Smart Ticketing Market

Global Smart Ticketing Market Size, Share & Trends Analysis Report, By Component (Hardware and Software), By Application ( Parking & Transportation and Sports & Entertainment) Forecast Period, 2021-2027 Update Available - Forecast 2025-2031

The global smart ticketing market is projected to grow at a modest CAGR of nearly 13.0% during the forecast period (2021-2027). The primary factor driving the market growth include the growing digitization and urbanization in emerging economies. Further, the growing adoption of smart ticketing systems in the travel and tourism industry is contributing to the growth of the market. Apart from these, the emerging shift towards contactless payments is further encouraging companies to invest in the sector. For an instance, in March 2021, Giesecke+Devrient (G+D) collaborated with IDEMIA and NXP Semiconductors. Together, the companies introduced the White Label Alliance (WLA) which respond to the increasing global demand for next-generation, discrete payment solutions for domestic and private-label payment brands.

WLA embeds and updates an open and complete payment standard that allows ready-to-deploy dual interface payment solutions including contact and contactless payment cards, mobile devices, and payment terminal acceptance. In addition, in May 2019, Hitachi signed an agreement with Trentino Trasporti, a provider of public transportation in several municipalities in Trentino, Italy. The agreement aims to carry out the Proof of Concept (POC) of the latest digital ticketing solution for the public transportation managed by Trentino Trasporti including Trento-Malé-Mezzana Railway and buses in the vicinity of Trento, Italy. This latest digital ticketing solution was developed to utilize smartphones as tickets by using Hitachi group’s experience of ticketing solutions and digital technology.

Impact of COVID-19 Pandemic on Global Smart Ticketing Market

COVID-19 pandemic has adversely impacted the global smart ticketing market. During the pandemic, the company has strategically invested in the production of smart ticketing. However, due to travel restrictions and lockdown imposed by the central government, the transportation sector had been hit hard by the pandemic. With the relaxation of lockdown restrictions and following social norms, the occupancy in buses is quite low.

Segmental Outlook

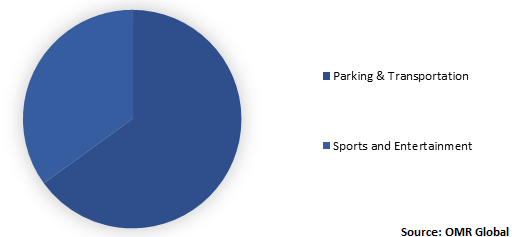

The global smart ticketing market is segmented based on component and application. Based on component, the market is segmented into hardware, software, and services. Among the component, the software segment is expected to have a considerable share in the market during the forecast period. The attributable factor for the growth of the segment is the growing digitization in ticketing services for enhancing the travel experience of passengers. The software allows people to book their tickets automatically. In addition, it allows a passenger to book a ride with a simple way from his home to his desired destination and at the desired time with a range in types of buses and tickets prices. Based on application, the market is segmented into parking & transportation and sports & entertainment. Among the application segment, the parking and transportation segment is expected to hold a lucrative share in the market during the forecast period.

Global Smart Ticketing Market Share by Propulsion Type, 2020 (%)

Parking and Transportation Segment to Hold a Lucrative Share in the Global Smart ticketing Market

The parking and transportation segment is expected to hold a lucrative share in the market during the forecast period. The attributable factor for the growth of the segment is that the smart ticketing solutions enable travelers to book their tickets in advance and buy store, confirm tickets with contactless debit cards and credit cards. Further, the companies are investing in the payment of the contactless transfer. For instance, in November 2019, Confidex signed an agreement with the Roads and Transport Authority of Dubai. Under this agreement, Confidex supplied limited use contactless smart tickets to the metro. The Roads and Transport Authority of Dubai holds mass transit traffic traveling with reusable, durable, contactless ticketing solutions. Confidex demonstrated its capability to offer a fan-folded ticket that high-temperature resistance at 100% humidity.

Regional Outlook

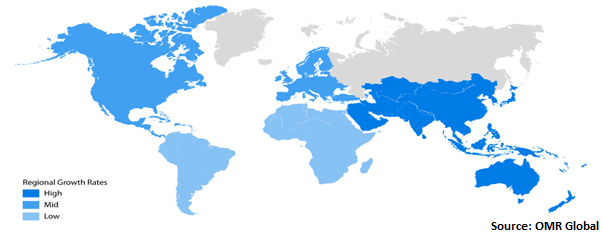

Geographically, the market is segmented into North America, Europe, Asia-Pacific, and the Rest of the World. The Asia-Pacific region is projected to hold a significant market share during the forecast period. The regional growth of the market is accredited to the growing urbanization and rising focus on digitalization across each sector in the region. Government initiatives towards demonetization and forcing cashless transactions are propelling the growth of the market. For instance, the Indian government launched digital India in July 2015, to convert India into a cashless society. In 2020, North America held a major market position in the global smart ticketing market. The well-developed infrastructure and growing investments in automotive and transportation are some of the key factors driving the growth of the regional market. In 2020, Europe is the second-largest market owing to the early adoption of advanced technology in the region.

Global Smart Ticketing Market Growth, by Region 2021-2027

Market Players Outlook

The prominent players in the global smart ticketing market include Thales Group, NXP Semiconductors N.V., and Infineon Technologies AG among others. These key manufacturers are adopting various strategies such as new product launches and approvals, mergers and acquisitions, partnerships and collaborations, and many others to thrive in a competitive environment. For an instance, In October 2020, IDEMIA collaborated with MasterCard and MarchMove. Through the collaboration, the companies aimed to develop a biometric card, which utilizes a fingerprint to authorize transactions at in-store payment terminals. The F.CODE Easy card takes the effortless and intuitive experience of biometric authentication from a mobile phone to a smart card. In December 2020, IDEMIA formed a partnership with ZWIPE, a biometric technology company. This partnership was aimed to promote biometric cards as the reference for contactless payments.

The Report Covers

- Market value data analysis of 2020 and forecast to 2027.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global smart ticketing market. Based on the availability of data, information related to pipeline products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

• Impact of COVID-19 on the Global Smart Ticketing Industry

• Recovery Scenario of Global Smart Ticketing Industry

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Conclusion

2.3. Porter’s Analysis

3. Competitive Landscape

3.1. Key Company Analysis

3.1.1. Thales Group

3.1.1.1. Overview

3.1.1.2. Financial Analysis

3.1.1.3. SWOT Analysis

3.1.2. NXP Semiconductors N.V

3.1.2.1. Overview

3.1.2.2. Financial Analysis

3.1.2.3. SWOT Analysis

3.1.3. Infineon Technologies AG

3.1.3.1. Overview

3.1.3.2. Financial Analysis

3.1.3.3. SWOT Analysis

3.2. Key Strategy Analysis

3.3. Impact of COVID-19 on Key Players

4. Market Determinants

4.1. Motivators

4.2. Restraints

4.3. Opportunities

5. Market Segmentation

5.1. Global Smart Ticketing Market by Component

5.1.1. Hardware

5.1.2. Software

5.2. Global Smart Ticketing Market, by Application

5.2.1. Parking & Transportation

5.2.1.1. Railways

5.2.1.2. Roadways

5.2.1.3. Airways

5.2.2. Sports & Entertainment

6. Regional Analysis

6.1. North America

6.1.1. US

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. South Korea

6.3.5. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. Assa Abloy AB

7.2. Atsuke

7.3. Conduent, Inc. and Flowbird

7.4. Confidex Ltd.

7.5. Giesecke & Devrient GmbH

7.6. Hitachi, Ltd.

7.7. IDEMIA SAS (Advent International, Inc.)

7.8. Scheidt & Bachmann GmbH

7.9. Siemens AG

1. GLOBAL SMART TICKETING MARKET RESEARCH AND ANALYSIS BY COMPONENT, 2020-2027 ($ MILLION)

2. GLOBAL SMART TICKETING HARDWARE MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

3. GLOBAL SMART TICKETING SOFTWARE MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

4. GLOBAL SMART TICKETING MARKET RESEARCH AND ANALYSIS BY APPLICATION 2020-2027 ($ MILLION)

5. GLOBAL SMART TICKETING FOR PARKING AND TRANSPORTATION MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

6. GLOBAL SMART TICKETING FOR SPORTS AND ENTERTAINMENT MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

7. GLOBAL SMART TICKETING MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2020-2027 ($ MILLION)

8. NORTH AMERICAN SMART TICKETING MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027 ($ MILLION)

9. NORTH AMERICAN SMART TICKETING MARKET RESEARCH AND ANALYSIS BY COMPONENT , 2020-2027 ($ MILLION)

10. NORTH AMERICAN SMART TICKETING MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2020-2027 ($ MILLION)

11. EUROPEAN SMART TICKETING MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027 ($ MILLION)

12. EUROPEAN SMART TICKETING MARKET RESEARCH AND ANALYSIS BY COMPONENT , 2020-2027 ($ MILLION)

13. EUROPEAN SMART TICKETING MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2020-2027 ($ MILLION)

14. ASIA-PACIFIC SMART TICKETING MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027 ($ MILLION)

15. ASIA-PACIFIC SMART TICKETING MARKET RESEARCH AND ANALYSIS BY COMPONENT , 2020-2027 ($ MILLION)

16. ASIA-PACIFIC SMART TICKETING MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2020-2027 ($ MILLION)

17. REST OF THE WORLD SMART TICKETING MARKET RESEARCH AND ANALYSIS BY COMPONENT, 2020-2027 ($ MILLION)

18. REST OF THE WORLD SMART TICKETING MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2020-2027 ($ MILLION)

1. IMPACT OF COVID-19 ON GLOBAL SMART TICKETING MARKET, 2020-2027 ($ MILLION)

2. IMPACT OF COVID-19 ON GLOBAL SMART TICKETING MARKET BY SEGMENT, 2020-2027 ($ MILLION)

3. RECOVERY OF GLOBAL SMART TICKETING MARKET, 2021-2027(%)

4. GLOBAL SMART TICKETING MARKET SHARE BY COMPONENT , 2020 VS 2027 (%)

5. GLOBAL SMART TICKETING MARKET SHARE BY APPLICATION, 2020 VS 2027 (%)

6. GLOBAL SMART TICKETING MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

7. GLOBAL SMART TICKETING HARDWARE MARKET SHARE BY REGION, 2020 VS 2027 (%)

8. GLOBAL SMART TICKETING SOFTWARE MARKET SHARE BY REGION, 2020 VS 2027 (%)

9. GLOBAL SMART TICKETING FOR PARKING AND TRANSPORTATION MARKET SHARE BY REGION, 2020 VS 2027 (%)

10. GLOBAL SMART TICKETING FOR SPORTS AND ENTERTAINMENT MARKET SHARE BY REGION, 2020 VS 2027 (%)

11. US SMART TICKETING MARKET SIZE, 2020-2027 ($ MILLION)

12. CANADA SMART TICKETING MARKET SIZE, 2020-2027 ($ MILLION)

13. UK SMART TICKETING MARKET SIZE, 2020-2027 ($ MILLION)

14. FRANCE SMART TICKETING MARKET SIZE, 2020-2027 ($ MILLION)

15. GERMANY SMART TICKETING MARKET SIZE, 2020-2027 ($ MILLION)

16. ITALY SMART TICKETING MARKET SIZE, 2020-2027 ($ MILLION)

17. SPAIN SMART TICKETING MARKET SIZE, 2020-2027 ($ MILLION)

18. ROE SMART TICKETING MARKET SIZE, 2020-2027 ($ MILLION)

19. INDIA SMART TICKETING MARKET SIZE, 2020-2027 ($ MILLION)

20. CHINA SMART TICKETING MARKET SIZE, 2020-2027 ($ MILLION)

21. JAPAN SMART TICKETING MARKET SIZE, 2020-2027 ($ MILLION)

22. SOUTH KOREA SMART TICKETING MARKET SIZE, 2020-2027 ($ MILLION)

23. REST OF ASIA-PACIFIC SMART TICKETING MARKET SIZE, 2020-2027 ($ MILLION)

24. REST OF THE WORLD SMART TICKETING MARKET SIZE, 2020-2027 ($ MILLION)