Smart Implants Market

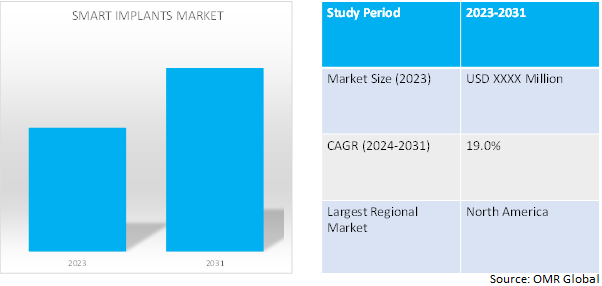

Smart Implants Market Size, Share & Trends Analysis Report by Product Type (Orthopedic Smart Implants, Cardiovascular Smart Implants, Ophthalmic Smart Implants, Dental Smart Implants, Cosmetic Smart Implants, and Others), by Surgery (Open and Minimally Invasive), and by End-User (Hospital, Ambulatory Surgical Centers, Orthopedic Clinics, Ophthalmic Clinics, Dental Labs, and Others) Forecast Period (2024-2031) Update Available - Forecast 2025-2035

Smart implants market is anticipated to grow at a CAGR of 19.0% during the forecast period (2024-2031). Smart implants refer to a sophisticated medical device that is surgically placed inside the body during medical procedures. It is equipped with advanced sensors, electronic components, and connectivity features. These implants are designed to monitor physiological parameters, deliver targeted therapies, and provide real-time data to healthcare professionals.

Market Dynamics

Increased Adoption of Technologies to Drive the Market Growth

Emerging technologies such as cloud computing, artificial intelligence, machine learning, blockchain technology, and virtual reality have changed conventional implant strategies and entered clinical practice. Furthermore, the increasing usage of smart sensor technologies to ease the procedure of post-operative measures is positively boosting the global smart implant market. Implant integrates advancements in nanogenerators and metamaterials into the fabric of medical implants, this technical innovation is playing a significant role in the growth of the smart implant market. For instance, in June 2021, Orthofix Medical Inc., a US-based medical device company and provider of spinal, orthopedic, bone growth, and motion preservation products, announced the U.S. launch and the first patient implant of its 3D-printed FORZA Titanium (Ti) Posterior Lumbar Interbody Fusion (PLIF) Spacer System with Nanovate technology. This innovative system is designed for PLIF procedures, which are used to treat degenerative disc disease, spondylolisthesis, and other spinal conditions.

Increasing Adoption of Personalized & Pervasive Healthcare to boost the demand

Globally, a healthcare paradigm shift has been observed from conventional treatment models to proactive & patient-centric models in which patient has the choice to manage & monitor their health themselves, using pervasive healthcare solutions. Further, the integrated personalized tools & solutions enable optimum treatment & monitoring choices by the healthcare professionals to strengthen the implant services to extract the desired outcomes such as disease management, diagnosis, treatment, remote disease monitoring, and progression along with the drug adherence solutions. Therefore, the constantly evolving personalized & pervasive healthcare is expected to open various new horizons for the adoption of smart implants across the globe.

Market Segmentation

Our in-depth analysis of the global smart implants market includes the following segments by product type, surgery, and application:

- Based on Product Type, the market is sub-segmented into knee & hip arthroplasty, spine fusion, intraocular lens, and pacing devices.

- Based on Surgery, the market is bifurcated into open and minimally invasive.

- Based on Application, the market is augmented into orthopedic, cardiovascular, ophthalmic, and dental.

Spine Fusion to Emerge as the Largest Segment

The growth in the forecast period can be attributed to advancements in spine surgery technologies, the increasing elderly population, changes in lifestyles, faster economic growth, and increasing reimbursement for spine implants. The rising incidences of spinal disorders are contributing to the growth of the global spine implants market. According to Branko PRPA, in September 2021, annually there are 1.34 to 4.6 spinal cases per million and 1,400 new cases diagnosed each year, with 33,000 having some type of disability in the US and among them, 30% of the adult female population suffers from lower back pain, compared to 25 percent of the adult male adult population and this is approximately 31% of men acknowledged that their condition affects their employment compared to 20% of women. In 2021, the prevalence of neuropathic pain was found to be between 16% and 55%. Therefore, the increased prevalence of spinal disorders along with the ease in treatment by Minimally Invasive Spine Surgical (MISS) approaches is driving the global spinal implants market.

Cardiovascular to Hold a Considerable Market Share

Based on the Application, the global smart implants market is sub-segmented into orthopedic, cardiovascular, ophthalmic, and dental. Among these, the cardiovascular sub-segment is expected to hold the largest share of the market. The primary factor supporting the segment's growth includes the high prevalence of cardiovascular diseases, advancements in cardiac implant technology, demand for personalized medicine, and the aging population with strokes.

Additionally, conditions such as coronary artery disease, arrhythmias, heart failure, and heart valve disorders require advanced smart implant options to manage and improve patient outcomes, data analytics capabilities to monitor cardiac function, detect abnormalities, and deliver tailored therapies. For instance, in May 2023, Robocath, a company that designs, develops, and commercializes smart robotic solutions for the treatment of cardiovascular diseases, announced the launch of its latest robotic platform - the R-One+.

Regional Outlook

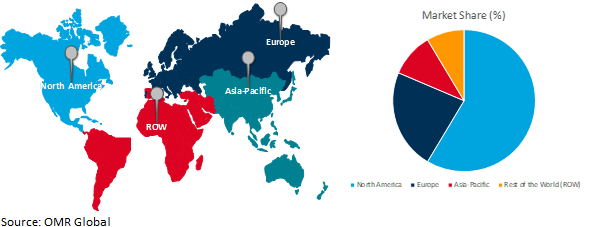

The global smart implants market is further segmented based on geography including North America (the US, and Canada), Europe (UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia), and the Rest of the World (the Middle East & Africa, and Latin America).

European countries to invest in biofuels and biorefineries

- Germany is the key investor and user of healthcare and smart implant-based products around the globe.

- The UK is growing awareness about advanced medical treatments leading to an increase in the implant market overall.

Global Smart Implants Market Growth by Region 2024-2031

North America Holds Major Market Share

Among all the regions, North America holds a significant share owing to the presence of sophisticated healthcare systems with access to advanced medical technologies, facilitating widespread availability and utilization of smart implant procedures and related equipment. An increase in the usage of smart implants for rapid and effective results in the US is among the key factors contributing to the regional market growth.

Additionally, North America has one of the highest healthcare expenditures globally, with significant investments in medical devices, surgical procedures, and innovative treatments. This high level of healthcare spending supports the adoption of smart implants, in the region. Key product launches, the high concentration of market players, and the manufacturer's presence in the US are some of the key factors driving the smart implants market growth in the country. For instance, in June 2021, Medtronic plc received US Food and Drug Administration (FDA) approval for its Vanta device recharge-free Implantable Neurostimulator (INS) with a device life that lasts up to 11 years.

Market Players Outlook

*Note: Major Players Sorted in No Particular Order.

The major companies serving the global smart implants market include Zimmer Biomet Holdings, Inc., NuVasive, Inc., CONMED Corp., Abbott, and Siemens Healthineers, among others. The market players are increasingly focusing on business expansion and product development by applying strategies such as collaborations, mergers, and acquisitions to stay competitive in the market. For instance, in January 2021, Stryker collaborated with OrthoSensor, Inc., to strengthen musculoskeletal care and sensor technology for total joint replacement. The acquisition aided Stryker by improving its portfolio of smart devices and implants which will help to generate the company’s sales.

The Report Covers

- Market value data analysis of 2023 and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global smart implants market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. Abbott

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. CONMED Corp.

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. NuVasive, Inc.

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Zimmer Biomet Holdings, Inc.

3.5.1. Overview

3.5.2. Financial Analysis

3.5.3. SWOT Analysis

3.5.4. Recent Developments

3.6. Key Strategy Analysis

4. Market Segmentation

4.1. Global Smart Implants Market by Product Type

4.1.1. Orthopedic Smart Implants

4.1.1.1. Knee Arthroplasty

4.1.1.2. Hip Arthroplasty

4.1.1.3. Spine Fusion

4.1.1.4. Fracture Fixation

4.1.1.5. Others

4.1.2. Cardiovascular Smart Implants

4.1.2.1. Pacing Devices

4.1.2.2. Stents

4.1.2.3. Structural Cardiac Implants

4.1.3. Ophthalmic Smart Implants

4.1.3.1. Intraocular lens

4.1.3.2. Glaucoma Implants

4.1.4. Dental Smart Implants

4.1.5. Cosmetic Smart Implants

4.1.6. Others

4.2. Global Smart Implants Market by Surgery

4.2.1. Open

4.2.2. Minimally Invasive

4.3. Global Smart Implants Market by End-User

4.3.1. Hospitals

4.3.2. Ambulatory Surgical Centers

4.3.3. Orthopedic Clinics

4.3.4. Ophthalmic Clinics

4.3.5. Dental Labs

4.3.6. Others

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

6. Company Profiles

6.1. ALEVA NEUROTHERAPEUTICS

6.2. BIOTRONIK SE & Co KG

6.3. Boston Scientific Corp.

6.4. Canary Medical Inc.

6.5. Cochlear Ltd.

6.6. Dexcom, Inc.

6.7. Edwards Lifesciences Corp.

6.8. IQ Implants USA

6.9. Medtronic Private Ltd.

6.10. Nevro Corp.

6.11. Rejoint Srl

6.12. Senseonics

6.13. Siemens Healthineers

6.14. Smart Implant Solutions

6.15. Smith & Nephew plc

6.16. Stryker

1. GLOBAL SMART IMPLANTS MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2023-2031 ($ MILLION)

2. GLOBAL ORTHOPEDICS SMART IMPLANTS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

3. GLOBAL CARDIOVASCULAR SMART IMPLANTS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

4. GLOBAL OPHTHALMIC SMART IMPLANTS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

5. GLOBAL DENTAL SMART IMPLANTS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

6. GLOBAL COSMETIC SMART IMPLANTS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

7. GLOBAL OTHER SMART IMPLANTS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

8. GLOBAL SMART IMPLANTS MARKET RESEARCH AND ANALYSIS BY SURGERY, 2023-2031 ($ MILLION)

9. GLOBAL SMART IMPLANTS FOR OPEN SURGERY MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

10. GLOBAL SMART IMPLANTS FOR MINIMALLY INVASIVE SURGERY MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

11. GLOBAL SMART IMPLANTS MARKET RESEARCH AND ANALYSIS BY END-USER, 2023-2031 ($ MILLION)

12. GLOBAL SMART IMPLANTS FOR HOSPITALS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

13. GLOBAL SMART IMPLANTS IN AMBULATORY SURGICAL CENTERS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

14. GLOBAL SMART IMPLANTS IN ORTHOPEDIC CLINICS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

15. GLOBAL SMART IMPLANTS IN OPHTHALMIC CLINICS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

16. GLOBAL SMART IMPLANTS IN DENTAL LABS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

17. GLOBAL SMART IMPLANTS IN OTHER END-USERS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

18. GLOBAL SMART IMPLANTS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

19. NORTH AMERICAN SMART IMPLANTS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

20. NORTH AMERICAN SMART IMPLANTS MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2023-2031 ($ MILLION)

21. NORTH AMERICAN SMART IMPLANTS MARKET RESEARCH AND ANALYSIS BY SURGERY, 2023-2031 ($ MILLION)

22. NORTH AMERICAN SMART IMPLANTS MARKET RESEARCH AND ANALYSIS BY END-USER, 2023-2031 ($ MILLION)

23. EUROPEAN SMART IMPLANTS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

24. EUROPEAN SMART IMPLANTS MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2023-2031 ($ MILLION)

25. EUROPEAN SMART IMPLANTS MARKET RESEARCH AND ANALYSIS BY SURGERY, 2023-2031 ($ MILLION)

26. EUROPEAN SMART IMPLANTS MARKET RESEARCH AND ANALYSIS BY END-USER, 2023-2031 ($ MILLION)

27. ASIA-PACIFIC SMART IMPLANTS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

28. ASIA-PACIFIC SMART IMPLANTS MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2023-2031 ($ MILLION)

29. ASIA-PACIFIC SMART IMPLANTS MARKET RESEARCH AND ANALYSIS BY SURGERY, 2023-2031 ($ MILLION)

30. ASIA-PACIFIC SMART IMPLANTS MARKET RESEARCH AND ANALYSIS BY END-USER, 2023-2031 ($ MILLION)

31. REST OF THE WORLD SMART IMPLANTS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

32. REST OF THE WORLD SMART IMPLANTS MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2023-2031 ($ MILLION)

33. REST OF THE WORLD SMART IMPLANTS MARKET RESEARCH AND ANALYSIS BY SURGERY, 2023-2031 ($ MILLION)

34. REST OF THE WORLD SMART IMPLANTS MARKET RESEARCH AND ANALYSIS BY END-USER, 2023-2031 ($ MILLION)

1. GLOBAL SMART IMPLANTS MARKET SHARE BY PRODUCT TYPE, 2023 VS 2031 (%)

2. GLOBAL ORTHOPEDIC SMART IMPLANTS MARKET SHARE BY REGION, 2023 VS 2031 (%)

3. GLOBAL CARDIVASCULAR SMART IMPLANTS MARKET SHARE BY REGION, 2023 VS 2031 (%)

4. GLOBAL OPHTHALMIC SMART IMPLANTS MARKET SHARE BY REGION, 2023 VS 2031 (%)

5. GLOBAL DENTAL SMART IMPLANTS MARKET SHARE BY REGION, 2023 VS 2031 (%)

6. GLOBAL COSMETIC SMART IMPLANTS MARKET SHARE BY REGION, 2023 VS 2031 (%)

7. GLOBAL OTHER SMART IMPLANTS MARKET SHARE BY REGION, 2023 VS 2031 (%)

8. GLOBAL SMART IMPLANTS MARKET SHARE BY SURGERY, 2023 VS 2031 (%)

9. GLOBAL SMART IMPLANTS FOR OPEN SURGERY MARKET SHARE BY REGION, 2023 VS 2031 (%)

10. GLOBAL SMART IMPLANTS FOR MINIMALLY INVASIVE MARKET SHARE BY REGION, 2023 VS 2031 (%)

11. GLOBAL SMART IMPLANTS MARKET SHARE BY END-USER, 2023 VS 2031 (%)

12. GLOBAL SMART IMPLANTS FOR HOSPITALS MARKET SHARE BY REGION, 2023 VS 2031 (%)

13. GLOBAL SMART IMPLANTS FOR AMBULATORY SURGICAL CENTERS MARKET SHARE BY REGION, 2023 VS 2031 (%)

14. GLOBAL SMART IMPLANTS FOR ORTHOPEDIC CLINICS MARKET SHARE BY REGION, 2023 VS 2031 (%)

15. GLOBAL SMART IMPLANTS FOR ORTHOPEDIC CLINICS MARKET SHARE BY REGION, 2023 VS 2031 (%)

16. GLOBAL SMART IMPLANTS FOR DENTAL LABS MARKET SHARE BY REGION, 2023 VS 2031 (%)

17. GLOBAL SMART IMPLANTS FOR OTHER END-USERS MARKET SHARE BY REGION, 2023 VS 2031 (%)

18. GLOBAL SMART IMPLANTS MARKET SHARE BY REGION, 2023 VS 2031 (%)

19. US SMART IMPLANTS MARKET SIZE, 2023-2031 ($ MILLION)

20. CANADA SMART IMPLANTS MARKET SIZE, 2023-2031 ($ MILLION)

21. UK SMART IMPLANTS MARKET SIZE, 2023-2031 ($ MILLION)

22. FRANCE SMART IMPLANTS MARKET SIZE, 2023-2031 ($ MILLION)

23. GERMANY SMART IMPLANTS MARKET SIZE, 2023-2031 ($ MILLION)

24. ITALY SMART IMPLANTS MARKET SIZE, 2023-2031 ($ MILLION)

25. SPAIN SMART IMPLANTS MARKET SIZE, 2023-2031 ($ MILLION)

26. REST OF EUROPE SMART IMPLANTS MARKET SIZE, 2023-2031 ($ MILLION)

27. INDIA SMART IMPLANTS MARKET SIZE, 2023-2031 ($ MILLION)

28. CHINA SMART IMPLANTS MARKET SIZE, 2023-2031 ($ MILLION)

29. JAPAN SMART IMPLANTS MARKET SIZE, 2023-2031 ($ MILLION)

30. SOUTH KOREA SMART IMPLANTS MARKET SIZE, 2023-2031 ($ MILLION)

31. REST OF ASIA-PACIFIC SMART IMPLANTS MARKET SIZE, 2023-2031 ($ MILLION)

32. LATIN AMERICA SMART IMPLANTS MARKET SIZE, 2023-2031 ($ MILLION)

33. THE MIDDLE EAST AND AFRICA SMART IMPLANTS MARKET SIZE, 2023-2031 ($ MILLION)