Smart Manufacturing Market

Global Smart Manufacturing Market Size, Share & Trends Analysis Report by Component (Hardware and Software & Services), by Technology (Programmable Logic Controller (PLC), Supervisory Controller and Data Acquisition (SCADA), Machine Vision, Distributed Control System (DCS), Product Lifecycle Management (PLM), and Others), and by End-Use Industry (Healthcare, Automotive, Aerospace & Defense, Oil & Gas, Food & Beverages, and Others) and Forecast 2020-2026 Update Available - Forecast 2025-2031

The global smart manufacturing market is growing at a significant CAGR of around 12.8% during the forecast period (2020-2026). The market is driven by the rising acceptance of automation in the manufacturing processes, backed by the increasing complexities in supply chain in the industries. In addition, increasing adoption of AI, IoT, industry 4.0, is offering growth opportunity to the smart manufacturing market. The market players are investing a huge amount in a wide range of innovative technologies such as robotic automation, autonomous vehicles, assistance technology, and quality control and predictive analysis. For instance, Siemen’s robotic prototype automatically reads and follows Computer-Aided Design (CAD) instructions to build the products without programming and is used in shop floor work.

A significant rise in big data has contributed to the adoption of big data analytics in manufacturing. With the growing digitalization across the globe, big data is on a continuous rise. Big data is quickly becoming a significant element of the fourth generation of ERP technology. According to the World Economic Forum, the connected world is producing data at a pace that is unprecedented in human history. Manufacturers expect big data analytics to have a huge impact on company’s performance. To remain competitive, manufacturers are embracing big data analytics, which is driving significant growth to the market.

Segmental Outlook

The smart manufacturing market is classified on the basis of component,technology, and end-use industry. Based on component, the market is bifurcated into hardware and software & services. Based on technology, the market is segmented into PLC, SCADA, machine vision, DCS, PLM, and others. Based on end-use industry, the market is segregated into healthcare, automotive, aerospace & defense, oil & gas, food & beverages, and others.

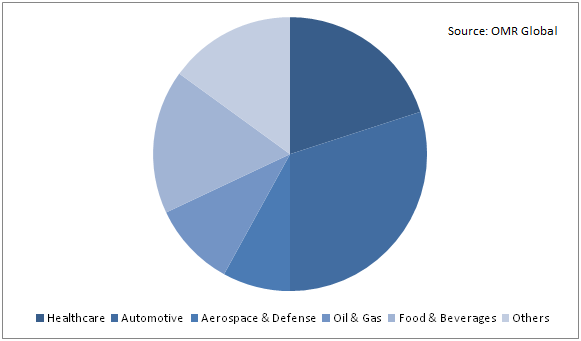

Global Smart Manufacturing Market Share by End-Use Industry, 2019(%)

Automotive industry contributes significantly in smart manufacturing market

Automotive industry is contributing significantly in smart manufacturing market across the globe. Significant investment by the major automobile manufacturers is supporting the integration of next-generation production technologies, which in turn, is boosting the adoption of smart manufacturing process. Predictive maintenance is considered as the best way to avoid manufacturing downtime, which causes significant losses to the automobile manufacturers. There is an increasing role of industrial robots in the automotive industry, which in turn, is offering significant opportunity for the growth of the market. For instance, as per IFR, in terms of market share, the most important consumer of robots is the automotive sector.As per IFR, the estimated annual supply of industrial robots in the automotive industry has increased from 103,000 units in 2016 to 116,000 in 2018. Bosch and General Electric are some major companies that are investing in machine learning-powered approaches in automotive sector.

Regional Outlook

The global smart manufacturing market is classified on the basis of geography,which includes North America, Europe, Asia-Pacific, and Rest of the World. North America holds a significant share in the global smart manufacturing market. The US plays the critical role in geographic contribution of North America in global smart manufacturing market,attributed to the increasing application of automation in the automotive and pharmaceutical industry. The region has well-developed ICT infrastructure and has witnessed huge adoption of a large number of connected devices. The presence of key market players in the region, such as IBM Corp. and Emerson Electric Co., further gives a boost to the growth of the market in the region. In addition, the government support is also contributing to the market growth. For instance, in February 2019, the US president signed an executive order for the American AI initiative. The federal government will play a crucial role to facilitate AI R&D and develop and deploy AI-associated technologies.

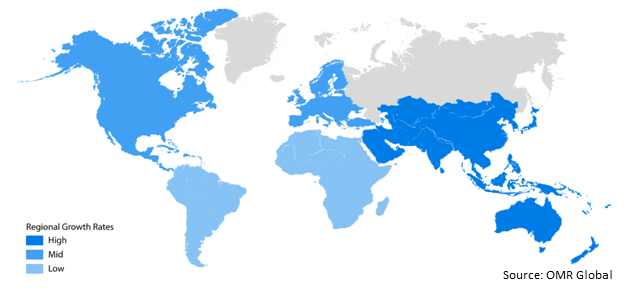

Global Smart Manufacturing Market Growth, by Region 2020-2026

Asia-Pacific is expected to propel with a considerable growth rate in the global market

Asia-Pacific is estimated to project a considerable CAGR in the global smart manufacturing market. The major countries which will contribute to the market are China, India, and Japan. China is the biggest player in smart manufacturing market. Asia-Pacific region has a potential market due to the increasing R&D and investments by big pharmaceutical companies in life science research coupled with harnessing innovation, that spurs the growth of smart manufacturing in the healthcare industry. Further, the advancement in consumer electronics, growing automotive sales, and the significant growth of major emerging economies, such as China, India, Japan, and South Korea will further boost the growth of smart manufacturing in these industries.

China’s manufacturing industry is growing at a much faster pace than any other economies. Announced in 2015, the “Made in China 2025” is one of the most lucrative projects, aimed at increasing competitiveness of Chinese manufacturing industries including consumer electronics and automotive. The goal of the project was to foster Chinese brands, boost innovation and reduce the country’s reliance on foreign technology by making the nation a major or dominant global manufacturer of various technologies. This initiative is aimed to transform China from a manufacturing giant to global manufacturing power by 2049. For instance, China plans to achieve 40.0% of domestically manufactured basic components and basic materials by 2020 and 70.0% by 2025. However, the plan is recently revised in January 2018, according to which China is aimed to become the global leading manufacturer of telecommunication, railway, and electrical power equipment by 2025. This initiative will increase the adoption of smart manufacturing of electronic and automotive parts in the country in the near future.

Market Players Outlook

The key players in the smart manufacturing market are contributing significantly by providing advanced technology-based products and through expanding their geographical presence across the globe. The key players operating in the global smart manufacturing market include ABB Ltd., Emerson Electric Co., SAP SE, Schneider Electric SE, Siemens AG,Honeywell International, Inc., General Electric Co., and Intel Corp. These market players adopt various strategies such as product launch, partnerships, collaborations, merger, and acquisitions to sustain a strong position in the market. For instance, in February 2019, Siemens AG announced the enhancement of its Digital Innovation Platform by updating and advancing its NX Software with AI and machine learning to raise the productivity by predicting next steps and updating the user interface and catering the various demands of the user.

The Report Covers

- Market value data analysis of 2019 and forecast to 2026.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global smart manufacturing market. Based on the availability of data, information related to pipeline products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

2.3. Rules & Regulations

3. Competitive Landscape

3.1. Company Share Analysis

3.2. Key Strategy Analysis

3.3. Key Company Analysis

3.3.1. ABB Ltd.

3.3.1.1. Overview

3.3.1.2. Financial Analysis

3.3.1.3. SWOT Analysis

3.3.1.4. Recent Developments

3.3.2. Emerson Electric Co.

3.3.2.1. Overview

3.3.2.2. Financial Analysis

3.3.2.3. SWOT Analysis

3.3.2.4. Recent Developments

3.3.3. SAP SE

3.3.3.1. Overview

3.3.3.2. Financial Analysis

3.3.3.3. SWOT Analysis

3.3.3.4. Recent Developments

3.3.4. Schneider Electric SE

3.3.4.1. Overview

3.3.4.2. Financial Analysis

3.3.4.3. SWOT Analysis

3.3.4.4. Recent Developments

3.3.5. Siemens AG

3.3.5.1. Overview

3.3.5.2. Financial Analysis

3.3.5.3. SWOT Analysis

3.3.5.4. Recent Developments

4. Market Determinants

4.1. Motivators

4.2. Restraints

4.3. Opportunities

5. Market Segmentation

5.1. Global Smart Manufacturing Market by Component

5.1.1. Hardware

5.1.2. Software & Services

5.2. Global Smart Manufacturing Market by Technology

5.2.1. Programmable Logic Controller (PLC)

5.2.2. Supervisory Controller and Data Acquisition (SCADA)

5.2.3. Machine Vision

5.2.4. Distributed Control System (DCS)

5.2.5. Product Lifecycle Management (PLM)

5.2.6. Others (3D Printing)

5.3. Global Smart Manufacturing Market by End-Use Industry

5.3.1. Healthcare

5.3.2. Automotive

5.3.3. Aerospace & Defense

5.3.4. Oil & Gas

5.3.5. Food & Beverages

5.3.6. Others (Chemical and Metals and Mining)

6. Regional Analysis

6.1. North America

6.1.1. United States

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. ABB Ltd.

7.2. Cisco Systems, Inc.

7.3. DXC Technology Co.

7.4. Emerson Electric Co.

7.5. Fanuc Corp.

7.6. Fujitsu Ltd.

7.7. General Electric Co.

7.8. Honeywell International, Inc.

7.9. IBM Corp.

7.10. Intel Corp.

7.11. Larsen & Toubro Infotech Ltd.

7.12. Mitsubishi Electric Corp.

7.13. Oracle Corp.

7.14. Robert Bosch GmbH

7.15. Rockwell Automation, Inc.

7.16. SAP SE

7.17. Schneider Electric SE

7.18. Siemens AG

7.19. Wipro Ltd.

7.20. Yokogawa Electric Corp.

1. GLOBAL SMART MANUFACTURING MARKET RESEARCH AND ANALYSIS BY COMPONENT, 2019-2026 ($ MILLION)

2. GLOBAL SMART MANUFACTURING HARDWARE MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

3. GLOBAL SMART MANUFACTURING SOFTWARE & SERVICES MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

4. GLOBAL SMART MANUFACTURING MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2019-2026 ($ MILLION)

5. GLOBAL PLC MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

6. GLOBAL SCADA MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

7. GLOBAL MACHINE VISION MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

8. GLOBAL DISTRIBUTED CONTROL SYSTEM (DCS) MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

9. GLOBAL PRODUCT LIFECYCLE MANAGEMENT (PLM) MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

10. GLOBAL OTHER TECHNOLOGIES MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

11. GLOBAL SMART MANUFACTURING MARKET RESEARCH AND ANALYSIS BY END-USE INDUSTRY, 2019-2026 ($ MILLION)

12. GLOBAL SMART MANUFACTURING IN HEALTHCARE MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

13. GLOBAL SMART MANUFACTURING IN AUTOMOTIVE MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

14. GLOBAL SMART MANUFACTURING IN AEROSPACE & DEFENSE MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

15. GLOBAL SMART MANUFACTURING IN OIL & GAS MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

16. GLOBAL SMART MANUFACTURING IN FOOD & BEVERAGES MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

17. GLOBAL OTHER APPLICATIONS MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

18. GLOBAL SMART MANUFACTURING MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2019-2026 ($ MILLION)

19. NORTH AMERICAN SMART MANUFACTURING MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

20. NORTH AMERICAN SMART MANUFACTURING MARKET RESEARCH AND ANALYSIS BY COMPONENT, 2019-2026 ($ MILLION)

21. NORTH AMERICAN SMART MANUFACTURING MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2019-2026 ($ MILLION)

22. NORTH AMERICAN SMART MANUFACTURING MARKET RESEARCH AND ANALYSIS BY END-USE INDUSTRY, 2019-2026 ($ MILLION)

23. EUROPEAN SMART MANUFACTURING MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

24. EUROPEAN SMART MANUFACTURING MARKET RESEARCH AND ANALYSIS BY COMPONENT, 2019-2026 ($ MILLION)

25. EUROPEAN SMART MANUFACTURING MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2019-2026 ($ MILLION)

26. EUROPEAN SMART MANUFACTURINGMARKET RESEARCH AND ANALYSIS BY END-USE INDUSTRY, 2019-2026 ($ MILLION)

27. ASIA-PACIFIC SMART MANUFACTURING MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

28. ASIA-PACIFIC SMART MANUFACTURING MARKET RESEARCH AND ANALYSIS BY COMPONENT, 2019-2026 ($ MILLION)

29. ASIA-PACIFIC SMART MANUFACTURING MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2019-2026 ($ MILLION)

30. ASIA-PACIFIC SMART MANUFACTURING MARKET RESEARCH AND ANALYSIS BY END-USE INDUSTRY, 2019-2026 ($ MILLION)

31. REST OF THE WORLD SMART MANUFACTURING MARKET RESEARCH AND ANALYSIS BY COMPONENT, 2019-2026 ($ MILLION)

32. REST OF THE WORLD SMART MANUFACTURING MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2019-2026 ($ MILLION)

33. REST OF THE WORLD SMART MANUFACTURING MARKET RESEARCH AND ANALYSIS BY END-USE INDUSTRY, 2019-2026 ($ MILLION)

1. GLOBAL SMART MANUFACTURING MARKET SHARE BY COMPONENT, 2019 VS 2026 (%)

2. GLOBAL SMART MANUFACTURING MARKET SHARE BY TECHNOLOGY, 2019 VS 2026 (%)

3. GLOBAL SMART MANUFACTURING MARKET SHARE BY END-USE INDUSTRY, 2019 VS 2026 (%)

4. GLOBAL SMART MANUFACTURING MARKET SHARE BY GEOGRAPHY, 2019 VS 2026 (%)

5. US SMART MANUFACTURING MARKET SIZE, 2019-2026 ($ MILLION)

6. CANADA SMART MANUFACTURING MARKET SIZE, 2019-2026 ($ MILLION)

7. UK SMART MANUFACTURING MARKET SIZE, 2019-2026 ($ MILLION)

8. FRANCE SMART MANUFACTURING MARKET SIZE, 2019-2026 ($ MILLION)

9. GERMANY SMART MANUFACTURING MARKET SIZE, 2019-2026 ($ MILLION)

10. ITALY SMART MANUFACTURING MARKET SIZE, 2019-2026 ($ MILLION)

11. SPAIN SMART MANUFACTURING MARKET SIZE, 2019-2026 ($ MILLION)

12. ROE SMART MANUFACTURING MARKET SIZE, 2019-2026 ($ MILLION)

13. INDIA SMART MANUFACTURING MARKET SIZE, 2019-2026 ($ MILLION)

14. CHINA SMART MANUFACTURING MARKET SIZE, 2019-2026 ($ MILLION)

15. JAPAN SMART MANUFACTURING MARKET SIZE, 2019-2026 ($ MILLION)

16. REST OF ASIA-PACIFIC SMART MANUFACTURING MARKET SIZE, 2019-2026 ($ MILLION)

17. REST OF THE WORLD SMART MANUFACTURING MARKET SIZE, 2019-2026 ($ MILLION)