Smart Electric Meter Market

Global Smart Electric Meter Market Size, Share & Trends Analysis Report, By Communication Technology (Power Line Communication, Cellular, and Radio Frequency), By Phase (Single Phase, and Three Phase), By End-User (Residential, Commercial, and Industrial), Forecast (2022-2028) Update Available - Forecast 2025-2031

The global smart electric meter market is anticipated to grow at a considerable CAGR of 7.6% during the forecast period. The growth of the market is attributed to favorable government initiatives and funding such as smart city projects by the European and Asia- Pacific government. In India, the government planned to build 90 smart cities by 2022. Additionally, the British government had planned to install a smart meter in every home by 2020. According to the national renewable energy laboratory, in the US 60 million smart electric meters will be installed by 2019. The cohesive government policies and initiatives are driving the growth of the smart electric meter market. Concepts of smart homes and smart cities and energy conservation by use of smart electric meters are also factors that are stimulating the market growth. However, a lack of a skilled workforce and reluctance by key end-users to adopt new technology may hamper the growth of the smart electric meter market. Moreover, interoperability issues and radiofrequency emissions are also expected to restrain market growth to some extent. With favorable government mandates and legislations, North America and Europe are expected to witness significant growth in the smart electric meter market.

Impact of COVID-19 Pandemic on Global Smart Electric Meter Market

The COVID-19 pandemic had a negative impact on the global smart electric meter market. During COVID-19, as of May 2020, 212 countries had been impacted by the pandemic, and the governments of these countries had ordered nationwide lockdowns which disrupted the supply chain operation of several industries. As a result, there was a considerable decline in transportation and related activities which in turn impacted or delayed the raw material used for the smart meter. Hence, the COVID-19 pandemic affected the growth of the global smart electric meter market. However, as the COVID-19 situation normalizes, the globalsmart electric meter market started recovering as industrial operations normalized after the recovery.

Segmental Outlook

The global smart electric meter market is segmented based on application, technology, material, and shape type. Based on the communication technology, the market is sub-segmented power line communication, cellular, and radiofrequency. Based on phase, the market is segmented into a single phase, and three-phase. And, based on the end-user, the market is segmented into residential, commercial, and industrial.

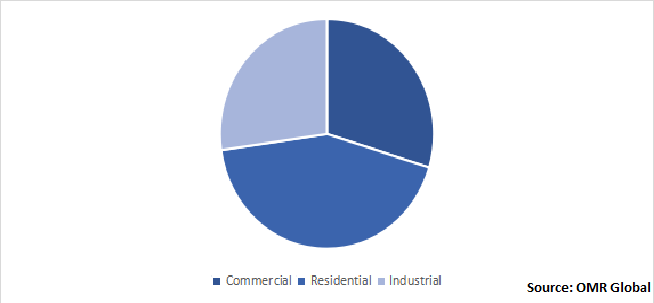

Global Smart Electric Meter Market Share by End-User, 2021 (%)

Residential Hold a Prominent Share in the Global Smart Electric Meter Market.

Based on the end-user, the residential segment is expected to grow at a significant rate during the forecast period. The growth of the segment is attributed to the rising consumer awareness of reducing energy usage is raising the demand for smart meters in the residential sector. Additionally, the installation of smart electric meters in residential places assists in reducing the dependence on fossil fuels as well as the smart electric meters can assist the consumers in monitoring, regularising, and reducing their consumption from the grid, and generators along with further integrating their consumption from renewable energy sources such as solar installations.

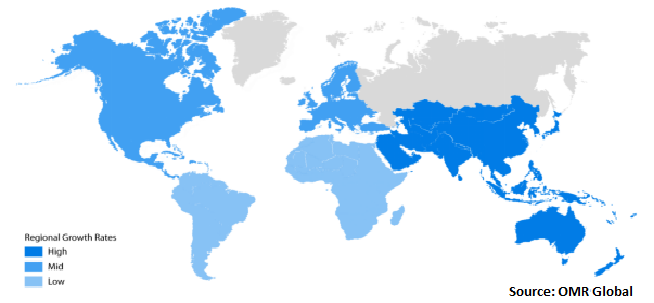

Regional Outlook

The global smart electric meter market is further segmented based on geography including North America (the US, and Canada), Europe (UK, Germany, Italy, Spain, France, and Others), Asia-Pacific (India, China, Japan, South Korea, and Others), and the Rest of the World (the Middle East &Africa, and Latin America). Asia-Pacific is anticipated to grow during the forecast period due to increased smart meter rollouts due to government initiatives and policies in growing markets such as countries like China, Japan, and South Korea.

Global Smart Electric Meter MarketGrowth by Region, 2022-2028

Europe Region Holds a Prominent Share in the Global Smart Electric Meter Market.

The Europe region holds a prominent share in the smart electric meter market. The major factor driving the growth of the market due to smart grid projects in the region. For instance, in November 2021, Northern Powergrid, the electricity distribution network operator for the North East, Yorkshire, and northern Lincolnshire in the UK announced to launch of the first-of-its-kind smart-grid program, known as "Microresilience," that uses energy storage systems and innovative communications technology.

Market Players Outlook

The major companies serving the global smart electric meter market include Itron, Inc., Sensus, Sagemcom, and Wasion Group, among others. The market players are considerably contributing to the market growth by the adoption of various strategies including mergers & acquisitions, partnerships, geographical expansion, and collaborations to stay competitive in the market. For instance, in September 2020, Sagemcom partnered with ELLEVIO and its local Partner, ONE Nordic to improve the Swedish electricity system by being one of the first Nordic DSO to start its 2nd generation smart meters large scale rollout. Additionally, Sagemcom developed and certified the new generation of smart meters which are installed in the field by ONE Nordic since June 2020 in the Stockholm area.

The Report Covers

- Market value data analysis of 2021 and forecast to 2028.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global smart electric meter market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1.Report Summary

- Current Industry Analysis and Growth Potential Outlook

- Impact of COVID-19 on the Global Smart Electric Meter Market

- Recovery Scenario of Global Smart Electric Meter Market

1.1.Research Methods and Tools

1.2.Market Breakdown

1.2.1.By Segments

1.2.2.BY Region

2.Market Overview and Insights

2.1.Scope of the Report

2.2.Analyst Insight & Current Market Trends

2.2.1.Key Findings

2.2.2.Recommendations

2.2.3.Conclusion

3.Competitive Landscape

3.1.Key Company Analysis

3.2.Key Strategy Analysis

3.3.Impact of Covid-19 on Key Players

4.Market Segmentation

4.1.Global Smart Electric Meter Market by Communication Technology

4.1.1.Power Line Communication

4.1.2.Cellular

4.1.3.Radio Frequency

4.2.Global Smart Electric Meter Market by Phase

4.2.1.Single Phase

4.2.2.Three Phase

4.3.Global Smart Electric Meter Market by End-User

4.3.1.Residential

4.3.2.Commercial

4.3.3.Industrial

5.Regional Analysis

5.1.North America

5.1.1.United States

5.1.2.Canada

5.2.Europe

5.2.1.UK

5.2.2.Germany

5.2.3.Italy

5.2.4.Spain

5.2.5.France

5.2.6.Rest of Europe

5.3.Asia-Pacific

5.3.1.China

5.3.2.India

5.3.3.Japan

5.3.4.South Korea

5.3.5.Rest of Asia-Pacific

5.4.Rest of the World

6.Company Profiles

6.1.Aclara Technologies LLC

6.2.ELSTER GROUP SE

6.3.GE Grid Solutions

6.4.HOLLEY METERING

6.5.Iskraemeco, d.d.

6.6.Itron

6.7.KAMSTRUP

6.8.LANDIS+GYR

6.9.NuriFlex

6.10.SAGEMCOM

6.11.SCHNEIDER ELECTRIC SE

6.12.SENSUS

6.13.SIEMENS ENERGY

6.14.S&T AG

6.15.Tantalus Systems Holding Inc

6.16.TOSHIBA CORP

6.17.Trilliant Holdings, Inc.

6.18.WASION GROUP

6.19.ZIV Automation

1.GLOBAL ELECTROCARDIOGRAPH ECG MARKET RESEARCH AND ANALYSIS BY COMMUNICATION TECHNOLOGY, 2021-2028 ($ MILLION)

2.GLOBAL SMART ELECTRIC METER BY POWER LINE COMMUNICATION MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

3.GLOBAL SMART ELECTRIC METER BY CELLULAR MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

4.GLOBAL SMART ELECTRIC METER BY RADIO FREQUENCY MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

5.GLOBAL SMART ELECTRIC METER MARKET RESEARCH AND ANALYSIS BY PHASE, 2021-2028 ($ MILLION)

6.GLOBAL SINGLE PHASE SMART ELECTRIC METER MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

7.GLOBAL THREE PHASE SMART ELECTRIC METER MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

8.GLOBAL SMART ELECTRIC METER MARKET RESEARCH AND ANALYSIS BY END-USER, 2021-2028 ($ MILLION)

9.GLOBALCOMMERCIAL SMART ELECTRIC METER MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

10.GLOBAL RESIDENTIAL SMART ELECTRIC METER MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

11.GLOBAL INDUSTRIAL SMART ELECTRIC METER MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

12.GLOBAL SMART ELECTRIC METER MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2021-2028 ($ MILLION)

13.NORTH AMERICAN SMART ELECTRIC METER MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

14.NORTH AMERICAN SMART ELECTRIC METER MARKET RESEARCH AND ANALYSIS BY OMMUNICATION TECHNOLOGY, 2021-2028 ($ MILLION)

15.NORTH AMERICAN SMART ELECTRIC METER MARKET RESEARCH AND ANALYSIS BY PHASE, 2021-2028 ($ MILLION)

16.NORTH AMERICAN SMART ELECTRIC METER MARKET RESEARCH AND ANALYSIS BY END-USER, 2021-2028 ($ MILLION)

17.EUROPEAN SMART ELECTRIC METER MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

18.EUROPEAN SMART ELECTRIC METER MARKET RESEARCH AND ANALYSIS BY COMMUNICATION TECHNOLOGY, 2021-2028 ($ MILLION)

19.EUROPEAN SMART ELECTRIC METER MARKET RESEARCH AND ANALYSIS BY PHASE, 2021-2028 ($ MILLION)

20.EUROPEAN SMART ELECTRIC METER MARKET RESEARCH AND ANALYSIS BY END-USER, 2021-2028 ($ MILLION)

21.ASIA-PACIFIC SMART ELECTRIC METER MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

22.ASIA-PACIFIC SMART ELECTRIC METER MARKET RESEARCH AND ANALYSIS BY COMMUNICATION TECHNOLOGY, 2021-2028 ($ MILLION)

23.ASIA-PACIFIC SMART ELECTRIC METER MARKET RESEARCH AND ANALYSIS BY PHASE, 2021-2028 ($ MILLION)

24.ASIA-PACIFIC SMART ELECTRIC METER MARKET RESEARCH AND ANALYSIS BY END-USER, 2021-2028 ($ MILLION)

25.REST OF THE WORLD SMART ELECTRIC METER MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

26.REST OF THE WORLD SMART ELECTRIC METER MARKET RESEARCH AND ANALYSIS BY COMMUNICATION TECHNOLOGY, 2021-2028 ($ MILLION)

27.REST OF THE WORLD SMART ELECTRIC METER MARKET RESEARCH AND ANALYSIS BY PHASE, 2021-2028 ($ MILLION)

28.REST OF THE WORLD SMART ELECTRIC METER MARKET RESEARCH AND ANALYSIS BY END-USER, 2021-2028 ($ MILLION)

1.IMPACT OF COVID-19 ON GLOBAL SMART ELECTRIC METER MARKET, 2021-2028 ($ MILLION)

2.IMPACT OF COVID-19 ON GLOBAL SMART ELECTRIC METER MARKET BY SEGMENT, 2021-2028 ($ MILLION)

3.RECOVERY OF GLOBAL SMART ELECTRIC METER MARKET, 2022-2028 (%)

4.GLOBAL SMART ELECTRIC METER MARKET SHARE BYCOMMUNICATION TECHNOLOGY, 2021 VS 2028 (%)

5.GLOBAL SMART ELECTRIC METER BY POWER LINE COMMUNICATION MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

6.GLOBAL SMART ELECTRIC METER BY CELLULAR MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

7.GLOBAL SMART ELECTRIC METER BY RADIO FREQUENCY MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

8.GLOBAL SMART ELECTRIC METER MARKET SHARE BY PHASE, 2021 VS 2028 (%)

9.GLOBAL SINGLE PHASE SMART METER MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

10.GLOBAL THREE PHASESMART ELECTRIC METER MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

11.GLOBAL SMART ELECTRIC METER MARKET SHARE BY END-USER, 2021 VS 2028 (%)

12.GLOBAL COMMERCIAL SMART ELECTRIC METER MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

13.GLOBALRESIDENTIAL SMART ELECTRIC METER MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

14.GLOBALINDUSTRIAL SMART ELECTRIC METER MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

15.GLOBAL SMART ELECTRIC METER MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

16.US SMART ELECTRIC METER MARKET SIZE, 2021-2028 ($ MILLION)

17.CANADA SMART ELECTRIC METER MARKET SIZE, 2021-2028 ($ MILLION)

18.UKSMART ELECTRIC METER MARKET SIZE, 2021-2028 ($ MILLION)

19.FRANCE SMART ELECTRIC METER MARKET SIZE, 2021-2028 ($ MILLION)

20.GERMANY SMART ELECTRIC METER MARKET SIZE, 2021-2028 ($ MILLION)

21.ITALY SMART ELECTRIC METER MARKET SIZE, 2021-2028 ($ MILLION)

22.SPAIN SMART ELECTRIC METER MARKET SIZE, 2021-2028 ($ MILLION)

23.REST OF EUROPE SMART ELECTRIC METER MARKET SIZE, 2021-2028 ($ MILLION)

24.INDIA SMART ELECTRIC METER MARKET SIZE, 2021-2028 ($ MILLION)

25.CHINA SMART ELECTRIC METER MARKET SIZE, 2021-2028 ($ MILLION)

26.JAPAN SMART ELECTRIC METER MARKET SIZE, 2021-2028 ($ MILLION)

27.SOUTH KOREA SMART ELECTRIC METER MARKET SIZE, 2021-2028 ($ MILLION)

28.REST OF ASIA-PACIFIC SMART ELECTRIC METER MARKET SIZE, 2021-2028 ($ MILLION)

29.REST OF THE WORLD SMART ELECTRIC METER MARKET SIZE, 2021-2028 ($ MILLION)