Smart Buildings Market

Global Smart Buildings Market Size, Share & Trends Analysis Report by Building Type (Residential, Commercial and,Industrial), by Solution (Safety & Security Management System, Energy Management System, Building Infrastructure Management System, Network Management, and Integrated Workplace Management System (IWMS)) and by Service (Consulting, Implementation and Support & Maintenance) Forecast Period (2022-2028). Update Available - Forecast 2025-2035

The global smart buildings market is anticipated to grow at a significant CAGR of 11.2% during the forecast period. The growing demand for energy efficient solutions will drive the smart buildings market. Energy costs are rising rapidly, and environmental issues have become major concern due to which there is growing focus to deliver more energy-saving solutions. Decline in energy consumption is a prime concern among commercial building owners to save money due to which various iniatives are being taken to provide energy efficient solutions to consumers. For instance, in February 2020, Honeywell launched Honeywell Forge Energy Optimization which is a machine learning solution that studies a building's energy consumption patterns and robotically regulates to optimal energy saving settings. The new autonomous building solution is focused towards reducing energy consumption and decrease a building's carbon footprint, which may result in growth of the smart buildings market.

Impact of COVID-19 Pandemic on Global Smart Buildings Market

The COVID-19 pandemic has spread to almost every country globally. It has adversely affected various industries, however, it has created opportunities for the smart buildings market especially in commercial buildings sector. The COVID-19 has increased the need for better air quality and effective ventilation in buildings to reduce viruses. In the post-lockdown period, people have become more hesitant to touch light switches, elevator buttons, and regulators, which may result in increasing number of buildings being advanced with touchless technology such as hands-free doors, voice-activated elevators, and phone-controlled door locks. These advanced technologies in buildings will result in growth of the market post-COVID-19 period.

Segmental Outlook

The global smart buildings market is segmented based on the building type, solution and, service. Based on the building type, the market is segmented into residential, commercial and industrial. Based on the solution, the market is sub-segmented into the safety & security management system, energy management system, building infrastructure management system, network management, and IWMS. Based on the service, the market is sub-segmented into the consulting, implementation and support & maintenance. Out of building type, commercial building segment is expected to hold major share in smart buildings market.

Global Smart Buildings Market Share by Building Type, 2021 (%)

The Commercial Segment Holds the Major Share in the Global Smart Buildings Market.

The commercial segment holds the major share in global smart buildings market due to increasing demand for advanced solutions for energy saving. Smart commercial buildings have advanced IoT sensors to collect data from various building functions which can be used by building’s operator to automate and enhance the building’s operations and maintenance. Further, in June 2021, Endeavor Business Media launched the Smart Buildings Technology, that brings integrated intelligence to new construction and existing commercial buildings. Smart buildings technology comprise the recent advances in communications systems, energy efficiency, IT/OT integration, intelligent building systems, occupant health & safety, and more.

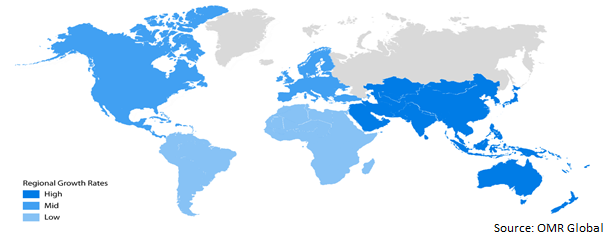

Regional Outlooks

The global smart buildings market is further segmented based on geography including North America (the US, and Canada), Europe (Italy, Spain, Germany, France, and Others), Asia-Pacific (India, China, Japan, South Korea, and Others), and the Rest of the World (the Middle East & Africa, and Latin America).

Global Smart Buildings Market Growth, by Region 2022-2028

The North America Region is anticipated to hold the largest share in the Global Smart Buildings Market.

North America is expected to grasp the largest share in the global smart building market. It holds the major portion of the market due to the usage of smart buildings based solutions and services in that region. The US and Canada are noticeable countries contributing in the development of technology in that region. Further, the US organizations are focused towards investing in smart building measures such as building controls and building system integration for leveraging energy efficiency and energy storage and deliver smart and sustainable buildings. For instance, in October 2021, The US Department of Energy (DOE) invested $61 million for 10 pilot projects focused towards deployment of new technology to transform homes and workplaces into advanced, energy-efficient buildings. These Connected Communities interact with the electrical grid to enhance their energy consumption to substantially decrease the carbon emissions and cut energy costs. At the same time, the Canadian government takes initiatives to support Canada's obligation to protect the environment and its resources by making centralized buildings more energy-efficient and dropping greenhouse gas emissions, which will drive the smart buildings market.

Market Players Outlook

The major companies serving the global smart buildings market include Intel Corp, Johnson Controls., KMC Controls, Legrand North America, LLC., Mode:Green Integrated Building Technology, PTC Inc., Schneider Electric, Siemens, Softdel, Spaceti., SPACEWELL INTERNATIONAL. and others. The market players are considerably contributing to the market growth by the adoption of various strategies including mergers & acquisitions, collaborations, funding, and new product launches, to stay competitive in the market. For instance, in January 2022, Johnson Controls acquired FogHorn, to accelerate Johnson Controls’ vision for smart autonomous buildings by incorporating Foghorn’s Edge AI platform which brings intelligence to the source of data inside the building, allowing secure and real-time machine learning driven solutions that address the challenges of sustainability, energy efficiency, indoor air quality, and security of buildings.

The Report Covers

- Market value data analysis of 2021 and forecast to 2027.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global smart buildings market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

• Impact of COVID-19 on the Global Smart Buildings Market

• Recovery Scenario of Global Smart Buildings Market

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. BY Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Bosch Sicherheitssysteme GmbH

3.1.1. Overview

3.1.2. Financial Analysis

3.1.3. SWOT Analysis

3.1.4. Recent Developments

3.2. Cisco Systems, Inc

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. Hitachi, Ltd.

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. Honeywell International Inc.

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. IBM Corp

3.5.1. Overview

3.5.2. Financial Analysis

3.5.3. SWOT Analysis

3.5.4. Recent Developments

3.6. Key Strategy Analysis

3.7. Impact of Covid-19 on Key Players

4. Market Segmentation

4.1. Global Smart Buildings Market by Building Type

4.1.1. Residential

4.1.2. Commercial

4.1.3. Industrial

4.2. Global Smart Buildings Market by Solution

4.2.1. Safety & Security Management System

4.2.2. Energy Management System

4.2.3. Building Infrastructure Management System

4.2.4. Network Management

4.2.5. Integrated Workplace Management System (IWMS)

4.3. Global Smart Buildings Market by Service

4.3.1. Consulting

4.3.2. Implementation

4.3.3. Support & Maintenance

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

6. Company Profiles

6.1. ABB Ltd.

6.2. BuildingIQ.

6.3. CopperTree Analytics Inc.

6.4. eFACiLiTY

6.5. ENTOUCH

6.6. Endeavor Business Media, LLC

6.7. 75F

6.8. IGOR INC

6.9. Intel Corp

6.10. Johnson Controls Internationals

6.11. KMC Controls

6.12. Legrand North America, LLC.

6.13. Mode:Green Integrated Building Technology

6.14. PTC Inc.

6.15. Schneider Electric SE

6.16. Siemens AG

6.17. Softdel System Pte. Ltd.

6.18. Spaceti s.r.o.

6.19. SPACEWELL INTERNATIONAL.

6.20. Telit

6.21. Thales Group

6.22. Verdigris Technologies, Inc.

1. GLOBAL SMART BUILDINGS MARKET RESEARCH AND ANALYSIS BY BUILDING TYPE, 2021-2028 ($ MILLION)

2. GLOBAL RESIDENTIAL SMART BUILDINGS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

3. GLOBAL COMMERCIAL SMART BUILDINGS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

4. GLOBAL INDUSTRIALSMART BUILDINGS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

5. GLOBAL SMART BUILDINGS MARKET RESEARCH AND ANALYSIS BY SOLUTION, 2021-2028 ($ MILLION)

6. GLOBAL SAFETY & SECURITY MANAGEMENT SYSTEM IN SMART BUILDINGS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

7. GLOBAL ENERGY MANAGEMENT SYSTEM IN SMART BUILDINGS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

8. GLOBAL BUILDING INFRASTRUCTURE MANAGEMENT SYSTEM IN SMART BUILDINGS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

9. GLOBAL NETWORK MANAGEMENT IN SMART BUILDINGS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

10. GLOBAL IWMS IN SMART BUILDINGS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

11. GLOBAL SMART BUILDINGS MARKET RESEARCH AND ANALYSIS BY SERVICE, 2021-2028 ($ MILLION)

12. GLOBAL SMART BUILDINGS CONSULTING MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

13. GLOBAL SMART BUILDINGS IMPLEMENTATION MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

14. GLOBAL SMART BUILDINGS SUPPORT & MAINTENANCE MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

15. GLOBAL SMART BUILDINGS MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2021-2028 ($ MILLION)

16. NORTH AMERICAN SMART BUILDINGS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

17. NORTH AMERICAN SMART BUILDINGS MARKET RESEARCH AND ANALYSIS BY BUILDING TYPE, 2021-2028 ($ MILLION)

18. NORTH AMERICAN SMART BUILDINGS MARKET RESEARCH AND ANALYSIS BY SOLUTION, 2021-2028 ($ MILLION)

19. NORTH AMERICAN SMART BUILDINGS MARKET RESEARCH AND ANALYSIS BY SERVICE, 2021-2028 ($ MILLION)

20. EUROPEAN SMART BUILDINGS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

21. EUROPEAN SMART BUILDINGS MARKET RESEARCH AND ANALYSIS BY BUILDING TYPE, 2021-2028 ($ MILLION)

22. EUROPEAN SMART BUILDINGS MARKET RESEARCH AND ANALYSIS BY SOLUTION, 2021-2028 ($ MILLION)

23. EUROPEAN SMART BUILDINGS MARKET RESEARCH AND ANALYSIS BY SERVICE, 2021-2028 ($ MILLION)

24. ASIA-PACIFIC SMART BUILDINGS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

25. ASIA-PACIFIC SMART BUILDINGS MARKET RESEARCH AND ANALYSIS BY BUILDING TYPE, 2021-2028 ($ MILLION)

26. ASIA-PACIFIC SMART BUILDINGS MARKET RESEARCH AND ANALYSIS BY SOLUTION, 2021-2028 ($ MILLION)

27. ASIA-PACIFIC SMART BUILDINGS MARKET RESEARCH AND ANALYSIS BY SERVICE, 2021-2028 ($ MILLION)

28. REST OF THE WORLD SMART BUILDINGS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

29. REST OF THE WORLD SMART BUILDINGS MARKET RESEARCH AND ANALYSIS BY BUILDING TYPE, 2021-2028 ($ MILLION)

30. REST OF THE WORLD SMART BUILDINGS MARKET RESEARCH AND ANALYSIS BY SOLUTION, 2021-2028 ($ MILLION)

31. REST OF THE WORLD SMART BUILDINGS MARKET RESEARCH AND ANALYSIS BY SERVICE, 2021-2028 ($ MILLION)