Smart Insulin Pens Market

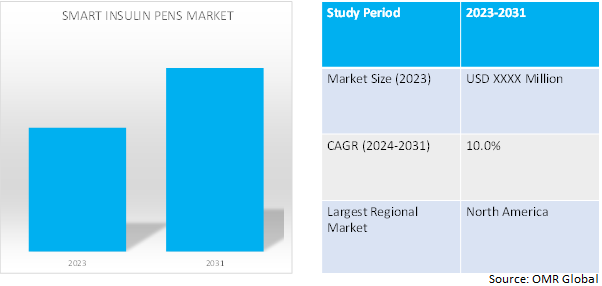

Smart Insulin Pens Market Size, Share & Trends Analysis Report by Connectivity Type (Bluetooth and NFC (Near-Field Communication)), by Indication (Type 1 Diabetes and Type 2 Diabetes), and by Distribution Channel (Hospital Pharmacy, Retail Pharmacy, and E-Commerce) Forecast Period (2024-2031) Update Available - Forecast 2025-2035

Smart insulin pens market is anticipated to grow at a CAGR of 10.0% during the forecast period (2024-2031). Smart insulin pens calculate and track doses and provide helpful reminders, alerts, and reports which come in the form of an add-on to the current insulin pen or a reusable form, which uses prefilled cartridges instead of vials or disposable pens.

Market Dynamics

The rising prevalence of diabetes boosts the demand for smart insulin pens

The persistent rise in the prevalence of diabetes globally has become a significant catalyst for the growth of the market. Diabetes, a chronic condition characterized by elevated blood sugar levels, has experienced a surge in incidence, attributed to sedentary lifestyles, poor dietary choices, and the aging demographic trend. For instance, according to the International Diabetes Federation (IDF) Diabetes Atlas, in 2021, 537 million adults aged 20-79 years were estimated to be living with diabetes around the globe. This number is predicted to reach to 643 million by 2030 and 783 million by 2045.

Integration of technology in healthcare driving the market growth

Globally, the evolution of smart insulin pens has been driven by the integration of digital technology into healthcare. Modern smart insulin pens can connect to mobile apps via Bluetooth and NFC, allowing for the automatic recording and tracking of dosing information. The industry has grown dramatically as a result of technological improvements, especially the integration of Continuous Glucose Monitoring (CGM) systems with smart insulin pens. By supplying real-time glucose level data, this connection enables users to make more educated decisions about insulin dosing. Smart insulin pens and CGM work together to improve accuracy and optimize diabetes management, which is why patients and healthcare providers are finding these technologies more and more appealing. Furthermore, the addition of mobile applications and Bluetooth connectivity to smart insulin pens has completely changed the landscape of diabetes care products. For instance, in November 2020, Medtronic plc announced the launch of InPen integrated with real-time Guardian Connect CGM data. This integrated system now provides real-time glucose readings alongside insulin dose information giving users everything they need to manage their diabetes in one view.

Market Segmentation

Our in-depth analysis of the global smart insulin pens market includes the following segments by type, product, and technology:

- Based on connectivity type, the market is sub-segmented into Bluetooth and NFC.

- Based on indication, the market is bifurcated into Type 1 diabetes and Type 2 diabetes.

- Based on the distribution channel, the market is augmented into hospital pharmacy, retail pharmacy, and e-commerce.

Type 1 Diabetes is Projected to Emerge as the Largest Segment

Based on the indication, the global smart insulin pens market is sub-segmented into Type 1 diabetes and Type 2 diabetes. Among these, the Type 1 diabetes sub-segment is expected to hold the largest share of the market. The primary factor supporting the segment's growth includes the features that it provides such as dose memory, reminders, and connectivity with digital platforms, ensuring accurate dosing and facilitating better adherence to treatment plans. The integration of smart insulin pens with CGM systems adds an extra layer of efficiency and convenience for individuals with Type 1 diabetes. This integration allows seamless coordination between insulin dosing and real-time glucose data, reinforcing the dominant position of smart insulin pens in addressing the complex needs of Type 1 diabetic patients.

Hospital Pharmacy Sub-segment to Hold a Considerable Market Share

Hospitals often serve as key distribution points for advanced medical devices, including smart insulin pens. Formulary inclusions within hospital settings, driven by the need for efficient and precise insulin delivery, contribute significantly to the dominant market share of smart insulin pens in the hospital pharmacy channel. Moreover, hospital pharmacies often operate under centralized procurement practices, streamlining the acquisition of medical devices for the entire institution. Smart insulin pens, known for their technological advancements and precision in insulin delivery, fit well within such procurement frameworks. The centralized nature of hospital pharmacies facilitates efficient distribution and contributes to the dominant market share of smart insulin pens in this channel. Rising investments in the hospital pharmacy sector have increased the production of smart insulin pens.

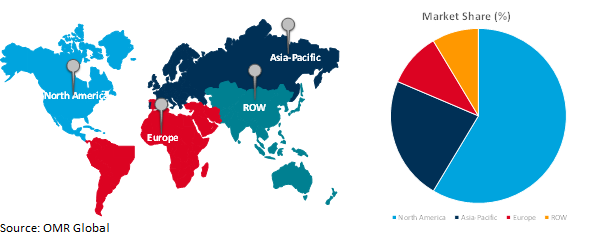

Regional Outlook

The global smart insulin pens market is further segmented based on geography including North America (the US, and Canada), Europe (UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia), and the Rest of the World (the Middle East & Africa, and Latin America).

European countries to invest in the smart insulin pens market

- Germany is the key investor in innovative products in the market with a primary focus on expanding their presence in the country.

- The rising prevalence of diabetes patients and technological advancement in the healthcare sector are key factors speeding growth and investment in the UK market.

Global Smart Insulin Pens Market Growth by Region 2024-2031

North America Holds Major Market Share

Among all the regions, North America holds a significant share owing to the presence of rising demand for insulin pens. North America region is characterized by a widespread reliance on insulin for effective diabetes management in the region. The prevalence of both Type 1 and Type 2 diabetes has led to a substantial population relying on insulin therapy. According to an article published by the University of South Carolina, in March 2023, insulin is as essential as water for many people with diabetes. Of the more than 30 million Americans with diabetes, approximately 7.4 million rely on insulin to manage their condition. This is owing to its accurate dosage control, practical features, and digital platform integration. Smart insulin pens have become essential in helping North America's increasing demand for insulin-based diabetes therapy to be met. The region's focus on cutting-edge technologies complements the features of smart insulin pens, strengthening its position as the industry leader.

As a result, increased use of insulin for the treatment of diabetes has favorably impacted business growth. For instance, in January 2021, US-based medical device company Insulet introduced its Omnipod DASH insulin management system (Omnipod DASH System) in Canada. The Omnipod DASH system is claimed to be the first and only tubeless device, which holds the potential to offer three days of non-stop insulin delivery.

Market Players Outlook

*Note: Major Players Sorted in No Particular Order.

The major companies serving the global smart insulin pens market include Novo Nordisk A/S, SANOFI, Insulet Corp., Crunchbase, and Medtronic Private Ltd., among others. The market players are increasingly focusing on business expansion and product development by applying strategies such as collaborations, mergers, and acquisitions to stay competitive in the market. For instance, in September 2023, Abbott signed an agreement to acquire Bigfoot Biomedical, a company that makes smart insulin pen caps that can sync with continuous glucose monitors to provide dose recommendations. Through this acquisition, the company aims to expand its product portfolio.

The Report Covers

- Market value data analysis of 2023 and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global smart insulin pens market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. Insulent Corp.

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. Novo Nordisk A/S

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. SANOFI

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Key Strategy Analysis

4. Market Segmentation

4.1. Global Smart Insulin Pens Market by Connectivity Type

4.1.1. First Generation

4.1.2. Bluetooth

4.1.3. NFC (Near-Field Communication)

4.2. Global Smart Insulin Pens Market by Indication

4.2.1. Type 1 Diabetes

4.2.2. Type 2 Diabetes

4.3. Global Smart Insulin Pens Market by Distribution Channel

4.3.1. Hospital Pharmacy

4.3.2. Retail Pharmacy

4.3.3. E-Commerce

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

6. Company Profiles

6.1. Berlin-chemie AG

6.2. Bigfoot Biomedical

6.3. Cambridge Consultants Ltd.

6.4. Crunchbase

6.5. DUKADA Aps

6.6. Eli Lilly and Co.

6.7. Emperra GmbH E-Health Technologies

6.8. F Hoffmann-La Roche Ltd

6.9. Jiangsu Delfu medical device Co., Ltd.

6.10. Medtronic Private Ltd.

6.11. Pendiq

6.12. Sooil Developments Co., Ltd.

6.13. Tandem Diabetes Care

6.14. Ypsomed Group

1. GLOBAL SMART INSULIN PENS MARKET RESEARCH AND ANALYSIS BY CONNECTIVITY TYPE, 2023-2031 ($ MILLION)

2. GLOBAL BLUETOOTH-BASED SMART INSULIN PENS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

3. GLOBAL NFC-BASED SMART INSULIN PENS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

4. GLOBAL SMART INSULIN PENS MARKET RESEARCH AND ANALYSIS BY INDICATION, 2023-2031 ($ MILLION)

5. GLOBAL SMART INSULIN PENS FOR TYPE 1 DIABETES MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

6. GLOBAL SMART INSULIN PENS FOR TYPE 2 DIABETES MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

7. GLOBAL SMART INSULIN PENS MARKET RESEARCH AND ANALYSIS BY DISTRIBUTION CHANNEL, 2023-2031 ($ MILLION)

8. GLOBAL SMART INSULIN PENS IN HOSPITAL PHARMACY MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

9. GLOBAL SMART INSULIN PENS IN RETAIL PHARMACY MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

10. GLOBAL SMART INSULIN PENS IN E-COMMERCE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

11. GLOBAL SMART INSULIN PENS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

12. NORTH AMERICAN SMART INSULIN PENS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

13. NORTH AMERICAN SMART INSULIN PENS MARKET RESEARCH AND ANALYSIS BY CONNECTIVITY TYPE, 2023-2031 ($ MILLION)

14. NORTH AMERICAN SMART INSULIN PENS MARKET RESEARCH AND ANALYSIS BY INDICATION, 2023-2031 ($ MILLION)

15. NORTH AMERICAN SMART INSULIN PENS MARKET RESEARCH AND ANALYSIS BY DISTRIBUTION CHANNEL, 2023-2031 ($ MILLION)

16. EUROPEAN SMART INSULIN PENS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

17. EUROPEAN SMART INSULIN PENS MARKET RESEARCH AND ANALYSIS BY CONNECTIVITY TYPE, 2023-2031 ($ MILLION)

18. EUROPEAN SMART INSULIN PENS MARKET RESEARCH AND ANALYSIS BY INDICATION, 2023-2031 ($ MILLION)

19. EUROPEAN SMART INSULIN PENS MARKET RESEARCH AND ANALYSIS BY DISTRIBUTION CHANNEL, 2023-2031 ($ MILLION)

20. ASIA-PACIFIC SMART INSULIN PENS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

21. ASIA-PACIFIC SMART INSULIN PENS MARKET RESEARCH AND ANALYSIS BY CONNECTIVITY TYPE, 2023-2031 ($ MILLION)

22. ASIA-PACIFIC SMART INSULIN PENS MARKET RESEARCH AND ANALYSIS BY INDICATION, 2023-2031 ($ MILLION)

23. ASIA-PACIFIC SMART INSULIN PENS MARKET RESEARCH AND ANALYSIS BY DISTRIBUTION CHANNEL, 2023-2031 ($ MILLION)

24. REST OF THE WORLD SMART INSULIN PENS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

25. REST OF THE WORLD SMART INSULIN PENS MARKET RESEARCH AND ANALYSIS BY CONNECTIVITY TYPE, 2023-2031 ($ MILLION)

26. REST OF THE WORLD SMART INSULIN PENS MARKET RESEARCH AND ANALYSIS BY INDICATION, 2023-2031 ($ MILLION)

27. REST OF THE WORLD SMART INSULIN PENS MARKET RESEARCH AND ANALYSIS BY DISTRIBUTION CHANNEL, 2023-2031 ($ MILLION)

1. GLOBAL SMART INSULIN PENS MARKET SHARE BY CONNECTIVITY TYPE, 2023 VS 2031 (%)

2. GLOBAL BLUETOOTH-BASED SMART INSULIN PENS MARKET SHARE BY REGION, 2023 VS 2031 (%)

3. GLOBAL NFC-BASED SMART INSULIN PENS MARKET SHARE BY REGION, 2023 VS 2031 (%)

4. GLOBAL SMART INSULIN PENS MARKET SHARE BY INDICATION, 2023 VS 2031 (%)

5. GLOBAL SMART INSULIN P-ENS FOR TYPE 1 DIABETES MARKET SHARE BY REGION, 2023 VS 2031 (%)

6. GLOBAL SMART INSULIN PENS FOR TYPE 2 DIABETES MARKET SHARE BY REGION, 2023 VS 2031 (%)

7. GLOBAL SMART INSULIN PENS MARKET SHARE BY DISTRIBUTION CHANNEL, 2023 VS 2031 (%)

8. GLOBAL SMART INSULIN PENS IN HOSPITAL PHARMACY MARKET SHARE BY REGION, 2023 VS 2031 (%)

9. GLOBAL SMART INSULIN PENS IN RETAIL PHARMACY MARKET SHARE BY REGION, 2023 VS 2031 (%)

10. GLOBAL SMART INSULIN PENS IN E-COMMERCE MARKET SHARE BY REGION, 2023 VS 2031 (%)

11. GLOBAL SMART INSULIN PENS MARKET SHARE BY REGION, 2023 VS 2031 (%)

12. US SMART INSULIN PENS MARKET SIZE, 2023-2031 ($ MILLION)

13. CANADA SMART INSULIN PENS MARKET SIZE, 2023-2031 ($ MILLION)

14. UK SMART INSULIN PENS MARKET SIZE, 2023-2031 ($ MILLION)

15. FRANCE SMART INSULIN PENS MARKET SIZE, 2023-2031 ($ MILLION)

16. GERMANY SMART INSULIN PENS MARKET SIZE, 2023-2031 ($ MILLION)

17. ITALY SMART INSULIN PENS MARKET SIZE, 2023-2031 ($ MILLION)

18. SPAIN SMART INSULIN PENS MARKET SIZE, 2023-2031 ($ MILLION)

19. REST OF EUROPE SMART INSULIN PENS MARKET SIZE, 2023-2031 ($ MILLION)

20. INDIA SMART INSULIN PENS MARKET SIZE, 2023-2031 ($ MILLION)

21. CHINA SMART INSULIN PENS MARKET SIZE, 2023-2031 ($ MILLION)

22. JAPAN SMART INSULIN PENS MARKET SIZE, 2023-2031 ($ MILLION)

23. SOUTH KOREA SMART INSULIN PENS MARKET SIZE, 2023-2031 ($ MILLION)

24. REST OF ASIA-PACIFIC SMART INSULIN PENS MARKET SIZE, 2023-2031 ($ MILLION)

25. LATIN AMERICA SMART INSULIN PENS MARKET SIZE, 2023-2031 ($ MILLION)

26. THE MIDDLE EAST AND AFRICA SMART INSULIN PENS MARKET SIZE, 2023-2031 ($ MILLION)