Smart Lighting Market

Smart Lighting Market Size, Share & Trends Analysis Report by Offering (Hardware and Software & Services), by End-User (Indoor and Outdoor), and by Communication Technology (Wired and Wireless) Forecast Period (2022-2028) Update Available - Forecast 2025-2035

Smart lighting market is anticipated to grow at a considerable CAGR of 20.6% during the forecast period. Owing to the rise in smart city projects across the globe, the smart lighting market has experienced significant growth in many outdoor applications such as roads and highways. Government authorities across the globe are focusing on initiatives and strategic partnerships to develop smart cities, hence improving market representation. Challenges such as environmental concerns and budget constraints incline the government to tackle these challenges with the support of digitalization. Moreover, driven by the requirement for sustainability and control, cities are upgrading the street lighting grid to LED which is much more energy efficient. For instance, in 2019, Los Angeles converted more than half of its 215,000 street lights to LED, over 110,000 of which are connected to and managed by the Interact City platform. Using the Interact City lighting management software, the Los Angeles Bureau of Street can remotely control street lights, monitor their status, and accurately report energy consumption. Additionally, In June 2020, The New York Power Authority (NYPA) partnered with Signify to support Smart Street Lighting NY. The project aims to replace at least half of the more than one million streetlights in the State of New York with energy-efficient and sustainable alternatives. To date, more than 50,000 LED streetlights have been installed or are currently being installed under the program.

Segmental Outlook

The global smart lighting market is segmented based on the offering, end-user, and communication technology. Based on the offering, the market is segmented into hardware, and software & services. Based on the end-user, the market is categorized into indoor and outdoor. Further, based on communication technology, the market is segmented into wired and wireless. Among the end-use application segment, the outdoor application segment is anticipated to witness the fastest growth owing to the ongoing and upcoming smart city projects in developing economies. Outdoor lighting applications primarily include highways, roadways, public places, and stadiums.

Among the end-use application segment, the indoor sub-segment is expected to cater to a prominent market share over the forecast period owing to rising demand for design aesthetics and tailored control of light in a single-source solution. Industry players are focusing on new product innovations in intelligent lighting systems that are ideal for indoor applications, fulfilling the demand for both aesthetics and automation. For instance, in 2020, Acuity Brands Lighting launched the new SLOT 1 line of linear LED luminaires from Mark Architectural Lighting. SLOT 1 is a collection of sleek, small form factor luminaires, for indoor lighting applications. The SLOT 1 family of LED luminaires comes with features such as low voltage power and control system, can be digitally connected to system-wide networked solutions devices and sensors, visually comfortable light output, modular design, and many more.

Regional Outlooks

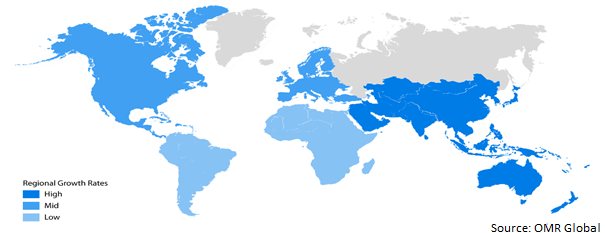

The global Smart Lighting market is further segmented based on geography including North America (the US, and Canada), Europe (Italy, Spain, Germany, France, and Others), Asia-Pacific (India, China, Japan, South Korea, and Others), and the Rest of the World (the Middle East &Africa, and Latin America). The market can be analyzed for a particular region or country level as per the requirement. Among these, the North American regional market is expected to cater to prominent growth over the forecast period. However, the Asia-Pacific region is projected to experience considerable growth in the smart lighting market.

Global Smart Lighting Market Growth, by Region 2022-2028

The North American Region Is Expected to Hold Prominent Share in the Global Smart Lighting Market

The North American region is expected to hold a prominent share in the growth of the smart lighting market during the forecast period. The high presence of key market players such as Hubbell Inc., Honeywell International Inc., Lutron Electronics, and Smartlabs Inc. in the North American region and high per capita income are driving the growth of the market in this region. Leading market players are increasingly inclining toward serving the rising requirements of technologically advanced products in the US market by leveraging technologies including the Internet of Things, (IoT). For instance, in July 2021, Smartlabs announced the launch of Nokia Smart Lighting, a suite of IoT-powered lighting and electrical control products in the US. Nokia Smart Lighting is intuitive-to-use and features universal compatibility with wide-ranging capabilities. The product line includes Paddle and Dial switches, a four-button, multi-function Keypad, Outlet, and Bridge.

Market Players Outlook

The major companies serving the global smart lighting market include Honeywell International Inc., Hubbell Inc., Lutron Electronics Co., Inc., Sengled Optoelectronics Co., Ltd., Signify Holding (Philips Hue), and others. The market players are considerably contributing to the market growth by the adoption of various strategies including mergers and acquisitions, partnerships, collaborations, funding, and new product launches, to stay competitive in the market. For instance, in July 2022, Signify announced a new range of smart WiZ lighting expanding on its existing line-up. the new range features a selection of table and floor lamps, a portable light switch, and new ceiling lights and lamps, providing its customers with a wide range of options to make their homes all connected with smart lighting.

The Report Covers

- Market value data analysis of 2021 and forecast to 2028.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global smart lighting market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segmentation

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendation

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. Honeywell International Inc.

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Development

3.3. Hubbell Inc.

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Development

3.4. Lutron Electronics Co., Inc.

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Development

3.5. Sengled Optoelectronics Co., Ltd.

3.5.1. Overview

3.5.2. Financial Analysis

3.5.3. SWOT Analysis

3.5.4. Recent Development

3.6. Signify Holding (Philips Hue)

3.6.1. Overview

3.6.2. Financial Analysis

3.6.3. SWOT Analysis

3.6.4. Recent Development

3.7. Key Strategy Analysis

4. Market Segmentation

4.1. Global Smart Lighting Market by Offering

4.1.1. Hardware

4.1.2. Software & Services

4.2. Global Smart Lighting Market by End-User

4.2.1. Indoor

4.2.2. Outdoor

4.3. Global Smart Lighting Market by Communication Technology

4.3.1. Wired

4.3.2. Wireless

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

6. Company Profiles

6.1. Acuity Brands, Inc.

6.2. Cooper Lighting, LLC

6.3. Govee Moments Trading Ltd.

6.4. Legrand Group

6.5. Lifi Labs, Inc.

6.6. Lucidity Lights, Inc.

6.7. Nanoleaf Canada Ltd.

6.8. Nooie

6.9. OSRAM GmbH

6.10. Savant Technologies LLC

6.11. Smartlabs Inc.

6.12. TP-Link Corporation Ltd.

6.13. Wyze Labs, Inc.

6.14. Yeelight

6.15. Zumtobel Group AG

1. GLOBAL SMART LIGHTING MARKET RESEARCH AND ANALYSIS BY OFFERING, 2021-2028 ($ MILLION)

2. GLOBAL HARDWARE FOR SMART LIGHTING MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

3. GLOBAL SOFTWARE & SERVICES FOR SMART LIGHTING MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

4. GLOBAL SMART LIGHTING MARKET RESEARCH AND ANALYSIS BY END-USER, 2021-2028 ($ MILLION)

5. GLOBAL SMART LIGHTING FOR INDOOR MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

6. GLOBAL SMART LIGHTING FOR OUTDOOR MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

7. GLOBAL SMART LIGHTING MARKET RESEARCH AND ANALYSIS BY COMMUNICATION TECHNOLOGY, 2021-2028 ($ MILLION)

8. GLOBAL WIRED SMART LIGHTING MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

9. GLOBAL WIRELESS SMART LIGHTING MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

10. GLOBAL SMART LIGHTING MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

11. NORTH AMERICAN SMART LIGHTING MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

12. NORTH AMERICAN SMART LIGHTING MARKET RESEARCH AND ANALYSIS BY OFFERING, 2021-2028 ($ MILLION)

13. NORTH AMERICAN SMART LIGHTING MARKET RESEARCH AND ANALYSIS BY END-USER, 2021-2028 ($ MILLION)

14. NORTH AMERICAN SMART LIGHTING MARKET RESEARCH AND ANALYSIS BY COMMUNICATION TECHNOLOGY, 2021-2028 ($ MILLION)

15. EUROPEAN SMART LIGHTING MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

16. EUROPEAN SMART LIGHTING MARKET RESEARCH AND ANALYSIS BY OFFERING, 2021-2028 ($ MILLION)

17. EUROPEAN SMART LIGHTING MARKET RESEARCH AND ANALYSIS BY END-USER, 2021-2028 ($ MILLION)

18. EUROPEAN SMART LIGHTING MARKET RESEARCH AND ANALYSIS BY COMMUNICATION TECHNOLOGY, 2021-2028 ($ MILLION)

19. ASIA-PACIFIC SMART LIGHTING MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

20. ASIA-PACIFIC SMART LIGHTING MARKET RESEARCH AND ANALYSIS BY OFFERING, 2021-2028 ($ MILLION)

21. ASIA-PACIFIC SMART LIGHTING MARKET RESEARCH AND ANALYSIS BY END-USER, 2021-2028 ($ MILLION)

22. ASIA-PACIFIC SMART LIGHTING MARKET RESEARCH AND ANALYSIS BY COMMUNICATION TECHNOLOGY, 2021-2028 ($ MILLION)

23. REST OF THE WORLD SMART LIGHTING MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

24. REST OF THE WORLD SMART LIGHTING MARKET RESEARCH AND ANALYSIS BY OFFERING, 2021-2028 ($ MILLION)

25. REST OF THE WORLD SMART LIGHTING MARKET RESEARCH AND ANALYSIS BY END-USER, 2021-2028 ($ MILLION)

26. REST OF THE WORLD SMART LIGHTING MARKET RESEARCH AND ANALYSIS BY COMMUNICATION TECHNOLOGY, 2021-2028 ($ MILLION)

1. GLOBAL SMART LIGHTING MARKET SHARE BY OFFERING, 2021 VS 2028 (%)

2. GLOBAL HARDWARE FOR SMART LIGHTING MARKET SHARE BY REGION, 2021 VS 2028 (%)

3. GLOBAL SOFTWARE & SERVICES FOR SMART LIGHTING MARKET SHARE BY REGION, 2021 VS 2028 (%)

4. GLOBAL SMART LIGHTING MARKET SHARE BY END-USER, 2021 VS 2028 (%)

5. GLOBAL SMART LIGHTING FOR INDOOR MARKET SHARE BY REGION, 2021 VS 2028 (%)

6. GLOBAL SMART LIGHTING FOR OUTDOOR MARKET SHARE BY REGION, 2021 VS 2028 (%)

7. GLOBAL SMART LIGHTING MARKET SHARE BY COMMUNICATION TECHNOLOGY, 2021 VS 2028 (%)

8. GLOBAL WIRED SMART LIGHTING MARKET SHARE BY REGION, 2021 VS 2028 (%)

9. GLOBAL WIRELESS SMART LIGHTING MARKET MARKET SHARE BY REGION, 2021 VS 2028 (%)

10. GLOBAL SMART LIGHTING MARKET SHARE BY REGION, 2021 VS 2028 (%)

11. US SMART LIGHTING MARKET SIZE, 2021-2028 ($ MILLION)

12. CANADA SMART LIGHTING MARKET SIZE, 2021-2028 ($ MILLION)

13. UK SMART LIGHTING MARKET SIZE, 2021-2028 ($ MILLION)

14. FRANCE SMART LIGHTING MARKET SIZE, 2021-2028 ($ MILLION)

15. GERMANY SMART LIGHTING MARKET SIZE, 2021-2028 ($ MILLION)

16. ITALY SMART LIGHTING MARKET SIZE, 2021-2028 ($ MILLION)

17. SPAIN SMART LIGHTING MARKET SIZE, 2021-2028 ($ MILLION)

18. REST OF EUROPE SMART LIGHTING MARKET SIZE, 2021-2028 ($ MILLION)

19. INDIA SMART LIGHTING MARKET SIZE, 2021-2028 ($ MILLION)

20. CHINA SMART LIGHTING MARKET SIZE, 2021-2028 ($ MILLION)

21. JAPAN SMART LIGHTING MARKET SIZE, 2021-2028 ($ MILLION)

22. SOUTH KOREA SMART LIGHTING MARKET SIZE, 2021-2028 ($ MILLION)

23. REST OF ASIA-PACIFIC SMART LIGHTING MARKET SIZE, 2021-2028 ($ MILLION)

24. REST OF THE WORLD SMART LIGHTING MARKET SIZE, 2021-2028 ($ MILLION)