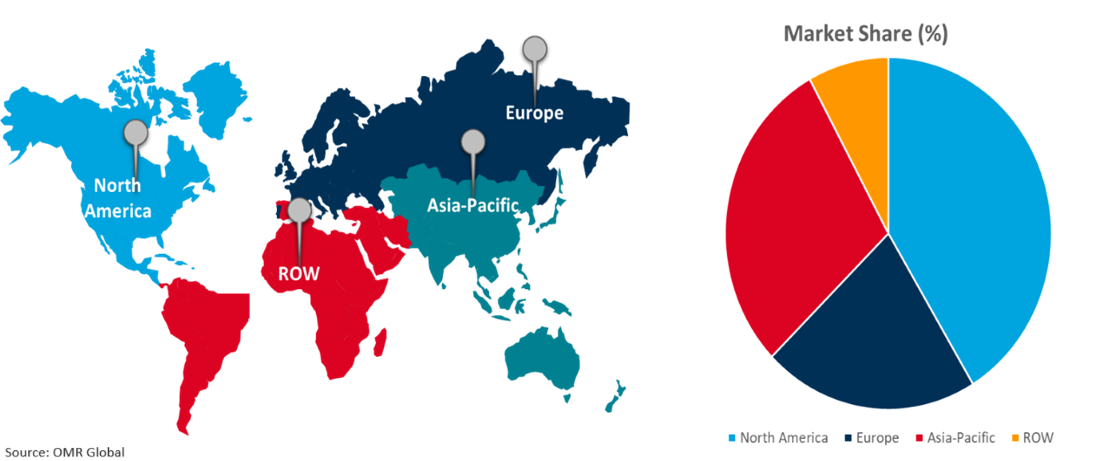

The global smart bed market is further segmented based on geography including North America (the US, and Canada), Europe (the UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia-Pacific), and the Rest of the World (the Middle East & Africa, and Latin America).

North America Dominate the Global Smart Bed Market

North America dominates the global market. The ongoing investment in modernizing healthcare infrastructure, the availability of advanced technology for developing and deploying smart technology across healthcare infrastructure, and the higher level of disposable income across the region are major contributors to the regional market share. The rising inclination toward creating smart home ecosystems, and the growing demand for smart beds in the residential sector is further aiding regional market share. For instance, in April 2024, Valley Health System plans to install the newest artificial intelligence technology and intelligent beds in its hospital in Paramus. The $868 million, 910,000-square-foot facility with 370 beds will incorporate AI-powered ambient monitoring in the rooms to prevent falls. Moreover, the system employs sensors, computer vision, and smart lanyards to detect patient movement, and it notifies staff members using stick-figure representations when patients leave their beds or stand up.

Global Smart Bed Market Growth by Region 2024-2031

Asia-Pacific is the Fastest Growing Global Smart Bed Market

- The Asia-Pacific region is projected to experience an exponential increase in the geriatric population in the coming decades, creating scope for the deployment of smart health infrastructure across the region.

- The region is also one of the fastest-growing in terms of disposable income and relative spending, creating demand for smart and technology-based lifestyle products.

Market Players Outlook

*Note: Major Players Sorted in No Particular Order.

The major companies serving the global smart bed market include Arjo AB, Sleep Number Corp., and Tempur Sealy International, Inc., among others. The market players are focusing on capitalizing on growth by adopting strategies such as collaboration, partnerships, and market expansion among others. For instance, in November 2023, Sleep Number introduced its next-generation Sleep Number smart beds and Lifestyle Furniture. The new smart beds have evolved from the original award-winning Sleep Number 360 smart beds. These latest developments are based on insights gained from over 19 billion hours of exclusive, long-term sleep data from the 360 smart beds. These beds utilize embedded, research-grade sensors and artificial intelligence (AI) to understand the unique biometrics and sleep patterns of each sleeper and automatically adjust to cater to an individual's evolving needs.

The Report Covers

- Market value data analysis of 2023 and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global smart bed market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Industry Trends

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. Arjo AB

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. Sleep Number Corp.

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. Tempur Sealy International Inc.

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Key Strategy Analysis

4. Market Segmentation

4.1. Global Smart Bed Market by Product Type

4.1.1. Manual

4.1.2. Semi-Automatic

4.1.3. Fully-Automatic

4.2. Global Smart Bed Market by End-User

4.2.1. Residential

4.2.2. Hospital

4.2.3. Others (Hotels, Resorts)

4.3. Global Smart Bed Market by Distribution Channel

4.3.1. Online

4.3.2. Offline

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

5.4.1. Latin America

5.4.2. Middle East and Africa

6. Company Profiles

6.1. Ascion, LLC

6.2. Boyd Sleep

6.3. DUX International

6.4. Ergomotion

6.5. GhostBed

6.6. Invacare Corp.

6.7. Hill-Rom Holdings, Inc.

6.8. IOF Srl

6.9. Joerns Healthcare

6.10. Johnson & Johnson Services, Inc.

6.11. Nilkamal Sleep

6.12. Leggett & Platt

6.13. PARAMOUNT BED CO., LTD.

6.14. ReST (Responsive Surface Technology)

6.15. Sealy Technology LLC

6.16. Stryker Corp.

6.17. The Sleep Company Comfort Grid Technologies Pvt. Ltd.

1. Global Smart Bed Market Research and Analysis by Product Type, 2023-2031 ($ Million)

2. Global Manual Smart Bed Market Research and Analysis by Region, 2023-2031 ($ Million)

3. Global Semi-Automatic Smart Bed Market Research and Analysis by Region, 2023-2031 ($ Million)

4. Global Fully Automatic Smart Bed Market Research and Analysis by Region, 2023-2031 ($ Million)

5. Global Smart Bed Market Research and Analysis by End-User, 2023-2031 ($ Million)

6. Global Smart Bed for Residential Market Research and Analysis by Region, 2023-2031 ($ Million)

7. Global Smart Bed for Hospital Market Research and Analysis by Region, 2023-2031 ($ Million)

8. Global Smart Bed for Other End-User Market Research and Analysis by Region, 2023-2031 ($ Million)

9. Global Smart Bed Market Research and Analysis by Distribution Channel, 2023-2031 ($ Million)

10. Global Online Smart Bed Market Research and Analysis by Region, 2023-2031 ($ Million)

11. Global Offline Smart Bed Analysis Market Research and by Region, 2023-2031 ($ Million)

12. North American Smart Bed Market Research and Analysis by Country, 2023-2031 ($ Million)

13. North American Smart Bed Market Research and Analysis by Product Type, 2023-2031 ($ Million)

14. North American Smart Bed Market Research and Analysis by End-User, 2023-2031 ($ Million)

15. North American Smart Bed Market Research and Analysis by Distribution Channel, 2023-2031 ($ Million)

16. European Smart Bed Market Research and Analysis by Country, 2023-2031 ($ Million)

17. European Smart Bed Market Research and Analysis by Product Type, 2023-2031 ($ Million)

18. European Smart Bed Market Research and Analysis by End-User, 2023-2031 ($ Million)

19. European Smart Bed Market Research and Analysis by Distribution Channel, 2023-2031 ($ Million)

20. Asia-Pacific Smart Bed Market Research and Analysis by Country, 2023-2031 ($ Million)

21. Asia-Pacific Smart Bed Market Research and Analysis by Product Type, 2023-2031 ($ Million)

22. Asia-Pacific Smart Bed Market Research and Analysis by End-User, 2023-2031 ($ Million)

23. Asia-Pacific Smart Bed Market Research and Analysis by Distribution Channel, 2023-2031 ($ Million)

24. Rest of The World Smart Bed Market Research and Analysis by Region, 2023-2031 ($ Million)

25. Rest of The World Smart Bed Market Research and Analysis by Product Type, 2023-2031 ($ Million)

26. Rest of The World Smart Bed Market Research and Analysis by End-User, 2023-2031 ($ Million)

27. Rest of The World Smart Bed Market Research and Analysis by Distribution Channel, 2023-2031 ($ Million)

1. Global Smart Bed Market Share by Product Type, 2023 Vs 2031 (%)

2. Global Manual Smart Bed Market Share by Region, 2023 Vs 2031 (%)

3. Global Semi-Automatic Smart Bed Market Share by Region, 2023 Vs 2031 (%)

4. Global Fully Automatic Smart Bed Market Share by Region, 2023 Vs 2031 (%)

5. Global Smart Bed Market Share by End-User, 2023 Vs 2031 (%)

6. Global Smart Bed for Residential Market Share by Region, 2023 Vs 2031 (%)

7. Global Smart Bed for Hospital Market Share by Region, 2023 Vs 2031 (%)

8. Global Smart Bed for Other End-User Market Share by Region, 2023 Vs 2031 (%)

9. Global Smart Bed Market Share by Distribution Channel, 2023 Vs 2031 (%)

10. Global Online Smart Bed Market Share by Region, 2023 Vs 2031 (%)

11. Global Offline Smart Bed Market Share by Region, 2023 Vs 2031 (%)

12. Global Smart Bed Market Share by Region, 2023 Vs 2031 (%)

13. US Smart Bed Market Size, 2023-2031 ($ Million)

14. Canada Smart Bed Market Size, 2023-2031 ($ Million)

15. UK Smart Bed Market Size, 2023-2031 ($ Million)

16. France Smart Bed Market Size, 2023-2031 ($ Million)

17. Germany Smart Bed Market Size, 2023-2031 ($ Million)

18. Italy Smart Bed Market Size, 2023-2031 ($ Million)

19. Spain Smart Bed Market Size, 2023-2031 ($ Million)

20. Rest of Europe Smart Bed Market Size, 2023-2031 ($ Million)

21. India Smart Bed Market Size, 2023-2031 ($ Million)

22. China Smart Bed Market Size, 2023-2031 ($ Million)

23. Japan Smart Bed Market Size, 2023-2031 ($ Million)

24. South Korea Smart Bed Market Size, 2023-2031 ($ Million)

25. Rest of Asia-Pacific Smart Bed Market Size, 2023-2031 ($ Million)

26. Latin America Smart Bed Market Size, 2023-2031 ($ Million)

27. Middle East And Africa Smart Bed Market Size, 2023-2031 ($ Million)