Smart Healthcare Market

Smart Healthcare Market Size, Share & Trends Analysis Report by Product Type (Electronic Health Records (EHR) Systems, Telemedicine and Remote Monitoring Devices, M-Health, Healthcare Analytics and AI Solutions, Hospital Information Systems (HIS), Smart Hospital Infrastructure, and Others) and by End-User (Hospitals and Clinics, Healthcare Payers and Insurers, Pharmaceutical and Life Sciences Companies, Government Agencies and Regulatory Bodies, and Others), Forecast Period (2024-2031)

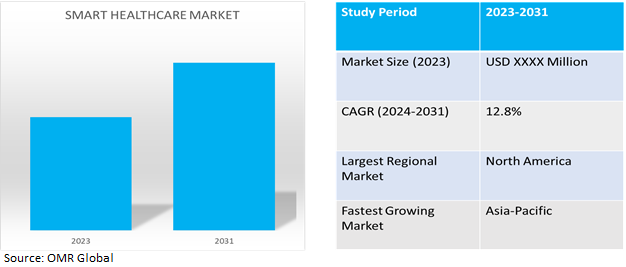

Smart healthcare market is anticipated to grow at a significant CAGR of 12.8% during the forecast period (2024-2031). Rising healthcare costs, aging populations, and chronic disease burdens influence the global smart healthcare market. Smart healthcare technologies like telemedicine, remote patient monitoring, and predictive analytics help optimize resource utilization and reduce healthcare expenditures. The aging population and chronic diseases also demand proactive disease management and personalized care delivery. Advancements in information technology, such as AI, IoT, big data analytics, and cloud computing, enable real-time data analysis and personalized treatment recommendations. The growing demand for remote monitoring and telehealth services, particularly during the COVID-19, drives the adoption of smart healthcare solutions.

Market Dynamics

Increased Adoption Of Telehealth And Telemedicine

The aging population's increasing need for healthcare services has been addressed through telehealth and telemedicine services, which allow for rapid medical advice and remote access to medical professionals. According to the World Health Organization (WHO), in October 2022, the global population is undergoing a significant demographic shift, with the proportion of individuals aged 60 years and older expected to nearly double from 12.0% to 22.0% between 2015 and 2050. By 2030, approximately 1 in 6 individuals globally be aged 60 years or over, and by 2050, the population of individuals aged 60 years and older is projected to reach 2.1 billion. Additionally, the number of persons aged 80 years or older is anticipated to triple, reaching 426 million by 2050.

Growing Integration Of AI Into Smart Healthcare Solutions

AI integration in smart healthcare solutions improves diagnostics, personalized medicine, predictive analytics, and decision support systems by analyzing large healthcare data volumes, enhancing patient outcomes and healthcare delivery efficiency. According to the organization International Business Machines (IBM), in July 2023, the AI healthcare market, which had a value of $11.0 billion in 2021, is expected to reach a staggering $187.0 billion by 2030. This significant growth will likely drive significant transformations in the healthcare industry, impacting medical providers, hospitals, pharmaceutical and biotechnology companies, and other stakeholders. Factors such as improved machine learning algorithms, increased data accessibility, affordable hardware, and the advent of 5G technology have all contributed to the widespread adoption of AI in healthcare, resulting in a faster analysis of vast amounts of health data.

Market Segmentation

Our in-depth analysis of the global Smart Healthcare market includes the following segments by product type, and end-user:

- Based on product type, the market is sub-segmented into electronic health records (EHR) systems, telemedicine and remote monitoring devices, m-health, healthcare analytics and AI solutions, hospital information systems (HIS), smart hospital infrastructure, and others (biometric identification and authentication solutions).

- Based on end-user, the market is sub-segmented into hospitals and clinics, healthcare payers and insurers, pharmaceutical and life sciences companies, government agencies and regulatory bodies, and others (research institutions and academic centers).

Electronic Health Records (EHR) Systems is Projected to Emerge as the Largest Segment

Based on the application, the global smart healthcare market is sub-segmented into network security, network optimization, customer analytics, virtual assistance, self-diagnostics, and others. Among these, the electronic health records (EHR) systems sub-segment is expected to hold the largest share of the market. The primary factor supporting the segment's growth includes government initiatives to promote digital health record adoption, improving healthcare delivery, patient outcomes, and system efficiency by providing financial incentives to healthcare facilities and providers. According to the Healthcare IT, in Janurary 2023, the National Health Authority of India introduced a program to support the development of digital health records within the country's healthcare system. Incentives, totaling up to $500,000, are offered to healthcare facilities, diagnostic centers, and digital solution providers, based on the number of digital health records created and linked to the Ayushman Bharat Health Account.

Hospitals and Clinics Sub-segment to Hold a Considerable Market Share

By eliminating the growing need for smart healthcare solutions, the acquisition expands the company's global reach to imaging centers, hospitals, specialist clinics, and research organizations.

For instance, in January 2024, GE HealthCare acquired MIM Software, a global provider of medical imaging analysis and artificial intelligence solutions for diagnostic imaging and urology at imaging centers, hospitals, specialty clinics, and research organizations globally. The acquisition aims to accelerate innovation and differentiate its solutions for patients and healthcare systems worldwide. MIM Software's imaging analytics and digital workflow capabilities include integrating diagnostic images into treatment plans, automation, quantitation, and a platform for Theranostics imaging and dosimetry.

Regional Outlook

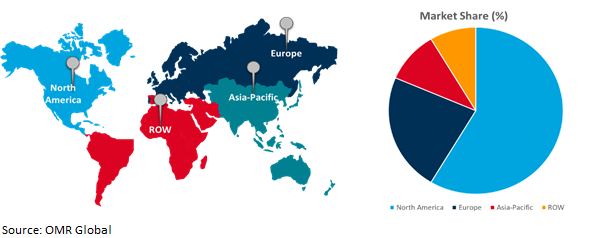

The global smart healthcare market is further segmented based on geography including North America (the US, and Canada), Europe (UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia-Pacific), and the Rest of the World (the Middle East & Africa, and Latin America).

Growing Healthcare Costs and Excessive Expenditure In Aisa-Pacific Region

The rising healthcare costs and wasteful spending highlight the need for efficient, cost-effective delivery models, with digital health technologies such as telemedicine and health analytics enhancing resource utilization and reducing administrative overhead. According to the World Economic Forum, January 2024, the digital transformation of healthcare has gained momentum in recent years owing to the need to address global challenges in the healthcare sector. These challenges include the rising costs of healthcare, an estimated $1.8 trillion of wasteful spending, a projected shortage of over 10 million healthcare workers by 2030, an increasing burden of chronic diseases, and disparities in access to care and outcomes between and within countries.

Global Smart Healthcare Market Growth by Region 2024-2031

North America Holds Major Market Share

Telehealth technologies are gaining popularity globally, with patients increasingly opting for virtual care, leading to a growing demand for smart healthcare solutions. According to the American Medical Association, in November 2023, during the past year, the utilization of telehealth services has risen significantly, with approximately 25.0% of patients opting for virtual care. This marks a notable increase from the pre-pandemic rate of 5.0%. The American Heart Association (AHA) Center for Telehealth, aims to address gaps in healthcare access by providing comprehensive telehealth education and resources. With telehealth utilization rising by 400.0%, it is estimated that up to $250.0 billion of healthcare spending shifted to virtual care, offering potential benefits for patients and providers alike. Furthermore, recent data from FAIR Health reveals that hypertension accounts for 14.0% of asynchronous telehealth diagnoses.

Market Players Outlook

*Note: Major Players Sorted in No Particular Order.

The major companies serving the global smart healthcare market include Cerner Corp., Cisco Systems, Inc., GE HealthCare Technologies Inc., Medtronic Plc., and Siemens Healthineers AG, among others. The market players are increasingly focusing on business expansion and product development by applying strategies such as collaborations, mergers, and acquisitions to stay competitive in the market. for instance, in February 2024, Virtua Health Launched AI Healthcare and Partnered With Care.ai. A pilot Virtual Nurse program in a medical-surgical unit enables bedside and remote nurses to work together, allowing secure communication and offsite patient family participation.

The Report Covers

- Market value data analysis of 2023 and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global smart healthcare market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. Cerner Corp.

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. Cisco Systems, Inc.

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. GE HealthCare Technologies Inc.

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Key Strategy Analysis

4. Market Segmentation

4.1. Global Smart Healthcare Market by Product Type

4.1.1. Electronic Health Records (EHR) Systems

4.1.2. Telemedicine and Remote Monitoring Devices

4.1.3. M-Health

4.1.4. Healthcare Analytics and AI Solutions

4.1.5. Hospital Information Systems (HIS)

4.1.6. Smart Hospital Infrastructure

4.1.7. Others (Biometric Identification and Authentication Solutions)

4.2. Global Smart Healthcare Market by End User

4.2.1. Hospitals and Clinics

4.2.2. Medical Billing Companies

4.2.3. Healthcare Payers

4.2.4. Government Healthcare Agencies

4.2.5. Others (Academic Medical Centers and Research Institutions)

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

5.4.1. Latin America

5.4.2. Middle East & Africa

6. Company Profiles

6.1. Adolf Würth GmbH & Co. KG

6.2. AIRSTRIP TECHNOLOGIES, INC.

6.3. Apple Inc.

6.4. AT&T Inc.

6.5. Bollhoff Group

6.6. Brooks Automation, Inc.

6.7. F. Hoffmann-La Roche Ltd

6.8. Hurst Green Plastics Ltd.

6.9. IBM Corp.

6.10. McKesson Corp.

6.11. Medtronic Plc

6.12. Olympus Corp.

6.13. Pepperl+Fuchs

6.14. Samsung Electronics Co., Ltd.

6.15. SAP SE

6.16. Siemens Healthineers AG

6.17. Solaire Medical, LLC

6.18. Veradigm LLC

1. GLOBAL SMART HEALTHCARE MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2023-2031 ($ MILLION)

2. GLOBAL ELECTRONIC HEALTH RECORDS SMART HEALTHCARE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

3. GLOBAL TELEMEDICINE AND REMOTE MONITORING DEVICES SMART HEALTHCARE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

4. GLOBAL M-HEALTH SMART HEALTHCARE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

5. GLOBAL HEALTHCARE ANALYTICS AND AI SOLUTIONS SMART HEALTHCARE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

6. GLOBAL HOSPITAL INFORMATION SYSTEMS SMART HEALTHCARE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

7. GLOBAL SMART HOSPITAL INFRASTRUCTURE SMART HEALTHCARE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

8. GLOBAL OTHER PRODUCT TYPE SMART HEALTHCARE MARKET SERVICES RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

9. GLOBAL SMART HEALTHCARE MARKET RESEARCH AND ANALYSIS BY END USER, 2023-2031 ($ MILLION)

10. GLOBAL SMART HEALTHCARE IN HOSPITALS AND CLINICS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

11. GLOBAL SMART HEALTHCARE IN HEALTHCARE PAYERS AND INSURERS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

12. GLOBAL SMART HEALTHCARE IN PHARMACEUTICAL AND LIFE SCIENCES COMPANIES MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

13. GLOBAL SMART HEALTHCARE IN GOVERNMENT AGENCIES AND REGULATORY BODIES MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

14. GLOBAL SMART HEALTHCARE IN OTHER END-USER MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

15. GLOBAL SMART HEALTHCARE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

16. NORTH AMERICAN SMART HEALTHCARE MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

17. NORTH AMERICAN SMART HEALTHCARE MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2023-2031 ($ MILLION)

18. NORTH AMERICAN SMART HEALTHCARE MARKET RESEARCH AND ANALYSIS BY END USER, 2023-2031 ($ MILLION)

19. EUROPEAN SMART HEALTHCARE MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

20. EUROPEAN SMART HEALTHCARE MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2023-2031 ($ MILLION)

21. EUROPEAN SMART HEALTHCARE MARKET RESEARCH AND ANALYSIS BY END USER, 2023-2031 ($ MILLION)

22. ASIA-PACIFIC SMART HEALTHCARE MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

23. ASIA-PACIFIC SMART HEALTHCARE MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2023-2031 ($ MILLION)

24. ASIA-PACIFIC SMART HEALTHCARE MARKET RESEARCH AND ANALYSIS BY END USER, 2023-2031 ($ MILLION)

25. REST OF THE WORLD SMART HEALTHCARE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

26. REST OF THE WORLD SMART HEALTHCARE MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2023-2031 ($ MILLION)

27. REST OF THE WORLD SMART HEALTHCARE MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

28. REST OF THE WORLD SMART HEALTHCARE MARKET RESEARCH AND ANALYSIS BY END USER, 2023-2031 ($ MILLION)

1. GLOBAL SMART HEALTHCARE MARKET SHARE BY PRODUCT TYPE, 2023 VS 2031 (%)

2. GLOBAL ELECTRONIC HEALTH RECORDS SMART HEALTHCARE MARKET SHARE BY REGION, 2023 VS 2031 (%)

3. GLOBAL TELEMEDICINE AND REMOTE MONITORING DEVICES SMART HEALTHCARE MARKET SERVICES SHARE BY REGION, 2023 VS 2031 (%)

4. GLOBAL M-HEALTH SMART HEALTHCARE MARKET SERVICES SHARE BY REGION, 2023 VS 2031 (%)

5. GLOBAL HEALTHCARE ANALYTICS AND AI SOLUTIONS SMART HEALTHCARE MARKET SERVICES SHARE BY REGION, 2023 VS 2031 (%)

6. GLOBAL HOSPITAL INFORMATION SYSTEMS SMART HEALTHCARE MARKET SERVICES SHARE BY REGION, 2023 VS 2031 (%)

7. GLOBAL SMART HOSPITAL INFRASTRUCTURE SMART HEALTHCARE MARKET SERVICES SHARE BY REGION, 2023 VS 2031 (%)

8. GLOBAL OTHER TYPE SMART HEALTHCARE MARKET SERVICES SHARE BY REGION, 2023 VS 2031 (%)

9. GLOBAL SMART HEALTHCARE MARKET SHARE BY END-USER, 2023 VS 2031 (%)

10. GLOBAL SMART HEALTHCARE IN HOSPITALS AND CLINICS MARKET SHARE BY REGION, 2023 VS 2031 (%)

11. GLOBAL SMART HEALTHCARE IN HEALTHCARE PAYERS AND INSURERS MARKET SHARE BY REGION, 2023 VS 2031 (%)

12. GLOBAL SMART HEALTHCARE IN PHARMACEUTICAL AND LIFE SCIENCES COMPANIES MARKET SHARE BY REGION, 2023 VS 2031 (%)

13. GLOBAL SMART HEALTHCARE IN GOVERNMENT AGENCIES AND REGULATORY BODIES MARKET SHARE BY REGION, 2023 VS 2031 (%)

14. GLOBAL SMART HEALTHCARE IN OTHER END-USER MARKET SHARE BY REGION, 2023 VS 2031 (%)

15. GLOBAL SMART HEALTHCARE MARKET SHARE BY REGION, 2023 VS 2031 (%)

16. US SMART HEALTHCARE MARKET SIZE, 2023-2031 ($ MILLION)

17. CANADA SMART HEALTHCARE MARKET SIZE, 2023-2031 ($ MILLION)

18. UK SMART HEALTHCARE MARKET SIZE, 2023-2031 ($ MILLION)

19. FRANCE SMART HEALTHCARE MARKET SIZE, 2023-2031 ($ MILLION)

20. GERMANY SMART HEALTHCARE MARKET SIZE, 2023-2031 ($ MILLION)

21. ITALY SMART HEALTHCARE MARKET SIZE, 2023-2031 ($ MILLION)

22. SPAIN SMART HEALTHCARE MARKET SIZE, 2023-2031 ($ MILLION)

23. REST OF EUROPE SMART HEALTHCARE MARKET SIZE, 2023-2031 ($ MILLION)

24. INDIA SMART HEALTHCARE MARKET SIZE, 2023-2031 ($ MILLION)

25. CHINA SMART HEALTHCARE MARKET SIZE, 2023-2031 ($ MILLION)

26. JAPAN SMART HEALTHCARE MARKET SIZE, 2023-2031 ($ MILLION)

27. SOUTH KOREA SMART HEALTHCARE MARKET SIZE, 2023-2031 ($ MILLION)

28. REST OF ASIA-PACIFIC SMART HEALTHCARE MARKET SIZE, 2023-2031 ($ MILLION)

29. LATIN AMERICA SMART HEALTHCARE MARKET SIZE, 2023-2031 ($ MILLION)

30. MIDDLE EAST AND AFRICA SMART HEALTHCARE MARKET SIZE, 2023-2031 ($ MILLION)